How Tennessee Wage Garnishment Policies Harm Consumers and Small Businesses

New report details how processes related to involuntary payments to debt collectors affect life in the Chattanooga area

Wage garnishment policies in Tennessee not only hurt individuals but also small businesses, according to a new report from the Community Foundation of Greater Chattanooga. When people receive judgments against them in a debt lawsuit, the debt collector can request that a portion of their paycheck be garnished and put toward the amount they owe. Employers are responsible for processing these garnishments. Failing to do so in a timely manner or making even a minor processing error can result in a business being brought to court and held responsible for its employee’s debt.

Researchers with the foundation, which received support for this work from The Pew Charitable Trusts, examined debt collection cases in Hamilton County, Tennessee, where Chattanooga is located. Among its multiple findings, the report highlights the difficulties caused by wage garnishment rules imposed on both defendants and their employers.

The foundation found that debt collection cases dominate the civil court dockets there, affecting 1 in 30 adults annually. Most of the lawsuits involve a large business, usually represented by a specialized collections law firm, that is suing a consumer, typically without an attorney. In line with national trends, fewer than half of defendants in these cases attend the initial court hearing. As a result, the cases often end in default judgment—an automatic win for a debt collector when the individual being sued doesn’t engage with the case.

Once a judgment is entered against a Tennessee consumer, a debt collector can pursue involuntary payment methods, including garnishing wages directly from a worker’s paycheck through the employer. Debt collectors can take as much as 25% of a worker’s paycheck under Tennessee law, leaving many unable to afford necessities, such as food and housing.

Although previous research has established that garnishment can lead to long-term financial instability for consumers, the impact on employers responsible for implementing garnishment orders, especially those with few resources and little experience, is less well known.

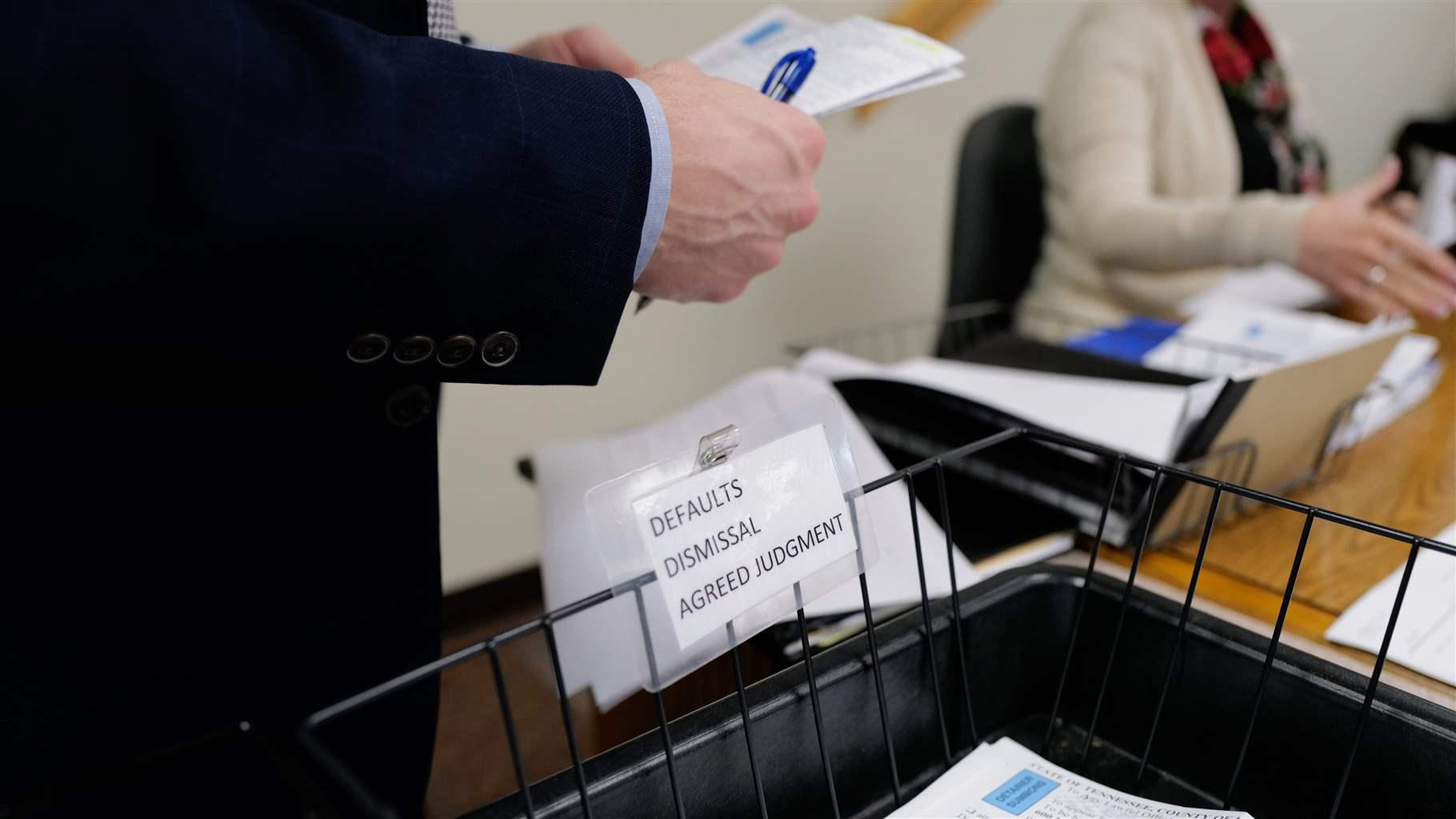

Employers that receive a garnishment order from the court in Tennessee have just 24 hours to notify their employee. Then they have 10 days to calculate the amount they should garnish, fill out a formal response form, and send the garnished pay to the court. The only instructions the employer receives are in the garnishment summons itself, a trifold piece of paper that is dense with text. The summons is single-spaced, in a small type, and written in jargon-filled legal language. In addition to outlining the duties of the employer, this single piece of paper also includes the plaintiff’s application for a garnishment order, the sheriff’s affidavit of service, and a notice to the debtor. The one-pager packs a lot of information into a single, difficult-to-read form, which could frustrate and confuse those who read it and need to use it.

Employers have nowhere to turn if they have questions. And if they make a mistake or miss the deadline, the debt collector can call them into court, where they can be held liable for an employee’s debt.

Court data analyzed by the foundation showed that between 2016 and 2022 in Hamilton County, debt collectors took 458 businesses to court, attempting to hold them responsible for the financial judgments against employees. In 6 out of every 10 of these cases, the business ended up having a judgment entered against them, giving the debt collector the ability to collect directly from the business.

“Every week I am issuing a final judgment against a business for not processing a garnishment correctly,” one judge in Hamilton County shared with researchers.

In addition to the liability that businesses assume when processing garnishments, employers must balance garnishment tasks with staff members’ regular duties. In conversations with local businesses and financial institutions, the foundation found that processing garnishments requires significant staff time and an advanced understanding of the legal process—two things that few small enterprises have.

Many businesses use payroll software that alleviates some of the burden, but smaller ones that manage payroll internally or do not have access to sophisticated payroll software or in-house legal experts are left to navigate the process and garnishment calculations on their own. A staffer at a large local nonprofit that provides health services reported that roughly 25% of her workload was related to garnishments for her employees—she processes about 40 each pay period.

Local employers also indicated that garnishments can drive workers away because they cannot afford to continue working with reduced wages. If employees choose to seek other jobs to escape garnishment, the employers find themselves having to recruit and train replacements.

The Tennessee Legislature has already developed policies to help protect consumers from garnishment, but they are difficult to take advantage of. Making it easier for qualifying consumers to avoid garnishment in the first place would help alleviate some of the burden that wage garnishments are placing on Tennessee employers.

In Tennessee, people with a judgment against them can request to pay back their debt in installments to avoid garnishment by filing what is known as a “slow pay” motion with the court. If the request is granted, a debt collector will get regular payments directly from the consumer, leaving the employer completely out of the process. However, court data analyzed shows that only 5% of Hamilton County residents with a judgment against them request to pay in installments, even though the safeguards are available to all Tennesseans, regardless of income level.

Tennesseans can also protect some funds in their bank accounts from being garnished by filing paperwork with the court, but few in the state are aware of this protection, which is complex and rarely used: Data shows that this was requested in only 1% of cases with a judgment.

Educating Tennessee consumers about their options when faced with garnishment and helping them take advantage of available payment plans would help people in the state avoid the worst consequences of a debt judgment against them and alleviate the burden on small employers. By improving garnishment policies and court forms, Tennessee can support businesses and consumers as well as the economic stability of its communities.

Giulia Duch Clerici works on The Pew Charitable Trusts' courts and communities project.