State Rainy Day Funds in 2017

How states are improving the way they prepare for the next recession

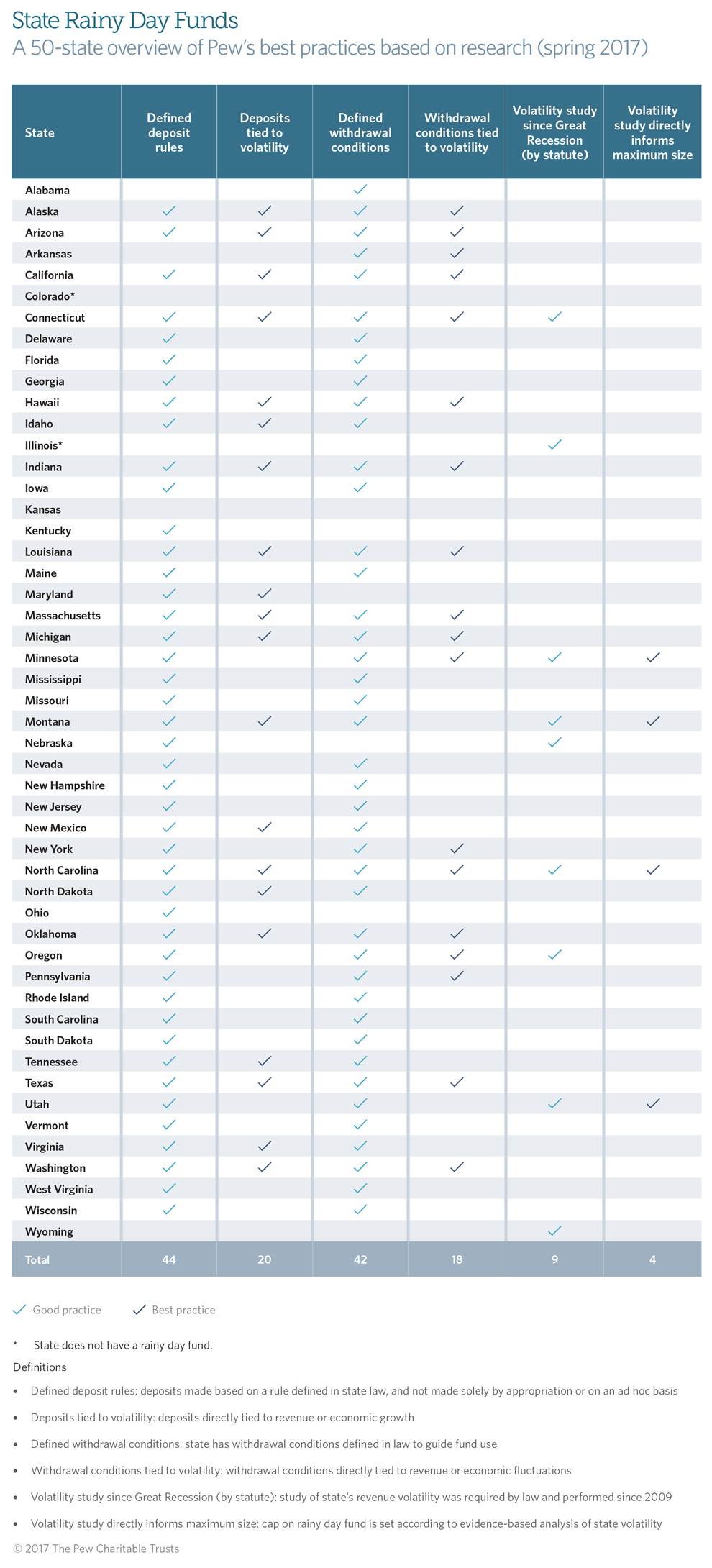

Forty-eight states have a budget stabilization fund, commonly known as a rainy day fund, to set aside money in good times so that it’s available in the bad. Despite the widespread use of these funds, the policies that guide deposits, withdrawals, and a fund’s size vary greatly. Since 2014, Pew has released three reports—“Building State Rainy Day Funds” (2014), “Why States Save” (2015), and “When to Use State Rainy Day Funds” (2017)—that provide evidence-based best practices for those policies.

Deposit rules tied to volatility allow states to save more in high-growth years when funds are available, and to set aside less in leaner years. Withdrawal conditions that are tied to economic or revenue fluctuations give policymakers a clear signal on whether the time is right to use reserves. And regular analyses of revenue volatility can be used to determine the maximum size of a rainy day fund. Since the Great Recession, when states found that their rainy day funds and other reserves were insufficient given the scale of the downturn, many have moved to embrace these best practices.

During the 2017 legislative session alone, six states—Hawaii, Maryland, Montana, New Mexico, North Carolina, and North Dakota—made significant rainy day fund reforms aligned with these best practices.

More states have rainy day funds

In 2015, only four states—Colorado, Illinois, Kansas, and Montana—lacked a rainy day fund. These funds are distinct entities, often guided by rules governing deposits and withdrawals, as opposed to general fund reserves that are kept with an unassigned ending balance. Kansas created a rainy day fund a year later, and Montana followed suit in 2017.

More states tie deposits to volatility

Rainy day funds are most effective when they help smooth swings in revenue, capturing a share of rising revenue during times of growth that can be used to help shore up state budgets during times of fiscal stress. States can most effectively build their rainy day funds during growth periods by ensuring that extraordinary revenue is transferred to the rainy day fund.

When “Building State Rainy Day Funds” was published, 12 states had policies linking their rainy day fund deposits to observed revenue volatility. Since then, eight more states have adopted this practice. Before this year, three states linked their rainy day funds to volatility: California in 2014, Connecticut in 2015, and Oklahoma in 2016. During the 2017 legislative sessions, five states joined them:

- Maryland enacted legislation that saves above-average collections of nonwithholding tax receipts—such as income received through capital gains and dividends—into the state’s Revenue Stabilization Account. Because nonwithholding income is a notoriously volatile portion of the state’s personal income tax, setting aside excess levels encourages year-to-year budget stability.

- Montana put in place a savings rule for its new rainy day fund that triggers deposits when revenue growth exceeds the average growth rate for the previous six years.1 The new rule, which is similar to a successful practice used in Virginia, will help the state save the most during peak economic growth.

- New Mexico’s Tax Stabilization Reserve account will now capture above-average collections from the oil and gas emergency school tax. This will help the state mitigate volatility and will prevent unsustainable revenue growth from being used to fund ongoing expenditures.

- North Carolina will now set aside 15 percent of projected revenue growth to its Savings Reserve Account at the beginning of the fiscal year. This creates a practice of predictable savings and ensures that deposits are largest when revenue growth is highest.

- North Dakota approved a new law to deposit oil and gas production tax revenue, a volatile revenue source, in excess of $400 million but less than $475 million into the state’s rainy day fund. This will help mitigate the impact of the booms and busts of severance tax collections on the budget.

States make progress on tying withdrawal conditions to economic or revenue fluctuations

Rainy day funds are best used for bolstering state budgets during cyclical downturns or other unexpected revenue shocks. Using balances in a rainy day fund during a period of economic growth—such as withdrawing money to help alleviate a structural imbalance—can result in fund overuse, leaving little or no money available during a downturn or emergency.

States therefore benefit by placing some conditions on rainy day fund use. These withdrawal conditions, ideally based on measures of economic or revenue volatility, can ensure that balances are available when they are most needed while discouraging rainy day fund use during a growth period.

During 2017, Hawaii, North Carolina, and North Dakota all put in place new withdrawal conditions tied to fiscal triggers:

- Hawaii established a new volatility-based withdrawal condition for its Emergency and Budget Reserve Fund. The state cannot make a withdrawal for a succeeding fiscal year unless the state has collected or is projected to collect less tax revenue in the current fiscal year compared with the immediately preceding fiscal year.

- North Carolina added clear and objective conditions to governing withdrawals from its Savings Reserve Account. These conditions will allow it to use the fund during times of poor fiscal performance and will discourage use during economic growth periods.

- In North Dakota, lawmakers revised the withdrawal conditions for the state’s Budget Stabilization Fund, linking its use to specific revenue decline thresholds. These changes more closely align withdrawal conditions with the economic and revenue environment.

States have moved toward evidence-based evaluations of reserve size

States have often struggled to determine adequate savings targets for their rainy day funds. During the Great Recession, many found their balances were insufficient to cover the shortfalls that emerged. Since then, several states have increased their rainy day fund caps or savings targets. As Pew wrote in a 2015 report “Why States Save,” however, these savings targets are most effective if they are based on a rigorous evaluation of a state’s fiscal position, and if they tie rainy day fund use to clear, measurable objectives.

The 2017 legislative sessions saw two states – Montana and North Carolina—link rainy day fund or reserve targets to an evidence-based analysis.

- In addition to creating a rainy day fund, Montana’s Legislative Fiscal Division conducted a volatility study to determine an optimal operating reserve level. That analysis found that maintaining operating reserves equal to 8.3 percent of expenditures would be sufficient to avoid statutory budget reduction triggers in 4 out of 5 biennia.

- North Carolina will now set its Savings Reserve Account target size based on an analysis of the state’s historic revenue volatility, which will be performed by the Office of State Budget and Management and the Fiscal Research Division of the General Assembly. This approach was modeled after a promising practice annually performed in Minnesota.

Where states stand in 2017

While many states have improved their rainy day fund policies since the Great Recession, there are still many best practices that states can adopt. This table shows which practices states have already adopted, and steps they may want to take to improve their rainy day fund.- This savings policy will go into effect in fiscal year 2021. Before then, Montana will make initial deposits to the Budget Stabilization Reserve using surpluses generated when revenue exceeds forecast.

America’s Overdose Crisis

Sign up for our five-email course explaining the overdose crisis in America, the state of treatment access, and ways to improve care

Sign up

Rainy Day Funds

Pew research shows proper management can safeguard states’ fiscal health

Fiscal 50: Tax Revenue Volatility

Learn More