Small Differences in Retirement Plan Fees Can Really Add Up

This video is hosted by YouTube. In order to view it, you must consent to the use of “Marketing Cookies” by updating your preferences in the Cookie Settings link below. View on YouTube

This video is hosted by YouTube. In order to view it, you must consent to the use of “Marketing Cookies” by updating your preferences in the Cookie Settings link below. View on YouTube

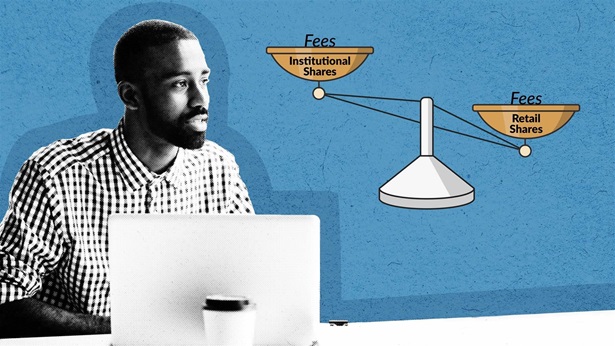

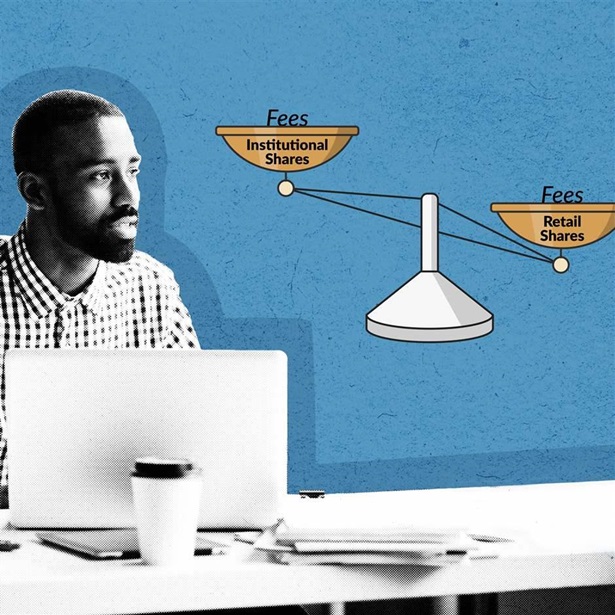

When switching jobs, retiring, or starting a business, many people choose to roll their 401(k) savings to an IRA in the same mutual fund. Unfortunately, this approach can lead to the loss of thousands of dollars over time because of what may seem like a small difference in fees.

How does this happen? And why didn't you know about it? Watch this animation for insights that can help you avoid toppling your retirement plans.

Interested in learning more? Explore more in-depth research on mutual fund costs.