Consumers Need Protection From Excessive Overdraft Costs

An evidence-based case for regulation to limit the number and amount of fees

Overview

Over the past several decades, banks have increasingly charged consumers fees, such as for overdraft, to generate revenue on checking accounts. Overdraft programs are marketed as a service provided by financial institutions, but in practice consumers often incur unexpected fees that exceed the original transaction amount.1 These charges can be levied on debit card, automated clearinghouse (ACH), ATM, checks, and other transactions. Most consumers do not learn of an overdraft for two or more days, and more than two-thirds of overdrafters say they would rather have a transaction declined than incur a $35 fee.2

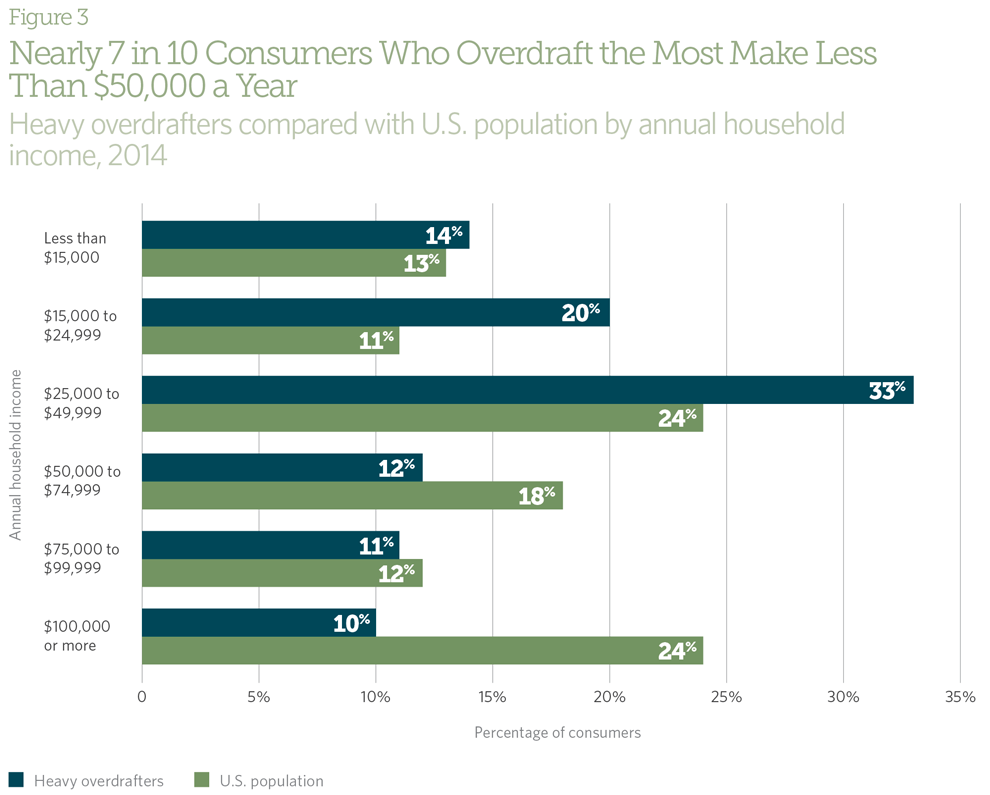

Further, the cost of overdraft programs is borne disproportionately by a small share of financially vulnerable consumers. According to research by the Consumer Financial Protection Bureau (CFPB), less than one-fifth of account holders—those who incur three or more overdraft fees per year—pay more than 90 percent of all overdraft fees triggered by debit cards, checks, and ACH electronic transactions.3 Similarly, The Pew Charitable Trusts’ chartbook Heavy Overdrafters: A Financial Profile, shows that “heavy overdrafters”—consumers who pay more than $100 in overdraft and nonsufficient funds (NSF) fees in a year—generally have incomes below the U.S. average, and overdraft fees consumed nearly a full week’s worth of their household incomes on average during the past year.

To examine the evolution of bank overdraft programs and their impact on consumers, Pew analyzed bank revenue information as reported to the Federal Deposit Insurance Corp. (FDIC) from 1984 to 2015, as well as fee schedules, account agreements, and supplemental disclosures of 44 of the nation’s 50 largest banks. (See Methodology.) This study also incorporates previous survey research on overdraft. Key findings include:

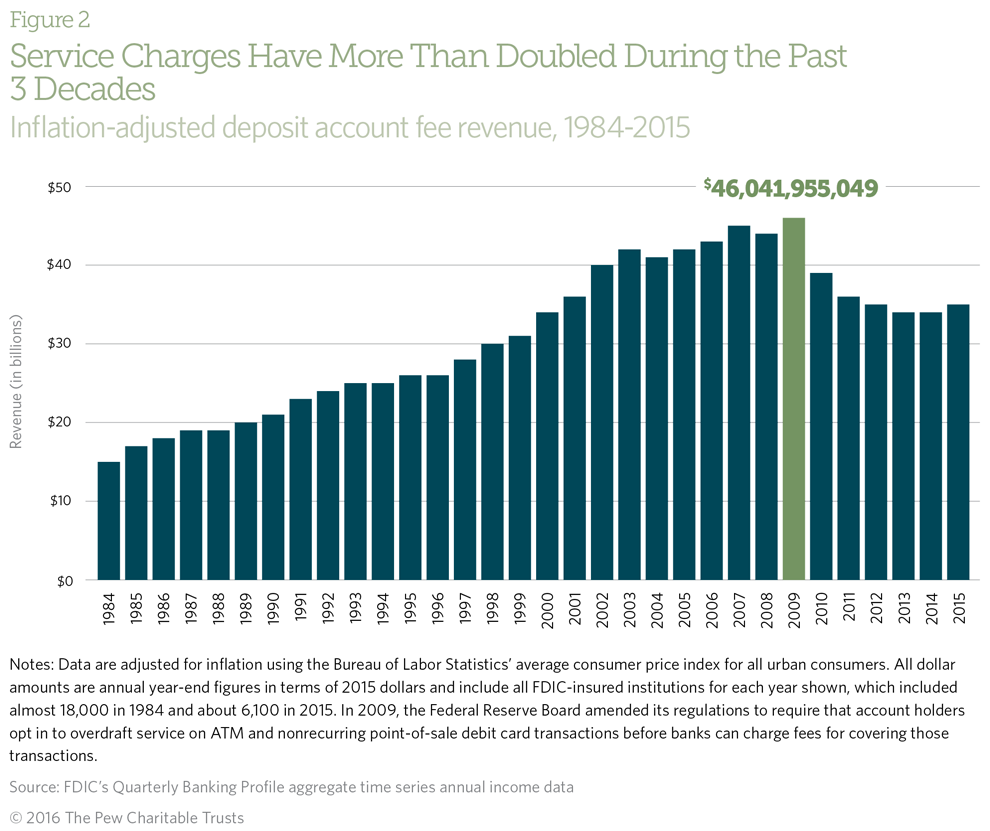

- Service charges on deposit accounts, which include overdraft and NSF fees, have more than doubled while interest income has decreased during the past three decades.

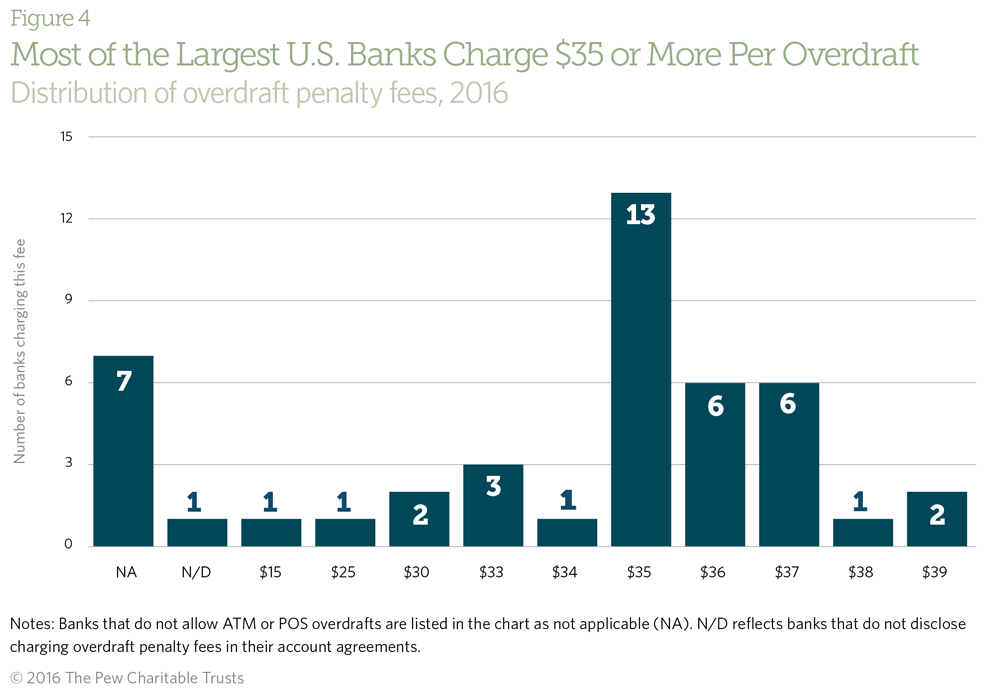

- Most of the largest U.S. banks with consumer checking accounts continue to charge at least $35 each time an overdraft is incurred.

- Many of the largest U.S. banks with consumer checking accounts fail to meet Pew’s recommended best practices on overdraft programs. More than 40 percent of these banks process transactions from largest to smallest by dollar amount—which can reduce the account balance more quickly and result in more overdrafts than other methods, such as posting transactions chronologically—and nearly 80 percent allow overdrafts on ATM and debit point-of-sale (POS) transactions.

Pew urges regulators to ensure that overdraft programs are transparent and designed only for infrequent and accidental occurrences.

To limit the negative financial impact of overdraft fees on the account holders who incur them the most, Pew urges regulators to ensure that overdraft programs are transparent and designed only for infrequent and accidental occurrences using any or a combination of the following:

- Enable banks and credit unions to offer affordable small-dollar loans in place of expensive overdraft penalty programs.4

- Make overdraft penalty fees reasonable and proportional either to the financial institution’s costs in providing the overdraft loan or to the overdraft amount.

- Allow financial institutions to charge customers a maximum of six overdraft fees in any 12-month period, and limit such fees to one per negative-balance episode (i.e., an overdraft that incurs one or more fees).

- Prohibit banks and credit unions from maximizing overdraft fees when posting deposits and withdrawals.

- Require financial institutions to provide account holders with clear, comprehensive terms and pricing information for all available overdraft options.

This brief explores how overdraft programs at the nation’s largest banks affect their customers and rates these banks on whether and to what extent they have adopted Pew’s best and good practices for overdraft. It also provides further detail on policy recommendations that would protect consumers and ensure the availability of safe small-dollar credit for those who need it.

The evolution of overdraft

Over the past three decades, fee income has played an increasingly significant role on bank balance sheets.5 In 1999, the Federal Reserve Bank of Minneapolis noted that increased competition from deregulation and technological innovation was driving banks to seek new sources of revenue to remain profitable.6 In 2004, research from the Federal Reserve Bank of Chicago showed that the growth of fee income was the result not only of deregulation but also of an emerging sense among banks that fees could diversify their sources of revenue.7

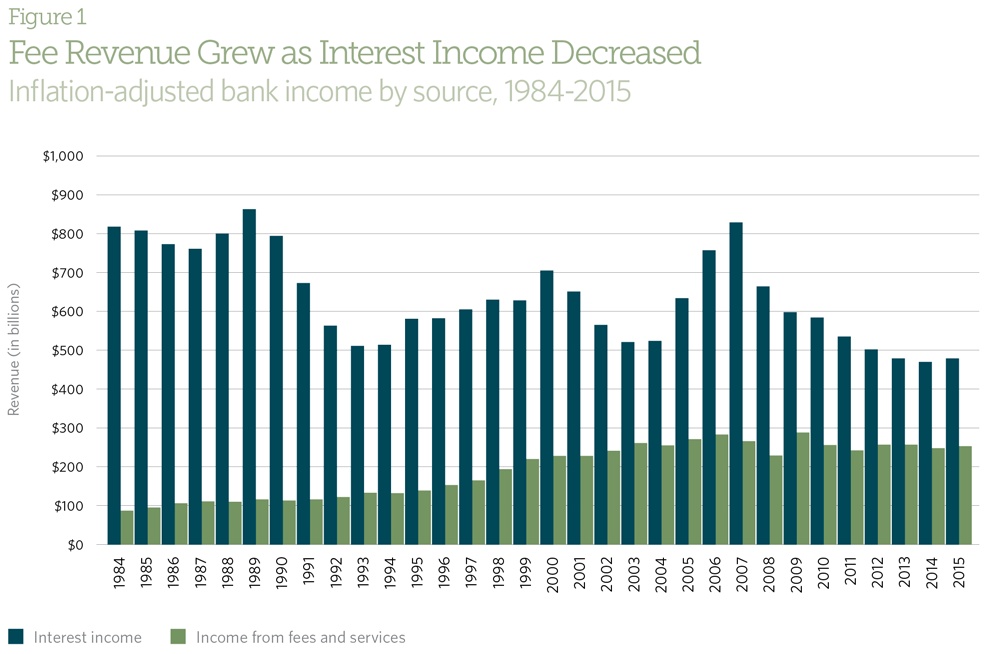

Income from fees for services has grown considerably over time. In 1984, fee revenue was small compared with income earned from interest. By 2015, this gap had narrowed substantially. (See Figure 1.)

Service charges on deposit accounts include overdraft, ATM, and account maintenance fees. From 1984 to 2015, banks more than doubled their revenue from service charges. (See Figure 2.) Overdraft and NSF fees make up a significant portion of charges levied on consumer deposit accounts.8

Overdraft fees are largely incurred by only a small number of financially vulnerable consumers: Just 18 percent of account holders pay 91 percent of overdraft and NSF fees.

In 2015, U.S. banks with assets exceeding $1 billion reported $11.16 billion in overdraft fee and NSF revenue, which constituted nearly two-thirds of all consumer deposit account fee revenue.9 Proponents of overdraft programs have suggested that fee revenue from these and other services is necessary to provide low-cost checking accounts.10 However, these fees are largely incurred by only a small number of financially vulnerable consumers: Just 18 percent of account holders pay 91 percent of overdraft and NSF fees triggered by debit cards, checks, and ACH electronic transactions.11 These customers paid more than three overdraft fees a year, most of them earn less than $50,000 a year (see Figure 3), and 25 percent pay a week’s worth of wages in overdraft fees annually.12

Cost of overdraft fees

Overdraft programs are marketed to consumers as services that provide coverage should an account balance turn negative. In practice, however, the fees incurred are often disproportionate to the original transaction amount and can place a burden on financially vulnerable consumers. Pew found that most of the 44 banks studied charge overdraft penalty fees exceeding $30 per occurrence and that more than 60 percent charge at least $35. The median fee among these banks is $35.13 (See Figure 4.)

Overdraft fees are flat and fixed; debit card overdrafts bear the most disproportionate penalty.

Debit card usage and overdraft

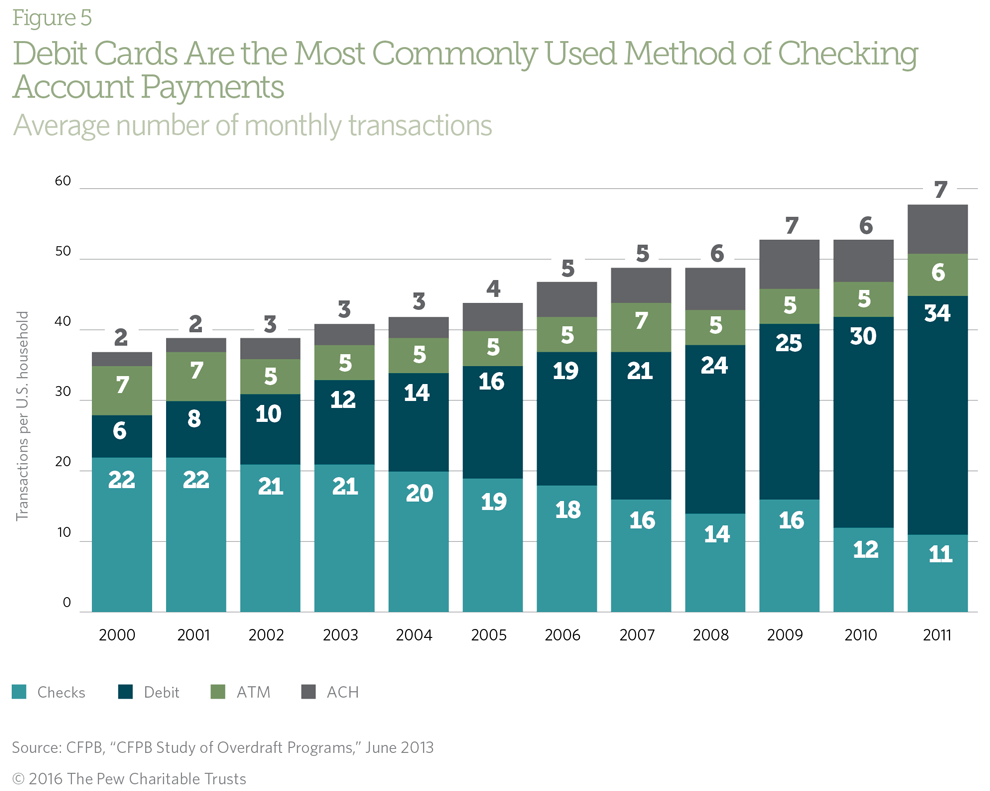

Research from the CFPB has found that the number of consumer checking account transactions increased more than 50 percent from 2000 to 2011.14 Figure 5 shows that this growth was largely driven by an increase in the use of debit cards. In 2011, debit cards were used for roughly 60 percent of checking account payments, up from less than 20 percent in 2000.15

CFPB research shows that among the various types of transactions that can result in overdraft, debit cards carry the lowest median value of all transactions that lead to overdrafts ($24, compared with nearly $100 for ACH, ATM, and check transactions), and Pew’s analysis shows that debit transactions are the preferred tool of the most financially vulnerable bank customers.16 Because overdraft fees are flat and fixed—they are the same whether an account is overdrawn by $10 or $100—debit card overdrafts bear the most disproportionate penalty because they tend to be the smallest transactions.

Heavy overdrafters generally have below-average incomes relative to the U.S. population, and overdraft fees consumed nearly a full week’s worth of their household incomes on average during the past year.17 This formula—a small share of consumers overdrawing most frequently and assuming disproportionate fees on small transactions—means that overdrafts cause some of the most financially at-risk consumers to leave the banking system. In 2015, 60 percent of those without a bank account reported high or unpredictable overdraft fees as one reason for not having an account.18

Best and good overdraft practices

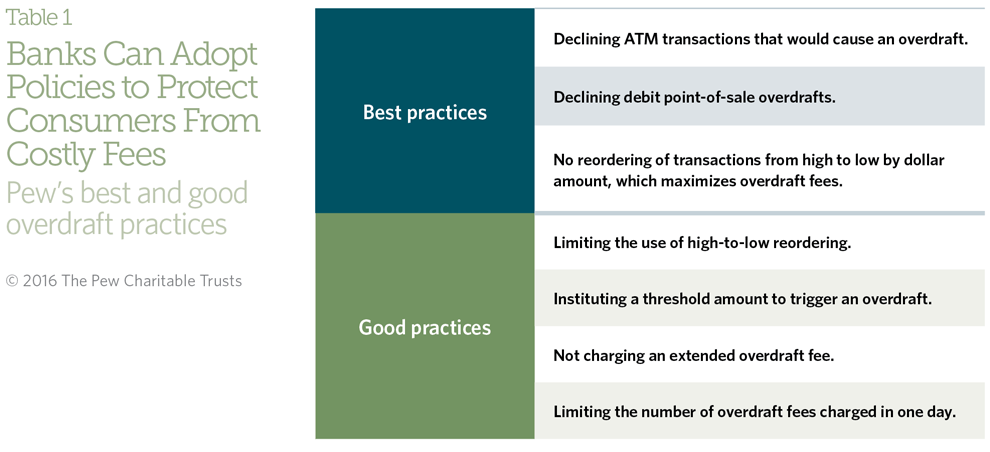

Pew first outlined its set of best and good practices for overdraft services in 2013 and has evaluated banks each year since to track the practices of the largest 50 banks that offer consumer checking accounts.19 In the four years since Pew began examining overdraft issues, the largest banks have adopted many of Pew’s good practices, but few meet all the best-practice standards, especially with regard to declining ATM and debit point-of-sale (POS) transactions. (See Table 1.)

Although adoption of these good and best practices is encouraging, it is voluntary. Regulatory action is needed to ensure adequate, permanent, and consistent protections for consumers against excessive overdraft fees.

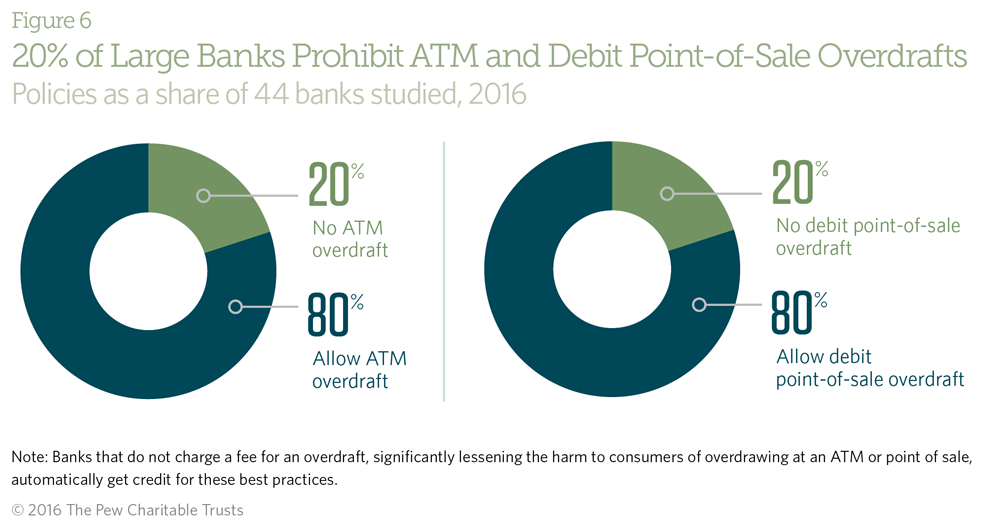

Declining transactions

Because ATM and debit POS transactions happen in real time, banks can protect their customers from unexpected fees by simply declining these transactions at no cost to the consumer. (See Figure 6.) For this reason, disallowing these transactions is a best practice. Most overdrafters say they would rather have a transaction declined than incur a $35 fee.20

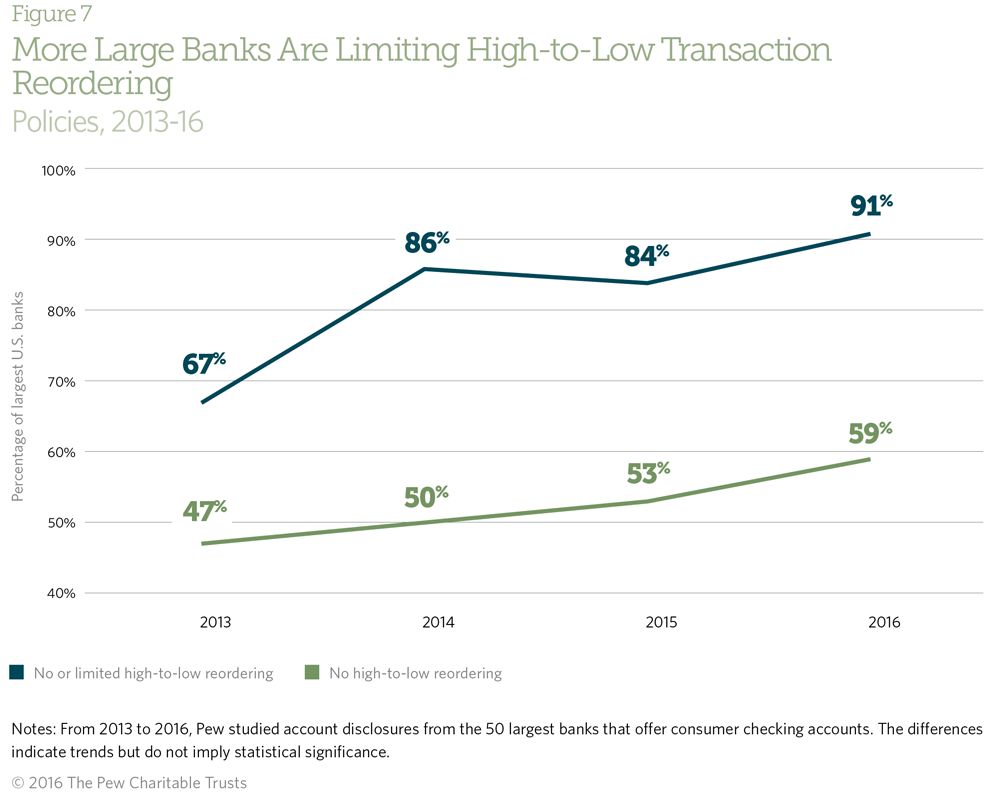

Processing transactions

The method each bank uses to process transactions is another important factor affecting consumers. Because reordering transactions from highest to lowest dollar amount during processing reduces account balances more quickly and results in more overdraft fees than other methods, Pew’s best practice is for banks to process all transactions either chronologically or from low to high by dollar amount. (See Figure 7.)

Extended overdraft fees

Extended overdraft fees are additional charges levied on customers who fail to repay a negative balance within a designated amount of time and are especially harmful to those least able to repay. Therefore, Pew’s recommended good practice is to prohibit the use of these fees. Nevertheless, 52 percent of the banks in this study still charge such additional fees: Among the banks examined for this study, the median period before incurring an extended overdraft fee was five days, and the median fee amount was $20. (See Appendix A.) Previous Pew research found that almost 20 percent of overdrafters have paid an extended fee.21

Recommendations

The costs associated with overdraft fees disproportionately affect vulnerable consumers, driving many out of the financial system. Federal regulators can write rules to reduce these harmful effects in a number of ways, including by limiting the size of overdraft fees, the frequency with which they can be incurred, or the overall cost. Adoption of the following options, individually or in combination, would help to limit the negative impacts of these fees:

- Enable banks and credit unions to offer affordable small-dollar loans in place of expensive overdraft penalty programs. The CFPB should set clear product safety standards for such credit products, including guidelines for affordable payments and reasonable time to repay.22 This should be done in conjunction with other federal agencies that regulate the safety and soundness of financial institutions (known as “prudential” regulators) as appropriate.

- Make overdraft penalty fees reasonable and proportional either to the financial institution’s costs in providing the overdraft loan or to the overdraft amount.

- Allow financial institutions to charge customers a maximum of six overdraft fees in any 12-month period, and limit such fees to one per negative-balance episode (i.e., an overdraft that incurs one or more fees). When customers incur the maximum number of fees, any additional credit extended to them should be required to comply with the rules that govern other types of credit.

- Prohibit banks and credit unions from maximizing overdraft fees when posting deposits and withdrawals, such as by reordering transactions by dollar amount from highest to lowest, causing the account to be overdrawn more quickly and incur more fees.

- Require financial institutions to provide account holders with clear, comprehensive terms and pricing information for all available overdraft options to ensure that consumers can make the best choice for their personal situations, including choosing not to opt in to any coverage.

Conclusion

Overdraft has evolved from an occasional courtesy into a product that many banks rely on for revenue. It is frequently marketed as a service for customers even though the costs are often disproportionate to the negative balance incurred, and the majority of those fees are paid by a small share of consumers who overdraw several times each year. Previous Pew research has shown that heavy overdrafters tend to earn lower incomes than the general U.S. population, and they spent nearly a week of wages on overdraft fees on average, causing many to leave the banking system altogether. These facts show that overdraft fees are often incurred most frequently by financially vulnerable account holders.

Debit cards are an important way for consumers to make payments and purchases, and are used extensively by those most vulnerable to overdraft. These transactions tend to be smaller than other methods of payment, but overdraft fees are flat, placing a larger burden on lower-income consumers, who tend to overdraw most frequently. As a result, banks are effectively charging their most financially vulnerable customers high prices for short-term loans.

Consumers—especially those who are most financially vulnerable—need protections to help them avoid expensive overdraft fees and remain viable in the banking system. The available options include limiting the number of fees that can be charged when an account balance is negative; ensuring that consumers have clear information about overdraft programs; making overdraft penalty fees reasonable and proportional; prohibiting banks from maximizing overdraft revenue through harmful reordering policies; and allowing banks and credit unions to offer affordable small loans in place of expensive overdraft penalty programs.

Endnotes

- Pew’s research finds that most large banks charge $35 or more per overdraft. Consumer Financial Protection Bureau research finds that the median overdraft transaction value for a debit card (the most common transaction device) that leads to an overdraft is $24. Consumer Financial Protection Bureau, Data Point: Checking Account Overdraft (July 2014), 18, http://files.consumerfinance.gov/f/201407_cfpb_report_data-point_overdrafts.pdf.

- The Pew Charitable Trusts, Overdrawn: Persistent Confusion and Concern About Bank Overdraft Practices (June 2014), 9-10, http://www.pewtrusts.org/~/media/assets/2014/06/26/ safe_checking_overdraft_survey_report.pdf.

- Consumer Financial Protection Bureau, Data Point: Checking Account Overdraft, 12. The automated clearing house is a network through which electronic transactions are sent between accounts.

- The Pew Charitable Trusts, “How CFPB Rules Can Encourage Banks and Credit Unions to Offer Lower-Cost Small Loans” (April 2016), http://www.pewtrusts.org/en/research-and-analysis/analysis/2016/04/05/how-cfpb-rules-can-encourage-banks-and-credit-unions-to-offer-lower-cost-small-loans. See also: The Pew Charitable Trusts, Payday Lending in America: Policy Solutions (October 2013), http://www.pewtrusts.org/~/media/legacy/uploadedfiles/pcs_assets/2013/ PewPaydayPolicySolutionsOct2013pdf.pdf; and Nick Bourke, “Regulators Should Let Banks Get Back to Small-Dollar Loans,” American Banker (September 2015), http://www.americanbanker.com/bankthink/regulators-should-let-banks-get-back-to-small-dollar-loans-1076693-1.html.

- In this paper, noninterest income and fee income are used interchangeably.

- Ron J. Feldman and Jason Schmidt, “Noninterest Income: A Potential for Profits, Risk Reduction and Some Exaggerated Claims,” Fedgazette (October 1999), https://www.minneapolisfed.org/publications/fedgazette/noninterest-income-a-potential-for-profits-risk-reduction-and-some-exaggerated-claims.

- Robert DeYoung and Tara Rice, “How Do Banks Make Money? The Fallacies of Fee Income,” Economic Perspectives (2004), https://chicagofed.org/~/media/publications/economic-perspectives/2004/ep-4qtr2004-part3-deyoung-rice-pdf.pdf.

- Consumer Financial Protection Bureau, CFPB Study of Overdraft Programs (June 2013), 15, http://files.consumerfinance.gov/f/201306_cfpb_whitepaper_overdraft-practices.pdf. The CFPB’s 2013 study on overdraft programs cites the following examples: The FDIC’s 2008 Study of Bank Overdraft Programs estimated that 74 percent of deposit account service charges in 2007 were attributable to overdraft and NSF fees; the Independent Community Bankers of America Overdraft Payment Services Study estimated the percentage at around 62 percent; and Strunk and Associates, an industry vendor that services 1,800 smaller institutions, estimated it at 78 percent.

- Consumer Financial Protection Bureau, Variation in Bank Overdraft Revenues and Contribution (February 2016), 2, http://files.consumerfinance.gov/f/201602_cfpb_variation-in-bank-overdraft-revenues-and-contribution.pdf. Overdraft revenue averaged 65.3 percent of service charges on consumer deposits for the 581 institutions with complete data.

- G. Michael Flores and Todd Zywicki, “Overdraft Protection Rules Could Hurt Consumers More Than They Help,” American Banker (Nov. 24, 2014), http://www.americanbanker.com/bankthink/overdraft-protection-rules-could-hurt-consumers-more-than-they-help-1071368-1.html.

- Consumer Financial Protection Bureau, Data Point: Checking Account Overdraft, 12.

- The Pew Charitable Trusts, Heavy Overdrafters: A Financial Profile (April 2016), 1, http://www.pewtrusts.org/~/media/assets/2016/04/heavyoverdrafters.pdf.

- The median overdraft transfer fee among large banks is $10, with a range of $0 to $16.

- Consumer Financial Protection Bureau, CFPB Study of Overdraft Programs (June 2013), 12, http://files.consumerfinance.gov/f/201306_cfpb_whitepaper_overdraft-practices.pdf.

- Ibid., 13.

- Consumer Financial Protection Bureau, Data Point: Checking Account Overdraft, 18; and The Pew Charitable Trusts, Heavy Overdrafters, 6.

- Ibid., 5.

- The Pew Charitable Trusts, What Do Consumers Without Bank Accounts Think About Mobile Payments? (June 2016), 4, http://www.pewtrusts.org/~/media/assets/2016/06/ fsp_what_do_consumers_without_bank_accounts_think_about_mobile_payments.pdf.

- The Pew Charitable Trusts, Checks and Balances: Measuring Checking Accounts’ Safety and Transparency (May 2013), http://www.pewtrusts.org/~/media/legacy/uploadedfiles/pcs_assets/2013/ checksbalancesnewpdf.pdf.

- The Pew Charitable Trusts, Overdrawn: Persistent Confusion and Concern About Bank Overdraft Practices, 10.

- Ibid., 8.

- See “How CFPB Rules Can Encourage Banks and Credit Unions to Offer Lower-Cost Small Loans,” http://www.pewtrusts.org/en/research-and-analysis/analysis/2016/04/05/how-cfpb-rules-can-encourage-banks-and-credit-unions-to-offer-lower-cost-small-loans.

How a Set of Small Banks Compares on Overdraft

An analysis of programs, fees, and terms at 45 financial institutions

Heavy Overdrafters

A financial profile

Overdrawn: Consumer Experiences with Overdraft

Survey shows checking account holders still confused, unhappy with practices and fees

Overdraft: The Need for New Rules

The need for new rules