Americans Want Payday Loan Reform, Support Lower-Cost Bank Loans

Results of a nationally representative survey of U.S. adults

Overview

Typical payday loans have unaffordable payments, unreasonable durations, and unnecessarily high costs: They carry annual percentage rates (APRs) of 300 to 500 percent and are due on the borrower’s next payday (roughly two weeks later) in lump-sum payments that consume about a third of the average customer’s paycheck, making them difficult to repay without borrowing again.

In June 2016, the Consumer Financial Protection Bureau (CFPB) proposed a rule to govern payday and auto title loans1 that would establish a process for determining applicants’ ability to repay a loan but would not limit loan size, payment amount, cost, or other terms. The CFPB solicited and is reviewing public comments on whether to include in its final rule alternatives to this process with stronger safeguards, particularly a “5 percent payment option” that would limit installment payments to 5 percent of monthly income, enabling banks and credit unions to issue loans at prices six times lower than those of payday lenders at scale. As such, it would be likely to win over many payday loan customers.2

An analysis by The Pew Charitable Trusts determined that the CFPB’s proposal would accelerate a shift from lump-sum to installment lending but, without the 5 percent option, would shut banks and credit unions out of the market, missing an opportunity to save consumers billions of dollars a year.3

To gauge public opinion on various reforms, including the proposed rule, Pew surveyed 1,205 American adults and found:

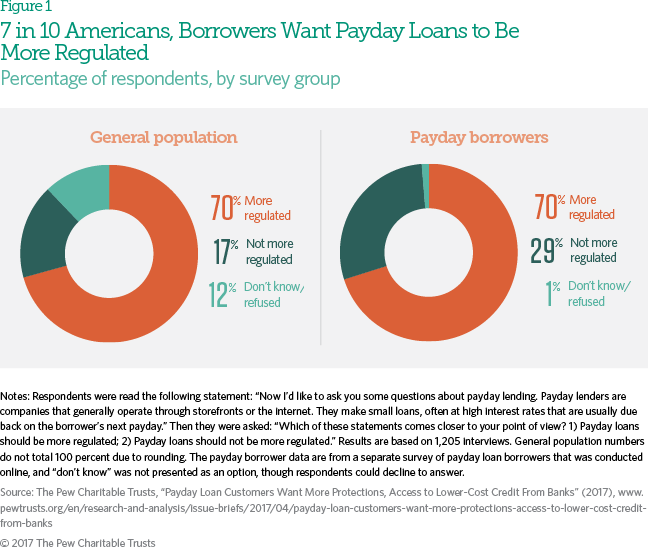

- 70 percent of respondents want more regulation of payday loans.

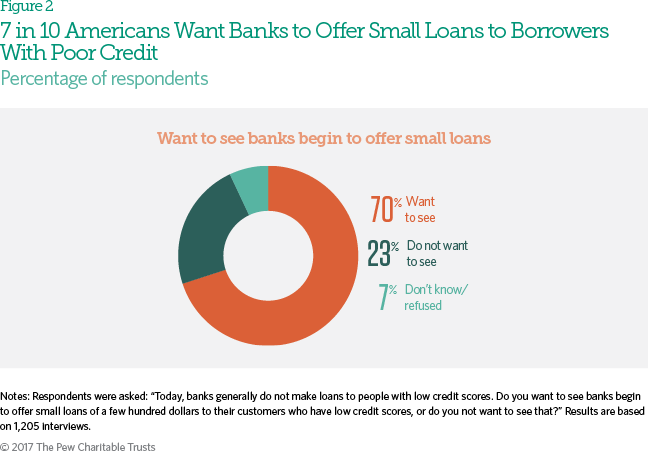

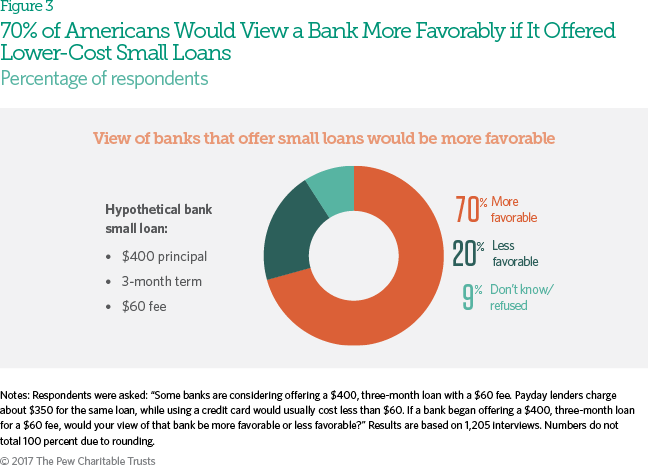

- 7 in 10 adults want banks to offer small loans to consumers with low credit scores, and the same proportion would view a bank more favorably if it offered a $400, three-month loan for a $60 fee (as reportedly planned).

- When evaluating a loan regulation’s effectiveness, Americans focus on pricing rather than origination processes.

- Respondents say typical prices for payday installment loans that would probably be issued under the proposed rule are unfair.

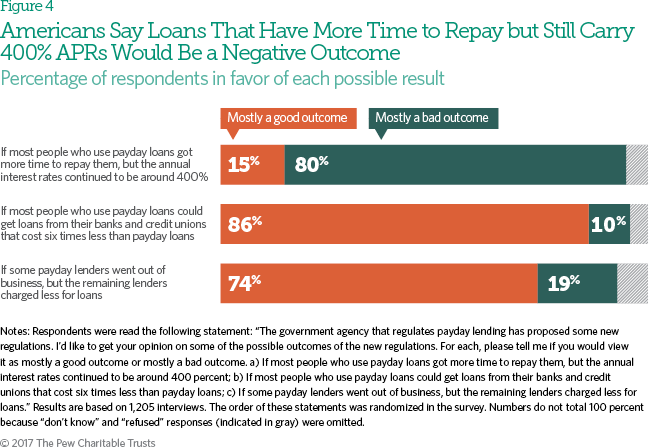

- 80 percent dislike the proposal’s likely outcome of 400 percent APR payday installment loans with more time to repay, but 86 percent say enabling banks and credit unions to offer lower-cost loans would be a success.

These results show that the public supports the CFPB’s actions but strongly favors allowing banks and credit unions to offer lower-cost loans. A separate Pew survey of payday loan borrowers found similar sentiments.4 This chartbook delves more deeply into these findings and discusses recommended changes to the proposal, including adoption of the 5 percent payment option, which is supported by Pew as well as many banks, community groups, and credit unions.

Roughly 12 million Americans use payday loans annually, spending an average of $520 on fees to repeatedly borrow $375.5 Borrowers and the general population support more regulation of the small-loan industry in equal proportions.

Banks generally cannot profitably make loans to people with low credit scores in the current regulatory environment. In May 2016, American Banker reported that at least three large banks were planning to use the 5 percent payment option that the CFPB proposed in its 2015 framework to offer such customers small loans repayable in affordable installments at prices roughly six times lower than average payday loans, such as a $400, three-month loan for a $60 fee.6 Most Americans would like to see banks begin offering these loans.

Seventy percent of survey respondents said they would have a more favorable view of a bank if it offered a $400, three-month loan for a $60 fee (as some banks are planning to do).7 Banks report that they would need to use the 5 percent payment option in order to make these loans available.

The most likely outcome of the CFPB’s June 2016 draft rule would be to shift the market to longer- term payday installment loans. Similar loans today carry interest rates of around 400 percent, and prices would not be likely to decline under the proposal. Most Americans view that as a bad outcome. If the CFPB modified its proposed rule to include the 5 percent payment option it featured in the 2015 framework, banks and credit unions would be likely to offer lower-cost loans, creating a better alternative for borrowers. The public overwhelmingly said that would be a good result.

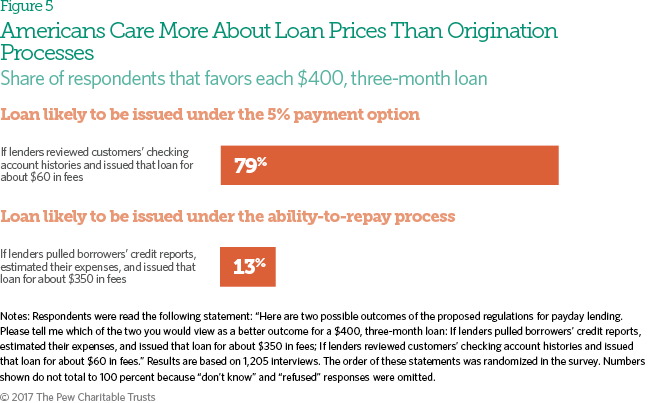

The CFPB’s proposed rule focuses on establishing the process that lenders must use to originate loans, allowing those willing to comply with those guidelines to charge high prices and preventing lower-cost providers, such as banks and credit unions, from offering lower-cost loans at scale. If banks are permitted to issue loans using borrowers’ checking account histories instead of the bureau’s proposed ability-to-repay process, their pricing for small-dollar loans would be roughly six times lower than that of typical payday lenders. By a margin of 6 to 1, Americans prefer the loans that would be available from banks and credit unions under the CFPB’s earlier 5 percent payment option to those that payday lenders would issue under the proposed ability- to-repay provision.

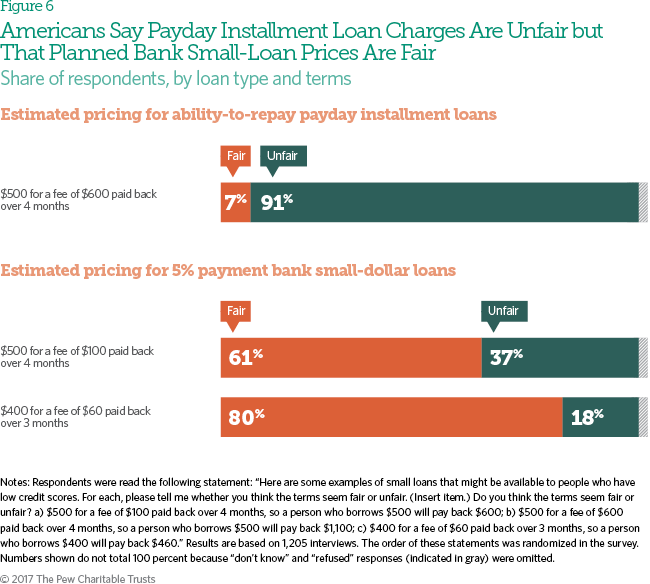

Americans view current payday installment loans and those likely to be issued under the CFPB’s proposed ability-to-repay provision as unfair, but they say the loans that banks and credit unions plan to offer under the 5 percent payment option would be fair. Banks and credit unions have said they cannot take on the paperwork, compliance, and regulatory risk of the ability-to- repay process but are interested in offering small credit at lower prices with stronger safeguards under the 5 percent option.

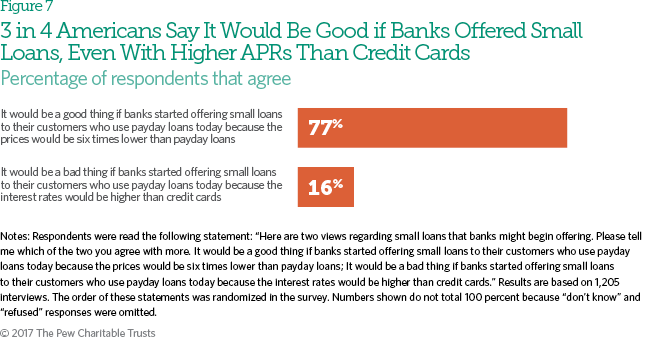

By a margin of almost 5 to 1, respondents said it would be a good thing if banks began offering small loans at prices six times lower than those of payday lenders, even if the rates would be higher than those for credit cards. All payday loan borrowers have a checking account because it is a loan requirement, so if these loans became available, they would be likely to replace a large share of high-cost loans.

Methodology

On behalf of The Pew Charitable Trusts, Social Science Research Solutions conducted a nationally representative random-digit-dialing (RDD) telephone survey of 1,205 adults Aug. 12–21, 2016. The survey included an oversample of approximately 200 African-American and Latino respondents, which was weighted to match the demographic incidence of the RDD sample, producing an overall sample representative of the general population. The margin of error including the design effect is plus or minus 3.37 percent at the 95 percent confidence level.

A detailed methodology is available at http://ssrs.com/omnibus.

Endnotes

- Proposed rule, 81 Fed. Reg. 47864 (July 22, 2016), https://www.federalregister.gov/documents/2016/07/22/2016-13490/payday-vehicle-title-and-certain-high-cost-installment-loans. For a summary of the proposed rule, see The Pew Charitable Trusts, “How the CFPB Proposal Would Regulate Payday and Other Small Loans: A Summary of the Draft Rule” (2016), http://www.pewtrusts.org/en/research-and-analysis/analysis/2016/09/07/how-the-cfpb-proposal-would-regulate-payday-and-other-small-loans.

- The Pew Charitable Trusts, “An Analysis of the Draft Rule: The CFPB’s Proposed Payday Loan Regulations Would Leave Consumers Vulnerable” (2016), http://www.pewtrusts.org/en/research-and-analysis/analysis/2016/09/07/the-cfpbs-proposed-payday-loan-regulations-would-leave-consumers-vulnerable.

- The Pew Charitable Trusts, “How CFPB Rules Can Encourage Banks and Credit Unions to Offer Lower-Cost Small Loans” (2016), http://www.pewtrusts.org/en/research-and-analysis/analysis/2016/04/05/how-cfpb-rules-can-encourage-banks-and-credit-unions-to-offer-lower-cost-small-loans.

- The Pew Charitable Trusts, “Payday Loan Customers Want More Protections, Access to Lower-Cost Credit From Banks” (2017), www.pewtrusts.org/en/research-and-analysis/issue-briefs/2017/04/payday-loan-customers-want-more-protections-access-to-lower-cost-credit-from-banks.

- The Pew Charitable Trusts, Payday Lending in America: Policy Solutions (October 2013), 12–16, http://www.pewtrusts.org/~/media/legacy/ uploadedfiles/pcs_assets/2013/pewpaydaypolicysolutionsoct2013pdf.pdf.

- Ian McKendry, “Banks’ Secret Plan to Disrupt the Payday Loan Industry,” American Banker, May 6, 2016, http://consumerbankers.com/cba-media-center/cba-news/banks-secret-plan-disrupt-payday-loan-industry; Consumer Financial Protection Bureau, Small Business Advisory Review Panel for Potential Rulemakings for Payday, Vehicle Title, and Similar Loans: Outline of Proposals Under Consideration and Alternatives Considered (March 26, 2015), http://files.consumerfinance.gov/f/201503_cfpb_outline-of-the-proposals-from-small-business-review-panel.pdf.

- Ibid.

Payday Loan Customers Want More Protections

Results of a nationally representative survey of U.S. borrowers

How to Fix Payday Loans