For States and Localities, Borrowing and Issuing Pension Obligation Bonds Increased as a Response to COVID-19

Monitoring and controls can help officials manage indebtedness as the economy begins to recover

It’s rare for state and local governments to fund day-to-day expenses with debt. But the usual budget-balancing practices—spending cuts, layoffs, tax and fee increases, and drawing on rainy day reserves—were, in some cases, insufficient to ease the sudden fiscal pressure that came with COVID-19 lockdowns.

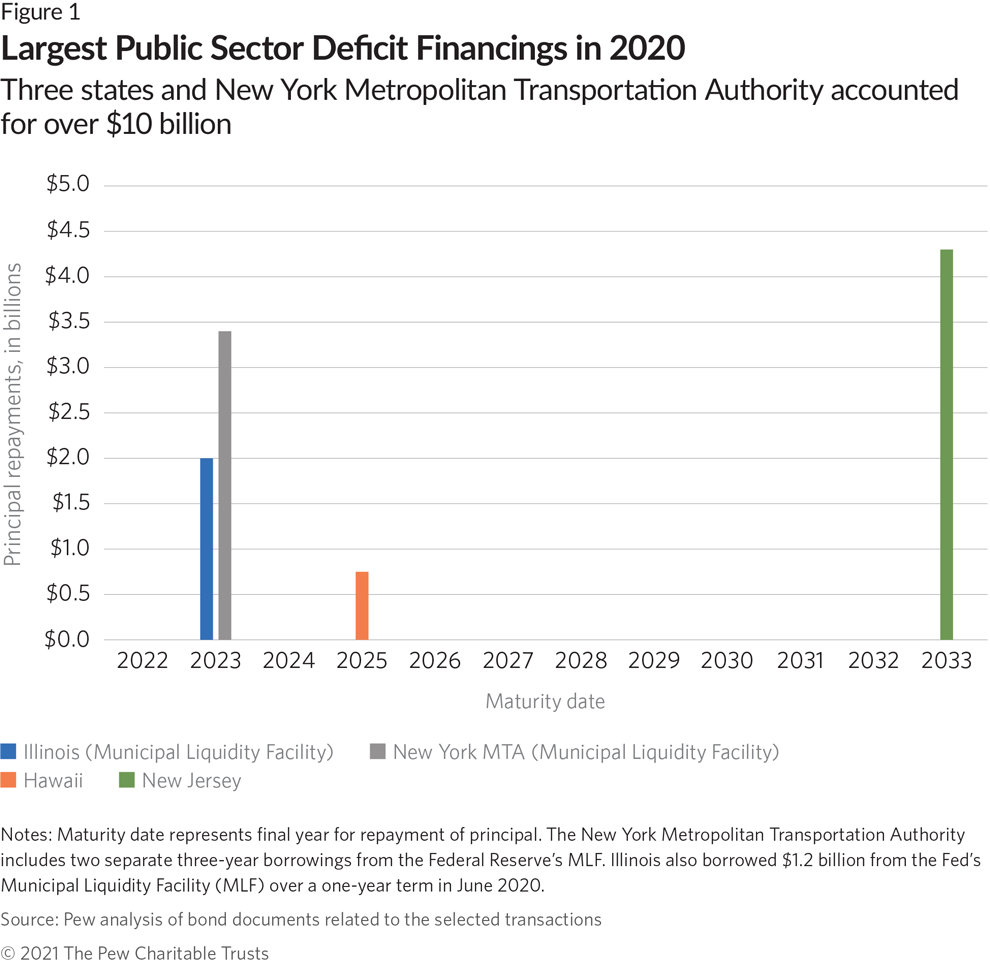

In 2020, states and localities issued more than $10 billion in deficit bonds to cover pandemic-related budget shortfalls, over terms ranging from three to 12 years. Hawaii, among the states hardest hit by the pandemic because of a decline in tourism, borrowed $748 million, and the Metropolitan Transportation Authority (MTA) in New York, which suffered steep declines in ridership, borrowed $3.4 billion from the Federal Reserve’s Municipal Liquidity Facility (MLF).

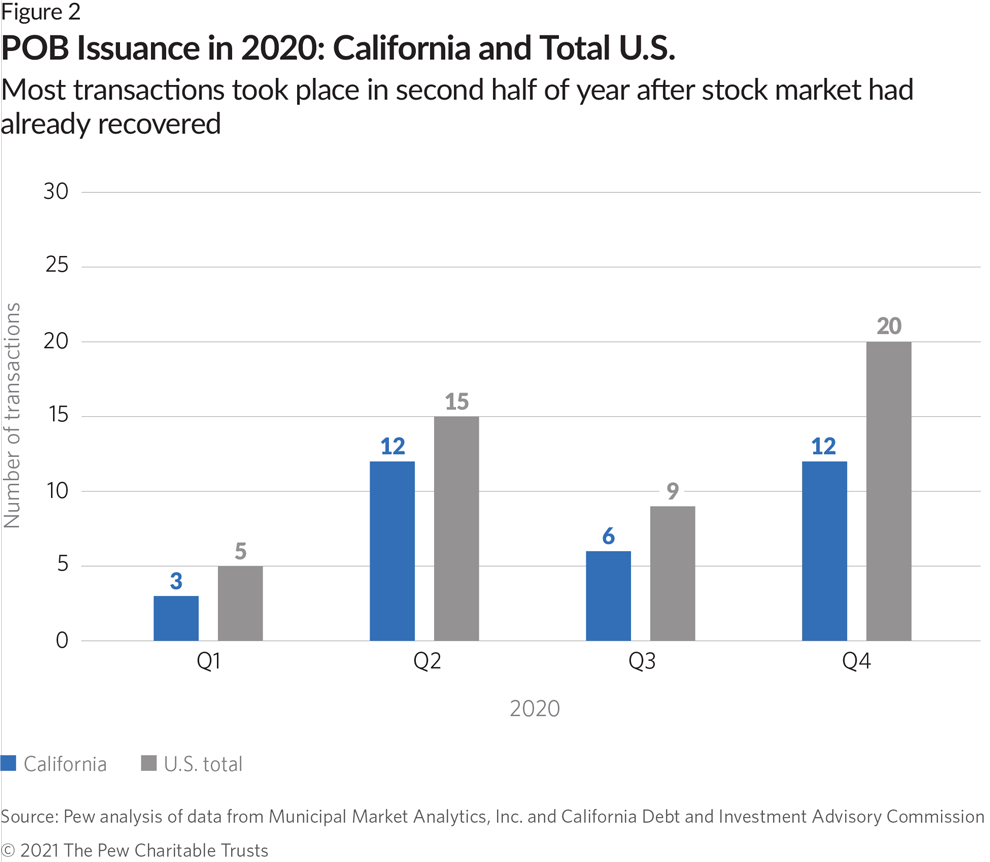

Governments also issued another $6 billion in pension obligation bonds (POBs), the largest volume in over a decade, with the majority of issues sold by cities, towns, and counties in California.

Issuing debt to close budget gaps and pay down unfunded pension liabilities can alleviate short-term budget pressures but also presents long-term risks. For example, borrowing can lead to structural deficits that require larger or continuous spending cuts down the road if future revenues fall short of projections. Separately, POBs increase the exposure of budgets and pension balance sheets to financial market volatility, specifically the risk that returns will be less than the borrowing costs. However, identifying these risks in advance and ensuring that the purpose of the borrowed funds is clear and supported by effective monitoring and controls can help manage them.

Although proceeds from deficit bond sales may be earmarked for specific short-term spending needs, the broader goal can be thought of as “revenue smoothing,” or using financing to re-allocate revenue from future years, when the economy has recovered, in order to maintain core services at the height of a downturn when resources are needed most.

Hawaii’s $748 million bond issuance in October offers the best example. At the time, the state projected that revenues would decline 11% in fiscal year 2021 on top of 6% losses the previous year. So, the state decided to borrow to bolster the rest of the year’s spending, agreeing to pay back the money in nearly equal installments over the next five years.

The borrowed funds were expected to blunt much of the fiscal pressure the state has faced in fiscal 2021, which was projected to be the worst year of the pandemic for revenues. Meanwhile, repaying the money will require only about $150 million from the budget each year from fiscal 2022 through fiscal 2026—by which time revenues will be growing at a healthy pace again, according to the state’s regular five-year forecast.

Monitoring and controls, including regular updates to near- and long-term revenue forecasts, can help ensure the revenue-smoothing goal is achieved. In the current fiscal environment, monitoring the use of budget debt would include accounting for revenue recovering faster than expected. That may require limiting the use of borrowed funds to avoid overspending, which could lead to structural budget deficits later on.

While monitoring through regular forecasting can help achieve revenue smoothing, implementing effective controls can also help guide the use of borrowed funds and the timing of their repayment. These controls can include a reserve fund with predefined rules for setting aside what’s needed to service the debt on the bonds—or call provisions in the bond agreement itself that allow for early redemption and accelerated repayment if revenues recover faster than expected.

New Jersey’s deficit financing is illustrative. In contrast to Hawaii’s five-year borrowing supported by a revenue forecast process tracking the same time period, New Jersey issued noncallable 12-year financing—meaning there’s no opportunity for early repayment—informed by revenue projections that span only two years. In the meantime, the economy and revenues have improved. That’s the good news. But because early repayment is not an option, there is also a greater risk that the borrowed funds will lead to longer-term structural deficits.

Although the risks for POBs—that investment returns will be lower than the borrowing rate over the life of the bonds—are different, the same analysis can be applied. Economic forecasts and revenue projections can be expanded to include various return scenarios and market shocks, allowing policymakers to more effectively monitor and develop contingency plans. And similar to deficit borrowing, monitoring and controls for POBs can be tailored to individual characteristics of the financing.

When POB proceeds are invested is particularly important. For example, the risk of incurring long-term losses is greatest when stock market valuations are near their peak. For POBs issued in 2020, a majority of which were offered in the second half of the year, this is especially relevant because equity valuations have risen substantially since the market’s sharp decline in March 2020.

Although improving revenue collections and additional stimulus have helped stabilize state and local finance, the outlook remains uncertain, and borrowing used to close budget gaps won’t be paid off for years. Effective monitoring and controls, including regular updates to revenue projections and tracking gains and losses on pension obligation bonds, can help policymakers navigate economic uncertainty and help to mitigate structural budget risks.

Greg Mennis is a director and Stephanie Connolly and Mollie Mills are senior associates with Pew’s public sector retirement systems project.