How Will the COVID-19 Pandemic Affect Philadelphia's Underfunded Retirement System?

Pew stress test may hold clues

The COVID-19 pandemic will have a vast and far-reaching impact on cities’ budgets, in terms of both reduced revenues from a widely shuttered economy and increased expenditures for essential services. And in Philadelphia, those expenses include financing the underfunded retirement plan for city workers.

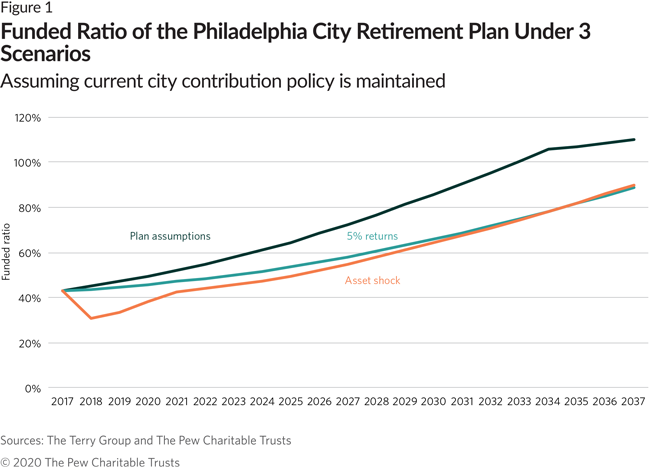

In late 2018, The Pew Charitable Trusts conducted a stress test analysis of the plan to help policymakers evaluate how it would fare under various economic conditions. Among the tested scenarios, as we reported in April 2019, was an asset price shock simulating a recession, with market returns initially declining by approximately 26 percent in year one, followed by a three-year recovery and then low, 5 percent equity returns over the long term—lower than the city’s current assumption of a 7.55 percent return.

How accurately that scenario simulates the current situation and near-term economic future, of course, remains to be seen. But the stress test showed that, even in an asset shock scenario, the city would still be able to sustainably pay down the plan’s accumulated pension debt over time. Under our simulation, the plan, which was 47 percent funded as of July 1, 2018, would be about 80 percent funded by 2035.

As Figure 1 shows, the pension plan’s funded ratio would fall in the first year or two, then recover relatively quickly, with the figure rising steadily thereafter. Over time, the results were similar to those of a scenario that assumes a steady 5 percent return on the plan’s investments.

These projections assume that city officials maintain their existing funding formula, which has been changed in recent years to increase payment levels. The formula pays the full actuarial determined contribution and also sets aside a portion of sales tax revenue and employee contributions as pension plan payments above and beyond the actuarial contribution. In the past few years, contributions from the city and its employees have been roughly equal to the payments going out. The recent adoption of a so-called stacked hybrid plan for new, nonuniformed employees also plays a role, reducing the plan’s exposure to investment risk.

Under the asset shock scenario, employer contributions to the retirement plan, expressed as a percentage of overall revenue, initially would rise as part of the downturn, then fall gradually in subsequent years. (See Figure 2.) In the current situation, however, near-term pressure on revenues is likely to be higher than in past downturns.

In the current environment, keeping to the existing formula will be a real challenge for officials, who may want to divert some of the money to more immediate needs. The proposed city budget, drafted prior to the COVID-19 pandemic, called for taxpayers to contribute $760 million to the plan, nearly 15 percent of the general fund budget. If that contribution and future contributions were to be reduced, the plan’s path toward fiscal well-being would become a longer one.

The city’s pension reforms, in terms of both contributions and benefits, have set the retirement plan on a path to sustainably deliver on pension promises as long as policymakers remain committed to their current contribution policy now and in the years to come. But maintaining those policies will have real costs for taxpayers and city services—and pose tough choices for officials at a challenging time.

Larry Eichel is project director of The Pew Charitable Trusts’ Philadelphia research and policy initiative.

America’s Overdose Crisis

Sign up for our five-email course explaining the overdose crisis in America, the state of treatment access, and ways to improve care

Sign up

A Stress Test of Philadelphia’s Retirement System