Use of Mortgages to Buy Lower-Priced Homes Declines in Philadelphia

Rising housing costs present additional challenges for low- and moderate-income households

A mortgage is the primary pathway to homeownership for many Americans, because few have the funds to purchase a home using cash. And the availability of lower-priced homes helps first-time buyers and people with limited resources access the financial benefits of homeownership.

But an analysis of deed transactions in Philadelphia by The Pew Charitable Trusts found that the share of mortgage-backed home sales in the lower-priced half of the city’s residential market has been declining. From 2000 to 2018, the percentage of such sales fell from 46% to 35%. And over the same period, the median sales price in Philadelphia doubled, rising from almost $80,000 to $160,000, while the number of homes sold for less than $100,000 fell from 13,820 to 7,864.

These two trends—the drop in the share of lower-priced transactions financed with a mortgage and the rising cost of housing—reflect greater challenges for people in the low- and moderate-income brackets looking to become homeowners.

For years, Philadelphia has been characterized by a higher homeownership rate among low- and moderate-income households than in many other cities; roughly one-third (31.4%) of Philadelphia’s homeowning households earned less than $35,000 in 2018. This new data raises questions about whether that pattern will continue and whether Philadelphians will still be able to find low-cost housing. The COVID-19 pandemic is likely to compound this uncertainty, as its full economic impact, including the effects felt by potential homebuyers, has yet to be realized.

Sales prices have increased since 2000

To understand mortgages’ declining role in financing lower-priced homes in Philadelphia, one must first consider what has happened to the city’s housing market over the past two decades. The median home sales price in 2018 was $160,000, twice as high as the median in 2000 (as expressed in 2018 dollars). (See Figure 1.) This was also 12% higher than the median in 2007, the peak prior to the Great Recession.

The rising median sales prices reflected both a decrease in the number of lower-cost homes sold and an increase in sales of higher-priced homes.

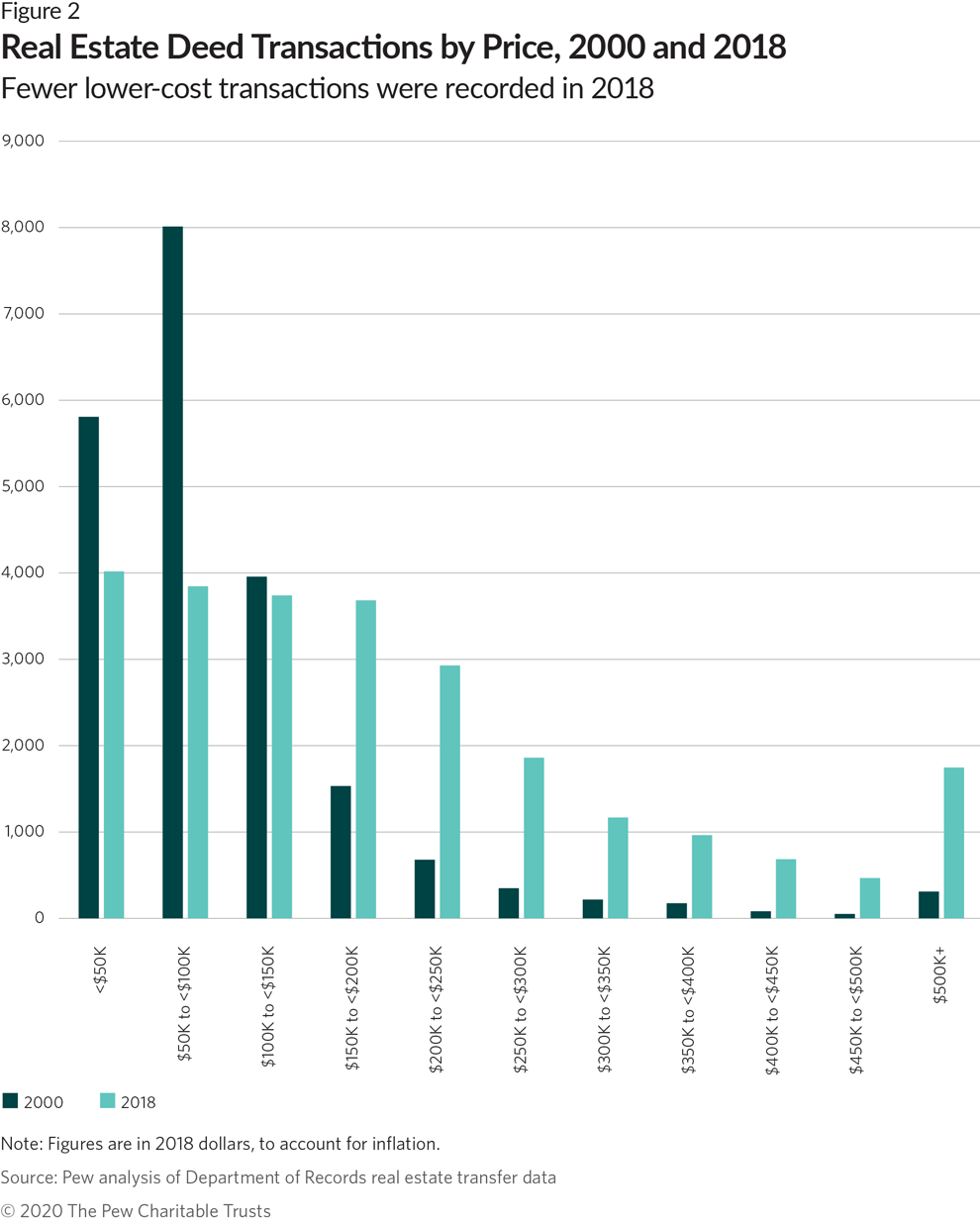

In 2000, nearly 14,000 homes sold for less than $100,000, accounting for 65% of transactions for that year. In 2018, fewer than 8,000 such transactions occurred, representing less than one-third of the year’s sales. And the number of homes sold for at least $500,000 more than quintupled from 2000 to 2018, to almost 1,800. (See Figure 2.)

Of particular note was the decline in the number of transactions in the $50,000 to less than $100,000 range—houses likely to be affordable for many households. Accounting for roughly 38% of all home sales in 2000 (at over 8,000 transactions), the share in this range decreased by more than half in 2018, falling to roughly 3,800—accounting for just 15% of sales.

And in 2000, 90% of sales occurred below $180,000. In 2018, that same 90% threshold occurred at $420,000.

The findings in this fact sheet are based on the city of Philadelphia’s deed records. Deeds list details about a home—such as the seller, buyer, price, and location—and the city issues a new deed every time a property changes ownership. Often, changes stem from a sale; however, adding a family member or a spouse to a deed or transferring it between related parties also requires a new deed.

Pew excluded from its analysis transactions that were not reflective of market prices, such as nominal sales (homes sold for $10 or less), sheriff’s sales (in which the sheriff was the buyer or seller), blanket sales (those in which multiple properties were sold together for a single, combined price), and government sales (in which the government was the buyer or seller).

Residential sales at the lower end of the market are less likely to be financed with a mortgage

Recent research has shown that small-dollar mortgages are often harder to obtain and less available than larger-dollar home loans.1 One reason is that the fixed costs associated with writing any mortgage limit the profitability for the lender when the loan is small; this effect is compounded by the more restrictive lending standards instituted after the 2007-09 recession.2

During the study period, between 50% and 60% of all home sales in Philadelphia were financed with mortgage loans. In 2018, about 54% involved mortgages; the share was about 58% in 2000.

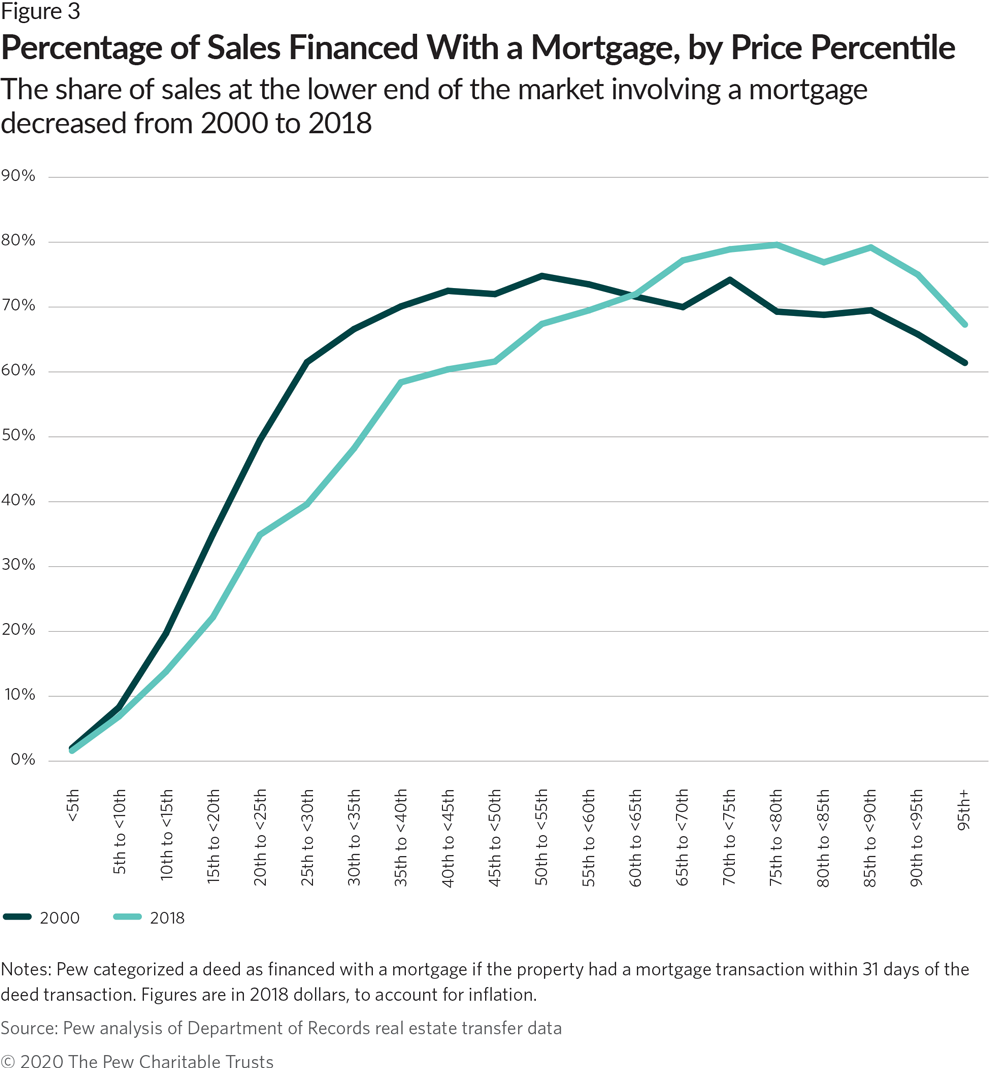

The percentage of lower-priced homes purchased with mortgages declined from 2000 to 2018. (See Figure 3.) For instance, 62% of homes sold for prices in the 25th to 30th percentile of the market in 2000 had mortgages; in 2018, that figure was only 40%, meaning that a greater share of buyers used mortgages at that price in 2000. In neither year were many home sales at the bottom of the market financed with mortgage loans. (We use price percentiles here rather than dollar amounts to compare the use of mortgages in 2000 and 2018, allowing us to focus on the lower end of the housing market in each year.)

In all, about 46% of sales below the median price were financed with mortgages in 2000; in 2018, that share was 35%. Looking only at sales in the 25th to 50th percentile reveals a similar pattern, with 69% involving a mortgage loan in 2000, versus 54% in 2018.

The number of houses financed with mortgages at particular prices also changed. For example, 7,158 homes that sold for less than $100,000 in 2000 involved mortgages, compared with only 1,627 in 2018. The number financed without a mortgage in this price category was nearly the same in both years. (See Figure 4.)

Mortgage-backed transactions between $50,000 and less than $100,000 fell from nearly 5,700 in 2000 to little more than 1,300 in 2018. Again, the number without mortgages was about the same in both years.

The data does not provide insight into why any of this happened; to what degree potential homebuyers did not seek mortgages, tried unsuccessfully to secure them, or were outpriced by cash buyers; or how much this stems from changing lending patterns or market conditions. Answering those questions is essential to any attempt to respond to the trends.

But the facts are clear: Lower-cost home sales have declined in Philadelphia, as has the share of mortgage-backed sales at the lower end of the price spectrum. These facts ultimately affect low- and moderate-income households’ ability to purchase homes and accrue the benefits associated with homeownership. Whether these trends will change in the aftermath of the current public health emergency remains to be seen.

Endnotes

- A. McCargo et al., “Small-Dollar Mortgages for Single-Family Residential Properties” (Urban Institute, 2018), https://www.urban.org/research/publication/small-dollar-mortgages-single-family-residential-properties.

- L. Goodman, W. Li, and B. Bai, “It’s Still Too Hard for Most Americans to Get a Mortgage,” Urban Wire (blog), Urban Institute, July 29, 2015, https://www.urban.org/urban-wire/its-still-too-hard-most-americans-get-mortgage; R. Abare, “Ten Years After the Crash, What Is the State of the Housing Market?,” Urban Wire (blog), Urban Institute, May 30, 2018, https://www.urban.org/urban-wire/ten-years-after-crash-what-state-housing-market.

America’s Overdose Crisis

Sign up for our five-email course explaining the overdose crisis in America, the state of treatment access, and ways to improve care

Sign up

Poverty in Philadelphia