The State of American Family Finances

Stocksy

StocksyMany families are unprepared to deal with financial emergencies.

As President Barack Obama prepares to deliver the State of the Union address, now is a good time for all policymakers to reflect on the state of Americans’ financial insecurity. Five years after the Great Recession, families still feel financially vulnerable. Among those who said they worry about their finances, more than 8 in 10 are concerned about a lack of savings, 71 percent fear they don’t have enough money to cover their expenses, and another 7 in 10 think they won’t have enough money for retirement.1

But Americans face more than psychological uncertainties: These concerns are grounded in harsh household realities. Earnings have grown little for the typical worker, and income is often volatile,2 with more than half of households reporting that their income or expenses vary from month to month.3 Because of this unpredictability, it is difficult for households to plan and save.

Not surprisingly, then, many families are unprepared to deal with financial emergencies. Over the course of a year, most families experience financial shocks—expenses or lost income they do not anticipate, such as car or house repairs, a pay cut, or an illness or injury—that can cause significant strain. Unfortunately, these events are often costly: The typical household spent $2,000, or about half a month’s income, on its most expensive financial shock.4

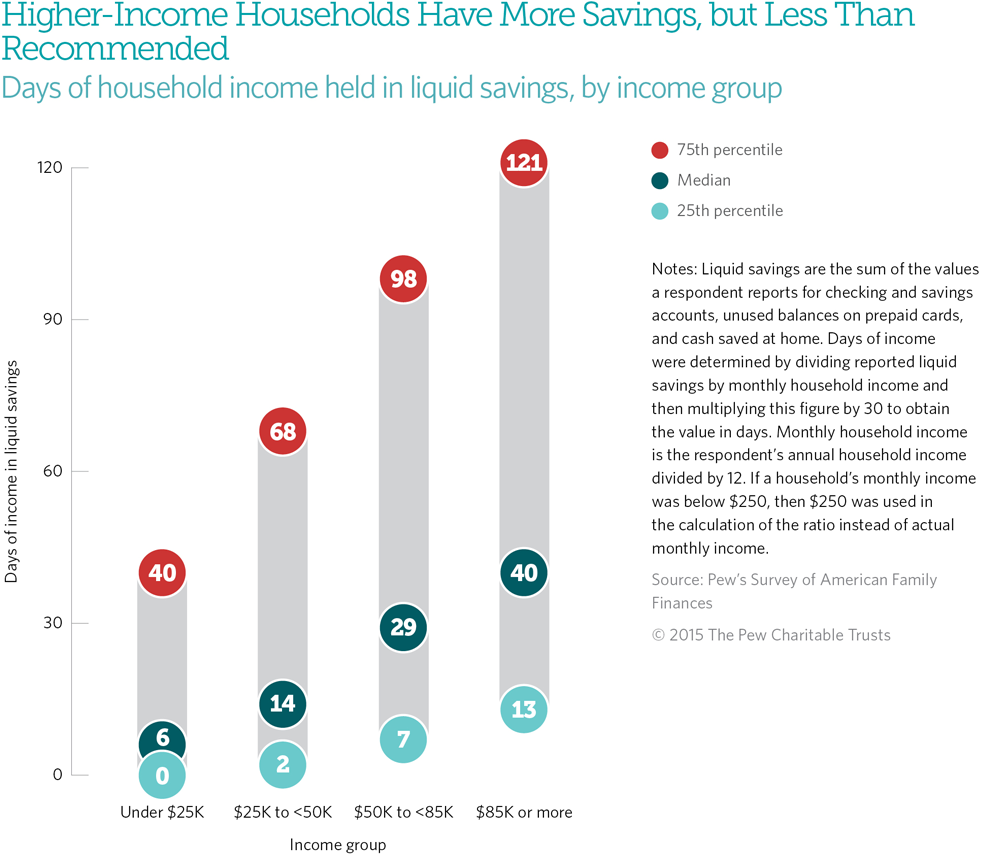

When such a shock occurs and income does not suffice, the least expensive solution is for families to turn to their liquid savings—funds that can be accessed quickly, such as cash or money in savings or checking accounts. But many households have very little savings, and the typical household cannot replace even one month of income through easily accessible funds.5 (See Figure below.) Households of color are particularly fragile: A quarter of black households would have less than $5 if they liquidated all of their financial assets.

Liquid savings are critical to counter the potentially devastating consequences that a shock can trigger. Americans believe they should have six months or more of income in reserves, but 85 percent fall short of this goal, and by a great deal. To reach Americans’ own recommended level of savings, the typical family would need another $9,365.6

As the president comments on the current state of the nation and as we all look forward to the year ahead, this moment presents an ideal opportunity to consider how policymakers can address the concerns that families face daily. Although many policies are in place to encourage families to accumulate long-term savings, few are directed at creating flexible short-term savings that would help households to weather financial emergencies and prepare for the future.

Pew’s research points to a variety of policy implications that should be considered. First, research shows that making savings automatic is one way to significantly increase emergency savings rates and levels. Families could also benefit from short-term savings products that provide flexibility rather than restrictions and penalties for withdrawals. Moreover, programs should promote growth in overall household savings, rather than in specific account types. Finally, giving consumers better tools to recognize the ebbs and flows of their finances may encourage them to build savings in times of surplus, providing a pool to draw on when money is tight.7

Financial security is a concern that bridges the political and socioeconomic spectrums. Promoting policies that improve families’ ability to weather economic storms puts the country on a more stable financial path, for this generation and for the one to come.

Endnotes

- The Pew Charitable Trusts, “Americans’ Financial Security: Perception and Reality” (March 2015), http://www.pewtrusts.org/~/media/Assets/2015/02/FSM-Poll-Results-Issue-Brief_ARTFINAL_v3.pdf.

- The Pew Charitable Trusts, “The Precarious State of Family Balance Sheets” (January 2015), http://www.pewtrusts.org/~/media/ Assets/2015/01/FSM_Balance_Sheet_Report.pdf.

- The Pew Charitable Trusts, “Americans’ Financial Security: Perception and Reality.”

- The Pew Charitable Trusts, “The Role of Emergency Savings in Family Financial Security: How Do Families Cope With Financial Shocks?” (October 2015), http://www.pewtrusts.org/en/research-and-analysis/issue-briefs/2015/10/the-role-of-emergency-savings-in-family-financial-security-how-do-families.

- The Pew Charitable Trusts, “The Precarious State of Family Balance Sheets.”

- The Pew Charitable Trusts, “The Role of Emergency Savings in Family Financial Security: What Resources Do Families Have for Financial Emergencies?” (November 2015), http://www.pewtrusts.org/~/media/assets/2015/11/emergency-savings-report-2_artfinal.pdf.

- More details on these policy suggestions can be found in: The Pew Charitable Trusts, “The Role of Emergency Savings in Family Financial Security: Barriers to Saving and Policy Opportunities for Closing the Gap” (January 2016), www.pewtrusts.org/en/research-and-analysis/issue-briefs/2016/01/barriers-to-saving-and-policy-opportunities.