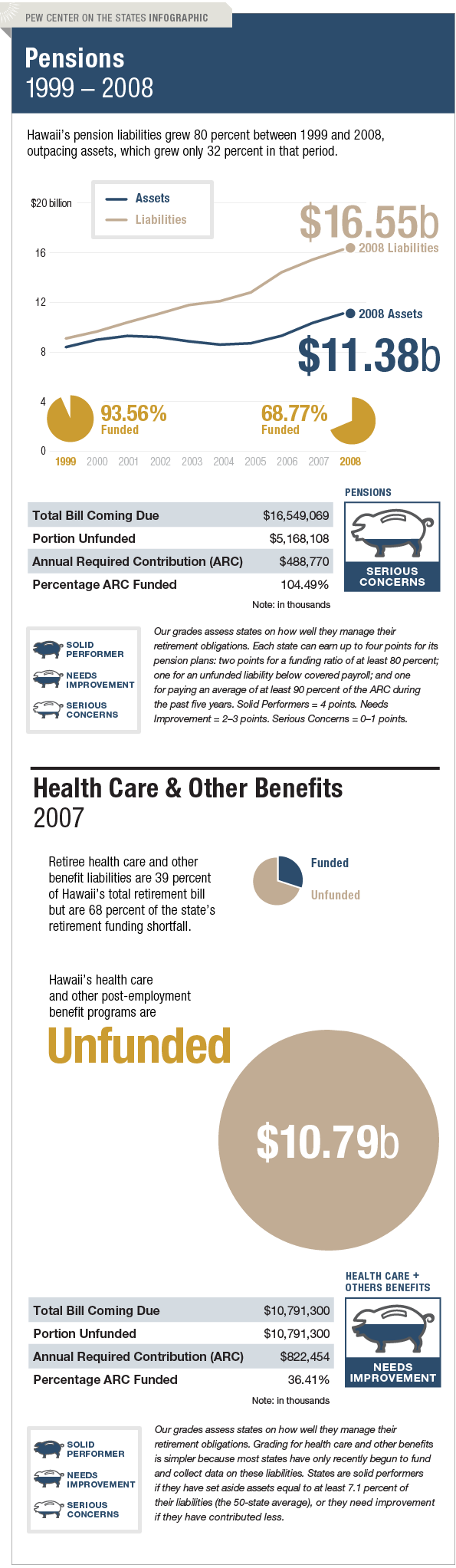

The Trillion Dollar Gap: Hawaii

Underfunded State Retirement Systems and the Roads to Reform

Hawaii's management of its long-term pension liability is cause for serious concern and needs to improve how it handles the bill coming due for retiree health care and other benefits. The Aloha State has funded only 69 percent of its total pension bill, well below the 80 percent benchmark that the U.S. Government Accountability Office says is preferred by experts. This drop in funding level emerged after the state reduced its annual contributions in 2000 and 2001 and often the dismal investment returns of 2001 and 2002.

In 2005, Hawaii created a defined benefit plan for new employees. The new plan's benefits are higher than the previous defined benefit plan, but employees now contribute to their retirement. The state also set up an irrevocable trust for its non-pension benefits.

As of fiscal year 2007, Hawaii—like 19 other states—had failed to sock away any assets to cover this long-term bill coming due. Relative to the size of its payroll and population, it has one of the greatest burdens—$10.8 billion—of any state in the country.