Payday Lending in America: Policy Solutions

QUICK SUMMARY

Pew's research conclusively shows that payday loans are unaffordable for most borrowers. The loans require payments equal to one-third of a typical borrower's income, far exceeding most customers' ability to repay and meet other financial obligations without quickly borrowing again.

In its third report in the Payday Lending in America series, Pew provides guidance for federal and state policymakers on how to make the payday loan marketplace more safe, transparent, and predictable.

Pew's recommendations draw on a detailed analysis of regulation in Colorado, where state policymakers replaced a single, unaffordable, lump-sum repayment with a series of installment payments distributed over six months.

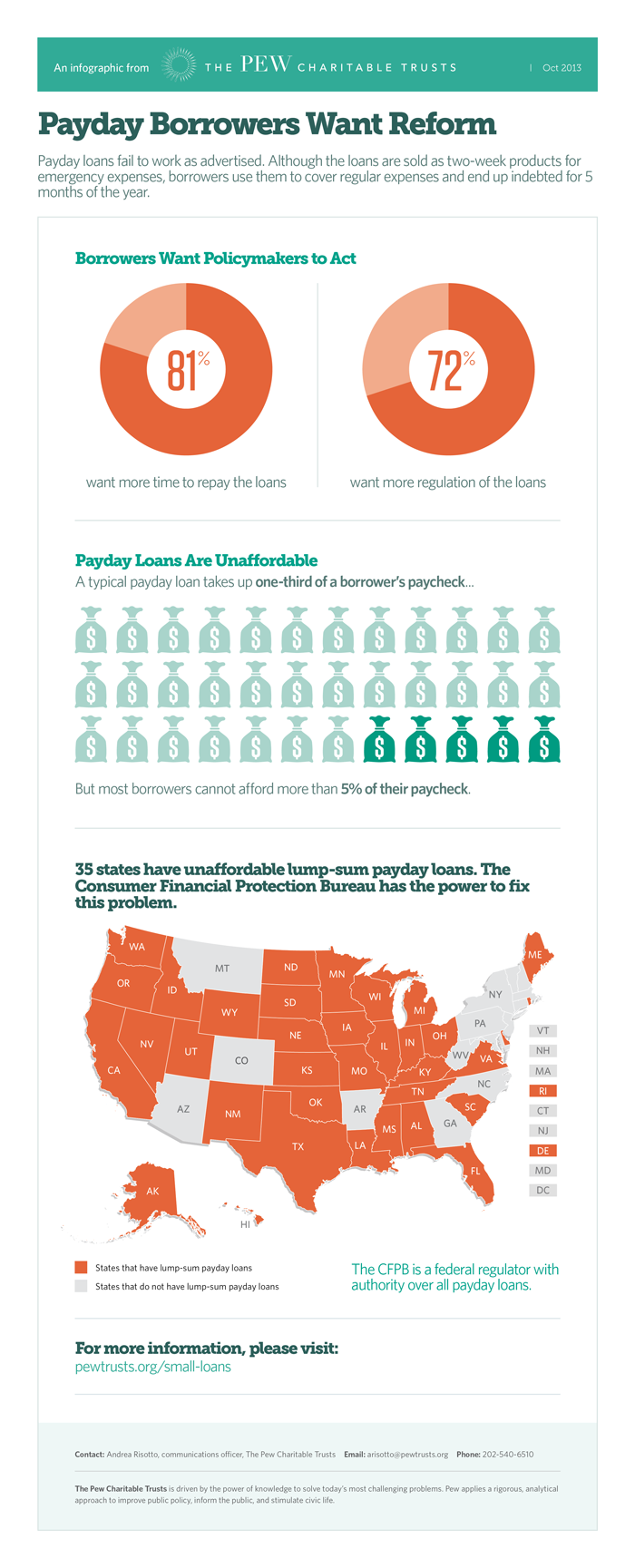

A poll of payday loan borrowers, which also appears in the latest report, indicates support for such reform—an overwhelming 9 in 10 support a system of installment payments over time instead of the conventional lump-sum-repayment structure.

Key Findings

- Most small-dollar loan borrowers can afford to put no more than 5 percent of their paycheck toward a loan payment and still be able to cover basic expenses. Survey and market data show that loan payments exceeding 5 percent of a borrower's individual gross income are unaffordable. Higher payments should be prohibited unless lenders demonstrate, through rigorous underwriting, that borrowers can afford more than that amount.

- In the 35 states that allow lump-sum payday loans, repayment of these loans requires approximately one-third of an average borrower's paycheck. In Colorado, where lawmakers required that loans be repayable in affordable installments, payments take up only 4 percent of a borrower's paycheck on average.

- Safeguards are needed to create successful small-dollar loan markets. Ensuring that borrowers can repay loans in installments over time will help alleviate the harms of payday lending. But unless policymakers also ensure that loans are structured according to the borrower's ability to repay—and protect against lenderdriven refinancing, noncompetitive pricing, excessively long loan lengths, and abusive repayment or collection practices—consumers will remain at risk.

- These safeguards can be applied in a way that works for lenders. Payday lenders continue to operate in the wake of a recent law change in Colorado, but borrowers are spending less, and payments are far more affordable. The 2010 state law change required payday lenders to allow borrowers to pay back loans in installments over time with the option to pay them off early without penalty.

- Payday borrowers strongly support requiring the loans to have affordable installment payments. Eight in 10 favor a requirement that payments take up only a small amount of each paycheck, and 9 in 10 favor allowing borrowers to pay back loans in installments over time.

- Policymakers should act now to eliminate the lump-sum payday loan in the 35 states where it currently thrives. The Consumer Financial Protection Bureau and other policymakers should take steps to make all small-dollar loans safer and more affordable by instituting the following requirements:

- Limit payments to an affordable percentage of a borrower's periodic income. (Research indicates that payments above 5 percent of gross income are unaffordable.)

- Spread costs evenly over the life of the loan.

- Guard against harmful repayment or collection practices.

- Require concise disclosures that reveal both periodic and total costs.

- States should continue to set maximum allowable charges on loans for those with poor credit.

The Impact of Colorado's Law on Borrowers

In 2012, the most recent year with data available, borrowers cumulatively spent 44 percent less than they had in 2009 under the conventional payday loan model, saving $41.9 million.

The loan's stated cost for a six-month term also gave borrowers a far more representative statement of their likely spending enabling them to make a more informed decision about whether to borrow.