Tax Code Connections

How changes to federal policy affect state revenue

Stocksy

StocksyThe state impact of federal tax code changes.

Overview

States have a great deal at stake when federal policymakers are considering tax policy changes, whether full-scale reform or targeted revisions. Of the 41 states (plus the District of Columbia) with broad-based personal income taxes, 40 states and the District connect in some way to the federal system by incorporating a range of federal tax expenditures—exclusions, deductions, and credits—into their state tax codes. These linkages to federal law, also known as conformity, mean that changes at the federal level can affect state tax collections and can increase total federal taxes paid in some states and decrease them in others, even if federal revenue remains unchanged nationwide.

To help policymakers at both the state and federal levels better understand the extent to which states are connected to and affected by changes to federal individual income tax expenditures, this analysis illustrates the state revenue impact of eliminating the large majority of federal tax expenditures. It also reduces federal tax rates by roughly 40 percent to achieve revenue neutrality—that is, to maintain pre-reform revenue levels. Importantly, the scenario is not a tax reform proposal, nor does it endorse any particular plan or a revenue-neutral approach to tax reform.

Of the 41 states (plus the District of Columbia) with broad-based personal income taxes, 40 states and the District connect in some way to the federal system by incorporating a range of federal tax expenditures—exclusions, deductions, and credits—into their state tax codes.

This analysis used a model of federal and state individual income tax systems that includes state conformity as of 2013 and simulates tax returns for all 50 states and the District for the same year. Based on those state linkages, the analysis found that federal changes had the following effects on state revenue:

- Overall state individual income tax revenue increased by about 34 percent.

- Revenue increases varied widely across the 40 states (plus the District) that have significant linkages to federal tax provisions, ranging from less than 5 percent to more than 50 percent and reflecting the broad range of conformity.

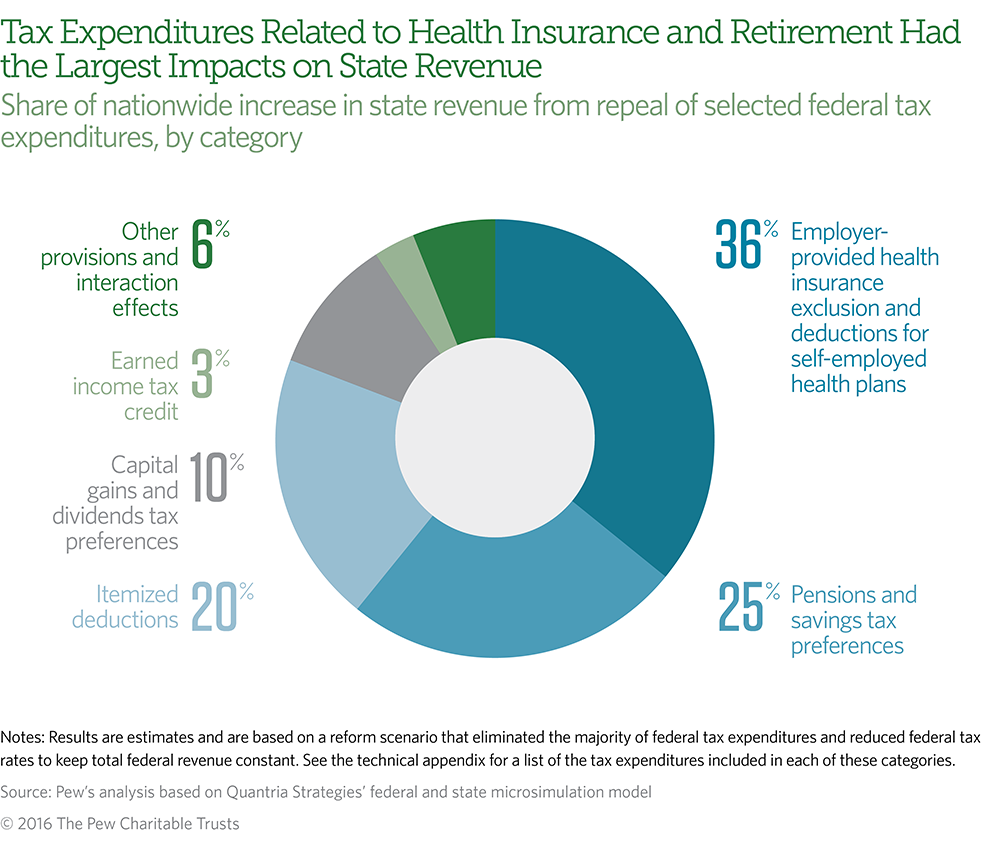

- Eliminating tax expenditures related to health insurance and retirement had the largest impact on state revenue because many states conform to them, they include a large amount of untaxed income, and they benefit a significant portion of the population.

In addition to state revenue impacts, this analysis estimates the effect on federal revenue within each state and finds that even if a federal reform is designed to be revenue neutral overall, the impact can vary by state. Because tax filers differ across states, total federal tax collections could increase in some states and decrease in others. In this analysis, federal income taxes paid rose in 29 states and fell in 21 and the District. Most of these revenue changes were not dramatic, with nearly all totaling 10 percent or less. This variation could contribute to diverse economic impacts by changing residents’ disposable income in different ways across states.

Federal tax changes present state policymakers with a series of decisions. First, conformity is a policy choice for states, so they must weigh whether to continue to link to a changed provision. This analysis assumes that policymakers choose to maintain their states’ existing levels of conformity and accept the federal changes, so eliminating federal tax expenditures causes their revenue to rise. (See “Conformity in This Analysis” on page 3 of the report PDF.) In that case, they would then need to decide how to use the new revenue—by increasing spending or lowering tax rates, for example. Alternatively, they could opt not to accept the changes to federal provisions, but that decision could make filing more complex, reduce compliance, and raise administrative costs.

State linkages to federal tax law, also known as conformity, mean that changes at the federal level can affect state tax collections and can increase total federal taxes paid in some states and decrease them in others, even if federal revenue remains unchanged nationwide.

Reducing or eliminating tax expenditures is sometimes called “broadening or expanding the tax base” because it increases the types or amount of income (the “base”) that is subject to tax. To capture as many of the links between state and federal tax systems as possible, the hypothetical expansion of the base that is included here exceeds that of most tax reform proposals and has the effect of significantly increasing state revenue. This analysis presents one example of federal tax changes, but the effect on states of a given policy proposal would depend on the specifics. Other types of changes could have different outcomes. For instance, more modest federal changes would have smaller effects on states. And federal changes that increase the value or number of tax expenditures—by adding or expanding deductions, for example—would reduce federal taxable income and revenue and could reduce revenue in conforming states.

Understanding the extent to which state income taxes are linked to the federal system is important for policymakers at both levels of government when evaluating federal revisions or reforms. In considering reforms, federal policymakers should realize that changes can affect state revenue, requiring states to decide whether to revise their tax policies; state leaders need to weigh the trade-offs of linking to federal tax expenditures, given the possible impacts of revisions; and both should recognize that the effect on federal revenue will vary by state. Identifying the depth and breadth of the connections between state and federal tax policy would help inform a wide range of tax policy debates at both levels of government.