Hawaii’s Pension Fund Positioned to Withstand Next Recession

Stress tests help validate increases in state, worker contributions

Like many states, Hawaii has faced challenges in recent years setting aside enough money to fulfill pension promises made to its public employees. In 2017, the state reported $15.7 billion in assets to cover $28.6 billion in liabilities, just over half the amount needed. That was a stark contrast from 2000, when the retirement system was 94 percent funded.

Two years later, Hawaii’s funding projections are on a better trajectory—and policymakers have a much clearer sense of potential future scenarios. The state government has taken steps to boost employer and employee contributions. And it has been an early adopter of required annual stress testing. This analytical tool looks at a range of scenarios for economic projections and investment returns to provide much better insight into potential long-term liabilities and costs.

Hawaii has not been alone in grappling with escalating pension debt. In 2016, states reported a cumulative $1.4 trillion in unfunded pension liabilities. And that gap is likely to widen in the face of economic uncertainties. After nine years of growth and stock market gains, many analysts think the U.S. may be due for a recession. Without sufficient assets on hand, state pension funds are more vulnerable than ever to market volatility.

Policymakers need to know how pension funds will perform under different economic circumstances, and what the impact might be on already strained government budgets. Because investment earnings typically make up the largest share of pension fund revenue, lower returns or losses must be offset by higher contributions from the state government and workers. Rigorous stress testing can illustrate how a downturn could affect pension balance sheets and, in turn, states’ ability to fund other core government services, such as schools, public safety, and infrastructure.

In response to concerns about the fiscal health of the pension fund, Hawaii enacted changes in 2017 that increased state contributions annually over a four-year time frame. For general employees, contributions will rise from 17 percent of payroll in 2017 to 24 percent in 2021, while rates will jump from 25 percent to 41 percent of payroll for police officers, firefighters, and corrections officers over the same period. Contributions will remain at these levels until the system is fully funded.

In 2017, lawmakers also unanimously passed legislation to require annual stress test reporting, making the state one of the first to routinely use this tool to monitor the fiscal health of its fragile pension system and help protect it from inevitable market volatility. California, Colorado, Connecticut, New Jersey, Virginia, and Washington have similar requirements in place.

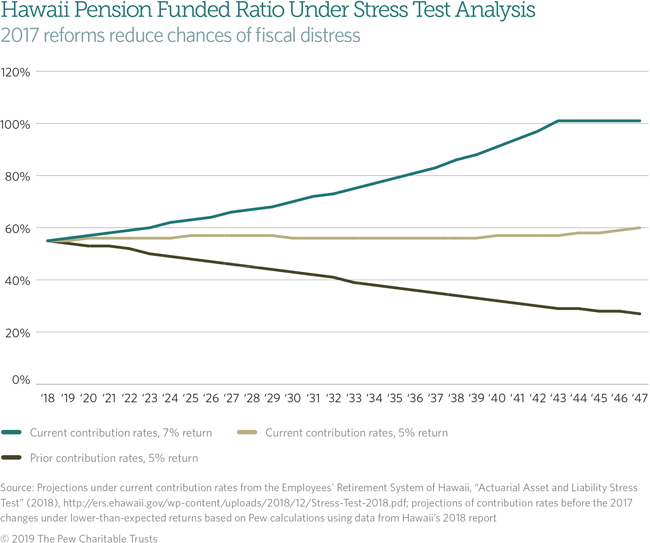

The latest stress test report shows that the increased contributions will go a long way toward sustaining the economics of the system. Hawaii published these results on Dec. 28, 2018, in the second report since the law went into effect. The analysis found that, under current contribution policies and annual return assumptions of 7 percent, the pension plan should be fully funded in fiscal year 2044.

The report also provided guidance on what would happen if return assumptions are not met. If actual returns came in at 5 percent each year, the state would have to increase contributions to stay on a path to fully fund the retirement system by 2047, its 30-year projection window. But even with 5 percent investment returns, the system’s funded ratio would stay fairly level at around 56 percent if the state followed the currently prescribed funding policy.

The Pew Charitable Trusts independently examined Hawaii’s stress testing analysis and found similar results. The outcomes underscored how the increased pension contributions required by the 2017 reforms should protect the system from insolvency.

Pew found that, at previous contribution rates, Hawaii’s funded ratio would have declined significantly in a low-return scenario—and could have fallen below a sustainable level without increased contributions. This analysis demonstrates how the increased pension contributions required by the 2017 legislation were an important change to keep the system solvent.

As Hawaii’s analysis shows, requiring stress tests as part of regular pension reporting can help assess contribution policies and provide an early warning if problems arise. Routine stress testing can help improve budgetary planning, allow better assessment of proposed pension changes, and avoid costly mistakes.

Greg Mennis is a director and Kate Kemmerer is a senior associate with The Pew Charitable Trusts’ public sector retirement systems project.

America’s Overdose Crisis

Sign up for our five-email course explaining the overdose crisis in America, the state of treatment access, and ways to improve care

Sign up

Hawaii Adds New Tool to Monitor State Pension Fund

States Turn to New Tool to Sustain Pension System Funding