The School District of Philadelphia’s Pension Costs

High annual payments will affect the district’s budget for years to come

Editor's note: On November 15, this brief was updated to correct Figure 3, which had incorrectly show the assets, liabilities, and pension debt of the Public School Employees’ Retirement System (PSERS) as being in the millions. The graphic has been updated to show that those amounts are in the billions.

Overview

The School District of Philadelphia is contributing historically high sums to the state-run pension system for its employees, and these hefty payments will affect budgets for the district and the city government for years to come.

Unlike Philadelphia’s municipal government, the School District of Philadelphia does not control the pension system for its employees. Rather, the pensions for approximately 18,300 people—including teachers and nearly everyone else employed by the district—are managed by the Pennsylvania Public School Employees’ Retirement System (PSERS), with decisions on funding and employee benefits made exclusively at the state level.

But as is the case with the city of Philadelphia and its municipal government pension system, the district is now paying more than it ever has into the retirement system, making up for years of low funding levels, investment returns that failed to meet expectations, and unfunded benefit increases. These factors have forced the School District of Philadelphia and other districts statewide to play catch-up in funding their obligations. In 2018, the Philadelphia school district’s net contribution to the system—after partial state reimbursement— was $154 million, up from $28 million eight years earlier. And this cost is expected to continue to rise, although not as dramatically, throughout the coming decade.

The higher contributions from Philadelphia and other districts, as well as the state reimbursements, have put PSERS on a path toward improved funding, but the district now faces some tough budget decisions as a result, a situation likely to persist in the years ahead. With the district now under local control after years of state stewardship, and with the city of Philadelphia making increased contributions to the school district’s finances, these costs will affect municipal finances as well.

The impact on Philadelphia

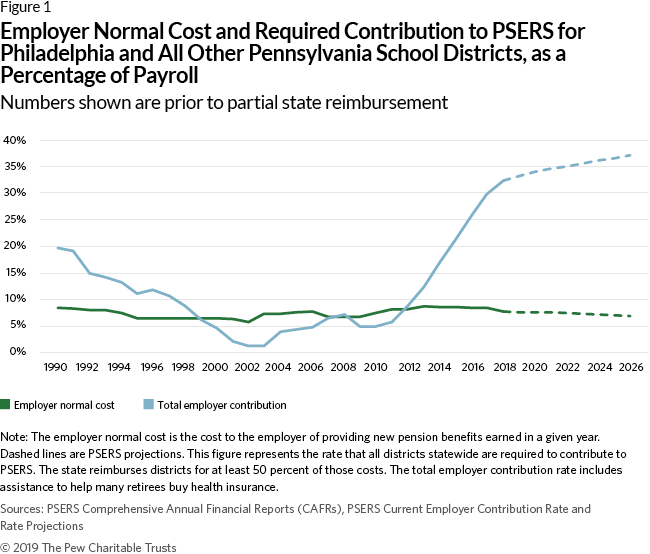

For school districts in Pennsylvania, the rate at which employees earn new pension benefits in a given year—known as the employer normal cost—has remained relatively steady for decades, although it is projected to continue its recent gradual fall. But the School District of Philadelphia’s required payments to PSERS have exploded since 2011. The district’s obligation to the pension system—as a percentage of payroll—rose from 5 percent in 2010 to 33 percent in 2018, the last year for which data were available. (See Figure 1.)

The state assists all local districts in making these payments through a legislatively mandated reimbursement, which now amounts to at least 50 percent of each district’s initial contribution. In Philadelphia’s case, the reimbursement was approximately 54 percent in 2018. As a result, the district’s net pension outlay amounted to 15 percent of its payroll that year (compared with 33 percent before the reimbursement), which was up sharply from a net of 2 percent in 2010.

The district’s pre-reimbursement contribution is projected to climb to more than 37 percent of payroll by 2026. The payments include assistance to help many retirees buy health insurance, which constitutes a small percentage of the total employer contribution (2.5 percent in 2018).

By comparison, the city of Philadelphia, which operates its own independent municipal retirement system for city employees, contributed roughly 38 percent of payroll, with no state reimbursement, toward its pension obligations in 2018, although that percentage is expected to begin declining in the next several years.1

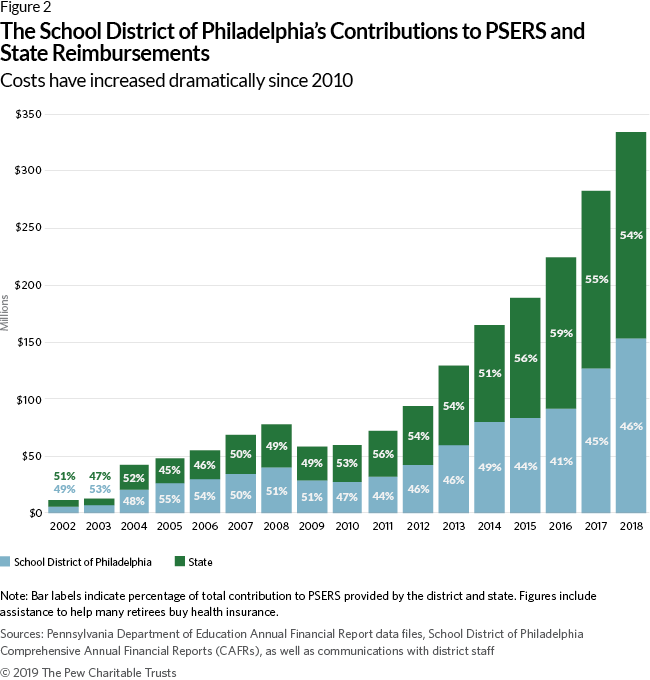

In dollar terms, the district paid more than $154 million ($334 million before the state reimbursement) into PSERS in 2018; the amount has increased every year since 2010, when it was $28 million ($60 million before the reimbursement). (See Figure 2.) In 2018, that represented roughly 5 percent of the district’s total expenditures (10 percent before the state reimbursement) of approximately $3.4 billion, of which about $2.5 billion was spent directly on district-operated schools.

As a result of the increase in pension costs, the district has had to make adjustments in spending in other parts of its budget. According to Uri Monson, the district’s chief financial officer, “Pension costs affect every investment we make, and the vast majority of the investments you want to make are in people.” Every decision to hire new staff, he said, “is that much more expensive.”

How PSERS Has Reformed Its Benefits Structure

Like the city of Philadelphia’s pension system and many others throughout the country, PSERS has changed its benefits structure for new employees in Pennsylvania with a view toward lowering costs and reducing risk.

All PSERS-covered employees hired before July 1, 2019, were in defined benefit pension plans. From that date forward, as a result of Act 5 of 2017, new employees have a choice of three different retirement benefits “member classes,” none of which is a full, traditional defined benefit plan.

Two of the three plans are hybrids in which employees contribute a fixed percentage of their salary to a defined benefit plan and a smaller percentage to a tax-deferred defined contribution savings account. In one of the plans, for example, an employee who had a starting salary of $25,000 that increased annually by 3 percent and who worked for 35 years would, upon retiring, receive a defined benefit of $28,190 per year, and would also have a retirement account of $215,190 from the defined contribution account.

The third plan is a pure defined contribution option. It requires employees to make a 7.5 percent contribution to a tax-deferred account, with a 2 percent employer match. At retirement, the same employee would receive a retirement account of $408,861, with no annual pension.

Why payments to the state system rose over the years

The increase in payments to PSERS by Philadelphia and other districts has been driven almost entirely by the need to pay off the system’s accumulated pension debt—the gap between the future costs of retiree benefits already promised to plan participants and pension fund assets. (See Figure 3.) Those benefits increased substantially in 2001 and 2002, including a 25 percent retroactive increase, as a result of the state Legislature’s passage of Act 9 in 2001.2 An analysis of the legislation’s long-term cost showed that about half of the School District of Philadelphia’s $154 million payment in 2018 was attributable to the benefit increases.3

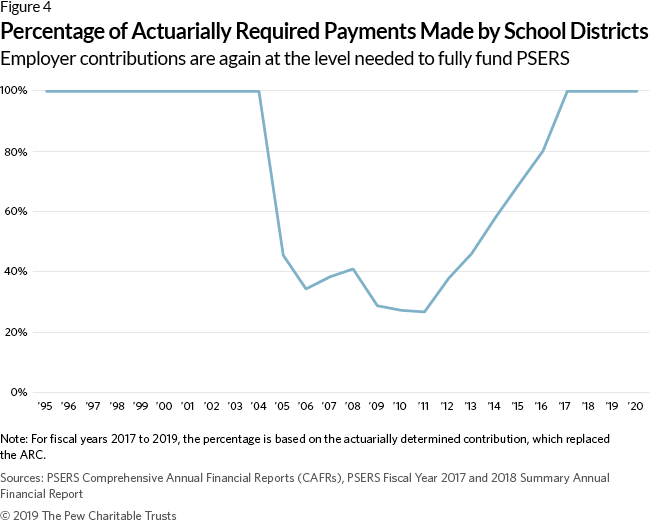

PSERS was last fully funded in 2002. Since then, the system’s pension debt has grown steadily, in large part because the amount of state-mandated school district payments into PSERS remained low for most of the next 10 years, often below the employer normal cost, even as liabilities were growing.4 The payments were far lower than the amount required to cover the normal cost while also paying down the pension debt; those two elements combined are known as the actuarially required contribution, or ARC.

The disparity between the ARC and the amount actually paid into the system by school districts first developed in 2005 and continued to grow until peaking in 2011, at which point districts throughout the state were paying only 27 percent of the ARC to PSERS. (See Figure 4.) In fact, from 2005 to 2013, Pennsylvania school districts ranked 49th among states in paying their ARC.5 Volatile investment returns, including a loss of 27 percent in the PSERS investment portfolio in the recession year of 2009, also took a toll on assets.

In response to PSERS’ dramatically increasing debt, the state mandated higher pension payments from school districts in Act 120 of 2010, a process that culminated with districts again making the full actuarially required payment beginning in 2017.

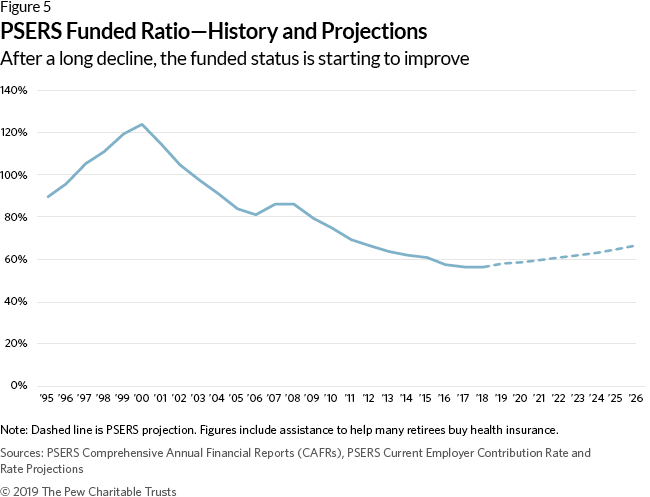

Aided by those substantially increased payments and strong recent investment returns, PSERS’ funded ratio—its assets divided by its liabilities—finally began to grow, reaching roughly 57 percent in 2018, after a largely uninterrupted decline lasting nearly two decades. (See Figure 5.) By comparison, Philadelphia’s Municipal Retirement System had a funded ratio of about 47 percent at the same time.

The increased payments to PSERS, which have been crucial to restoring the system’s financial position, have now begun to climb more slowly as districts are paying into the system at a rate that PSERS anticipates will nearly eliminate the pension debt by 2042, a trajectory that lags slightly behind the one projected for the city’s pension fund.6

For the PSERS projections to prove accurate, actuarial assumptions, including expected investment returns, must be met; even relatively small fluctuations in investment returns may cause the employer contribution rate and plan funded ratio to depart substantially from projections.7

How the School District of Philadelphia’s situation compares with those of other urban districts

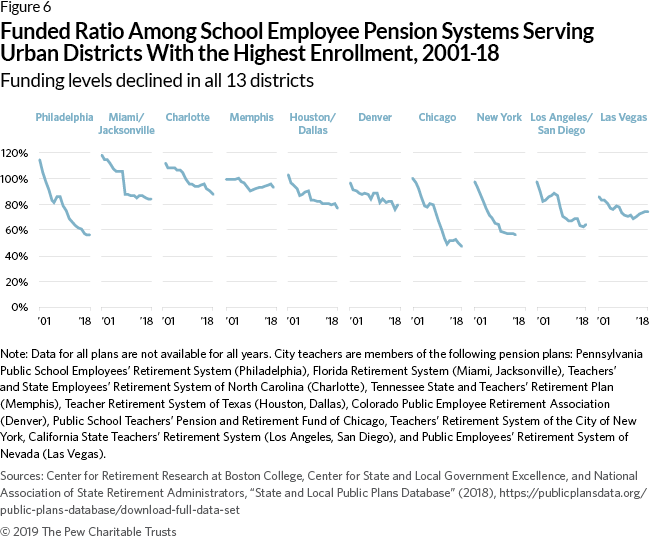

The fall in PSERS’ funded ratio is in keeping with many other school pension funds nationwide. Despite the recent uptick in funding, the longer-term drop between 2001 and 2018, from 114 to 57 percent, has been particularly steep relative to the nine other pension systems covering employees in the nation’s largest urban school districts. (See Figure 6.) For most of these urban districts, as in Philadelphia, plans are managed at the state level—the exceptions being Chicago, Denver, and New York, where the pension funds are managed by the school districts.

Conclusion

PSERS, and by extension the School District of Philadelphia, is on a trajectory toward substantially reducing its pension debt. But years of deferred investments and benefit increases have taken their toll in the form of massive pension debt and the high payments required to get back to full funding. Those costs, while not crippling, have put the district, now back under local control, in a position where it must be especially prudent in managing its expenses and its exposure to fluctuations in its revenue sources.

Endnotes

- The Pew Charitable Trusts, “A Stress Test of Philadelphia’s Retirement System” (2019), https://www.pewtrusts.org/-/media/assets/2019/04/philly-pension-stress-test.pdf.

- G. Mennis (director, public sector retirement systems program, The Pew Charitable Trusts), testimony before the Pennsylvania State Senate Finance Committee (April 15, 2015), https://pasenategop.com/wp-content/uploads/2016/12/PA-Senate-Fin-Cmte-Testimony-4-15-15.pdf.

- An analysis of Act 9 by an independent actuarial firm, The Terry Group, in 2017 found that benefit increases led to nearly $17 billion in additional benefit payments paid out by PSERS, $3.8 billion in additional employee contributions received, and nearly $20 billion more in accrued liabilities. The net impact as of 2017 was $32.6 billion, with an additional $2.4 billion in the cost of new benefits expected in future years. The total cost to PSERS of the Act 9 prospective and retrospective benefit enhancements adds up to about two-thirds of the 2017 unfunded liability.

- Mennis, testimony. For an analysis of the causes of the growth in PSERS pension debt, see University of Chicago, Harris School of Public Policy, “From High to Low: Understanding How the Pennsylvania Public School Employees’ Retirement System Became Underfunded” (2017), https://harris.uchicago.edu/files/pateachers.pdf.

- Mennis, testimony.

- M.J. Knittel, Pennsylvania Independent Fiscal Office Actuarial Note for Senate Bill 1, Printer’s Number 902, (2017), http://www.psers.pa.gov/About/PFR/Documents/ACN_SB1_PN_902_2017_06_04.pdf; The Pew Charitable Trusts, “A Stress Test of Philadelphia’s Retirement System.” PSERS staff communicated to Pew that it is projected to take another 10 years (until 2052) to pay off small residual debt caused by more recent investment returns not meeting the assumed rate.

- Y. Yin and D.J. Boyd, “Investment Return Volatility and the Pennsylvania Public School Employees’ Retirement System” (Rockefeller Institute of Government, SUNY, 2017), https://rockinst.org/wp-content/uploads/2018/02/PSER-Report-2017-09-01-1.pdf; D. Draine (senior officer, research and state policy, public sector retirement systems program, The Pew Charitable Trusts), testimony before the Public Pension Management and Asset Investment Review Commission (Nov. 19, 2018), http://jsg.legis.state.pa.us/resources/documents/ftp/act5/pdf/Appendix-I-Submissions-and-Exhibits.pdf.

America’s Overdose Crisis

Sign up for our five-email course explaining the overdose crisis in America, the state of treatment access, and ways to improve care

Sign up

Philadelphia’s Road to Pension Recovery

A Stress Test of Philadelphia’s Retirement System