Retirement Assets in State Automated Savings Programs Hit $1 Billion

Access to saving opportunities helping more than 800,000 workers across seven states

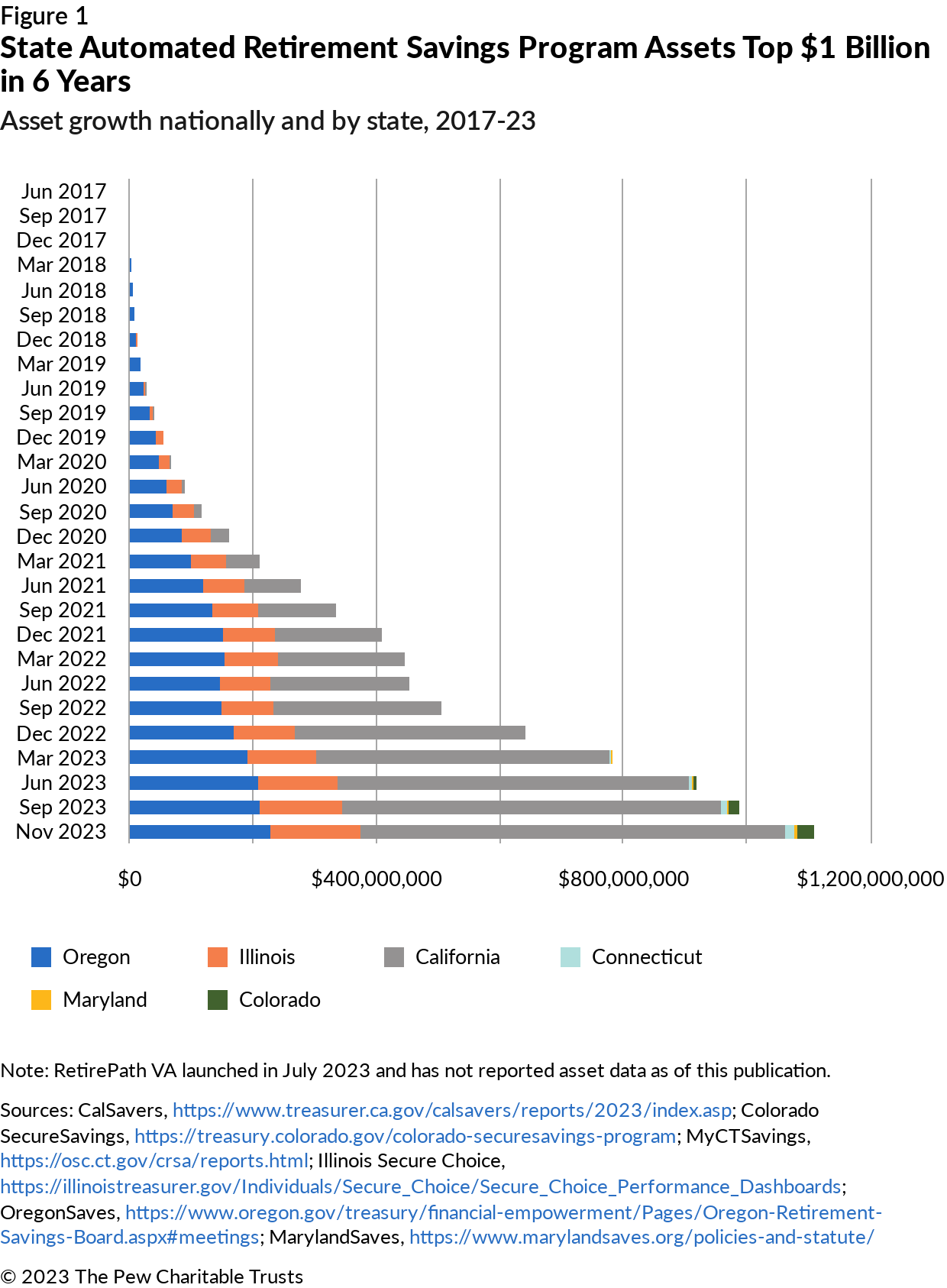

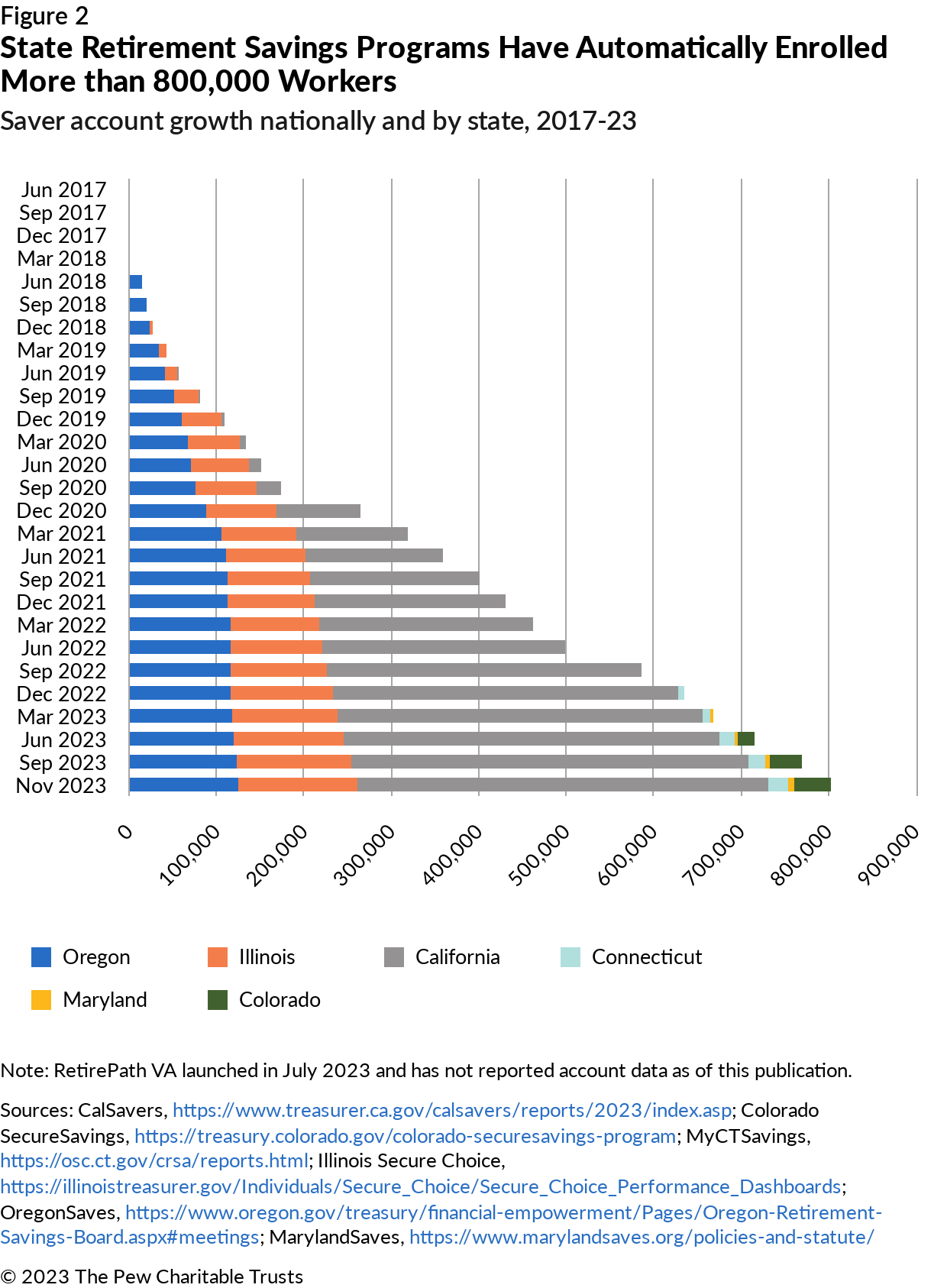

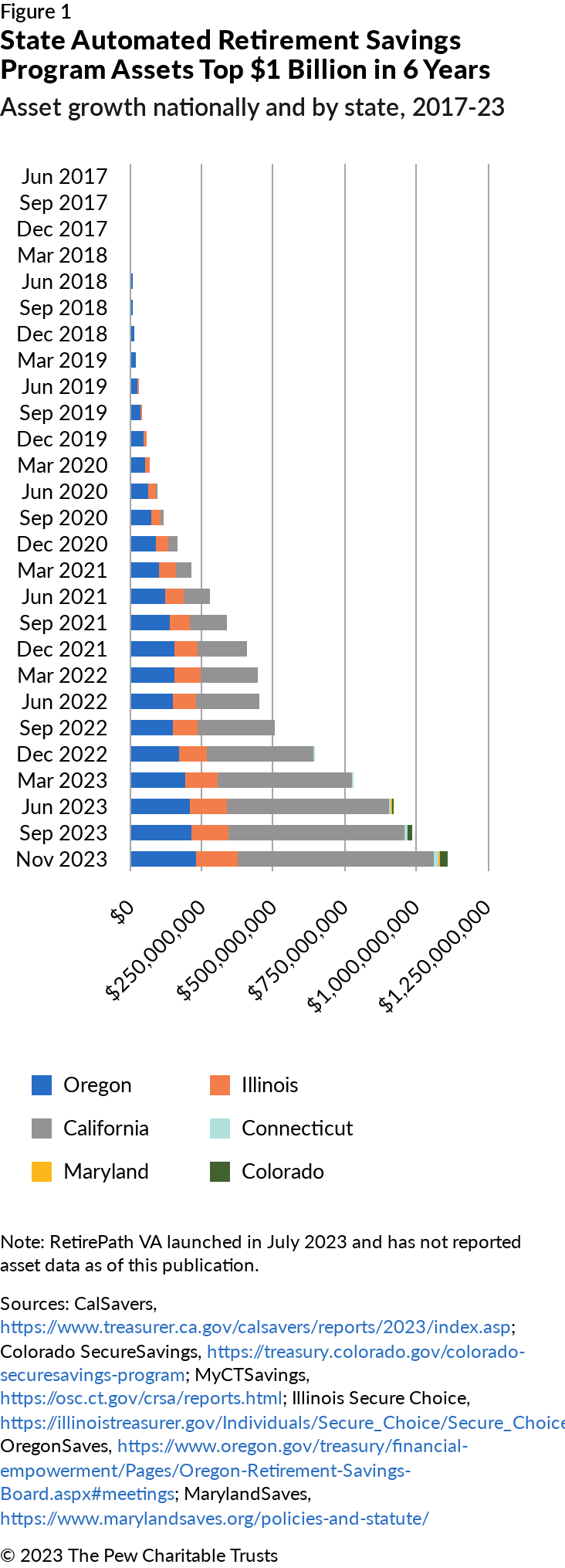

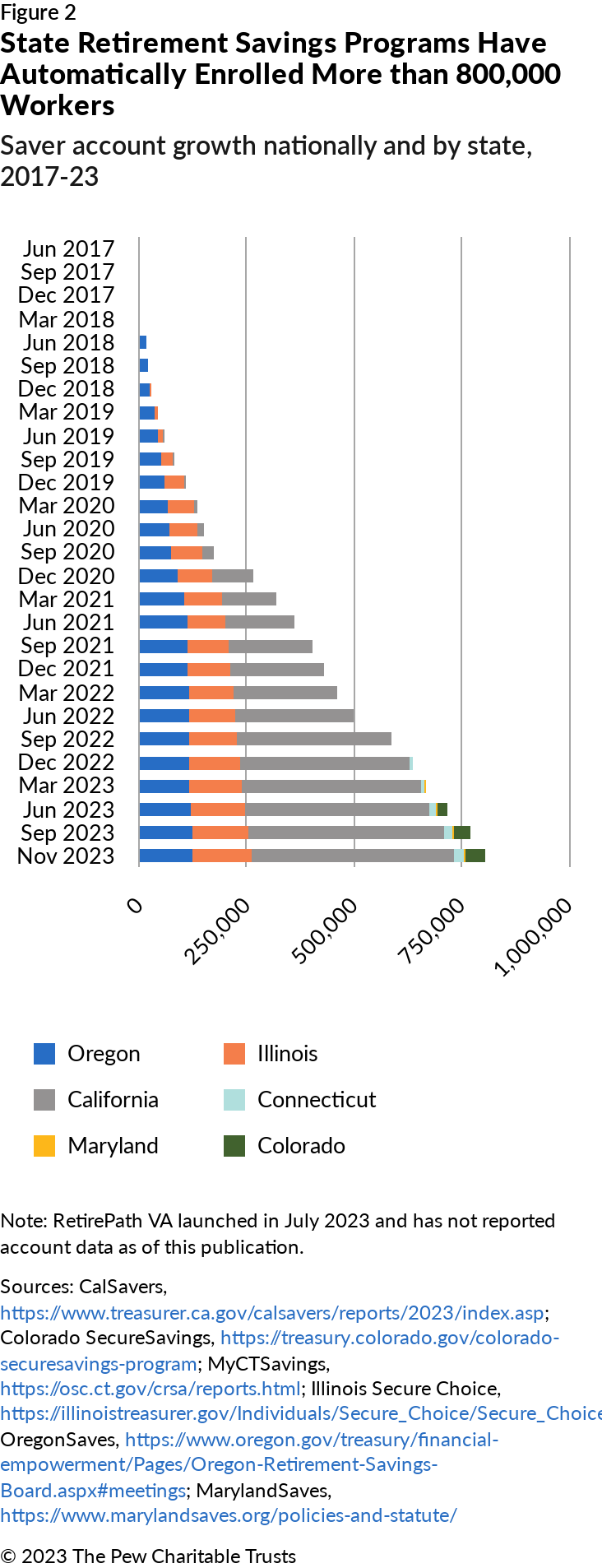

Automated savings programs, intended to help private sector workers put earnings away for their retirement, hit a major milestone in November: Cumulative account assets across the seven state programs topped $1 billion. Since 2017, when Oregon launched a pilot for its OregonSaves program, momentum has been building around automated savings for private sector workers who lack opportunities to save for retirement through their jobs.

Six other programs have launched in the past five years—Illinois Secure Choice (2018), CalSavers (2019), MyCTSavings (2022), Maryland$aves (2022), Colorado SecureSavings (2023), and RetirePath Virginia (2023)—and they are transforming the savings landscape for tens of thousands of small businesses and their employees.

Why state automated savings programs matter

According to the Investment Company Institute, Americans hold a total of $9.9 trillion in employer-provided defined contribution plans, such as 401(k) accounts, and $12.6 trillion in individual retirement accounts (IRAs). But only 52% of workers can save at their workplaces, the most effective path over the long term. Private providers market plans to employers nationwide and play a pivotal role in workers’ retirement security when an employer chooses to establish such a plan. But what if you work for a private sector employer that does not offer a plan? Until recently, your options were limited. Now, states are stepping in to fill the void. In a crowded and complex retirement savings market, these programs can:

- Address the access gap. An estimated 56 million private sector workers cannot save at work through payroll deduction, yet workers are 15 times more likely to save if they have that ability.

- Automatically enroll workers. Lack of time and confidence leads workers to procrastinate on saving for future needs. Automatic enrollment helps them get started—with the option to adjust their payroll contributions in the future according to their needs.

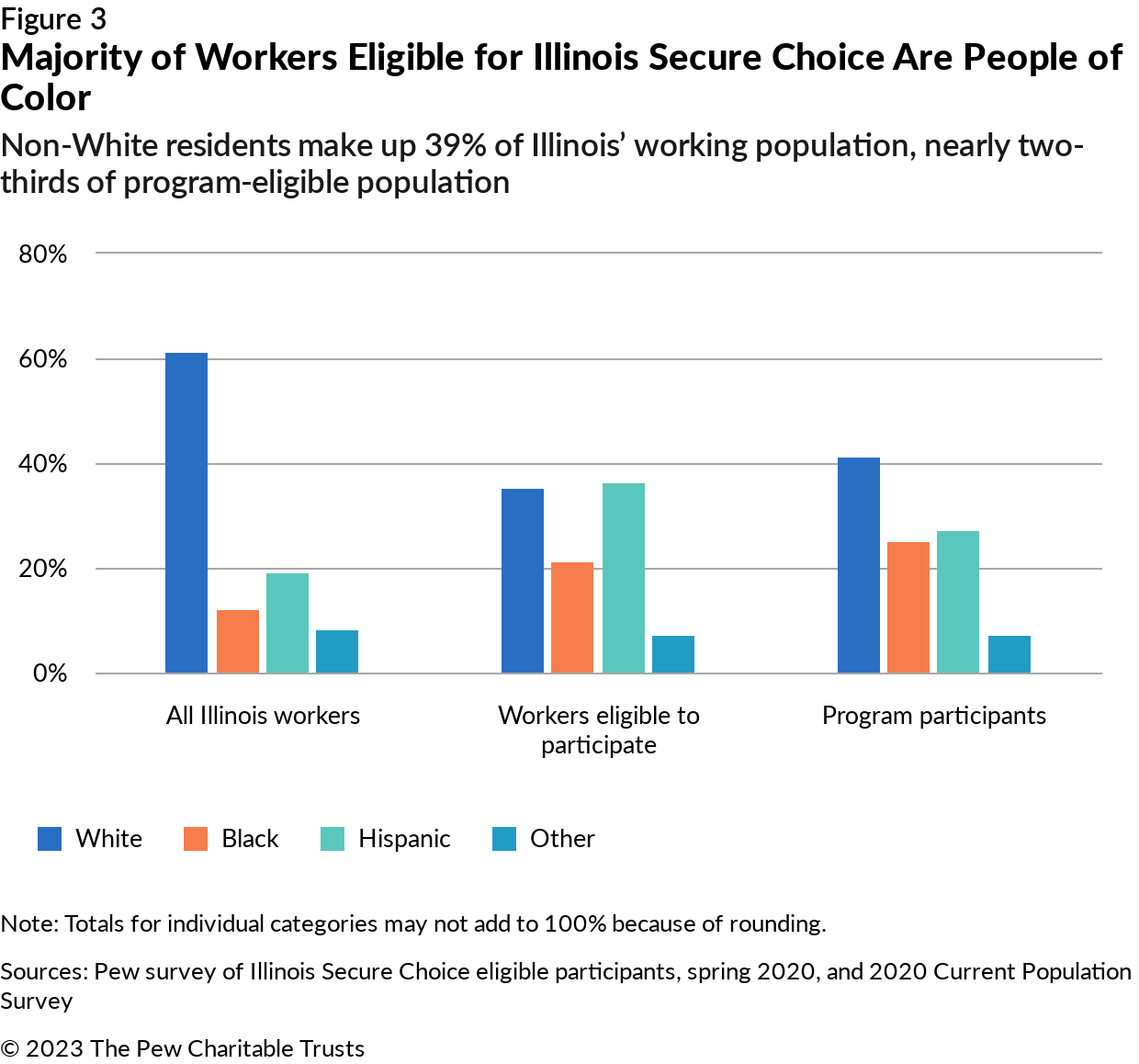

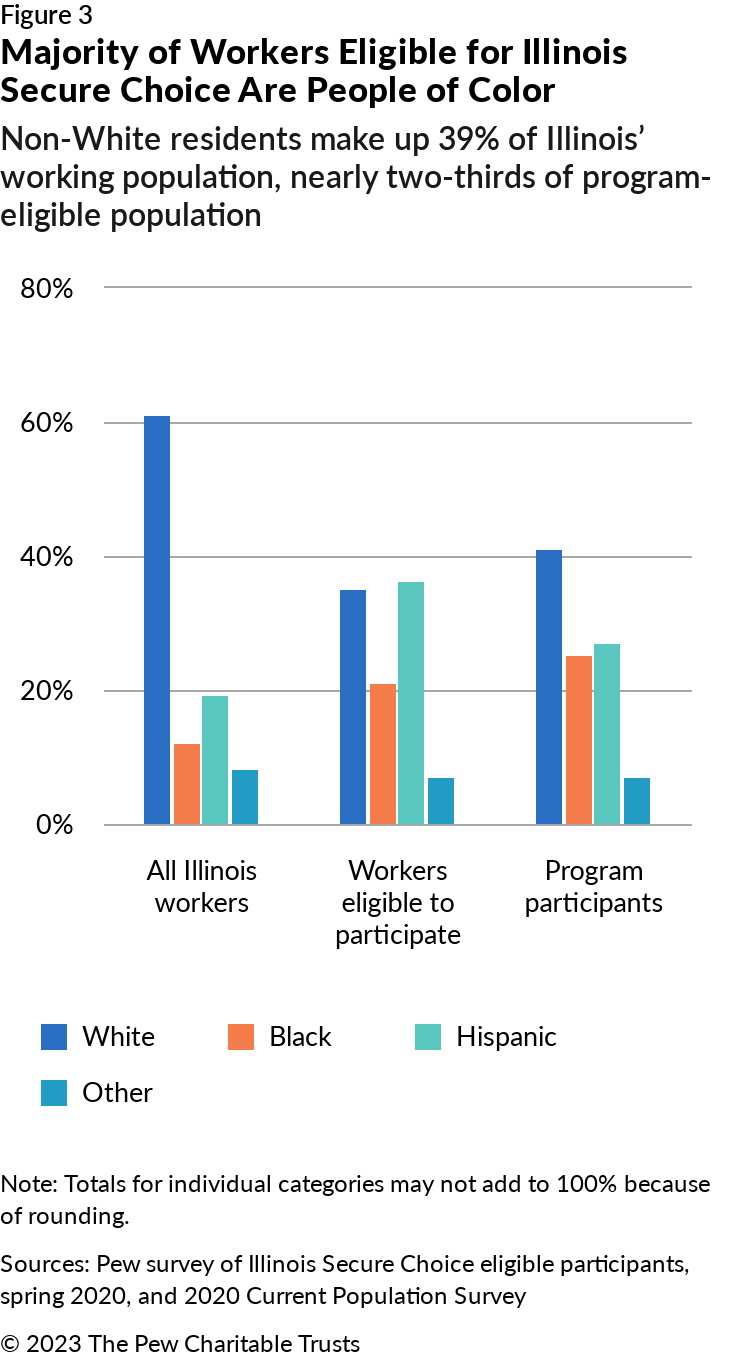

- Include groups not typically covered by employer-sponsored plans. A recent Pew survey on Illinois Secure Choice compared the state’s total working population with the population eligible for Secure Choice. Workers eligible for the savings program, in contrast to the wider population:

- Skewed female, younger, and unmarried.

- Were predominantly high school educated and included a greater share of people of color.

- Allow employers to offer a benefit at no cost. Many small businesses are unable to offer retirement benefits because of high startup costs and lack of administrative capacity. State programs offer an important benefit and help businesses recruit and retain workers.

- Complement the private sector. Some employers in program states are fulfilling the state requirement to offer work-based retirement savings by starting new private plans. This private market expansion helps to close the access gap and provides more robust savings options for some workers.

- Reduce future costs to taxpayers. State budgets face a $334.3 billion shortfall over the next 20 years if they do not address insufficient retirement saving. Encouraging everyone to save now for future expenses will decrease pressure on social safety net programs.

Savings will continue to grow: 6 states implementing programs in next 2 years

More state programs are coming online in the near term and policymakers are exploring ways to partner across state lines. Although interstate compacts are common to provide tax-advantaged savings accounts to people with disabilities through state-run ABLE programs, partnerships in state efforts to boost private savings are still new.

Colorado SecureSavings, which launched in early 2023, is the first program to formalize such a partnership. Both the Maine Retirement Investment Trust (MERIT) and the Delaware EARNS programs have agreed to partner with Colorado. The partner states hope to reduce administrative costs and increase total assets under management. Maine is now in a soft launch and plans to officially launch the full program in January 2024. The Delaware EARNS board approved the Colorado partnership in early December and plans to launch that state’s program in 2024.

Programs in Hawaii, New Jersey, New York, and Vermont, meanwhile, are in the early stages of development and are likely to launch by 2025. With seven programs continuing implementation and six new ones coming online, program assets are likely to experience exponential growth over the next few years.

Recent legislative wins, more states considering proposals

Lawmakers in Minnesota and Nevada passed automatic savings measures in 2023. Bills to create programs were introduced in Alaska, the District of Columbia, Massachusetts, Pennsylvania, Rhode Island, and Tennessee; as of publication, bills in Alaska, D.C., Massachusetts, and Pennsylvania are still active because of longer legislative calendars. In addition, according to the Center for Retirement Initiatives at Georgetown University, 22 state legislatures and D.C. introduced bills to establish or amend programs or form study groups to evaluate retirement options during the 2023 legislative session.

With so much interest nationwide, and with $1 billion saved by what will soon be 1 million savers, it’s clear that automated savings programs are an important market addition. They fill a gap not only for workers but also for the 195,000 registered employers who can now provide a valuable benefit, and for current and future taxpayers who are concerned about their state’s bottom line.

Kim Olson works for The Pew Charitable Trusts’ retirement savings project, helping state governments that are studying, legislating, or implementing automated savings programs.