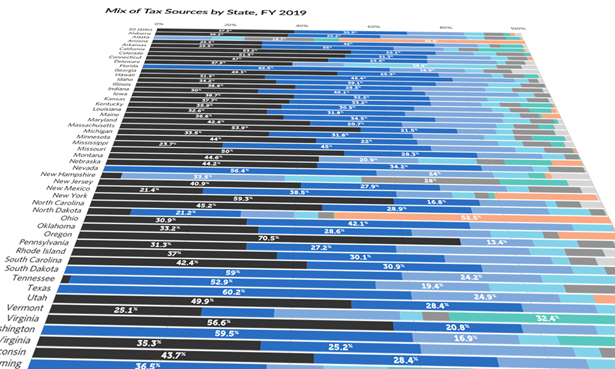

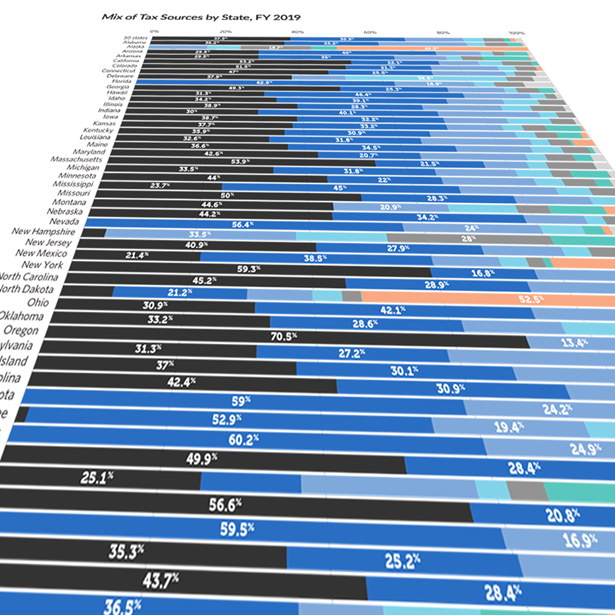

Where States Get Their Money

FY 2018

Note: this data has been updated.

Taxes and federal funds together account for 81% of revenue for the 50 states. Taxes are the largest revenue source in 44 states, while federal funds are greatest in six: Alaska, Louisiana, Mississippi, Montana, New Mexico, and Wyoming.

This infographic displays a breakdown of each state’s revenue by major categories.