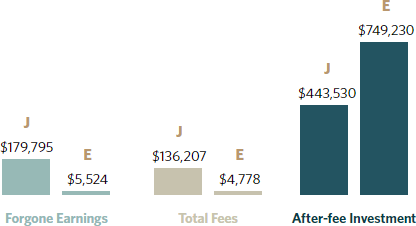

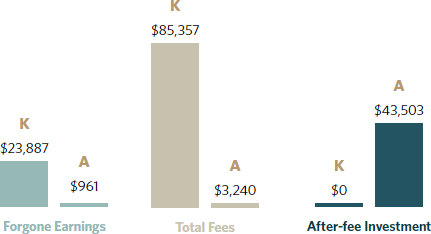

How Fees Affect Retirement Savings Over Time

Compound interest is a powerful feature of investing. Small sums put aside routinely can grow dramatically over time. However, the same forces apply to retirement plan fees; what may seem like small charges can compound over time, hindering investment growth and resulting in significant forgone earnings.

Follow the scenarios or explore your own retirement to see the impact of fees.