Small Business Views on Retirement Savings Plans

Survey explores employer challenges to plan sponsorship and support for new initiatives

Overview

As policymakers in more states consider measures to help private sector workers save for retirement, the views and concerns of employers— particularly small- and medium-sized business owners—have been a major topic of discussion. Americans accumulate the vast majority of their retirement funds through employer-sponsored defined contribution plans, such as 401(k) accounts. However, more than 40 percent of full-time employees do not have access to one.1

States have been considering an array of policy approaches2 to help more private sector workers save. Among those are creating state-sponsored individual retirement accounts funded automatically from employer payrolls (auto-IRAs), authorizing state-administered plans that cover workers from multiple employers, and setting up online marketplaces that provide plan options for employers. (For a more detailed summary of these options, see “How States Are Working to Address the Retirement Savings Challenge: Three Approaches.”)3

The Pew Charitable Trusts recently surveyed over 1,600 small- and medium-sized business owners or managers to better understand the barriers to—and motivations for—offering retirement plans and to get their views on policy initiatives. The survey included employers who sponsor plans and those who do not. The responses, in one of the few such surveys conducted in the past decade, generally show strong support for offering retirement benefits and for various policy initiatives that would boost savings.

Among the major findings:

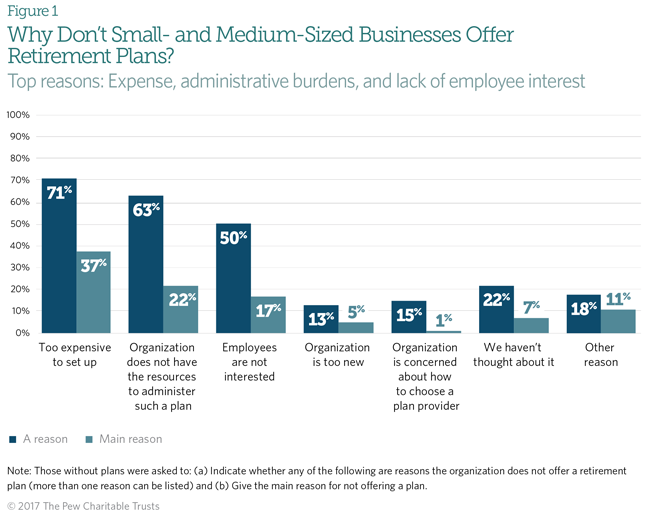

- Employers most often cited expense, limited administrative resources, and lack of employee interest as main reasons for not offering retirement plans.

- Three-quarters of business owners who do not offer a plan said that under current circumstances, they would be no more likely to offer one in the next two years than they are now.

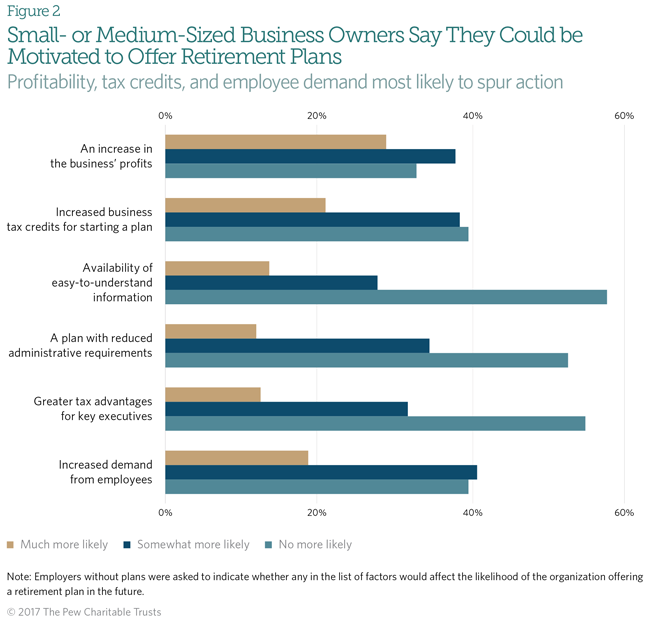

- Key changes that could lead employers to offer a plan include greater profitability, financial incentives, and increased demand from employees.

- When asked about IRA plans funded entirely by employees that use automatic enrollment and pre-determined deductions from their pay, employers without plans were either somewhat or strongly supportive of the concept. Many said the main reason for this support was that the auto-IRA plan would help their employees.

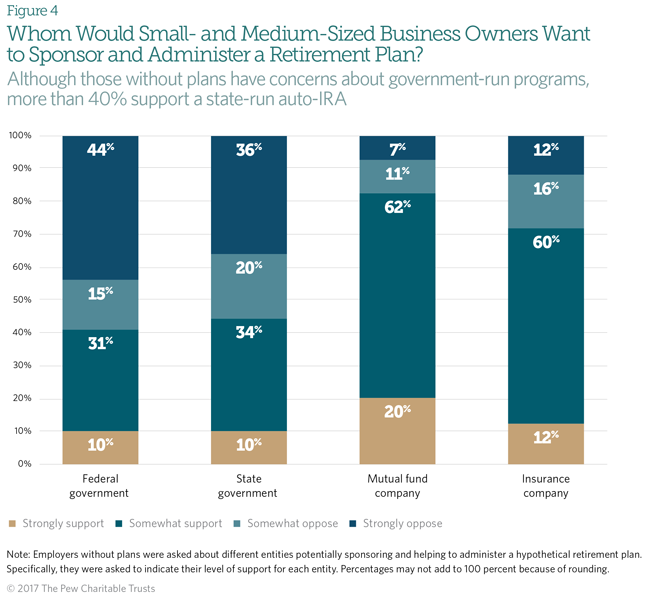

- At the same time, that support varied somewhat depending on which entity served as the program sponsor. Support for an auto-IRA initiative proved highest if the plan would be sponsored by an insurance or mutual fund company; it dropped if a state or federal government ran the program. Still, more than 40 percent supported a government-run program.

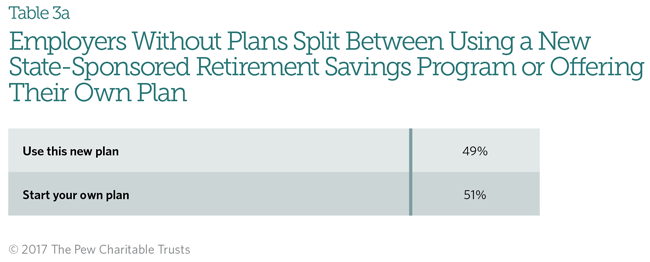

- If their state implemented an auto-IRA plan, 13 percent of businesses that already have plans said they would drop theirs and enroll their workers in the state program. Meanwhile, half of those without plans said that they would start their own rather than go into the state program. For employers that have been contemplating whether to start a plan, the auto-IRA program might nudge them to consider plan sponsorship.

- Employers expressed strong support for voluntary programs such as online marketplace exchanges or multiple employer plans.

For detailed information about the questions and response rates, see Appendix A.

When workers have access to plans, the vast majority will participate. Still, many small- and medium-sized employers say they cannot offer retirement benefits. When asked why they did not offer a plan, many listed multiple reasons, but the main one cited by most was the expense in starting a plan. Lack of administrative resources and perceived lack of interest from employees were other important reasons. Perhaps because of these challenges, 75 percent of those surveyed said they were no more likely to start a plan in two years than they are now.4

Employers without plans were asked whether certain factors would make them more likely to offer retirement benefits. Nearly a third said that an increase in their profits would make starting a plan much more likely. Financial incentives in the form of tax credits, as well as increased demand from employees, also made instituting a retirement program more likely. On the other hand, majorities said that availability of easy-to-understand information, reduced administrative burdens, and greater tax advantages for executives were not as likely to lead to retirement benefit offerings.

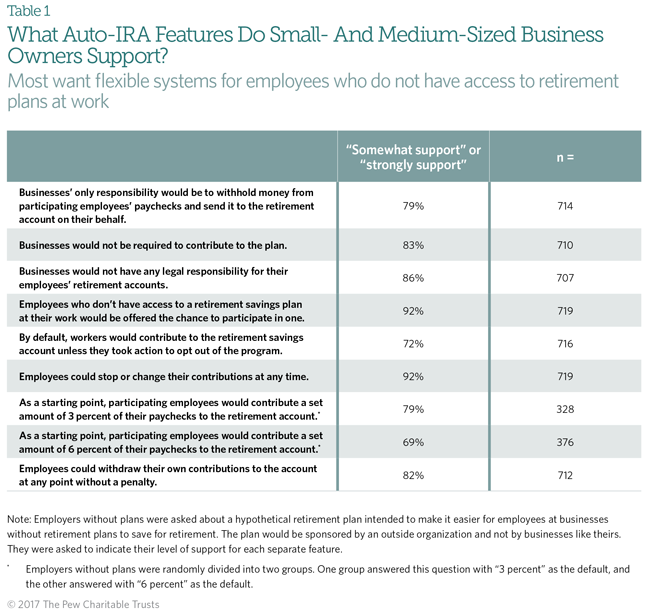

Several states have proposed initiatives to reduce the barriers facing employers in offering retirement plans to their workers. In one approach, all employers meeting certain criteria must either offer a retirement plan for their workers or enroll the workers in the state’s auto-IRA plan. Employers without plans were asked about a hypothetical auto-IRA program. The survey sought feedback on individual plan components, first without noting the auto-IRA sponsor. The vast majority either strongly or somewhat supported each of the individual elements of the auto-IRA plan. Ninety-two percent either somewhat or strongly supported providing access to a retirement plan and allowing employees to stop or change their contributions.

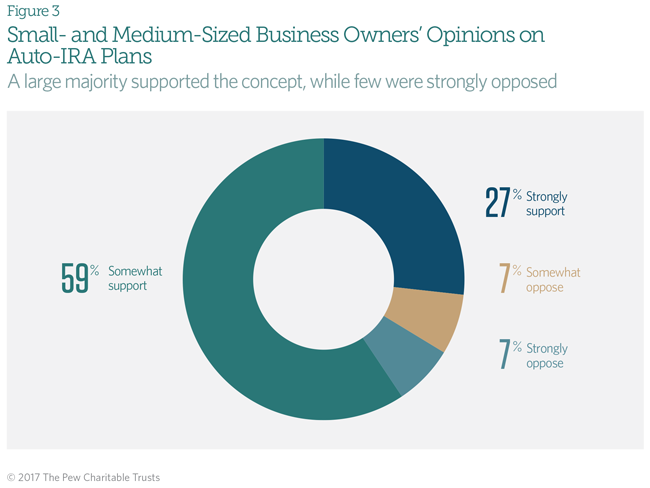

When asked about the plan in its entirety, 27 percent of employers without plans strongly supported and 59 percent somewhat supported the concept of an IRA with automatic enrollment and deductions—a total of 86 percent, compared with 7 percent somewhat and 7 percent strongly opposed.

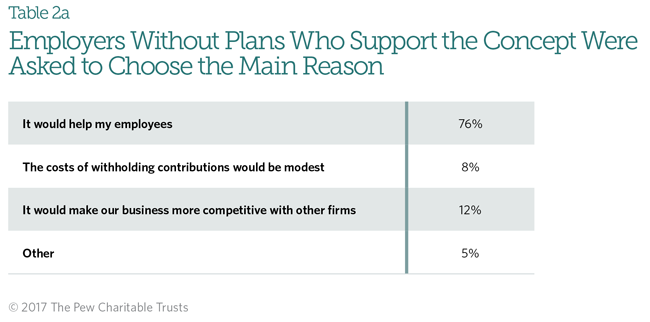

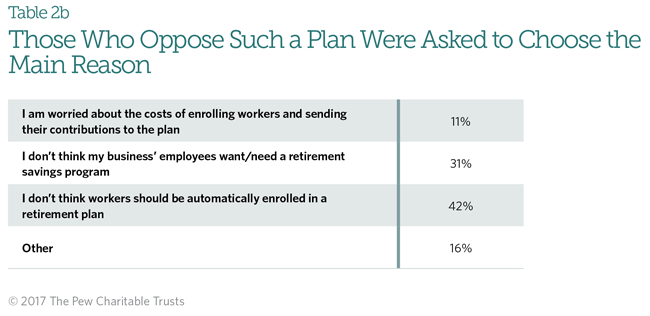

The survey asked opponents and supporters for the main reasons for their positions. Three-quarters of employers who supported the auto- IRA said that such an approach would help their employees. Few pointed to the potentially modest cost of withholding the contributions or competitive reasons. Opponents said that employees would not want a retirement savings plan or that employees should not be enrolled in such a plan automatically.

Employers without a retirement plan were asked about their support for the auto-IRA proposal with different entities sponsoring the program. Support proved highest if a mutual fund (82 percent) or insurance company (72 percent) sponsored the auto-IRA plan, while fewer backed the idea of government sponsorship, and the level of strong opposition was much higher. However, more than 4 in 10 still supported such a program if the state (44 percent) or federal government (41 percent) was the sponsor.

State auto-IRA programs would not affect employers who sponsor plans that qualify under federal law. When employers without plans were asked what they would do if they had to choose between a state-run auto-IRA retirement savings plan and starting their own, 51 percent said that they would start their own. Many employers want to offer retirement benefits to their workers, and employer-sponsored plans that are qualified under the Employee Retirement Income Security Act (ERISA), the federal law that regulates retirement plans, can generate more retirement savings than current state auto-IRA proposals. For employers that have been contemplating whether to start a plan, the auto-IRA program might nudge them to move forward.

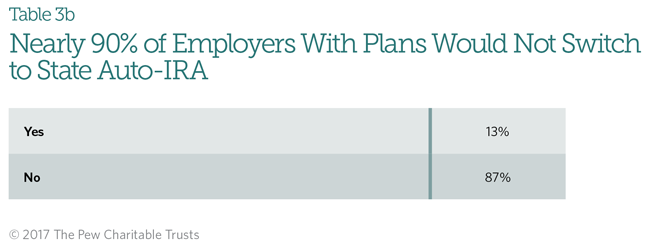

If a state sponsored an auto-IRA retirement savings plan for private sector workers, employers with plans might drop their retirement benefits so workers could enroll in the state plan. Still, only 13 percent expressed interest in switching to the state-run program.

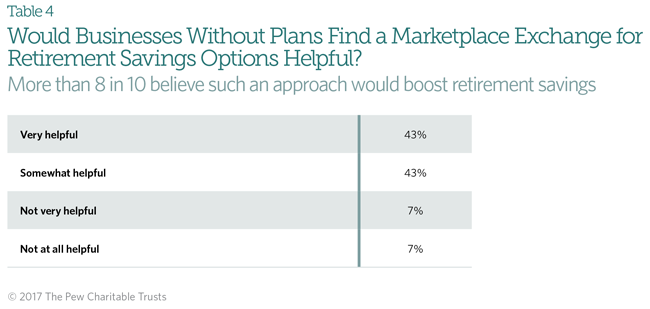

Employers without retirement plans were asked whether state-run online marketplaces could be helpful. Under such exchanges, financial services companies would offer retirement plan products to small businesses. Employers would not be obligated to select one. Most employers said that such an approach would be either very or somewhat helpful to them (86 percent).

The U.S. Department of Labor has made clear that states can operate ERISA-governed plans that cover many private sector employers.5 For example, a multiple employer plan (MEP) includes workers from a group of unrelated employers.6

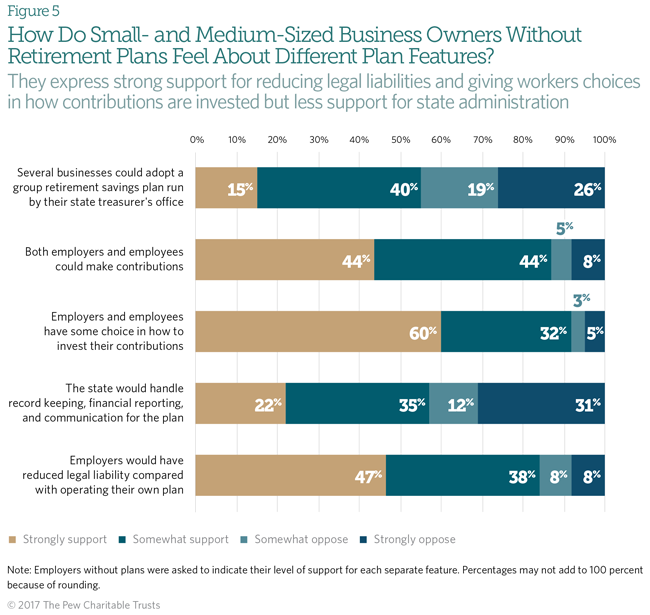

Employers without plans were asked about a hypothetical MEP proposal. The vast majority expressed strong or some support for the ability of both employers and employees to make contributions, for offering choices in investing contributions, and for ensuring reduced legal liability. Support was less strong— though still over 50 percent—for a plan run by the state treasurer’s office and for the state handling administrative functions.

Conclusion

Many Americans face the prospect of inadequate savings once they retire, primarily because they have not had access to an employer-sponsored retirement savings program. Research and industry experience show that most employees will save through an employer plan if given the opportunity. Pew’s research shows that employers— especially small- and medium-sized businesses—face challenges when trying to offer retirement benefits to their workers, and they do not expect these challenges to ease in the near future.

To help more private sector workers save, states are proposing a variety of reforms, such as auto-IRA savings plans, online marketplace exchanges, and state-run MEPs. The employers surveyed here appear to welcome and support these initiatives to help their workers achieve some level of retirement security. However, many small- and medium-sized business owners and managers have concerns about government involvement or are skeptical of government’s ability to effectively implement these proposals. Additional evidence of those sentiments can be seen in Pew’s recent focus groups on these issues. (See “Business Owners’ Perspectives on Workplace Retirement Plans and State Proposals to Boost Savings.”)7

The survey findings presented here suggest ways in which state policymakers might craft proposals that take into consideration the attitudes and experiences of small- and medium-sized business owners.

Methodology

The data in this chartbook were collected in the Small Business Retirement Survey by The Pew Charitable Trusts through a contract with ICF International. The survey targets private sector small- and medium-sized businesses across the United States that have between five and 250 employees. The probability sample is based on the Dun & Bradstreet list of businesses. A representative of the business who was knowledgeable about benefits and who had input on benefit-related decisions responded to the survey. The survey used a stratified survey design to ensure representative national estimates. The strata were the four census regions, whether an enterprise was a goods-producing or service-producing business, and the number of employees (5 to 50 and 51 to 250).

The survey used computer-assisted telephone interviewing (CATI) to collect data. The survey was fielded from April 26, 2016, through June 29, 2016. The data collection effort yielded 1,639 completed interviews. The estimated maximum margin of error for the survey is +/- 3.2 percentage points. The sample is split between employers who sponsor a retirement plan (56 percent) and those who do not (44 percent). In terms of workforce size, 68 percent have 5 to 24 total employees, and the remaining 32 percent have 25 to 250 total employees.

Appendix A: Notes to figures and tables

Figure 1

Participants without plans were asked: (a) Indicate whether any of the following are reasons their organization does not offer a retirement plan (more than one reason can be listed) and (b) Which is the main reason they do not offer a plan.

Total n for each item:

- Too expensive to set up: n = 695

- Organization does not have the resources to administer such a plan: n = 712

- Employees are not interested: n = 663

- Organization is too new: n = 716

- Organization is concerned about how to choose a plan provider: n = 715

- We haven’t thought about it: n = 710

- Other reason: n = 720

- Main reason: n = 551

Figure 2

Employers without plans were asked to indicate whether any of the following would impact the likelihood of their organization offering a retirement plan in the future.

Total n for each item:

- An increase in the business’s profits: n = 721

- Increased business tax credits for starting a plan: n = 716

- Availability of easy-to-understand information: n = 723

- A plan with reduced administrative requirements: n = 719

- Greater tax advantages for key executives: n = 716

- Increased demand from employees: n = 722

Table 1

Employers without plans were asked about a hypothetical retirement plan intended to make it easier for employees at businesses without retirement plans to save for retirement. The plan would be sponsored by an outside organization and not by businesses like theirs. They were asked to indicate their level of support for each separate feature.

Figure 3

Employers without plans were asked about hypothetical auto-IRA plan features together. They were asked whether they would strongly support, somewhat support, somewhat oppose, or strongly oppose the plan. Percentages do not add to 100 percent because of rounding. Total n: 715

Table 2a

Total n: 624

Table 2b

Total n: 85

Figure 4

Employers without plans were asked about different entities potentially sponsoring and helping to administer a hypothetical retirement plan. Specifically, they were asked to indicate their level of support for each entity.

Total n for each item:

- Federal government: n = 718

- State government: n = 717

- Mutual fund company: n = 711

- Insurance company: n = 716

Table 3a

Total n: 659

Table 3b

Total n: 823

Figure 5

Employers without plans were asked to indicate their level of support for each separate feature.

Total n for each item:

- Several different businesses could adopt a group retirement savings plan: n = 710

- Both employers and employees could make contributions: n = 717

- Employers and employees have some choice in how to invest: n = 718

- The state would handle record keeping: n = 715

- Reduced legal liability: n = 710

Endnotes

- The Pew Charitable Trusts, Who’s In, Who’s Out: A Look at Access to Employer-Based Retirement Plans and Participation in the States (January 2016), 1, http://www.pewtrusts.org/~/media/assets/2016/01/ retirement_savings_report_jan16.pdf. See also U.S. Government Accountability Office, Retirement Security: Federal Action Could Help State Efforts to Expand Private Sector Coverage (September 2015), 15, http://www.gao.gov/assets/680/672419.pdf; U.S. Bureau of Labor Statistics, “National Compensation Survey: Employee Benefits in the United States, March 2015” (September 2015), http://www.bls.gov/ncs/ebs/benefits/2015. In 2015, the private sector employee take-up rates, which measure participation for those who have access to a plan, for defined benefit and defined contribution plans were 84 and 71 percent, respectively.

- The Pew Charitable Trusts, “How States Are Working to Address the Retirement Savings Challenge” (2016), http://www.pewtrusts.org/en/research-and-analysis/fact-sheets/2016/07/how-states-are-working-to-address-the-retirement-savings-challenge-three-approaches.

- Ibid.

- Employers who did not offer plans were asked, “What is the likelihood that your organization will start a retirement plan in the next two years?”

- U.S. Department of Labor, Employee Benefits Security Administration, “Savings Arrangements Established by States for Non- Governmental Employees,” proposed rule, 29 C.F.R. 2510, RIN 1210-AB71, Federal Register 80, no. 222, pp. 72006–72014 (Nov. 18, 2015), http://webapps.dol.gov/FederalRegister/HtmlDisplay.aspx?DocId=28542&AgencyId=8&DocumentType=1; U.S. Department of Labor, Employee Benefits Security Administration, “Interpretive Bulletin Relating to State Savings Programs That Sponsor or Facilitate Plans Covered by the Employee Retirement Income Security Act of 1974,” 29 C.F.R. 2509, RIN 1210- AB74, Federal Register 80, no. 222, pp. 71936–71940 (Nov. 18, 2015), http://webapps.dol.gov/FederalRegister/HtmlDisplay.aspx?DocId=28540&AgencyId=8&DocumentType=3.

- Multiple employer plans (MEPs) should not be confused with multi-employer plans, which are plans usually created and operated under a collective bargaining arrangement between employers and a union.

- The Pew Charitable Trusts, “Business Owners’ Perspectives on Workplace Retirement Plans and State Proposals to Boost Savings” (2016), http://www.pewtrusts.org/~/media/assets/2016/09/ business_owners_workplace_retirement_plans.pdf.