Look West for Strongest Growth Since the Recession

Note: These data have been updated. To see the most recent data and analysis, visit Fiscal 50.

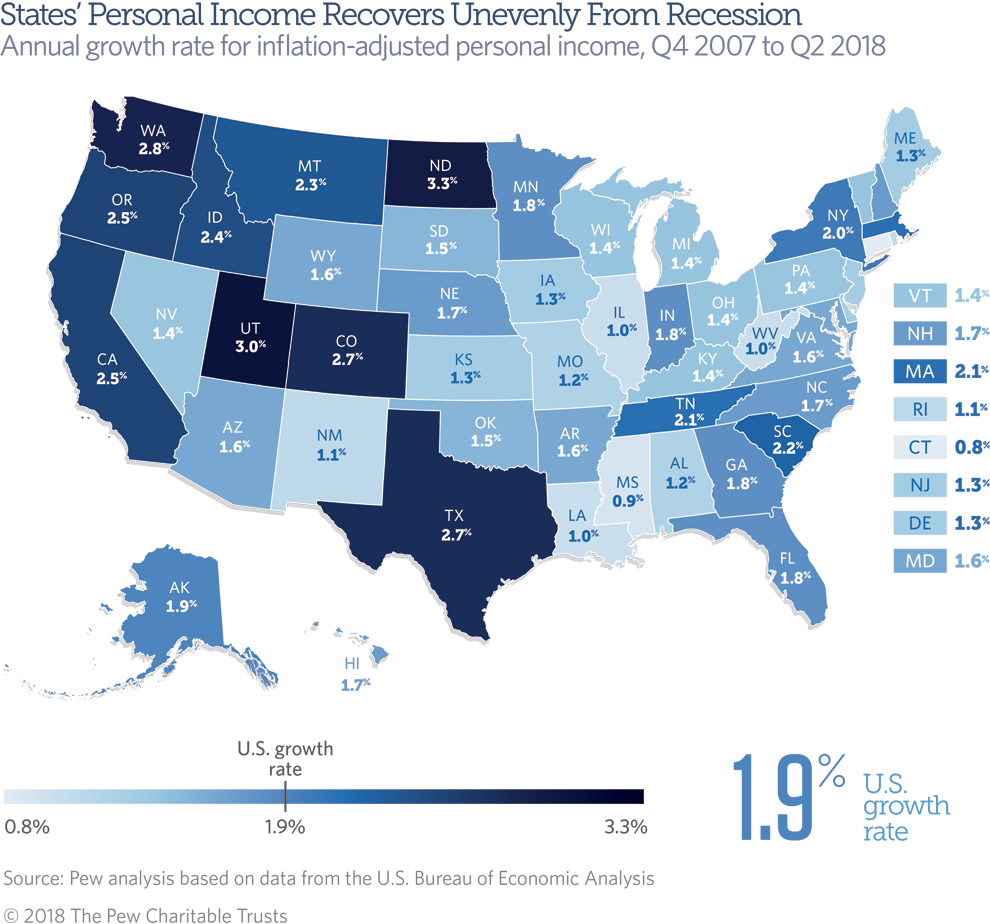

The second-longest U.S. economic expansion has played out unevenly across states. Growth has been strongest in North Dakota and a group of mostly Western states and weakest in Connecticut, as measured by the rate of change in each state’s total personal income since the start of the Great Recession. In the first half of 2018, all but a couple of states shared in widespread gains.

The national recovery has been long-running, but growth in total U.S. personal income is still off its historic pace. As of the second quarter of 2018, the combined personal income of U.S. residents rose by the equivalent of 1.9 percent a year over the 10-plus years since the recession began, compared with the equivalent of 2.3 percent over the past 20 years, after accounting for inflation.

The rates represent the constant pace at which inflation-adjusted state personal income would need to grow each year to reach the most recent level and are one way of tracking a state’s economy.

After tumbling nationwide except in West Virginia during the depths of the recession, personal income totals have recovered in all states but have grown at far different rates.

Eight states’ growth since the start of recession beat the 20-year U.S. rate as of the second quarter of 2018, and nearly all were in the West. North Dakota once again led; the sum of its residents’ personal income has increased the equivalent of 3.3 percent a year. Connecticut and four other states recorded the weakest recovery, with growth rates at or below the equivalent of 1 percent a year. None of those states are in the West.

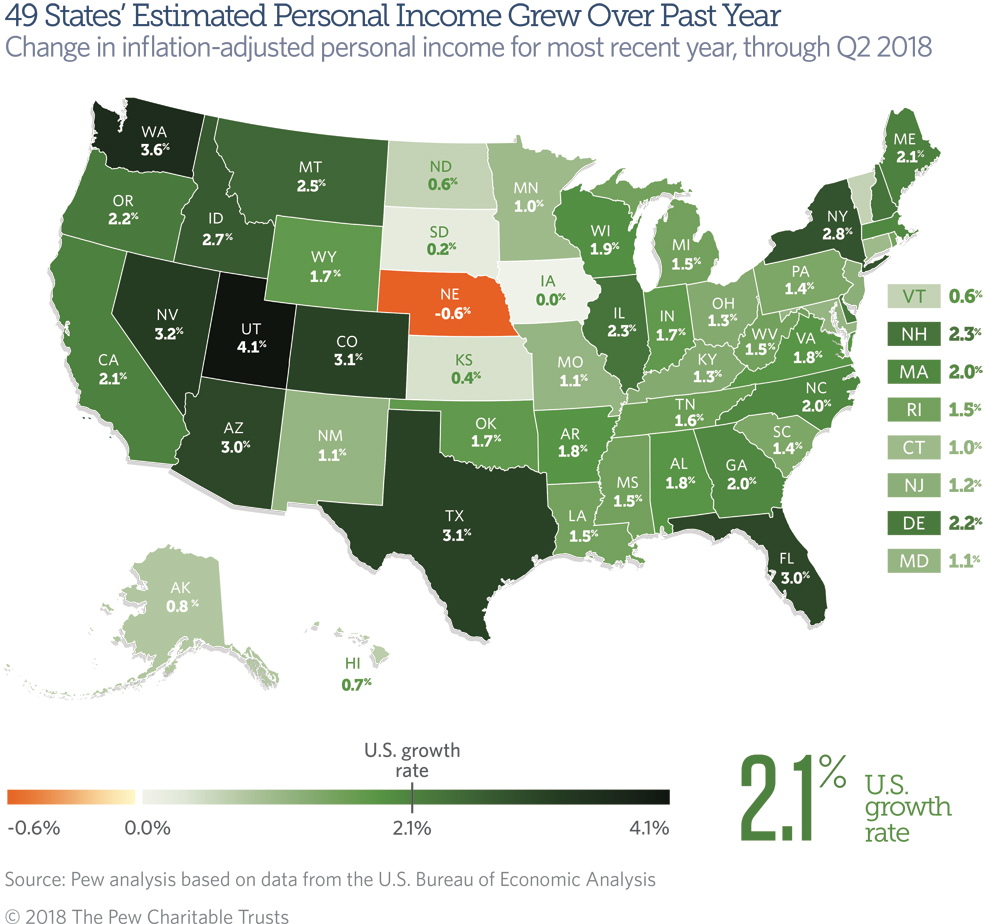

Since a slowdown in 2016, when personal income in nearly a third of states declined in at least one quarter, growth has accelerated and gains have been more widespread. So far in 2018, only two states—Nebraska in the second quarter and Iowa in the first quarter—have had drops in personal income compared with a year earlier. The strongest short-term growth has been in Utah and Washington. These results are based on estimates and subject to revision, as is Pew’s ranking of growth rates for state personal income. (Because of data revisions by the U.S. Bureau of Economic Analysis, for example, 2017 results are stronger than previously reported, and North Dakota gained rather than lost income, as previously reported for the first quarter of 2018.)

Personal income estimates include wages and salaries, which make up about half of the total, and other income received by state residents, such as earnings from owning a business and property income, as well as benefits provided by employers or the government, such as Social Security checks and Medicaid and Medicare coverage. State personal income does not include realized or unrealized capital gains, such as those from stock market investments. Trends in personal income matter to state governments because tax revenue and spending demands may rise or fall along with residents’ incomes. However, these statewide sums are aggregates and should not be used to describe trends for individuals and households.

Growth since the start of the recession

The constant annual growth rate for each state’s aggregate, inflation-adjusted personal income since the fourth quarter of 2007 (when the 2007-09 recession began) to the second quarter of 2018 shows:

- North Dakota has had the strongest annualized growth (3.3 percent) since the start of the recession after the use of new drilling technologies led to an oil production boom. Even though its economy lost ground for three years after oil prices plunged in 2014, oil production and residents’ combined personal income still far surpass pre-recession levels.

- The next-largest growth rates since late 2007 were nearly all in the West: Utah (3.0 percent), Washington (2.8 percent), Colorado and Texas (each 2.7 percent), California and Oregon (each 2.5 percent), and Idaho (2.4 percent).

- Connecticut’s growth was the weakest of any state since the end of 2007, the equivalent of 0.8 percent a year, largely because of losses in manufacturing, especially in the chemical industry.

- The other slowest-growing states, with annualized rates of 1 percent or less, were Mississippi (0.9 percent) and Illinois, Louisiana, and West Virginia (each at 1.0 percent).

Growth over the past year

Estimated change in each state’s aggregate, inflation-adjusted personal income in the second quarter of 2018 from a year earlier (subject to data revisions) shows:

- Nationally, total personal income rose 2.1 percent in the second quarter of 2018 compared with a year earlier, below its post-recession peak of 5.3 percent growth at the start of 2011.

- Growth was fastest in Utah (4.1 percent), followed by four other Western states—Washington (3.6 percent), Nevada (3.2 percent), Colorado (3.1 percent), and Arizona (3.0 percent)—plus Texas (3.1 percent) and Florida (3.0 percent).

- Colorado stands out as the only state to have ranked among the five fastest-growing states in each of the past four quarters.

- Estimated personal income fell in one state from a year earlier: Nebraska (-0.6 percent). Nebraska and Iowa—the only state in which personal income fell in the first quarter of 2018 from a year earlier—were hit by declining farm earnings amid low crop prices.

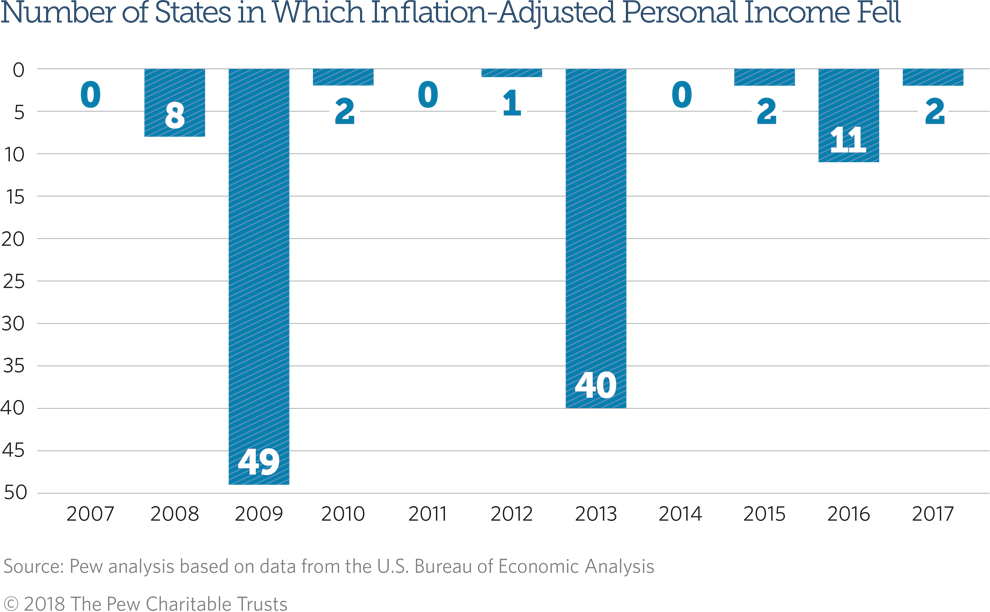

Ups and downs since recession

Use of constant annual growth rates allows comparisons of states’ economic performance since the recession, which lasted from December 2007 to June 2009. However, personal income did not actually change at a steady pace, instead falling in some years and rising in others.

Viewed by calendar year, inflation-adjusted personal income fell in eight states in 2008 but in 49 states in 2009, with West Virginia the only state to escape the 18-month recession without a calendar-year drop. The country rebounded over the next three years until 2013, when personal income fell in 40 states, in part because many taxpayers shifted the timing of income in reaction to federal tax changes. Weak earnings in industries such as farming and energy weighed down personal income and helped account for declines in 11 states in 2016. A rebound added to growth in all but two states in 2017: North Dakota and South Dakota.

Over the past decade, Delaware and North Dakota have endured the most frequent drops, with personal income falling in five of the 10 years. However, Delaware has not had a decline since 2013, while North Dakota’s annual total personal income most recently fell in 2015, 2016, and 2017. The fewest decreases over the 10 years were in Colorado, Idaho, Illinois, Utah, and Washington. Their personal income fell just once, in 2009.

What is personal income

Personal income sums up residents’ paychecks, Social Security benefits, employers’ contributions to retirement plans and health insurance, income from rent and other property, and benefits from public assistance programs such as Medicare and Medicaid, among other items. Personal income excludes capital gains.

Federal officials use state personal income to determine how to allocate support to states for certain programs, including funds for Medicaid. State governments use personal income statistics to project tax revenue for budget planning, set spending limits, and estimate the need for public services.

Growth in personal income should not be interpreted solely as wage growth; wages and salaries account for about half of U.S. personal income.

Looking at personal income per capita or state gross domestic product, which measures the value of all goods and services produced within a state, can yield different insights on state economies. So can looking at household data, which are based on a different measure of income.

Download the data to see state-by-state growth rates for personal income from 2007 through the second quarter of 2018. Visit Pew’s interactive resource Fiscal 50: State Trends and Analysis to sort and analyze data for other indicators of state fiscal health.