The Trillion Dollar Gap: Washington

Underfunded State Retirement Systems and the Roads to Reform

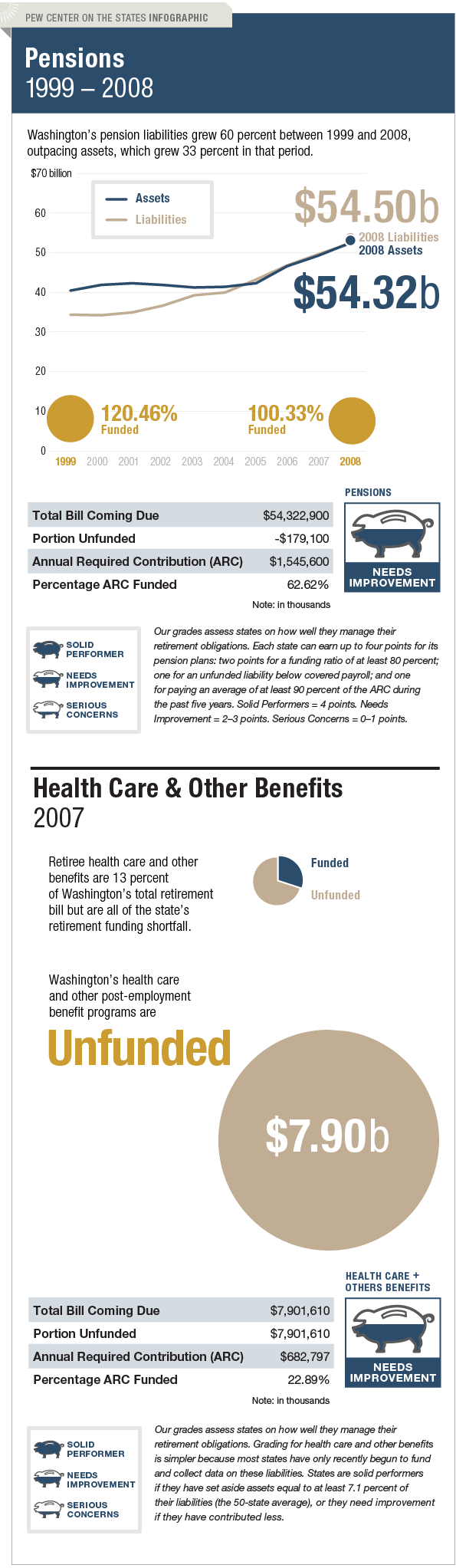

Washington needs to improve how it manages its long-term liabilities for both pensions and retiree health care and other benefits. The state has failed to meet its actuarially required contributions since 2001. And while the level still exceeds the 80 percent benchmark that the U.S. Government Accountability Office says is preferred by experts, the percentage of its liabilities that is funded has declined from a high of 126 percent since the beginning of this decade to 100 percent in 2008.

Washington conducts its actuarial valuations on December 31, so the state's most recent data reflect more of the pension fund investment losses of the 2008 calendar year than states with valuations on June 30. In 2006, Washington created a pension funding stabilization account with an initial appropriation of $350 million. That same year, the state increased employer contribution rates for various retirement plans.

Meanwhile, as of 2007, Washington had failed to set aside any assets to cover its $7.9 billion long-term liability for retiree health care and other benefits.