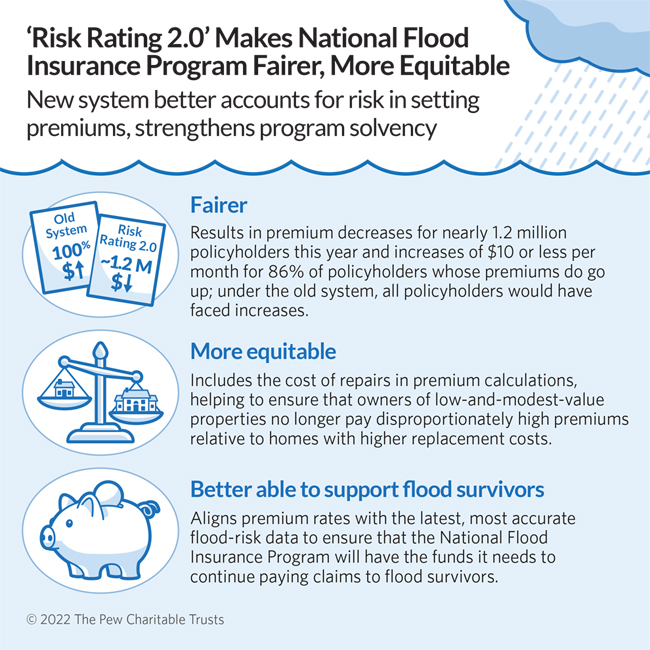

FEMA’s New Flood Insurance Premium System, Explained

‘Risk Rating 2.0’ translates to fairer premiums, including decreases for over 1 million property owners

On April 1, 2022, the Federal Emergency Management Agency implemented the most substantial change to flood insurance rate-setting in the history of the National Flood Insurance Program (NFIP). FEMA’s new system, dubbed Risk Rating 2.0, sets NFIP premiums using a more comprehensive suite of data than the agency has used in the past. Risk Rating 2.0 was launched for new policies on Oct. 1, 2021, and expanded to existing policyholders in April.

As property owners renew their NFIP policies over the next year, the new premium-pricing system will apply, with these features:

- Lower premiums for an estimated 1.2 million property owners, or 23% of all NFIP policies. Under the previous system, all policyholders would have faced an increase in premiums.

- Of those policyholders who will pay more, an estimated 86% will see an increase of no more than $10 a month for the year.

- Under the new rate structure, FEMA considers factors such as the cost of repairing a property, its proximity to water, and catastrophe modeling to better reflect each property’s flood risk. This is fairer than the old premium-setting approach, which resulted in owners of some lower-risk and lower-priced properties essentially subsidizing the policies of higher-risk and higher-priced ones.

Laura Lightbody is the director and Brian Watts is a senior associate with The Pew Charitable Trusts’ flood-prepared communities project.