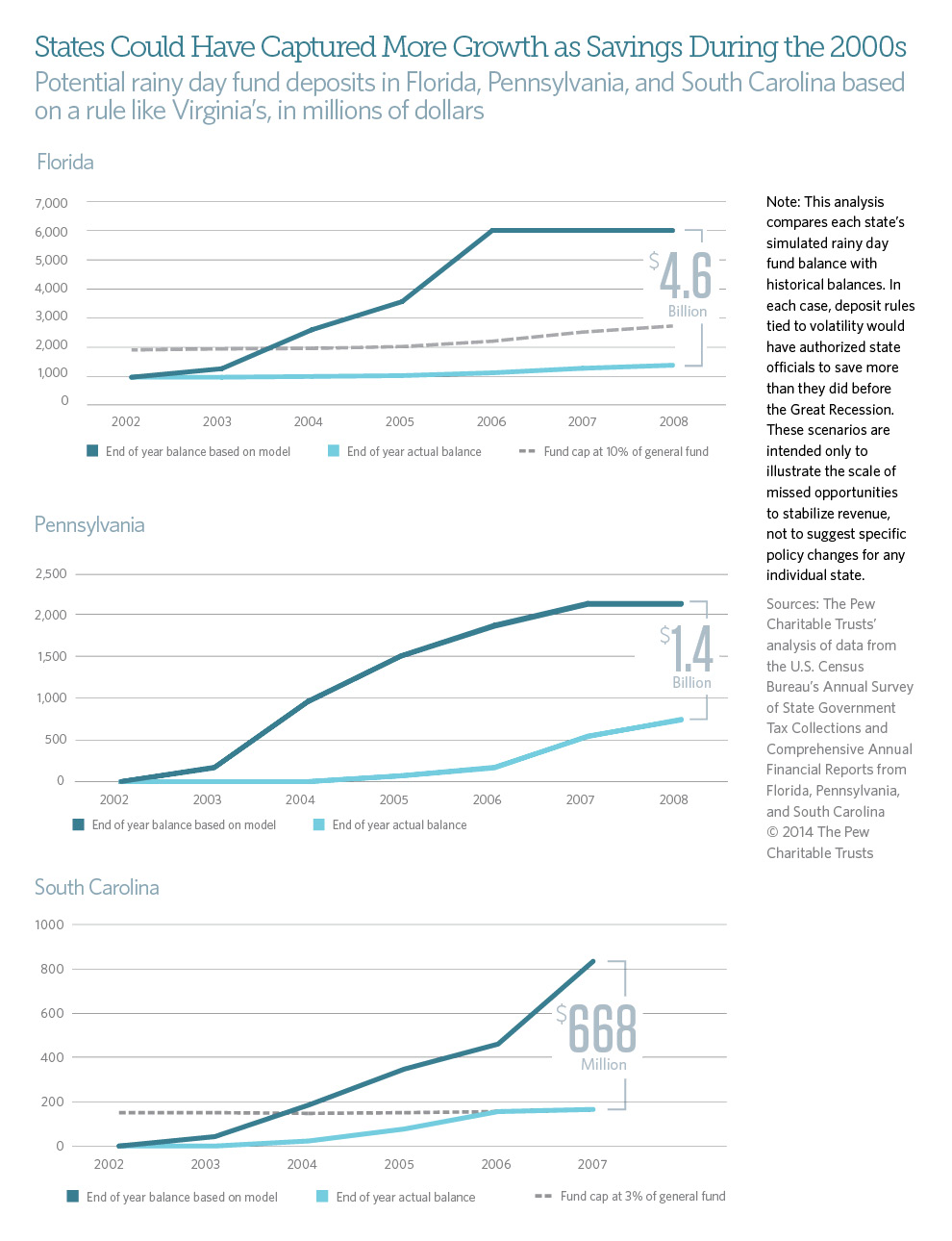

States Could Have Captured More Growth as Savings During the 2000s

Potential rainy day fund deposits in Florida, Pennsylvania, and South Carolina based on a rule like Virginia's

States could have built a larger financial cushion during the economic expansion of the 2000s by linking budget stabilization fund deposits to volatility. Pew ran three counterfactual scenarios that simulate what Florida, Pennsylvania, and South Carolina would have allocated to rainy day funds during the economic expansion preceding the Great Recession (2003-08), if they had used deposit mechanisms similar to those for Virginia’s Revenue Stabilization Fund.1 Pew then compared each state’s simulated fund balance to actual rainy day fund balances in 2008.2 In each case, deposit rules tied to volatility would have authorized state officials to save more than they did before the Great Recession.3

The choice to save is not always an easy one. Setting aside revenue often means forgoing tax cuts or additional spending on programs. Over the long run, however, the tough choices states make in good times can prevent them from having to make even tougher ones during bad times, when residents may be least able to absorb the impact of tax increases or cutbacks in spending. Linking savings to actual fluctuations can harness growth without requiring contributions during lean years.

In the process, these policies can also help states better align recurring revenue with ongoing spending commitments. Setting aside unusual or unexpected growth as “one-time” revenue can help keep budgets in balance and can serve as an indicator that annual costs are too high or revenue is too low, information that is key to maintaining long-term fiscal health. For more information, see “Building State Rainy Day Funds.”

Endnotes

1Florida, Pennsylvania, and South Carolina were selected because they are large, have different economies and tax systems, experienced economic growth during the mid-2000s, and have deposit rules that are not connected to volatility. They also experienced few tax policy changes and made no withdrawals from the fund over the years included in Pew’s study, simplifying the hypothetical scenarios. Virginia’s rule, which sets aside half of all revenue above a six-year average, was selected because it allows fund growth to keep pace with inflation and economic expansion over time. Furthermore, since this rule uses an average of past performance to determine above-trend revenue growth, it is automatically calibrated to the volatility in the state where it is applied. This simulation eliminates the lag between revenue collections and rainy day fund deposits that is part of the actual process in Virginia.

2Pew calculated annual deposits and fund balances for Florida, Pennsylvania, and South Carolina based on tax revenue data obtained from the Census Bureau (without controlling for tax policy changes). These calculations were compared with data on actual deposits and balances obtained from state documents (“2013 Florida Tax Handbook,” 27; Commonwealth of Pennsylvania, Comprehensive Annual Financial Report for the Fiscal Year Ended June 30, 2011, 224; South Carolina Budget and Control Board, “Historical Analyses,” 1.) This analysis assumes no economic impact to the state from saving this revenue rather than using it for additional appropriations, tax reductions, or another purpose. For South Carolina, the scenario runs from 2003-07 because policymakers withdrew money from their fund in 2008. The model did not suggest additional deposits in 2008.

3These scenarios are intended only to illustrate the scale of missed opportunities to stabilize revenue, not to suggest specific policy changes for a specific state.