States Encounter Uneven Personal Income Growth as Aid Subsides

Note: This data has been updated. To see the most recent data and analysis, visit Fiscal 50.

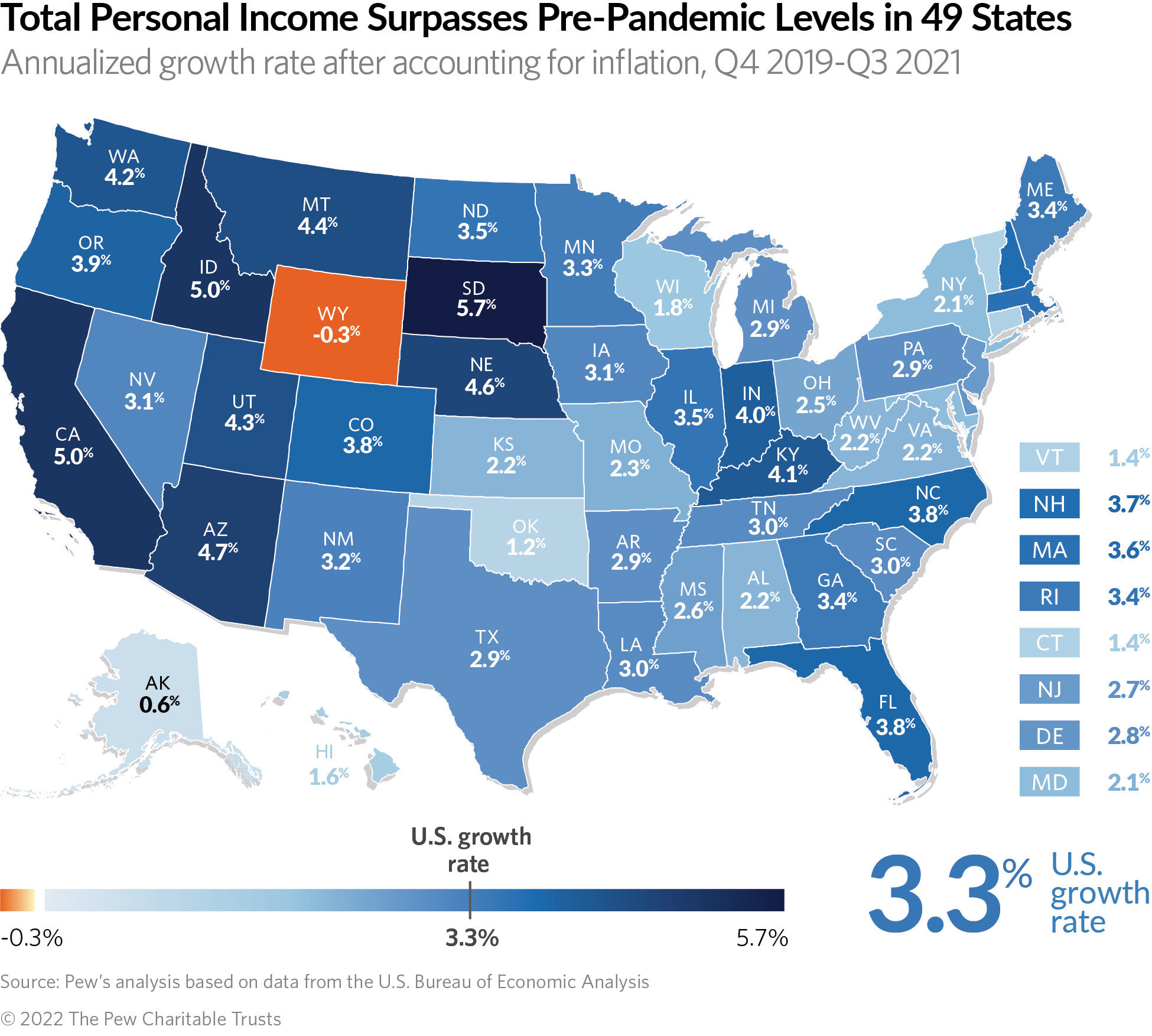

As federal aid to pandemic-stricken families and businesses has receded, income from workers’ wages and salaries is playing a larger role in sustaining states' personal income growth. Total personal income for the third quarter of 2021 continued to exceed pre-pandemic levels in nearly every state after accounting for inflation, with a group of Great Plains and Western states recording the strongest growth.

Nationally, the sum of personal income from all sources in the third quarter of 2021 was up an annualized inflation-adjusted rate of 3.3% from the last full quarter preceding the coronavirus pandemic. Growth rates varied widely, however, ranging from a slight reduction in Wyoming to the equivalent of 5.7% gain a year in South Dakota.

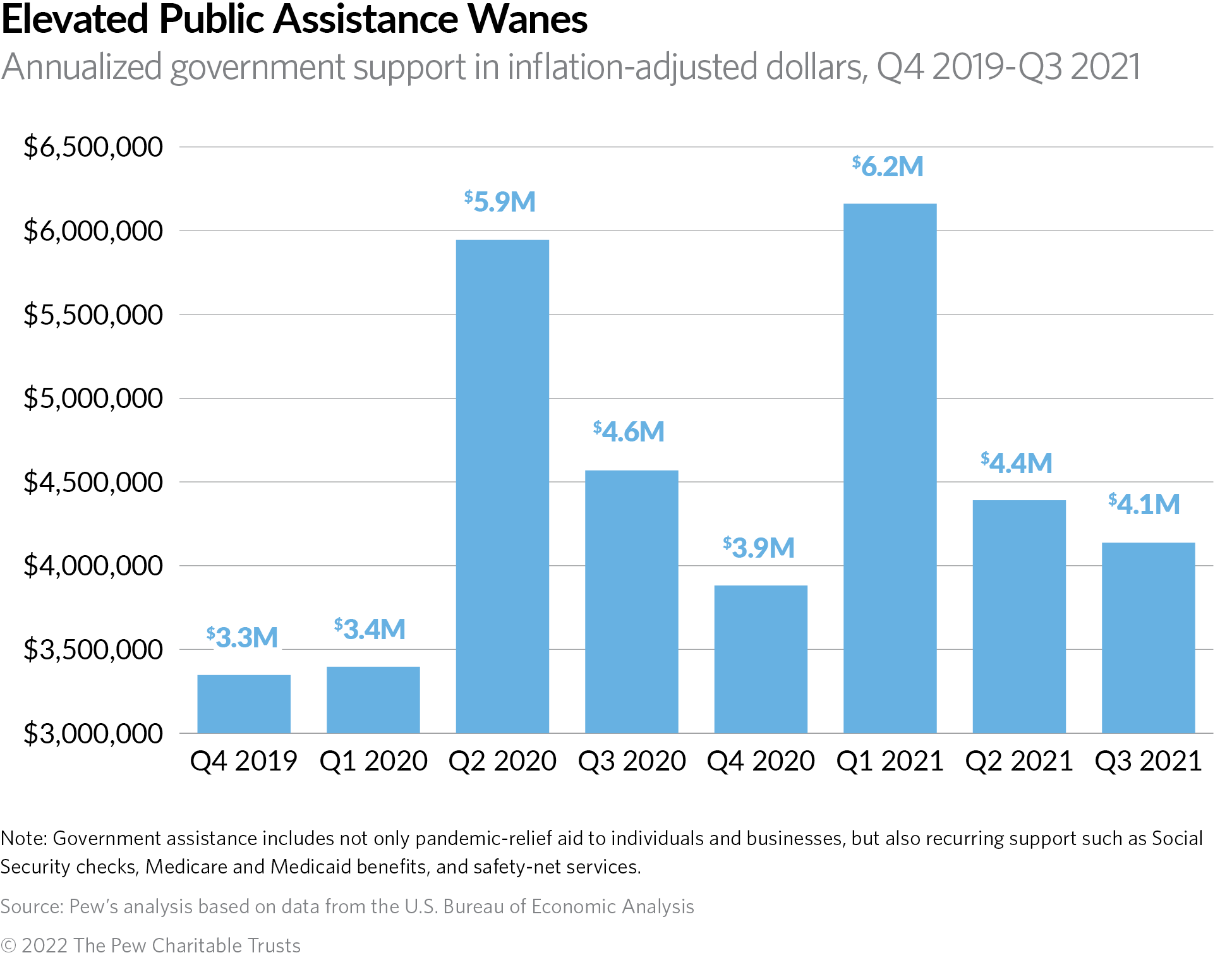

Throughout the pandemic, government assistance has largely driven states’ gains. But government support has started to wane along with pandemic-related aid such as unemployment insurance payments and relief checks. Total government assistance—which also includes Social Security, Medicare, and other safety-net programs—was still above pre-pandemic levels, though, with an annualized increase of 13.1% since the start of the pandemic.

At the same time, the largest portion of personal income—earnings from work—has gradually rebounded as businesses hire more workers. States with the biggest increases in total personal income since the pandemic began also have some of the strongest earnings growth. South Dakota has the top growth rate in both total personal income (5.7%) and earnings (7.9%), largely a result of a major uptick in farm-related income. Other states with the greatest earnings gains include Montana (5.4%), Idaho (5.3%), and Nebraska and North Dakota (both 5%). These annualized growth rates represent how much total personal income would have increased had it grown at a steady pace since the fourth quarter of 2019.

But not all states have experienced the same growth. Work-related earnings in four states remained below pre-pandemic totals after accounting for inflation. Alaska, New Mexico, and Wyoming suffered substantial reductions in earnings from oil production and other mining activities, while a weakened tourism industry drove Hawaii’s drop in earnings. These declines affect state budgets, too, as weak earnings effectively hinder tax revenue collections.

State personal income has fluctuated greatly over the course of the pandemic, reflecting the timing of multiple rounds of pandemic-related federal aid. Personal income shot up to abnormally high levels in early 2021, driven by another wave of federal relief payments and other government assistance distributed to individuals and businesses to mitigate the economic impacts of the coronavirus. Total personal income declined nationally in the second and third quarters of 2021.

State personal income sums up all the money that residents receive from work, certain investments, income from owning a business and property, and government assistance, including the extra federal aid provided in response to the pandemic, as well as benefits from employers or the government. Other measures should be used to approximate income growth for individuals, such as state personal income per capita or household income. Data presented here is not intended to provide an overall assessment of states’ economies, as other economic measures should be considered.

Growth since the start of the COVID-19 recession

A comparison of states’ annualized growth rates for total inflation-adjusted personal income between the fourth quarter of 2019—before the pandemic and recession—and the third quarter of 2021 shows:

- After South Dakota’s 5.7% annualized rate, the fastest growth in total personal income since the pandemic was in California and Idaho (both 5%), Arizona (4.7%), and Nebraska (4.6%).

- Six of the 10 states with the fastest growth rates were in the West. Most of these same states experienced some of the sharpest long-term population gains, a trait typically associated with a strong labor force and economic expansion.

- Alaska (0.6%) and Wyoming (-0.3%) recorded the weakest performance, due in part to losses in their energy sectors.

- In 11 states, total personal income would still be below pre-pandemic totals if not for elevated levels of government assistance, which includes payments from pandemic aid, Medicare, Medicaid, Social Security, and other programs. These states are Alaska, Connecticut, Hawaii, Louisiana, Nevada, New Mexico, New York, Oklahoma, Vermont, West Virginia, and Wyoming.

- Government assistance remained well above pre-pandemic levels in every state. California’s growth rate was the largest (18.3%), followed by Hawaii (18%) and Massachusetts and Nevada (both 17.9%).

Trends over the past year

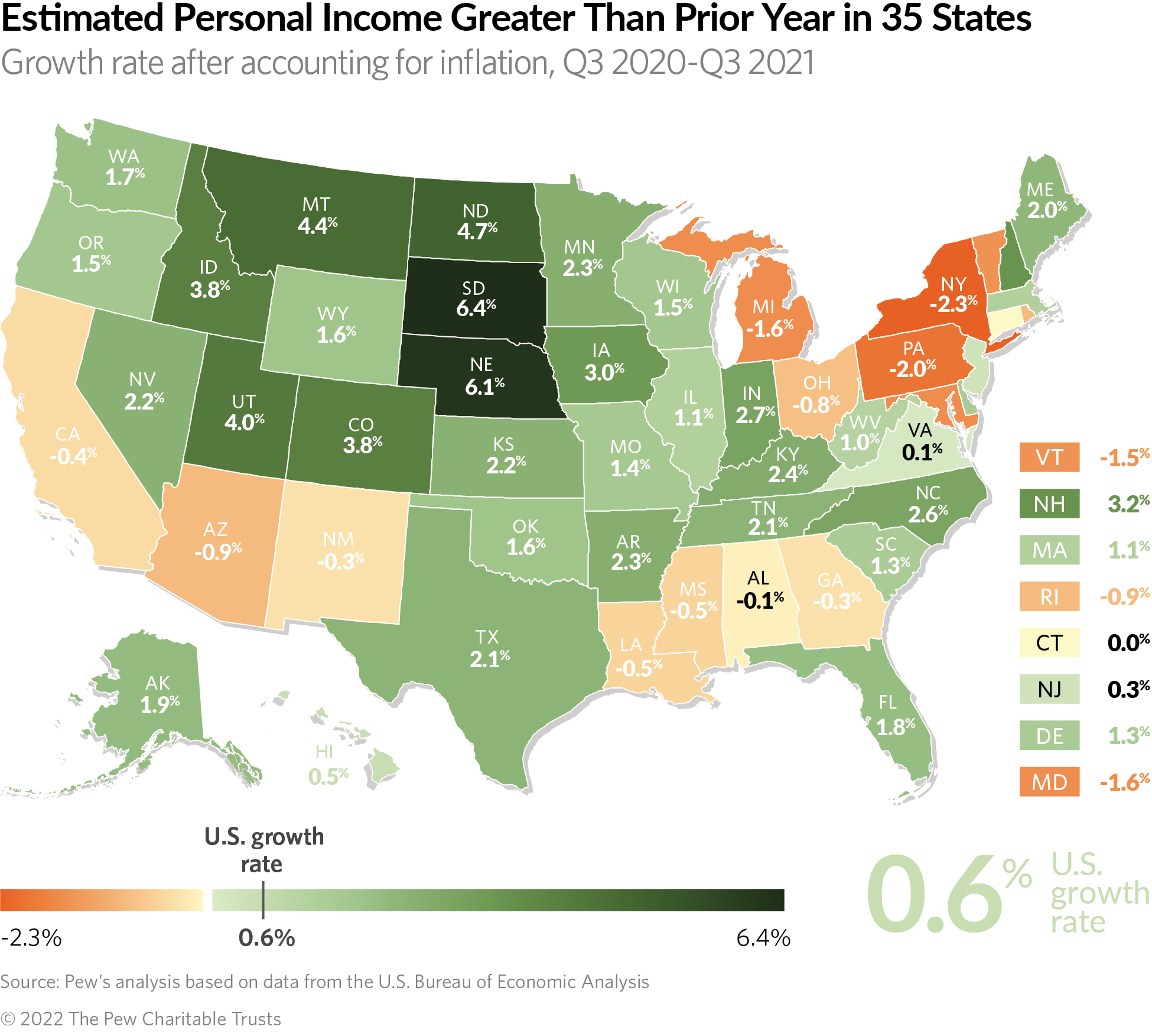

Total national personal income changed little over the year ending in the third quarter of 2021, up just 0.6% after accounting for inflation. Earnings from work increased 4.8% nationally, reflecting an economy that has steadily recovered from sharp job losses following the arrival of the pandemic. At the same time, government assistance was down significantly (-9.2%) from the third quarter of 2020, largely a result of a drop in unemployment insurance payments.

Increases in earnings were enough to offset reductions in government assistance payments in most states. However, more than a dozen states still recorded personal income declines over the year.

State highlights over the past year

A comparison of estimated inflation-adjusted state personal income in the third quarter of 2021 with the third quarter of 2020 shows:

- South Dakota led all states with a growth rate of 6.4% in total personal income, followed by Nebraska (6.1%), North Dakota (4.7%), and Montana (4.4%).

- Income from earnings alone increased in every state. North Dakota’s gain in earnings of 10.4% was the largest of any state, followed by South Dakota, Montana, Nebraska, and New Hampshire.

- The sharpest declines in total personal income were in New York (-2.3%), Pennsylvania (-2%), and Michigan and Maryland (both -1.6%). These states also incurred some of the greatest declines in government assistance from the previous year.

- Government assistance fell in 44 states over the year, with declines ranging from -18.8% in California to -0.2% in Wyoming.

Results for the third quarter of 2021 are based on estimates and are subject to revision, as are Pew’s rankings of growth rates for state personal income.

Pandemic relief and state ledgers

State personal income matters to state governments not only because it helps assess the economic well-being of its residents but also because changes in residents’ income can signal that tax revenue and spending demands are apt to rise or fall, with repercussions for state budgets.

Soon after the start of the pandemic, the huge spike in personal income totals in every state was driven not by economic growth but by the surge of public relief money—especially from the federal government—that was provided to individuals and businesses. The extra money that residents had available to spend helped support state economies disrupted by the pandemic and recession and also generated state tax revenue—either through sales taxes on purchases or income taxes in those states that tax unemployment checks.

Ups and downs since the Great Recession

The multiple rounds of federal support for individuals and businesses have led to starkly different results so far than were seen during the Great Recession, when total personal income fell nationally, including in every state. Thanks to the unprecedented temporary government aid, states largely avoided sharp declines in personal income after COVID-19 left millions unemployed. Total personal income exceeded its pre-pandemic level in every state less than a year after the latest recession officially ended, after accounting for inflation. In contrast, it took five years from the end of the Great Recession for the last state—Nevada—to recover to its pre-recession personal income level.

This analysis’s use of annualized growth rates allows for comparisons of states’ economic performance over several years. But personal income did not actually change at a steady pace, instead falling in some years and rising in others.

No state escaped the 18-month Great Recession without a calendar-year drop in total personal income. The country rebounded over the next three years until 2013, when personal income fell in 38 states, in part because many taxpayers shifted the timing of income in reaction to federal tax changes. The longest recovery in U.S. history ended on a high note with every state’s calendar-year increase in 2018 and 2019. Thanks to the extra federal support for individuals and businesses, all states avoided drops in personal income in 2020, despite the pandemic that continues to disrupt the economy.

This analysis is an update to Pew’s state personal income indicator. State personal income is one of several indicators that are part of Pew’s Fiscal 50 project tracking key fiscal, economic, and demographic trends.

What is personal income?

Personal income sums up residents’ paychecks, Social Security benefits, employers’ contributions to retirement plans and health insurance, income from rent and other property, and benefits from public assistance programs such as Medicare and Medicaid, among other items. Personal income excludes realized or unrealized capital gains, such as those from stock market investments.

Federal officials use state personal income to determine how to allocate support to states for certain programs, including Medicaid. State governments use personal income statistics to project tax revenue for budget planning, set spending limits, and estimate the need for public services.

Several issues influence state personal income, many of which are beyond policymakers’ immediate control. Some of the more critical factors include national and global economic conditions, business cycles for a state’s major industries, demographic trends, and investments made over decades.

Growth in personal income should not be interpreted solely as wage growth; wages and salaries account for about half of U.S. personal income. Likewise, growth in total state personal income should not be seen as a measure of how much the income of average residents has changed.

Looking at state gross domestic product, which measures the value of all goods and services produced within a state, would yield different insights on state economies.

Download the data to see state-by-state growth rates for personal income from 2019 through the third quarter of 2021. Visit Pew’s interactive resource “Fiscal 50: State Trends and Analysis” to sort and analyze data for other indicators of state fiscal health.