State Revolving Loan Fund Gains Momentum in Congress

Representative explains why supporting flood mitigation is a bipartisan and national concern

This Q&A, originally posted Dec. 12, 2018, was updated to reflect the reintroduction of H.R. 1610 in the U.S. House of Representatives on March 8, 2019. Also updated were the amount of damage that flooding has caused since 2000 and the amount of money that the federal government has spent on disaster recovery in recent years.

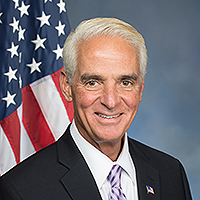

Representatives Charlie Crist (D-FL) and Roger Williams (R-TX) introduced legislation in March to create a partnership between the federal government and states to reduce flood risk and save lives. The bill — the State Flood Mitigation Revolving Loan Fund Act of 2019 (H.R. 1610) — would provide low-interest loans to help communities, businesses, schools, and families prepare for floods.

In the last Congress, Senators Jack Reed (D-RI), John Kennedy (R-LA), and Bob Menendez (D-NJ) introduced a similar bill in the Senate (S. 1507) in June 2017. The state revolving loan program is supported by more than 130 national and local groups from South Carolina to California.

Pew asked Rep. Crist why this new piece of legislation could be a game changer for communities.

Q: What can be achieved by a loan fund program for flood mitigation?

A: Flooding is the most costly and common natural disaster across the U.S., causing more than $800 billion in losses since 2000 according to the National Oceanic and Atmospheric Administration (NOAA). States need a stable source of funding for more flood mitigation and a state revolving loan program can serve this purpose, enabling more communities to take action. Research shows that these risk-reduction measures are cost-effective, with a return on investment of $6 for every $1 spent. Ultimately, this loan fund proposal would be the first mitigation program on a national scale that truly pays for itself. It would help break the cycle of paying to rebuild properties that flood repeatedly.

Q: How would the program work?

A: This proposal creates a partnership between the Federal Emergency Management Agency (FEMA) and the states. Each state, territory, or tribal government that chooses to participate would establish a revolving loan fund to give low-interest loans, and in some cases grants, for a range of activities proven to reduce flood risk. Projects to be chosen by the states could involve a variety of flood mitigation efforts, including elevating or floodproofing homes and businesses; conserving and protecting wetlands, dunes, and other natural areas that can absorb floodwaters; purchasing flood-prone properties; and larger-scale projects such as improving stormwater management in neighborhoods and towns.

Each state fund would be seeded with dollars from FEMA and a contribution from the state itself. States would manage their funds under general principles established by FEMA but tailored to the state’s flood risks and priorities. As payments on outstanding loans are returned to the state fund, these flood mitigation dollars would “revolve,” becoming available for additional projects. Once established, this program would allow each state to be proactive and prepared. Rather than waiting for congressional appropriations or disaster assistance, state officials could make plans and set priorities around a more predictable flow of money to a pipeline of flood mitigation projects. This way, even a modest initial federal expenditure can lead to a larger return on investment. It’s how we can foster an enduring commitment to prepare communities before floods strike.

Q: Why should this approach appeal to all members of Congress?

A: Storms and floods are not confined to any one state or region. Every state in the nation has suffered flood losses at some level, and we all share an interest in the collective safety of our citizens and protecting taxpayer dollars. The state revolving loan program will save lives and dollars by supporting projects to lower flood risk, making flood risk reduction common practice in building and growing local communities. Flood insurance policyholders will benefit from lower insurance premiums as their risks are reduced, and communities will avoid the loss of business and other economic disruptions associated with flooding. These are benefits everyone can get behind.

Q: Why start a loan fund for mitigation when federal grants already exist for this purpose?

A: Current programs fall short of our needs. Two key federal grant programs support projects aimed at reducing risk: the Hazard Mitigation Grant Program and the Pre-Disaster Mitigation Grant Program. The first is available only after disaster strikes, and the second has never been funded adequately. Taken together, these existing programs have not been enough to close the nation’s flood preparedness gap. The federal government has spent more than $300 billion on disaster assistance in recent years, but far less has gone toward mitigation.

In addition, the revolving loan fund program is a tested model that many states and municipalities have experience using. These programs have been applied to affordable housing, renewable energy, clean water, energy efficiency, and other community interests. For example, the Clean Water State Revolving Fund program finances improvements to wastewater infrastructure. Since its inception in 1987, the program has leveraged $42 billion in federal funds for $126 billion worth of clean water infrastructure. Such a program would offer similar benefits for flood mitigation. While a new flood mitigation fund would likely start with a modest amount of federal funding, the value of those dollars would grow as they are matched by state shares, private investments, and revolving loan payments.

This new program can help stem the increasing pressure of federal disaster spending – not by denying communities help after floods but by helping them to build stronger before disaster strikes and, in turn, making their residents safer.