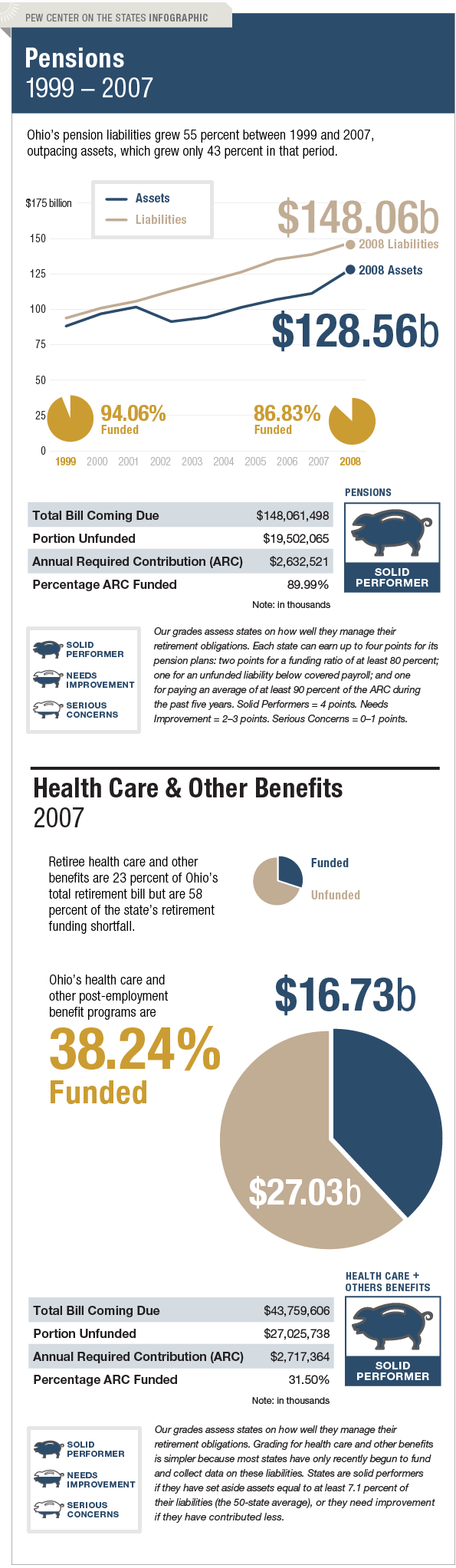

The Trillion Dollar Gap: Ohio

Underfunded State Retirement Systems and the Roads to Reform

Ohio is a national leader in managing its long-term liabilities for both pensions and retiree health care and other benefits. It has funded 87 percent of its total pension bill—above the 80 percent benchmark that the U.S. Government Accountability Office says is preferred by experts—and the Buckeye State has nearly met its actuarially required contribution levels, averaging 95 percent of its total annual bill during the past five years. Ohio has also succeeded in keeping its pension contributions consistent from year to year by setting its maximum contribution in statute at 14 percent of payroll for the Ohio Public Employees Retirement System, with any extra money being used to fund retiree health care and other non-pension benefits. As a result, the state has managed to set aside $16.7 billion, or more than 38 percent of its nearly $43.8 billion liability, to cover those long-term costs.