Employment Rate Up Again, but Lags Pre-Recession High

The U.S. employment rate for adults of prime working age rose in 2017 for a seventh consecutive year but still fell short of its high before the Great Recession. In another sign of progress, the number of states with prime-age employment rates that were clearly below pre-recession levels continued to shrink—down to just 10.

The U.S. employment-to-population for 25- to 54-year-olds, which measures the share of people in their prime working years who have jobs, averaged 78.6 percent for the 12 months of 2017, up from 77.9 percent a year earlier. In the wake of the 2007-09 recession, the employment rate hit lows of about 75 percent. Despite rising for years, the prime-age employment rate in 2017 was still below 2007’s level of 79.9 percent.

The results mean that for every 100 prime-working-age adults nationwide, 1.3 fewer were employed in 2017 than before the recession, or a total of 1.6 million fewer prime-age adults with jobs. For state governments, lower employment among residents can translate into less tax revenue, and potentially additional demand for social services.

Despite a persistent employment-rate gap among prime-age workers, the labor market has been gaining strength for years. In 2012, shortly after Pew’s analysis of the data began, 37 states had employment rates that lagged 2007 levels by a statistically significant amount. That count fell to 34 in 2013, 28 in 2014, 22 in 2015, and 16 in 2016. By 2017, the number had fallen to 10. Most other states in 2017 had rates below pre-recession levels, but not by statistically significant amounts. No state’s rate had surpassed 2007 levels by a statistically significant amount. The prime-age employment rate hit a recent peak in 2007, but even that level was below heights reached in 2000.

As the U.S. employment-rate gap has narrowed, a better-known measure—unemployment—has also improved, falling close to pre-recession rates. Among prime-age workers, the unemployment rate in 2017 was 3.8 percent—down from a peak of 8.7 percent in 2010—compared with 3.7 percent in 2007. While employment and unemployment rates are related, they measure somewhat different groups. An increase in the share of 25- to 54-year-olds who were neither working nor looking for work—a group that is not counted in the unemployment rate—is the reason that the prime-age employment rate was lower in 2017 than during the year before the recession.

State highlights

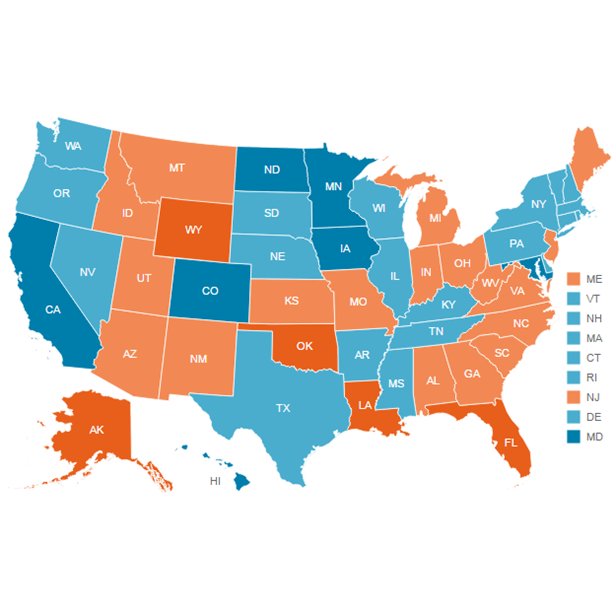

A state-by-state comparison of the difference in the employment-to-population ratio for 25- to 54-year-olds between 2007 and 2017 shows:

- Among the 10 states with statistically significant differences in their employment rates, the largest difference was in New Mexico. For every 100 prime-working-age New Mexicans, 6.4 fewer were employed, meaning that the state’s prime-age employment rate decreased by 6.4 percentage points. The other nine states with employment-rate drops include Nevada (down 4.8 points), South Dakota (down 4.7 points), Washington (down 4.2 points), Alabama (down 4.0 points), South Carolina (down 3.6 points), Florida (down 3.1 points), North Carolina (down 2.7 points), Ohio (down 2.3 points), and Georgia (down 2.2 points).

- Rates were higher in 10 states, but the increase was not statistically significant, so it is unclear whether their rates had surpassed pre-recession levels. The states with higher rates than a decade earlier were: Michigan (by 1.5 percentage points), Massachusetts (1.2 points), Minnesota (1.1 points), Wisconsin (0.9 point), Vermont (0.6 point), Indiana, New Hampshire, and Oregon (0.5 point each), Colorado (0.3 point), and New Jersey (0.1 point).

- In 30 states, employment rates were lower, but not by statistically significant amounts, so it is unclear whether their 2017 rates were less or more than pre-recession levels.

- Five states—California, Louisiana, New York, Tennessee, and Virginia—fell off the list of those with statistically significant differences in their employment rates. This change means that their rates in calendar 2017 were probably closer to their pre-recession levels than they were over the 12 months through June 2017.

How employment affects state ledgers

Economic conditions, including employment, are major drivers of state finances. Changes in employment rates among adults in their prime working years can affect both sides of a state’s budget ledger.

- Revenue: Paychecks help generate individual income tax dollars and fuel consumer spending, which produces tax revenue from sales and business income.

- Expenditures: People without jobs frequently need more services such as Medicaid and other safety-net programs, which can increase states’ costs.

What is the employment-to-population ratio?

Although unemployment figures receive substantial media attention, many economists also track the employment-to-population ratio because it provides a broader view of labor market conditions. The unemployment rate, for example, excludes people who are not looking for jobs, but the employment rate captures this group in its measurement of population.

Focusing on 25- to 54-year-olds reduces the distortion of employment trends resulting from demographic effects such as older and younger workers’ choices regarding retirement or full-time education.

Another gauge of employment trends is the labor force participation rate. While the employment-to-population ratio tracks the percentage of the population that has jobs, the labor force participation rate measures the percentage that is working or actively looking for work.

A statistically significant decrease or increase indicates a high level of confidence that there was a true change in the employment rate. Changes that are not statistically significant offer less certainty and could be the result of variations in sampling or other methods used to produce employment estimates. Without additional testing for statistical significance, caution should be exercised when comparing changes in employment rates among states.

Download the data to see individual state trends. Visit Pew’s interactive resource Fiscal 50: State Trends and Analysis to sort and analyze data for other indicators of state fiscal health.

Fiscal 50: State Trends and Analysis

Sort and chart data about key fiscal and economic trends in the 50 states, and read Pew's insights.

America’s Overdose Crisis

Sign up for our five-email course explaining the overdose crisis in America, the state of treatment access, and ways to improve care

Sign up