How Much Should States Save to Weather Economic Ups and Downs?

Data-driven caps for rainy day funds help policymakers determine the right amount to set aside for reserves

As more states set aside reserves during good economic times for unanticipated needs, there is no single approach for how best to cap, or set the maximum allowable size, of a rainy day fund. Still, it is always critical that the process be data-driven. To accomplish this, policymakers can use budget stress tests to inform how much money they should have on hand to weather economic shocks and budget shortfalls.

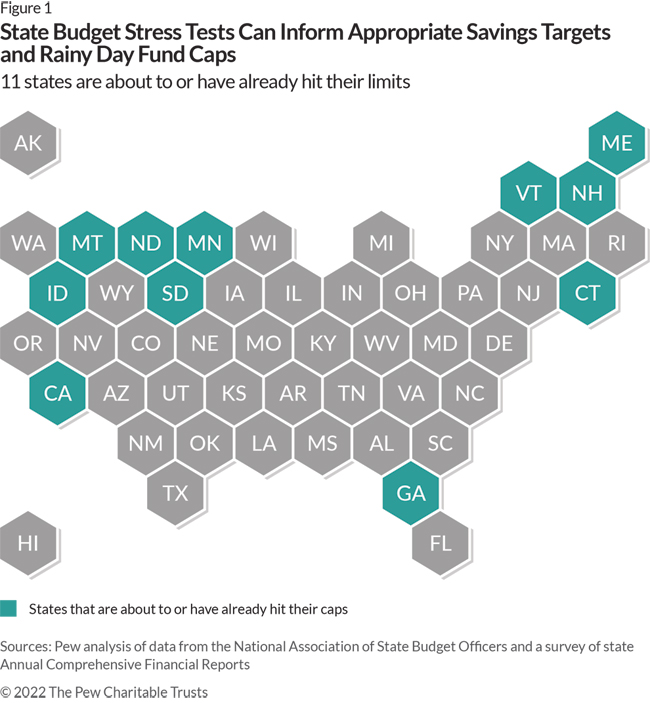

State tax revenue has surged over the past two years, allowing many states to amass record-high rainy day fund balances. That positive news, however, raises the question of how large these savings accounts should be allowed to grow. Thirty-two states have set caps on their rainy day funds. Based on Pew’s analysis, as of the end of fiscal year 2021, 11 of these were about to or had already hit their caps.

But states have not generally relied on data and analysis to determine how large their rainy day funds need to be to provide a financial backstop when economic downturns bring budget challenges. Stress tests can help. These analyses estimate how far revenue could fall and how much spending demands would increase during more difficult times or because of other fiscal shocks.

Most rainy day fund caps limit the size of the savings accounts based on a percentage of annual spending from state general funds: Caps between 5% and 15% of general fund spending are typical, with 10% most common. But simply setting a cap on reserves as a proportion of annual spending may not capture a state’s entire budget picture and policymakers should consider other factors as well, such as revenue volatility. Specifically, states with higher year-to-year variation in tax collections, such as those that rely heavily on severance tax revenue like Alaska and North Dakota, should have larger rainy day fund balances to help mitigate the larger drops in revenue they are likely to face during economic downturns.

Since the Great Recession, several states have taken that into consideration. Connecticut, Georgia, Michigan, Oklahoma, Virginia, and, most recently, New York, have all raised their caps to 15%. Many states, however, haven’t updated their caps since they were created decades ago, even as their revenue volatility has changed over time. And some states with the lowest caps, such as Delaware, Louisiana, Montana, and New Jersey, have above-average revenue volatility.

Louisiana, for example, has the lowest percentage-based cap at 4% of state revenue and a lower than average rainy day fund balance. It ranks in the bottom 10 for days a state could run on rainy day funds alone, an indicator used to compare states’ balances. Although higher-than-expected revenue collections in the state helped create a budget surplus, a situation that would usually allow a state to increase rainy day fund deposits, Louisiana’s rainy day fund cap limits lawmakers’ flexibility to prioritize savings.

States that set their caps too low risk having insufficient savings to close budget shortfalls during financial crises, but saving more than necessary also has downsides: Every dollar in state reserves is one less dollar to invest in other priorities. Budget stress tests offer a way to avoid saving too much or too little. Using these tests, policymakers can estimate the size of the budget shortfalls they would face under various economic downturn scenarios, such as moderate or severe recessions.

In doing this, state officials might decide they want sufficient rainy day fund balances to completely close a shortfall caused by a moderate recession, but in a severe recession they would rely on other budget-balancing strategies, such as spending cuts, tax increases, and accounting maneuvers.

Stress tests produced by Maine, for example, provide estimates of how long the state could be supported by its rainy day fund—statutorily capped at 18% of the prior year’s general fund revenues—if hypothetical recession scenarios were to occur. These analyses help convey that if the state’s rainy day fund was to be exhausted before a budget shortfall is eliminated, the governor and legislature would need to find alternative ways to balance the budget.

Budget stress tests can also help policymakers decide how much to save, which is how states such as Minnesota and New Mexico use these analyses. Further, states can use budget stress tests to reassess their rainy day fund caps—a logical next step for those using stress tests to set initial savings targets.

For example, a state could set the cap at the same level as the target and adjust both annually. Each year, North Carolina uses its stress test to determine the rainy day fund balance needed to weather at least nine out of 10 economic scenarios for two years. This target also serves as a cap: Once the target is reached, revenue that otherwise would go to the rainy day fund is sometimes automatically redirected elsewhere by statute. For example, some states divert that money to their employee pension funds or education funds.

Importantly, if state caps are set below the savings levels needed, policymakers should raise their caps. Conducting stress tests can help states identify the appropriate savings level. The use of these tests has expanded quickly over the past five years as states such as Utah and Minnesota have demonstrated their value.

Still, most states do not conduct stress tests. More should at a time when surpluses are providing states with opportunities to save and policymakers need a way to determine whether those savings are growing too large. By using stress tests to inform these decisions, states can ensure that their rainy day funds work for their needs, while making certain they can meet other budget priorities as well.

Jen Janson analyzes state policies with a focus on budget stress tests and tax revenue volatility for The Pew Charitable Trusts’ state fiscal policy project.