Personalized Interventions Hold Promise for Student Loan Borrowers at Risk of Delinquency, Default

Research demonstrates that insight into behavior and experiences of those in debt should guide reform

Overview

More than a million federal student loan borrowers default each year, and the U.S. Department of Education reports that as of June 2020, roughly 1 in 5 borrowers with federal student loans was in default.1 Since that time, the coronavirus pandemic and related economic downturn have continued to take a significant toll on households and businesses across the country.

Failing to repay a student loan can have serious, long-term financial consequences. When borrowers do not make payments, they become delinquent on their loans, and when they reach 270 days past due, they default. As a result, borrowers can face collection fees; wage garnishment; money being withheld from income tax refunds, Social Security, and other federal payments; damage to their credit scores; and even ineligibility for other aid programs, such as help with homeownership.2

To mitigate the serious challenges confronting student loan borrowers, Congress and the Trump administration have paused payments and interest charges for most loans and suspended collection efforts for those in default until Jan. 31, 2021. However, the difficulties that borrowers face are likely to outlast these temporary interventions. When the pauses end, tens of millions of borrowers—many of whom will need assistance— will transition back into repayment at the same time, likely straining the system and potentially overloading loan servicers, the companies hired by the U.S. Department of Education to collect and help borrowers manage payments.

In many ways, the issues that borrowers face in repayment are a result of the design of the repayment system, including when and how information is delivered to borrowers, gaps in the repayment benefits and protections that are available, and the difficulty that borrowers have in accessing those features. As the research outlined in this brief indicates, people’s experiences inside and outside the repayment system directly influence their ability to access and avail themselves of these benefits.

Congress has authorized, and the Department of Education offers, a range of options to help borrowers manage their monthly payments and avoid delinquency and default, including income-driven repayment plans that calculate monthly payments based on borrowers’ incomes and family sizes. However, a series of focus groups with student loan borrowers conducted by The Pew Charitable Trusts in 2018 and 2019 found that even when the economy is functioning well, the programs’ confusing enrollment and annual recertification processes can make it difficult for borrowers to take advantage of these choices.3 In addition, participants reported confusion about repayment requirements, unaffordable payments, inconsistent interactions with servicers, and growing loan balances, all of which caused frustration with and distrust of the repayment process. Although research indicates that some borrowers do not engage with the repayment system or can be difficult to reach, focus group participants who had made payments or interacted with their servicers said failures of the system chipped away at their resolve to repay, even when they were initially motivated to do so.4

These takeaways reinforce the findings from Pew’s quantitative research that borrowers’ needs, experiences, and challenges should drive reforms to the student loan system. They are consistent with a growing body of research pointing to the issues that student loan borrowers face in navigating repayment and complex federal requirements and showing that borrowers who have difficulty repaying are more likely to question the value of loans in helping to facilitate higher education, which remains a key pathway to upward economic mobility for many.5

Gaining a deeper understanding of borrowers’ experiences will ensure that policymakers are better equipped to meet the longer-term needs of borrowers who struggle and help them repay their loans and avoid the negative consequences of delinquency, default, and growing balances. In addition, borrowers’ experiences provide insight into how reducing the complexity of the repayment system can help ensure that those at greatest risk of delinquency and default are put in a position to succeed.

This issue brief examines research on how borrowers perceive and behave within the student loan repayment system, and highlights key findings that could reduce rates of delinquency and default:

- Effective communication can increase borrower engagement. Strategically framed, targeted, and personalized information has the potential to reduce confusion, increase borrower action, and help borrowers avoid delinquency and default.

- Reducing friction points can improve enrollment in affordable repayment plans. Taking borrower behavior into account when making structural changes to the repayment system could make it easier for borrowers to repay their loans. Recent research demonstrates the importance of streamlining repayment processes so that borrowers face fewer friction points and benefit from automated processes where appropriate. For example, some delinquent borrowers could benefit from being auto-enrolled in income-driven plans that lower payments before their loans reach 90 days past due.

Accordingly, the U.S. Department of Education and Congress should take the following actions to help borrowers more easily and successfully repay their student loans:

- Give borrowers clear, actionable, timely, and borrower-tested information. The Department of Education recently indicated its intention to incorporate ongoing, frequent, and tailored borrower engagement into its servicing system, and to hold contractors accountable for a host of related, specific performance metrics. As part of this process, the department should work with its contractors to identify and implement best practices for communicating with borrowers—especially those most at risk of delinquency and default— and require use of these practices among servicers to ensure consistency and accuracy. Promising practices include carefully considering how repayment options are explained, conducting targeted follow-up, and scheduling times for borrowers seeking assistance to call their servicers. The impact of new practices on borrowers’ repayment behavior should be carefully tested and studied before being implemented on a larger scale. In addition, it is critical to help borrowers avoid delinquency during and immediately after periods of transition—such as the one that will happen after the current pauses expire—by focusing on those who previously showed signs of distress, such as early delinquency or pausing of payments repeatedly or for long periods of time.

- Establish strong, clear standards for servicing along with other forms of oversight to ensure proper implementation. Standards should include a focus on borrower outcomes, such as reducing rates of delinquency and default. In addition, the department can provide more detailed, regular updates on, and new statistics about, the status of the federal loan portfolio and borrowers’ pathways through repayment. Such improvements to student loan data would help identify problems that borrowers are experiencing in repayment, and improvements that servicers and the department should make.

- Make it easier for borrowers to enroll in income-driven plans. To provide repayment flexibility during times of great uncertainty, such as the current pandemic, servicers should be temporarily permitted to enroll borrowers into an income-driven plan without requiring extensive paperwork—for example, orally, through a website, or through electronic communication. Outside of pandemic-specific considerations, timely implementation of the Fostering Undergraduate Talent by Unlocking Resources for Education (FUTURE) Act—which directs the Internal Revenue Service and the Department of Education to securely share relevant borrower tax return data—will streamline administrative roadblocks and help borrowers more easily enroll and remain in income-driven repayment plans.

Elements of Loan Repayment

Federal student loans are managed by third-party companies, known as servicers. These firms are expected to perform functions such as collecting payments and helping borrowers select a repayment plan and access tools for pausing payments in accordance with federal rules, regulations, and directions.6

Repayment plans

Borrowers who graduate, drop below half-time enrollment, or leave school automatically get a six-month grace period before their first payments are due.7 Unless they select another plan, borrowers start repayment in the Standard Repayment Plan, which has fixed payments over a 10-year period so that borrowers will pay off the principal and interest on their loans over that span as long as payments are made in full and on time.8 If eligible, borrowers also have the option to enroll in other plans that lower monthly payments or extend the repayment period, but these plans may increase the interest accrued and therefore the amount repaid over the life of the loan.

Graduated Plan: This program allows borrowers to initially make lower monthly payments than those in the standard plan, but the payment amount increases every two years for 10 years so that borrowers will pay off the principal and interest over that span as long as payments are made in full and on time.

Extended Plan: Borrowers with balances over $30,000 can enroll in extended or extended graduated plans, which are modified versions of the standard and graduated plans that generally support repayment over 25 years.9

Income-driven plans: These plans have monthly payments that are calculated based on a borrower’s income and family size, which must be recertified annually.10 Congress has authorized the Department of Education to forgive any remaining balance after 20 or 25 years of qualifying payments.

Pausing payments

A set of tools, known as deferment and forbearance, is available to support borrowers who need to postpone or suspend their payments. Eligible borrowers include those who are enrolled at least half time in school, unemployed, disabled, serving in the military, or experiencing economic hardship, among other reasons.11

Deferment: Borrowers with certain types of loans may be able to pause their payments and avoid accruing interest during the deferment period.12 Most borrowers who use deferments do so while enrolled in school or when experiencing financial hardship, such as unemployment.

Forbearance: In general, loans paused using forbearance accrue interest. Borrowers can opt into discretionary forbearances—typically offered during periods of economic hardship—or be placed in mandatory forbearances by their servicers. Servicers can apply forbearances while they process income-driven repayment and other loan-related applications or while borrowers work to submit required documentation. In addition to pausing future payments, forbearance can be applied retroactively to make delinquent accounts current so the borrowers can, for example, enroll in income-driven plans.

Borrowers who qualify for a deferment or a forbearance can typically postpone their payments for up to a year at a time (although some borrowers use these tools for shorter periods) and for a maximum of three years per tool.13 With some types of deferment and many types of forbearance, when the period of suspended payments ends, unpaid interest on the loan capitalizes—that is, it is added to the principal and increases the amount subject to interest charges.14

Delinquency and default

When borrowers do not make payments, they become delinquent on their loans, and when they reach 270 days without a payment, they default.15 Student loan delinquencies are generally reported to national credit bureaus after 90 days of nonpayment. Most loans today remain with the servicer while they are between 271 and 360 days past due. Loans are then transferred to the Department of Education’s Debt Management and Collections System and eventually can be assigned to a private collection agency. Borrowers can make payments during the transfer period to avoid being sent to collections.

Unlike most other types of debt, federal student loans continue to accrue interest during default and are rarely discharged in bankruptcy.16

Effective communication can increase borrower engagement

Pew’s focus groups found that although some borrowers were able to navigate the student loan repayment system effectively, many others reported facing challenges managing their loans. These difficulties were driven by borrowers’ experiences both inside and outside the repayment system. For example, many said they experienced confusion and received inconsistent information, especially regarding crucial points in the repayment process, such as the transition from school into repayment and enrollment in income-driven repayment plans.17 At the same time, borrowers who struggled to repay reported that financial instability was the biggest barrier to making payments. They reported wanting to make payments but being unable to because of financial difficulties, including unexpected expenses. These borrowers said they had limited resources and needed to cover costs for transportation, housing, child care, and groceries before paying student loans.18

Similarly, research examining financial insecurity more broadly—which many are experiencing as a result of the pandemic—has found that having limited access to financial resources may constrain families’ abilities to navigate complex decisions, such as those that many must make within the student loan repayment system.19 Many of the opinions expressed and experiences described by participants in Pew’s focus group research echo those of similar focus groups and reflect the findings of analyses performed by government entities, researchers, servicers, and consumer advocates.20

According to the Department of Education, for example, some borrowers report that a lack of clear communication makes it difficult to navigate the complex repayment system. Specifically, they mention not having the information they need to select the right repayment option, not knowing how to avoid and get out of delinquency and default, receiving communications that are hard to understand, and receiving conflicting or inconsistent information.21

Analyses of student loan borrower complaints by the department and the Consumer Financial Protection Bureau found that borrowers reported problems related to communication, customer service, and loan status accuracy, including indications that they received conflicting or incorrect information about income-driven plan enrollment or how to exit default.22 Likewise, consumer advocates report that borrowers receive inconsistent information about similar issues.23 And student loan servicers and others have indicated that struggling borrowers can be difficult to reach and that broader improvements across the repayment system—particularly related to simplifying repayment processes—are needed.24

These analyses, and other research focused on borrower behavior as described below, underscore that strategically framed and timed information has the potential to reduce confusion, increase borrower engagement, and promote positive outcomes.

Strategically framed and personalized information can drive borrower action and lead to better outcomes

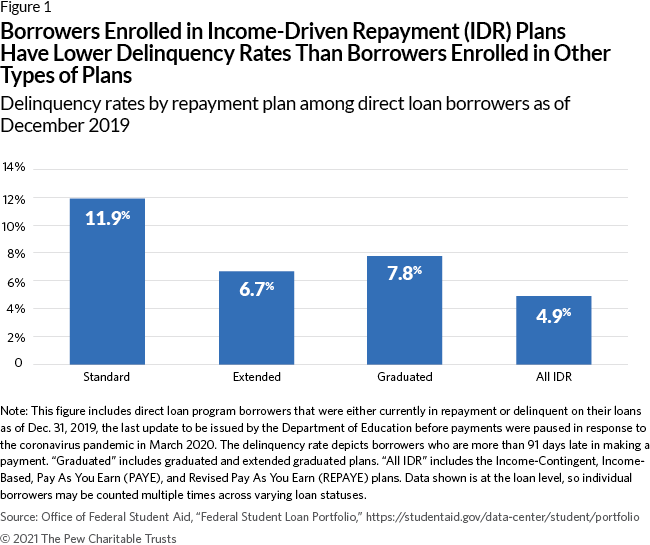

Research shows that income-driven plans can help borrowers struggling to repay loans manage financial insecurity and avoid delinquency and default.25 (See Figure 1.)

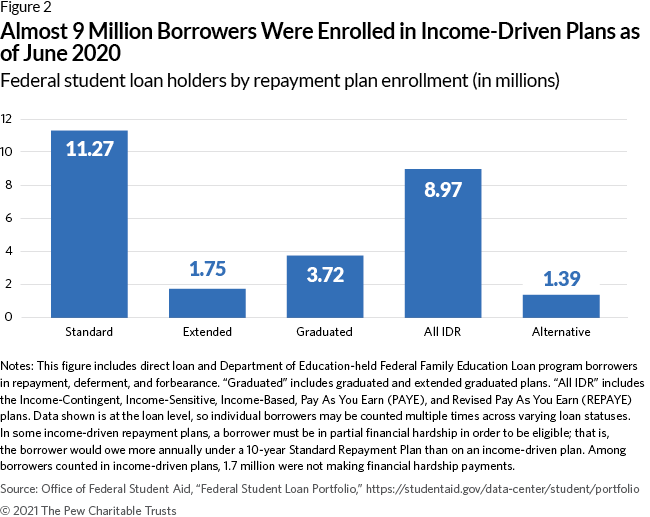

Enrollment in income-driven repayment plans has increased over the past decade as communication about and awareness of the plans have improved, and as more borrowers have become eligible. Yet enrollment in such plans remains lower than in the Standard Repayment Plan, with around 30% of all borrowers enrolled in them. (See Figure 2.)

Recent research indicates that there may be borrowers currently not enrolled who would benefit from an income-driven plan.26 For example, income-driven plans can help many manage financial distress, repay more money, and do so more consistently.27 Still, it is worth noting that income-driven repayment plans may not be the best choice for all borrowers. These plans can decrease monthly payments to as little as $0 per month for those under a certain income threshold, but in doing so, they extend the repayment period, have the potential to cost the borrower more over the long term, and can cause the principal balance to grow if the payments are too low to cover the monthly interest. The Department of Education projects that, depending on income and loan balance, some borrowers enrolled in income-driven repayment plans could repay as much as 1.5 to two times what they originally borrowed.28 This reinforces the need for clear and consistent communication with borrowers about their repayment options as their financial circumstances evolve.

For borrowers who might benefit from an income-driven plan, the way such plans are framed may affect enrollment. Recently, researchers from the University of Maryland surveyed undergraduate students about what choices they would make when selecting a repayment plan in the future. When the researchers emphasized the financial insurance benefits of income-driven plans—specifically, that these plans could ensure that payments remained affordable during unexpected changes in income—borrowers, especially those concerned about unemployment or low earnings after graduation, were more likely to choose them.29

More borrowers preferred the Standard Plan, in which monthly payments are set at a fixed amount for up to 10 years, when the researchers stressed the additional costs of income-driven plans, including potentially longer periods in repayment and more paid in interest over the life of the loan. Research conducted by the Office of Evaluation Sciences in the U.S. General Services Administration found that emails encouraging borrowers to avoid making loan payments higher than 10% of their incomes, and providing an example of an income that would qualify for a $0 payment in an income-driven plan, increased applications among borrowers currently in deferment.30 A separate study found that showing borrowers how much their payment would increase if they were unable to recertify their income (as required for income-driven plans) increased recertification rates.31 Taken together, this research suggests that policymakers may be able to increase the number of borrowers enrolled in income-driven plans if information about such plans is appropriately framed and personalized.

Properly timed information can help borrowers make informed decisions

The timing of information given to borrowers is another important factor in their repayment success. When borrowers graduate, leave school, or drop below half-time enrollment, they are supposed to complete an online exit counseling course, which provides information about repayment. Qualitative research from Pew indicates that although many borrowers did not recall participating in exit counseling, even some of those who said they did participate reported not feeling prepared to manage repayment and instead learned through trial and error.32

Exit counseling provides essential information about loans and repayment with the goal of preparing borrowers for success, but research on the effectiveness of such programs suggests that the information provided is often too general, and that when too much complex material is delivered all at once, it can be overwhelming. Exit counseling is provided during a period of disruption in students’ lives; students who leave school without completing a degree—a group that is more likely to struggle in repayment—might not receive this counseling at all, and many borrowers do not experience financial distress until years after they leave school, making it unlikely that the information provided, no matter how helpful, will be remembered when needed.

Conversely, studies have shown that directing pertinent information to specific populations when they need it can be effective: People tend to retain information they can apply to their current circumstances, while advice is less likely to “stick” when it is not immediately relevant.33 Government research has found that targeted emails to defaulters emphasizing the negative consequences of remaining in default increased rates of loan rehabilitation, a process that borrowers can use to get out of default.34 (Research from other fields has similarly found that people are more motivated to act when they are at risk of losing something, versus when they have something to gain.35) Notably, scheduling times for defaulted borrowers to speak with a representative and including that information in email subject lines also increased contact rates. The scheduled times were during low-volume call times at facilities, suggesting that providing borrowers a time to call could also help evenly distribute resources.36

Reducing friction points can improve enrollment in affordable repayment plans

Structural changes to the repayment system that account for borrower behavior and automate certain decisions could also increase repayment success.

Streamlining processes increases borrower use of income-driven repayment

The Department of Education is developing and implementing the Next Generation Financial Services Environment (Next Gen), an initiative to modernize and streamline the technology and operational components of the student loan repayment system.37 As part of this process, the department identified a host of friction points for borrowers in the current system, including difficulty navigating the application and recertification processes for enrolling in income-driven repayment plans.38 In Pew focus groups, borrowers reported that such administrative hurdles made it difficult to manage the repayment process and contributed to them falling off track.39

Making it easier for borrowers to provide information when applying for income-driven repayment plans may increase enrollment in the plans. For example, researchers working with a federal student loan servicer were able to significantly boost enrollment by emailing borrowers applications that were already filled out and required the borrower to provide only an electronic signature.40 Other research conducted in collaboration with servicers found that mailing information to borrowers about income-driven plan enrollment in a “document jacket” that highlighted only the required parts of the application to fill in also increased enrollment.41

Although the recently passed federal FUTURE Act has the potential to address some of these challenges and help streamline enrollment in income-driven plans, it has not been fully implemented and leaves some problems unaddressed. For example, some Pew focus group participants reported that they did not know about income-driven plans or said their payments were or still would be unaffordable, primarily because those borrowers’ incomes were volatile or because the plans did not account for certain expenses.42 (See “FUTURE Act Could Improve Access to Affordable Repayment Plans.”)

FUTURE Act Could Improve Access to Affordable Repayment Plans

In December 2019, the federal FUTURE Act became law.43 Among its provisions, this legislation includes measures to improve the system for repaying federal student loans for approximately 9 million borrowers now enrolled in income-driven repayment plans and those who will enroll in the future by directing the IRS and the Department of Education to securely share relevant borrower data. This data sharing has the potential to streamline the burdensome and duplicative income verification requirements for these plans, bolster the accuracy of income information used to determine borrowers’ repayment obligations, and reduce improper payments.

The act requires the education and treasury secretaries to submit regular reports to Congress on implementation status, but it has no effective date and leaves much of the process at the discretion of these agencies. Effective implementation of the act by the Education and Treasury departments would help ensure that millions of borrowers are able to more easily enroll and remain enrolled in income-driven repayment plans. However, implementation will be a lengthy process that could create additional barriers for borrowers, and it raises key questions, such as: How can the actions of each agency best reduce the barriers that prevent borrowers from accessing affordable repayment plans? When and how can borrowers agree to having their data shared?44

To successfully deliver on the legislation’s promise, Congress, the Department of Education, and the IRS should ensure that five key issues are addressed. Implementation should:

- Be prompt and carefully designed to ensure that unnecessary administrative hurdles no longer prevent borrowers from accessing affordable plans. Data sharing is complex, and it will be helpful for policymakers to identify and understand the specific steps the department and the IRS need to take to facilitate data security. It will also be important to ensure that borrowers no longer experience the consequences of an inefficient system, which are significant.45

- Put in place multiple opportunities to engage with struggling borrowers. To more easily access income-driven repayment plans, borrowers will need to agree to having their data shared. Questions remain as to how and when they will give this approval. For example, can borrowers provide approval only when applying for income-driven repayment, or also during other interactions across the loan life cycle, such as the new Annual Student Loan Acknowledgment or when leaving school during exit counseling?

Recent Pew research indicates that a significant share of borrowers interact with the repayment system in more than one way, such as by requesting, being placed in, or retroactively using loan deferments or forbearances.46 Some, however, do not engage before falling behind on loan repayment or in periods of financial stress. This suggests opportunities for engaging with struggling borrowers, both before and after they leave school.

- Ensure that borrowers are clearly informed about payment changes. How and when borrowers who agree to data sharing are notified annually of their new payments is important. Pew’s focus groupwork highlights that participants’ broader financial realities informed how they repaid their loans. For example, those struggling the most with repayment indicated that they had limited resources and needed to cover their costs for transportation, housing, child care, and groceries before paying student loans.47

- Ensure that the repayment process remains manageable for those who do not give approval. If borrowers do not give approval, they must still be allowed to access income-driven plans by using tools that currently exist, such as the IRS Data Retrieval Tool—a mechanism that borrowers can manually use to transfer tax information into their plan applications—or submit alternative documentation of their incomes. In addition, a clear process must be established to allow borrowers, such as those who lose their jobs, to easily recertify their incomes before the next year’s tax information is available.

- Align with other efforts by the Department of Education to improve the student loan servicing system. For example, as part of Next Gen, there could be opportunities to request borrower agreement for data sharing in the department’s Aid Summary or Loan Simulator tools, which currently act as centralized hubs for customer account information.

Automation, as appropriate, is a powerful tool for reducing friction within the repayment system

Making certain choices automatic can have a powerful effect on individuals’ decision-making. For example, researchers found that requiring people to “opt out” instead of “opt in” to retirement savings plans increases plan participation and that many people pursue options that they believe are the most commonly chosen.48 Analysis indicates that these principles could also apply to student loan repayment. Currently, when borrowers leave school or drop below half-time enrollment, they are automatically enrolled in the Standard Repayment Plan if they do not select another option. Today, approximately 40% of borrowers with federally managed loans are enrolled in this plan.49 However, in a recent experiment, when borrowers were shown a website portraying income-driven repayment plans as the automatic enrollment option at the start of repayment, they generally elected to remain in such plans.50

Although automatic options are promising, policymakers must be careful about how they are designed and used in the student loan repayment system, given that income-driven plans can increase the time and money spent in repayment. In addition, income-driven payments may still be unaffordable for some borrowers. For example, in previous Pew research, several Texas borrowers as well as focus group participants from around the country who were enrolled in income-driven repayment plans reported using forbearances and deferments to pause payments, some for long periods.51 Some indicated that the formula that calculates monthly income-driven payments did not adequately consider monthly expenses, such as rent payments, phone bills, health and child care, and transportation.

Other quantitative and qualitative research indicates that many borrowers who struggle to repay are already experiencing other types of financial distress.52 Pew’s work on family financial security demonstrates that the state of a family’s finances can play a role in its ability to repay a student loan: Many families, even those that appear financially secure, can have income that varies from month to month or experience financial shocks that make it difficult to plan and budget, even for regular expenses such as student loans.53

Thus, it is important to consider implementing automated processes at points in the repayment process when borrowers are most likely to benefit. This might be achieved, for example, by facilitating the enrollment of delinquent borrowers in income-driven or other plans that lower payments before loans reach 90 days past due, which is when loan delinquencies are generally reported to national credit bureaus. Additionally, successful implementation of the FUTURE Act, as discussed above, would reduce the need for millions of borrowers to annually recertify their incomes.

More can be done to develop policies and programs informed by borrower behavior

The Department of Education and Congress should keep borrower behavior in mind as they design and implement policies related to student loan repayment and servicing.

Information given to borrowers should be clear, actionable, timely, and borrower-tested

Identify best practices

Student loan repayment policies can be complex and difficult to navigate for even the most seasoned borrowers. The Department of Education recently indicated its intention to incorporate ongoing, frequent, and tailored borrower engagement as part of Next Gen and announced that it will conduct iterative user-testing of its communications with borrowers.54 According to government procurement documents, servicers and other contractors will have the opportunity to provide feedback and insights to the department about working with borrowers to help inform development of data-driven outreach campaigns and will be held accountable for a host of related, specific performance metrics.55

As part of this initiative, the department should work with its contractors to identify and implement best practices in communicating with borrowers, especially those most at risk of delinquency and default. Communications that consider how repayment options are framed—such as those that detail the benefit that borrowers stand to gain through enrollment in an income-driven plan—and scheduling times for borrowers seeking assistance to call their servicers and avoid long waits seem particularly promising and worthy of additional exploration.

Once best communication practices are identified, the department should disseminate and require their use among servicers to ensure consistency and accuracy. The department’s Aid Summary or Loan Simulator tools— centralized hubs for customer account information—provide additional opportunities for the department to share targeted information about repayment with borrowers.56

Provide information during periods of transition

Providing borrowers with timely information is even more critical in periods of transition. After the current coronavirus-related period of paused payments ends, tens of millions of borrowers will transition back into repayment at the same time.57 And as part of Next Gen, the department recently announced that it is planning to transition loans from current servicers to vendors selected as part of a procurement for a new servicing platform, the Interim Servicing Solution.58

As part of its Draft Strategic Plan for fiscal years 2020-24, the Office of Federal Student Aid (FSA), the unit within the Department of Education that oversees the federal loan program, indicated that it plans to track and respond to early warning signs for borrowers in repayment and intervene to offer a range of options to improve borrowers’ likelihood of repaying.59 Pew research highlights indicators that can help identify at-risk borrowers before they are in distress, such as those who miss payments early, repeatedly suspend payments, or have previously defaulted.60 Although these are important factors to watch for immediately after transitions, changes inside and outside the repayment system can also cause new groups of borrowers to struggle. For example, in the past several months, millions of Americans have lost their jobs and will continue to experience income volatility because of the economic downturn.

As part of these large-scale changes, the department and its contractors could use existing data and personalized information about a borrower’s repayment situation to provide targeted outreach to those who showed signs of distress before periods of transition, and seek to quickly identify those who go off track immediately after a transition.61 These borrowers may need additional assistance enrolling in, recertifying for, or modifying their payments within income-driven repayment plans. This should include borrowers who:

- Were delinquent before the transition.

- Missed payments within their first three months of entering repayment (if they recently entered repayment).

- Experienced hardship as evidenced by enrolling in a non-administrative forbearance or an economic hardship deferment, making partial payments, or being in default.

- Paused payments repeatedly and for long periods.

- Paused or missed payments or made partial payments while enrolled in an income-driven repayment plan.

- Need to take action soon as part of the existing repayment cycle, including those who have loans that entered repayment recently or have an approaching recertification date for an income-driven repayment plan.

After periods of transition, additional leeway could be given to those who miss payments in order to give servicers more time to reach them. Borrowers may also need time to re-enroll in or change their automatic debit arrangements or change repayment plans. Delaying negative credit reporting or using an administrative forbearance period to keep borrowers current will allow borrowers and servicers to focus first on a successful transition.

Strategically frame and time information

The research in this paper outlines several promising practices for communication with borrowers, including:

- Emphasizing the financial insurance aspect of income-driven repayment plans for at-risk borrowers— specifically, that these plans could ensure that payments remain affordable during unexpected changes in income.62

- Following up via email, phone, and text with borrowers who express interest in income-driven plans when contacted and with those who submit incomplete applications or whose applications are otherwise not approved.63

- Emphasizing that borrowers experiencing hardship could be eligible to make a lower or $0 payment in an income-driven repayment plan.64

- Emphasizing the consequences of inaction, such as highlighting the increased monthly payment that will occur if a borrower does not recertify for an income-driven plan and the credit-related consequences of delinquency.65

In addition, the department and servicers should ensure that the most critical information and messaging are consistent across platforms (i.e., email, social media, paid media, and websites) and readily available no matter which means borrowers use to enter the system.

Establish strong, clear standards for servicing and provide oversight to ensure proper implementation

Within the current servicing system, clear standards and improved oversight could help policymakers implement policies and procedures based on borrower behavior. Standards should include a focus on borrower outcomes—such as reducing rates of delinquency and default—and require targeted outreach to borrowers in periods of transition. As part of Next Gen, FSA intends to centralize some of the responsibilities currently held by servicers.66 As it does so, FSA accountability for borrower outcomes will be equally important.

In addition, the Department of Education should provide more detailed and frequent updates on the status of the federal loan portfolio (especially before and after periods of large-scale transition), including types of deferment and forbearance, length of delinquencies, and repayment plan enrollment. Right now, such data is made available only once per quarter. Publishing this data monthly would provide more opportunities for real-time analysis and identification of problems and improvements that servicers and the department should make.

Beyond increasing the frequency of updates for already published figures, the department should publish new statistics on income-driven repayment plan enrollment, including the balances and payment amounts of enrolled borrowers, annual recertification rates that include how many borrowers lost their partial financial hardship status, and rates of balance growth over time. New metrics on student loan servicing could also include the number of income-driven repayment applications submitted and processed across the portfolio, the volume and types of communication that servicers initiate and receive, and the questions or issues most commonly raised by borrowers. Such metrics could be used to identify areas where servicers might need additional resources or support. In addition to these snapshots, policymakers should support research and policy reform by expanding access to data from the National Student Loan Data System, the database that tracks the status of federal student loans.67

Help borrowers enroll in affordable plans

Since the onset of the pandemic, millions of Americans have lost their jobs and will continue to experience income volatility because of the economic downturn. This means that the information in their tax returns may not match their current incomes. The process for updating income information in order to reduce monthly payments, now and even before the pandemic, can be time-intensive for borrowers and servicers.68

To provide repayment flexibility during times of financial uncertainty, servicers should be temporarily permitted to enroll borrowers into an income-driven plan without requiring extensive paperwork—for example, orally, through a website, or through electronic communication. Borrowers who do not have taxable income are already allowed to self-certify their incomes and family sizes, giving them access to a more streamlined application process. The U.S. Government Accountability Office recently concluded that the Department of Education could do more to prevent errors or fraud in this process.69 Timely implementation of the FUTURE Act will bolster the accuracy of income information used to determine repayment obligations and reduce improper payments.

The temporary provisions put in place during the pandemic can provide insight into what structural changes will help meet the long-term needs of borrowers struggling with delinquency and default. Once evaluated, a more flexible enrollment process could be an important stopgap measure until the FUTURE Act can be fully implemented.

The Department of Education and its contractors should also highlight the steps needed for borrowers to enroll in an income-driven repayment plan or to recertify their current enrollment. Providing a checklist of documents that borrowers need to enroll or recertify, including examples of the documents and where to obtain them, could help reduce confusion about the enrollment process.

More research is needed

In addition to improved communications practices informed by research on borrower behavior, larger changes to the student loan repayment system are needed, and several opportunities exist for additional analysis. First, streamlining the repayment system may not be enough to address the barriers to repayment that some borrowers face. More data is needed to show how borrowers use income-driven plans and whether structural changes would meet the needs of those struggling most with delinquency, default, and growing loan balances. For example, experts have proposed a range of potential changes, including altering or phasing out the amount of income that is set aside in calculations to determine a monthly payment amount or basing payments on a combination of income and amount borrowed, among other variables.70 Stakeholders have also suggested that the number and variety of income-driven plans can also be challenging for borrowers to navigate and that reducing the available options would facilitate enrollment. (Currently, borrowers can ask servicers to enroll them into the income-driven plan with the lowest monthly payment instead of choosing a specific plan.)

The Foundations for Evidence-Based Policymaking Act (Evidence Act), signed into law in 2019, may be useful for ensuring that any such plan reforms consider the latest data and research. The act emphasizes evidence-based policymaking and requires each agency to develop a plan containing key research questions and methods for harnessing federally available data to address them.71 As the Department of Education moves forward with its plan, evaluating servicer performance and best practices and barriers to enrollment in affordable repayment plans should be priorities.

Finally, as part of Next Gen, the department has begun employing the use of a virtual assistant using artificial intelligence to address common borrower questions in real time.72 The assistant can answer questions as well as help borrowers make payments and contact their servicers. The performance of this new feature should be carefully monitored, especially as the field of artificial intelligence continues to develop. For example, FSA should collect and publish data on the number and types of requests received by its new online tools and whether those issues were successfully resolved. It is critical not only that the virtual assistant provide accurate information but also that the algorithms used to build the system be inclusive and account for cultural and lingual differences. A system that fails in this respect may be unable to effectively direct many distressed borrowers to available relief measures.

Conclusion

Gaining a deeper understanding of borrowers’ behaviors and experiences will ensure that policymakers are better equipped to optimize the design of the repayment system to benefit those most at risk of delinquency and default. Although some questions remain about which approaches are most effective, recent studies from other fields have indicated that some interventions may not be “one-size-fits-all” and that the context in which individuals experience interventions is important. Efforts to reform the repayment system should heed these lessons; success will require a combination of streamlining processes, reducing complexity, and improving servicer-borrower communication.73 Understanding and applying these insights is key to ensuring that longer-term structural changes meet the needs of those struggling most with delinquency, default, and growing loan balances.

Endnotes

- Office of Federal Student Aid, “Federal Student Loan Portfolio,” accessed Oct. 26, 2020, https://studentaid.ed.gov/sa/about/data-center/student/portfolio. One in 5 borrowers in default includes direct loans and Federal Family Education Loan program loans held by the Department of Education. Although default technically occurs after 270 days of missed payments, these figures measure default after 360 days.

- The Pew Charitable Trusts, “Student Loan Default Has Serious Financial Consequences” (2020), https://www.pewtrusts.org/en/research-and-analysis/fact-sheets/2020/04/student-loan-default-has-serious-financial-consequences.

- The Pew Charitable Trusts, “Borrowers Discuss the Challenges of Student Loan Repayment” (2020), https://www.pewtrusts.org/en/research-and-analysis/reports/2020/05/borrowers-discuss-the-challenges-of-student-loan-repayment.

- ideas42, “Boosting Timely Loan Repayment: Education on Debt Relief Options” (2016), https://www.ideas42.org/wp-content/uploads/2016/12/I42-718_Brief_GreatLakes_3.pdf; The Pew Charitable Trusts, “Student Loan System Presents Repayment Challenges” (2019), https://www.pewtrusts.org/en/research-and-analysis/reports/2019/11/student-loan-system-presents-repayment-challenges; The Pew Charitable Trusts, “Borrowers Discuss the Challenges of Student Loan Repayment.”

- D. Herbst, “Liquidity and Insurance in Student Loan Contracts: The Effects of Income-Driven Repayment on Borrower Outcomes” (Princeton University, 2020), https://drive.google.com/file/d/1A-gq_LIqffY6r2gDTcUK9-Y3ZV8Go6SU/view; L. Ahlman, “Casualties of College Debt: What Data Show and Experts Say About Who Defaults and Why” (The Institute for College Access and Success, 2019), https://ticas.org/sites/default/files/pub_files/casualties_of_college_debt_0.pdf; U.S. Department of the Treasury, “A Financial System That Creates Economic Opportunities: Banks and Credit Unions” (2017), https://www.treasury.gov/press-center/press-releases/documents/a%20financial%20system.pdf; U.S. Department of the Treasury, “A Financial System That Creates Economic Opportunities: Nonbank Financials, Fintech, and Innovation” (2018), https://home.treasury.gov/sites/default/files/2018-08/A-Financial-System-that-Creates-Economic-Opportunities---Nonbank-Financials-Fintech-and-Innovation_0.pdf; S. Reber and C. Sinclair, “Opportunity Engines: Middle-Class Mobility in Higher Education” (The Brookings Institution, 2020), https://www.brookings.edu/research/opportunity-engines-middle-class-mobility-in-higher-education/; The Pew Charitable Trusts, “Student Loan System Presents Repayment Challenges.”

- Common Manual Unified Student Loan Policy, “Common Manual,” accessed Oct. 26, 2020, http://commonmanual.org/; U.S. Government Accountability Office, “Federal Student Loans: Education Could Improve Direct Loan Program Customer Service and Oversight” (2016), https://www.gao.gov/assets/680/677159.pdf.

- Office of Federal Student Aid, “Student Loan Repayment,” accessed Oct. 26, 2020, https://studentaid.gov/manage-loans/repayment.

- Office of Federal Student Aid, “Choose the Federal Student Loan Repayment Plan That’s Best for You,” accessed Oct. 26, 2020, https://studentaid.ed.gov/sa/repay-loans/understand/plans.

- Ibid. Borrowers who consolidate can repay over 30 years.

- Payments may not cover the amount of interest accruing on the loan.

- Office of Federal Student Aid, “Get Temporary Relief,” accessed Oct. 26, 2020, https://studentaid.ed.gov/sa/repay-loans/deferment-forbearance.

- Subsidized loans do not accrue interest while the borrower is in school at least half time, during the six-month grace period, and during periods of deferment. In general, interest does accrue on subsidized loans during forbearances. In contrast, interest typically accrues on unsubsidized loans during school, the grace period, and periods of deferment and forbearance.

- Office of Federal Student Aid, “Get Temporary Relief”; U.S. Government Accountability Office, “Federal Student Loans: Actions Needed to Improve Oversight of Schools’ Default Rates” (2018), https://www.gao.gov/products/GAO-18-163. Certain borrowers may be eligible for a range of deferments of forbearances, some of which may not be time-limited.

- Office of Federal Student Aid, “Understand How Interest Is Calculated and What Fees Are Associated With Your Federal Student Loan,” accessed Oct. 26, 2020, https://studentaid.gov/understand-aid/types/loans/interest-rates.

- Office of Federal Student Aid, “Student Loan Delinquency and Default,” accessed Oct. 26, 2020, https://studentaid.gov/manage-loans/default. Borrowers are also considered delinquent—and can eventually default—when they make partial payments.

- J. Delisle, P. Cooper, and C. Christensen, “Federal Student Loan Defaults: What Happens After Borrowers Default and Why” (American Enterprise Institute, 2018), https://www.aei.org/research-products/report/federal-student-loan-defaults-what-happens-after-borrowers-default-and-why/; Office of Federal Student Aid, “In Some Cases, You Can Have Your Federal Student Loan Discharged After Declaring Bankruptcy,” accessed Oct. 26, 2020, https://studentaid.gov/manage-loans/forgiveness-cancellation/bankruptcy.

- The Pew Charitable Trusts, “Borrowers Discuss the Challenges of Student Loan Repayment.”

- Ibid.

- A. Mani et al., “Poverty Impedes Cognitive Function,” Science 341, no. 6149 (2013): 976-80, https://science.sciencemag.org/content/341/6149/976.

- Center for Responsible Lending, “Debt and Disillusionment: Stories of Former For-Profit College Students as Shared in Florida Focus Groups” (2018), https://www.responsiblelending.org/sites/default/files/nodes/files/research-publication/crl-florida-debt-disillusionment-l-aug2018.pdf; J. Delisle and A. Holt, “Why Student Loans Are Different: Findings From Six Focus Groups of Student Loan Borrowers” (2015), https://static.newamerica.org/attachments/2358-why-student-loans-are-different/StudentLoansAreDifferent_March11_Updated.e7bf17f703ad4da299fad650f47ac343.pdf; FDR Group, “Perceptions and Experiences of For-Profit School Attendees in Orlando (FL): A Focus Group Report” (2017), https://www.responsiblelending.org/sites/default/files/nodes/files/research-publication/crl-fdr-forprofit-orlando-28sep2017.pdf; FDR Group, “Taking Out and Repaying Student Loans: A Report on Focus Groups With Struggling Student Loan Borrowers” (2015), https://static.newamerica.org/attachments/2358-why-student-loans-are-different/FDR_Group_Updated.dc7218ab247a4650902f7afd52d6cae1.pdf; C.L. Johnson et al., “What Are Student Loan Borrowers Thinking? Insights From Focus Groups on College Selection and Student Loan Decision Making,” Journal of Financial Counseling and Planning 27, no. 2 (2016), https://www.researchgate.net/publication/311267987_What_Are_Student_Loan_Borrowers_Thinking_Insights_From_Focus_Groups_on_College_Selection_and_Student_Loan_Decision_Making; UnidosUS and the UNC Center for Community Capital, “It Made the Sacrifices Worth It: The Latino Experience in Higher Education” (2018), https://communitycapital.unc.edu/files/2018/04/UnidosUS-Student-Debt-Report.pdf.

- Office of Federal Student Aid, “General Session 4: Next Gen FSA” (presentation, FSA Training Conference, Atlanta, 2018), https://fsaconferences.ed.gov/conferences/library/2018/2018FSAConfSessionGS4.ppt; Office of Inspector General, “Federal Student Aid: Additional Actions Needed to Mitigate the Risk of Servicer Noncompliance With Requirements for Servicing Federally Held Student Loans” (U.S. Department of Education, 2019), https://www2.ed.gov/about/offices/list/oig/auditreports/fy2019/a05q0008.pdf.

- Consumer Financial Protection Bureau, “Annual Report of the CFPB Student Loan Ombudsman: Transitioning From Default to an Income-Driven Repayment Plan” (2016), https://files.consumerfinance.gov/f/documents/102016_cfpb_Transmittal_DFA_1035_Student_Loan_Ombudsman_Report.pdf; Office of Federal Student Aid, “Annual Report FY 2019” (2019), https://www2.ed.gov/about/reports/annual/2019report/fsa-report.pdf; Consumer Financial Protection Bureau, “Annual Report of the CFPB Private Education Loan Ombudsman” (2020), https://www.consumerfinance.gov/documents/9271/cfpb_annual-report_private-education-loanombudsman_2020.pdf.

- P. Yu (director, Student Loan Borrower Assistance Project), testimony before the U.S. House of Representatives Financial Services Committee, 116 (Sept. 20, 2019), http://www.nclc.org/issues/yu-test-sept2019.html.

- Education Finance Council, “Higher Education Act Recommendations,” https://www.efc.org/page/issues_hea; J. Remondi, president and CEO, Navient, letter to CFPB, “Consumer Financial Protection Bureau Request for Information Regarding Student Loan Borrower Communications Docket No. CFPB-2016-0018,” June 12, 2016, https://news.navient.com/static-files/f378cb51-5d48-45ae-9f4b-a5fcf304bf55.

- C. Campbell and N. Hillman, “A Closer Look at the Trillion: Borrowing, Repayment, and Default at Iowa’s Community Colleges” (Association of Community College Trustees, 2015), https://www.acct.org/files/Publications/2015/ACCT_Borrowing-Repayment-Iowa_CCs_09-28-2015.pdf; Congressional Budget Office, “Income-Driven Repayment Plans for Student Loans: Budgetary Costs and Policy Options” (2020), https://www.cbo.gov/publication/55968.

- The Pew Charitable Trusts, “Borrowers Discuss the Challenges of Student Loan Repayment.”

- D. Herbst, “Liquidity and Insurance in Student Loan Contracts.”

- U.S. Department of Education, “Fiscal Year 2021 Budget Proposal” (2020), https://www2.ed.gov/about/overview/budget/budget21/justifications/r-sloverview.pdf.

- K.G. Abraham et al., “Framing Effects, Earnings Expectations, and the Design of Student Loan Repayment Schemes” (National Bureau of Economic Research, 2018), https://www.nber.org/papers/w24484.

- Office of Evaluation Sciences, “Increasing IDR Applications Among Eligible Student Loan Borrowers Through Targeted Messages” (U.S. General Services Administration, 2016), https://oes.gsa.gov/projects/idr-applications-targeted-messages/. The findings among borrowers in forbearance were not statistically significant.

- Office of Evaluation Sciences, “Increasing IDR Re-Certification Among Student Borrowers” (U.S. General Services Administration, 2016), https://oes.gsa.gov/projects/idr-re-certification/.

- The Pew Charitable Trusts, “Borrowers Discuss the Challenges of Student Loan Repayment.”

- B. Akers, “Experimental Evidence on the Impact of Student Debt Letters on Borrowing, Financial Literacy and Academic Progress” (Brookings Institution, 2017), https://www.brookings.edu/wp-content/uploads/2017/12/es_20170601_akers-debt-letters.pdf; C. Urban et al., “State Financial Education Mandates: It’s All in the Implementation” (FINRA, 2015), https://www.finra.org/sites/default/files/investoreducationfoundation.pdf; D. Fernandes, J.G. Lynch Jr., and R.G. Netemeyer, “Financial Literacy, Financial Education, and Downstream Financial Behaviors,” Management Science 60, no. 8 (2014), https://pubsonline.informs.org/doi/abs/10.1287/mnsc.2013.1849; M. Miller et al., “Can You Help Someone Become Financially Capable? A Meta-Analysis of the Literature” (The World Bank, 2014), http://documents.worldbank.org/curated/en/297931468327387954/pdf/WPS6745.pdf; B.M. Marx and L.J. Turner, “Student Loan Choice Overload” (National Bureau of Economic Research, 2019), http://econweb.umd.edu/~turner/Marx_Turner_Choice_Overload.pdf; P. Fernbach and A. Sussman, “Teaching People About Money Doesn’t Seem to Make Them Any Smarter About Money— Here’s What Might,” MarketWatch, Oct. 27, 2018, https://www.marketwatch.com/story/financial-education-flunks-out-and-heres-whats-being-done-about-it-2018-10-10; R. Darolia, “An Experiment on Information Use in College Student Loan Decisions” (Federal Reserve Bank of Philadelphia, 2016); T. Kaiser and L. Menkhoff, “Does Financial Education Impact Financial Literacy and Financial Behavior, and If So, When?” The World Bank Economic Review 31, no. 3 (2017), https://academic.oup.com/wber/article/31/3/611/4471971; U.S. Financial Literacy and Education Commission, “Best Practices for Financial Literacy and Education at Institutions of Higher Education” (2019), https://home.treasury.gov/system/files/136/Best-Practices-for-Financial-Literacy-and-Education-at-Institutions-of-Higher-Education2019.pdf.

- Office of Evaluation Sciences, “Increasing Student Loan Rehabilitation Rates for Defaulted Borrowers” (U.S. General Services Administration, 2016), https://oes.gsa.gov/projects/loan-rehab-rates/.

- S. Schindler and S. Pfattheicher, “The Frame of the Game: Loss-Framing Increases Dishonest Behavior,” Journal of Experimental Social Psychology 69 (2017): 172-77, https://psycnet.apa.org/record/2016-49273-001.

- Office of Evaluation Sciences, “Increasing Student Loan Rehabilitation Rates for Defaulted Borrowers.”

- Office of Federal Student Aid, “Latest Next Gen FSA News,” accessed Oct. 26, 2020, https://studentaid.gov/announcements-events/next-gen; U.S. Department of Education, “U.S. Department of Education’s Office of Federal Student Aid Announces New Contracts With Five Companies to Improve Customer Service, Increase Accountability,” accessed Oct. 26, 2020, https://www.ed.gov/news/press-releases/us-department-educations-office-federal-student-aid-announces-new-contracts-five-companies-improve-customer-service-increase-accountability.

- SAM.gov, “Nextgen Business Process Operations,” accessed Oct. 26, 2020, https://beta.sam.gov/opp/4ccf4acdbe7d196698111dc16aa94616/view?keywords=nextgen&sort=-modifiedDate&index=&is_active=true&page=2&date_filter_index=0&inactive_filter_values=false&organization_id=100001616. Friction points are sometimes referred to as pain points in the Department of Education’s Next Gen procurement documents.

- The Pew Charitable Trusts, “Borrowers Discuss the Challenges of Student Loan Repayment.” Focus group participants in all categories said the complex application and annual recertification processes for income-driven plans made it difficult to take full advantage of them.

- H. Mueller and C. Yannelis, “Reducing Barriers to Enrollment in Federal Student Loan Repayment Plans: Evidence From the Navient Field Experiment” (Working paper, 2019), https://bfi.uchicago.edu/wp-content/uploads/3_MuellerHolger_Navient-presentation-September-2019-Chicago-HH-Conf.pdf. It is important that the organization and wording of the application itself is behaviorally informed. Borrowers will need to be able to quickly and easily understand what they are signing and check that all the information is correct.

- ideas42, “Boosting Timely Loan Repayment.” The increased income-driven plan enrollment observed in these studies may be partially explained by the concept of reciprocity. Researchers in other fields have noted that if it is evident that a service provider put in effort to engage, its clients may be encouraged to match that effort. E. Fehr and S. Gächter, “Fairness and Retaliation: The Economics of Reciprocity,” Journal of Economic Perspectives 14, no. 3 (2000): 159-81, https://www.aeaweb.org/articles?id=10.1257/jep.14.3.159.

- The Pew Charitable Trusts, “Borrowers Discuss the Challenges of Student Loan Repayment.”

- Public Law No: 116-91: Fostering Undergraduate Talent by Unlocking Resources for Education (FUTURE) Act (2019), https://www.congress.gov/bill/116th-congress/house-bill/5363.

- S. Sattelmeyer, “Law Will Ease Access to Affordable Student Loan Repayment If Implemented Effectively,” March 2, 2020, The Pew Charitable Trusts, https://www.pewtrusts.org/en/research-and-analysis/articles/2020/03/02/law-will-ease-access-to-affordable-student-loan-repayment-if-implemented-effectively.

- B. Denten, S. Sattelmeyer, and R. Williams, “Streamlined Data Sharing Could Help Millions Pay Back Student Loans,” The Pew Charitable Trusts, July 22, 2019, https://www.pewtrusts.org/en/research-and-analysis/articles/2019/07/22/streamlined-data-sharing-could-help-millions-pay-back-student-loans.

- The Pew Charitable Trusts, “Student Loan System Presents Repayment Challenges.”

- The Pew Charitable Trusts, “Borrowers Discuss the Challenges of Student Loan Repayment.”

- J. Beshears et al., “The Importance of Default Options for Retirement Saving Outcomes: Evidence From the United States,” in Social Security Policy in a Changing Environment,(University of Chicago Press, 2009), https://www.nber.org/papers/w12009; N. Goldstein, R. Cialdini, and V. Griskevicius, “A Room With a Viewpoint: Using Social Norms to Motivate Environmental Conservation in Hotels,” Journal of Consumer Research 35, no. 3 (2008): 472-82, https://academic.oup.com/jcr/article/35/3/472/1856257; K. Farrow, G. Grolleau, and L. Ibanez, “Social Norms and Pro-Environmental Behavior: A Review of the Evidence,” Ecological Economics 140 (2017): 1-13, https://ideas.repec.org/a/eee/ecolec/v140y2017icp1-13.html; R. Cialdini et al., “Managing Social Norms for Persuasive Impact,” Social Influence 1, no. 1 (2006): 3-15, https://www.fs.fed.us/psw/publications/winter/psw_2006_winter001.cialdini.pdf.

- Office of Federal Student Aid, “Federal Student Loan Portfolio.”

- J.C. Cox, D. Kreisman, and S. Dynarski, “Designed to Fail: Effects of the Default Option and Information Complexity on Student Loan Repayment” (National Bureau of Economic Research, 2018), https://aysps.gsu.edu/files/2018/11/GSU_EXCEN_WP_2018-04.pdf.

- The Pew Charitable Trusts, “Student Loan System Presents Repayment Challenges”; The Pew Charitable Trusts, “Borrowers Discuss the Challenges of Student Loan Repayment.”

- K. Blagg, “Underwater on Student Debt: Understanding Consumer Credit and Student Loan Default” (Urban Institute, 2018), https://www.urban.org/research/publication/underwater-student-debt/view/full_report.

- The Pew Charitable Trusts, “Are American Families Becoming More Financially Resilient? Changing Household Balance Sheets and the Effects of Financial Shocks” (2017), http://www.pewtrusts.org/en/research-and-analysis/issue-briefs/2017/04/are-american-families-becoming-more-financially-resilient#0-overview; The Pew Charitable Trusts, “How Do Families Cope With Financial Shocks? The Role of Emergency Savings in Family Financial Security” (2015), http://www.pewtrusts.org/en/research-and-analysis/issue-briefs/2015/10/the-role-of-emergency-savings-in-family-financial-security-how-do-families; The Pew Charitable Trusts, “How Income Volatility Interacts with American Families’ Financial Security: An Examination of Gains, Losses, and Household Economic Experiences” (2017), http://www.pewtrusts.org/en/research-and-analysis/issue-briefs/2017/03/how-income-volatility-interacts-with-american-families-financial-security.

- SAM.gov, “NextGen Business Process Operations.”

- Ibid.

- M. Brown, “Keeping the Promise: New Tools for a Better-Than-Ever Aid Experience,” Homeroom (blog), U.S. Department of Education, Feb. 24, 2020, https://blog.ed.gov/2020/02/keeping-promise-new-tools-better-ever-aid-experience/; Office of Federal Student Aid, “Try Loan Simulator,” accessed Oct. 26, 2020, https://studentaid.gov/loan-simulator/.

- S. Sattelmeyer, R. Williams, and S. Orenstein, “Five Actions Federal Policymakers Can Take to Help Student Loan Borrowers Manage the Pandemic’s Impact,” The Pew Charitable Trusts, accessed Oct. 26, 2020, https://www.pewtrusts.org/en/research-and-analysis/articles/2020/05/11/five-actions-federal-policymakers-can-take-to-help-student-loan-borrowers.

- SAM.gov, “Pre-Solicitation Conference for the Interim Servicing Solution,” accessed Oct. 26, 2020, https://beta.sam.gov/opp/a70ce787cb0e451991185d8bdb75470b/view?index=opp¬ice_type=&page=1&is_active=true&organization_id=100001616,100525303; SAM.gov, “Interim Servicing Solution,” accessed Nov. 11, 2020, https://beta.sam.gov/opp/9a3c5525a1ff4a92a667de6f4a5bced2/view.

- Office of Federal Student Aid, “Draft Fiscal Year 2020 through 2024 Strategic Plan,” accessed Oct. 26, 2020, https://studentaid.gov/sites/default/files/fy2024-strategic-plan-draft.pdf.

- The Pew Charitable Trusts, “Student Loan System Presents Repayment Challenges.”

- Such outreach efforts may be bolstered by eliciting the “fresh start effect,” a phenomenon identified by researchers wherein individuals are motivated to change their behavior in response to notable changes in their environments. H. Dai, K. Milkman, and J. Riis, “The Fresh Start Effect: Temporal Landmarks Motivate Aspirational Behavior,” Management Science 60, no. 10 (2014): 2563-82, https://www.jstor.org/stable/24550930?casa_token=OlkbZ9MfXRUAAAAA:-hh2AUAva13HT287qnkZUJSnlXKaNKEq7ed1ALgXWdmZd0v4vNQuKtScQzUD8QNS1fbHPrR5PCWz0-m_w_IwCUS3kGd_Kedp7NABvrXt8H0E1g3VAjr5Vg.

- Abraham et al., “Framing Effects.”

- Office of Evaluation Sciences, “Increasing IDR Applications.”

- Ibid.

- Office of Evaluation Sciences, “Increasing IDR Re-Certification”; S. Gächter et al., “Are Experimental Economists Prone to Framing Effects? A Natural Field Experiment,” Journal of Economic Behavior & Organization 70, no. 3 (2009): 443-46, https://www.ssoar.info/ssoar/bitstream/handle/document/28311/ssoar-jebo-2009-3-gachter_et_al-are_experimental_economists_prone_to.pdf?sequence=1; N.C. Barberis, “Thirty Years of Prospect Theory in Economics: A Review and Assessment,” Journal of Economic Perspectives 27, no. 1 (2013): 173-96, https://www.aeaweb.org/articles?id=10.1257/jep.27.1.173; The Decision Lab, “Why Do We Prefer to Ignore Negative Information? The Ostrich Effect Explained,” accessed Oct. 26, 2020, https://thedecisionlab.com/biases/ostrich-effect/; C. Headlam, E. Marano, and J. Yu, “Using Behavioral Science to Identify Barriers to Credit Intensity and Satisfactory Academic Progress” (Center for Applied Behavioral Science at MDRC, 2019), https://www.mdrc.org/sites/default/files/FinishLine_2019_Report-Final_0.pdf; The Pew Charitable Trusts, “Borrowers Discuss the Challenges of Student Loan Repayment.” Policymakers should be wary of the “ostrich effect,” in which negative framing may make people less likely to respond.

- U.S. Department of Education, “U.S. Department of Education’s Office of Federal Student Aid Announces New Contracts.”

- The Pew Charitable Trusts, “Student Loan System Presents Repayment Challenges.”

- Office of Federal Student Aid, “If Your Federal Student Loan Payments Are High Compared to Your Income, You May Want to Repay Your Loans Under an Income-Driven Repayment Plan,” accessed Oct. 26, 2020, https://studentaid.gov/manage-loans/repayment/plans/income-driven.

- U.S. Government Accountability Office, “Federal Student Loans: Education Needs to Verify Borrowers’ Information for Income-Driven Repayment Plans” (2019), https://www.gao.gov/products/GAO-19-347; U.S. Government Accountability Office, “Federal Student Loans: Supplemental Data on Income and Family Size Information for Income-Driven Repayment Plans” (2020), https://www.gao.gov/products/GAO-20-591R.

- D. Cheng and J. Thompson, “Make It Simple, Keep It Fair: A Proposal to Streamline and Improve Income-Driven Repayment of Federal Student Loans” (The Institute for College Access and Success, 2017), https://ticas.org/affordability-2/make-it-simple-keep-it-fair/; J. Delisle, “How to Make Student Debt Affordable and Equitable” (American Enterprise Institute, 2019), https://www.aei.org/researchproducts/report/how-to-make-student-debt-affordable-and-equitable/.

- U.S. Government Accountability Office, “Evidence-Based Policymaking: Selected Agencies Coordinate Activities, but Could Enhance Collaboration” (2019), https://www.gao.gov/assets/710/702997.pdf.

- Office of Federal Student Aid, “Meet Aidan,” accessed Oct. 26, 2020, https://studentaid.gov/h/aidan.

- D.C. Byndloss, “Sometimes It Takes More Than a Nudge,” MDRC, accessed Oct. 26, 2020, https://www.mdrc.org/publication/sometimes-it-takes-more-nudge.