Small Differences in Mutual Fund Fees Can Cut Billions From Americans' Retirement Savings

Investor costs generally higher in IRAs than in workplace plans—and require greater attention

Overview

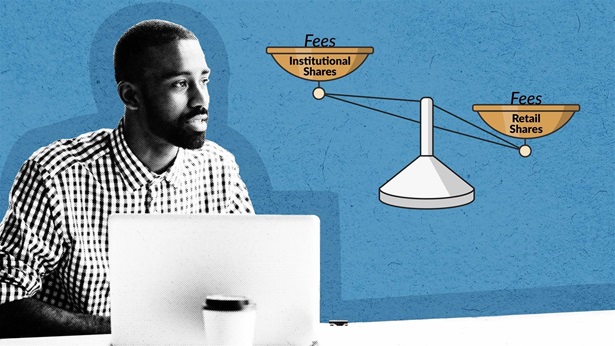

When leaving an employer, either through retirement or a job change, people with employer-sponsored retirement plans such as 401(k)s face choices about their investments. Many roll their savings over into an individual retirement account (IRA), but there can be financial risk in this approach: Thousands of dollars in savings can be lost over time because of what may seem like modest differences in fees between funds or between types of shares within a fund.

That’s because mutual funds have share classes that charge different fees depending on the type of investor, particularly whether the shares are held by individuals using their own savings—retail investors—or institutions investing on behalf of others. Institutional investors, including employer-sponsored retirement plans, can leverage their purchasing power to access lower fee shares. An analysis of fee differences shows that the routine shifting of billions of dollars each year from 401(k)s—which are often able to purchase lower-cost institutional shares— into IRAs in which savers frequently purchase retail shares can translate into significantly higher costs for retail investors, costs that can eat into their long-term savings significantly.

In the aggregate, the amount of retirement savings lost in such rollovers potentially reaches tens of billions of dollars. In 2018 alone, investors rolled $516.7 billion from employer retirement plans into traditional IRAs.1 An analysis of fee differentials suggests that over a hypothetical retirement period of 25 years, those retail investors could see an aggregate reduction in savings of about $45.5 billion—just from that single year of rollovers.

Today, as investors leave workplace plans, they often receive marketing from financial firms nudging them toward IRAs. And the fee disclosures are written in a technical manner that is difficult for the average consumer to understand.2 Small differences in fees can lead to big losses; consumers could end up making decisions that chip away at their hard-earned retirement savings.

Glossary: Types of Shares in Mutual Funds

Share class: Mutual funds offer investors different classes of shares. Each class invests in the same portfolio with the same objective, but each has a different required minimum initial investment. Fee structures differ as well, depending on marketing expenses and how intermediaries such as brokers and financial advisers are compensated. Share classes are generally designated as either institutional shares or retail, depending on whether a large minimum investment is required.

Institutional shares: Share classes that are designated as institutional typically require a large initial investment (the minimum can be in excess of $100,000), making them available to institutional investors, such as employer-sponsored retirement plans, that pool workers’ contributions or to individuals who are able to meet the minimum requirements. These share classes typically have the lowest expenses.

Retail shares: Share classes that are designated as retail have low minimum investment requirements or sometimes no minimums. These shares tend to be broadly accessible to all investors but often have higher expenses than institutional shares do.

To highlight the impact on individual investors, this brief examines the difference between institutional and retail class annual expenses across all mutual funds that offered at least one institutional and one retail share in 2019.3 The data illustrates how the differences can affect three hypothetical investors: a recent retiree, an investor who shifts a low-cost workplace fund to a higher-cost IRA fund, and an early-career job switcher. In each example, switching from institutional to retail shares of the same fund leads to tens of thousands of dollars in lost retirement savings.

Among the key findings of the fee analysis:

- For mutual funds that primarily hold equities, costs are significantly greater for retail shares. Annual expenses for median retail shares were 0.34 percentage points higher than those for institutional shares. Although this seems like a small difference, it represents about 37% higher fees.

- Mutual funds that hold both equities and bonds—known as hybrid funds—and bond mutual funds have lower expenses than equity funds do. And that means that small differences can represent large comparative trade-offs when looking at the costs associated with retail and institutional shares. Median retail share expenses are about 41% higher for hybrid funds (a difference of 0.19 percentage points) and 56% higher for bond funds (a 0.31 percentage-point difference) compared with median institutional share expenses.

- In the aggregate, looking at the smallest median fee difference shows a large potential impact on the long-term savings of those invested in retail shares. Applying the 0.19 percentage-point difference seen for hybrid funds to the entire $516.7 billion in rollover assets in 2018 amounts to more than $980 million in direct fees in a single year alone. That translates into tens of billions of dollars in potential losses to savings related to fees and forgone earnings over a 25-year period.

- Clear, accessible information about fees is needed. Employers also should consider offering services that help retirees and others leaving their jobs make decisions that help them minimize fee costs. Among the options could be keeping their investments in a workplace 401(k) plan if permitted.

Background on mutual fund fees

Mutual funds, the most common type of investment in 401(k) plans,4 offer investors different types of shares, known as classes (often denoted by letter symbols such as A or I), and investors in different share classes typically pay different fees. That’s because although fund managers invest each class’s assets in the same portfolio of securities and have the same investment objectives, each class may offer its own services, features, or arrangements, with fees and expenses that differ from those for other classes of the same fund. That can depend on factors such as:

- The costs of marketing and distribution, including incentives for financial advisers and brokers.

- The minimum amount for initial investment.

- How long the investment is held.

To cover fund management and marketing, each share class charges fundholders its own annual expense as a percentage of the value of the assets held. This fee is commonly referred to as a fund’s expense ratio.

Although there are many different share classes, a key distinction is whether the class is open to institutional or retail investors. Individuals could technically meet the requirements to purchase institutional shares on their own, but the investors in these shares, which usually have lower fees, are more often pension or 401(k) plan sponsors where the aggregate investments exceed the required minimum.

Institutional investors then can take advantage of bulk purchasing power to negotiate and obtain lower fees. Sometimes an individual investor can access institutional shares by using the services of a financial adviser whose firm can access lower-cost shares; however, investing through an adviser typically incurs adviser fees that might offset the savings from lower fund operating expenses.

Why share classes and fees matter for retirement

When people retire or change jobs, they often roll their savings from an employer-sponsored retirement plan— with lower institutional share class fees—into IRAs. In those accounts, mutual funds are usually sold as individual or retail investments with potentially higher retail share class fees.

These rollovers from workplace plans represent the vast majority of new assets within IRAs. Although IRAs have long been a way for those without access to an employer-sponsored plan to save, only 13% of working Americans use these accounts to put away money for retirement.5

Meanwhile, from 2009 to 2018, rollovers from employer-sponsored retirement plans accounted for more than 95% of traditional IRA inflows each year.6 In 2018 alone, households transferred $516.7 billion in assets from workplace plans to traditional (non-Roth) IRAs.7 In 2020, about 57% of households with such IRAs indicated in a survey that the balance included rollover assets. Of those who completed rollovers, 56% reported that those rolled-over assets constitute their entire IRA balance.8 As a result, IRAs hold more in retirement assets than employer-sponsored defined contribution plans.9

Workers have other options. They can keep their assets in employer-sponsored plans, either by leaving them in a previous employer’s plan, if permitted, or by rolling them into a new one if available.10 Even in retirement, in most cases, savers can choose to leave assets in their workplace plan, taking only required distributions.11

Rolling over savings into an IRA does not guarantee that an investor will pay higher fees, but many could lose savings if they are unable to parse fee information in often opaque disclosures. At the same time, some smaller employer plans—such as a 401(k) without significant assets under management—may offer limited funds with relatively higher fees.12 An investor willing to seek out low-expense—or similar-expense—funds can do so in an IRA, but knowledge of investment expense ratios remains low, and many investors make decisions based on factors other than these costs.13

A look at The Hartford MidCap Fund, which the analysis showed was representative of a typical fund, illustrates the types of share classes available within a mutual fund. Table 1 shows the different shares and fees associated with nine different share classes. The first two cells show share classes typically sold to individual investors, while the shaded cells show share classes that are sold to institutions, such as employer-sponsored retirement plans.

Table 1

Share Classes and Fees in The Hartford MidCap Fund in 2019

Institutional investors tend to pay significantly lower costs than retail investors

| Share class | A | C | F | I | R3 | R4 | R5 | R6 | Y |

|---|---|---|---|---|---|---|---|---|---|

| Expense ratio (%) | 1.10 | 1.86 | 0.74 | 0.85 | 1.45 | 1.14 | 0.84 | 0.74 | 0.78 |

Key: Institutional share classes are F, I, R3, R4, R5, R6, and Y.

Note: Expense ratios represent the amount paid in fees divided by the total investment and can be used to compare fund costs. Source: Survivor-Bias-Free U.S. Mutual Fund Database

© 2022 The Pew Charitable Trusts

If a separating employee moved savings from the R6 shares, a typical share class available in a 401(k) plan, to the A shares in an IRA—keeping the money in the same fund—the annual fees would increase substantially from 0.74% to 1.10%.14 Because fees are taken out of invested assets, the impact of higher fees compounds over time due to reduced growth. Previous research has found that many people don’t read fee disclosures, or if they do, they don’t understand them. Retirees who roll over funds into an IRA then could be investing their savings in higher-fee shares.

Expense differences between institutional and retail shares

Pew analyzed the difference between average institutional and retail share class expense ratios across all mutual funds that offered at least one institutional share and one retail share in 2019. Using the reported annual expenses for that year in the Survivor-Bias-Free U.S. Mutual Fund Database from the Center for Research in Security Prices at the University of Chicago, we computed an asset-weighted average expense ratio for both types of shares for each fund. (For details on the data source and methods, see the methodology section.)15

Mutual Fund Asset Types

Equity: Investments are primarily individual company stocks.

Bond: Investments are primarily fixed-income securities, such as government bonds.

Hybrid: Investments are a mix of equities and fixed income.

Table 2 shows the distribution of median fund-level asset-weighted annual expense ratios broken out by investment asset type (equities, hybrid funds, and bonds) for both retail and institutional shares. We also calculate the difference between the median expenses for each type. Additional details about the distribution of fees can be found in the appendix.

Equity mutual funds have the highest expenses overall, but there is a 0.34 percentage-point difference in the median asset-weighted annual expenses between institutional and retail shares for these funds. Median retail shares of equity funds have annual expenses about 37% higher than the institutional shares. The difference between median retail and institutional shares for bond mutual funds is slightly smaller, at 0.31 percentage points. However, because these are lower-cost investments, retail shares are comparably more expensive, with median bond retail funds having 56% higher costs than the institutional shares.

Although the difference in median expenses between retail and institutional shares of hybrid funds was the smallest, at 0.19 percentage points, the difference is still quite big in comparative terms. Median hybrid retail shares have 41% higher annual expenses compared with hybrid institutional shares. Using these calculations, we can quantify the potential losses to savings when an investor rolls over retirement savings into an IRA without taking expense ratios into account.

Table 2

Mutual Fund Expense Ratios Across Investment Types

Institutional shares have lower fees than retail shares across the board

| Investment type | Institutional shares’ median expense ratio (%) | Retail shares’ median expense ratio (%) | Difference |

|---|---|---|---|

| Equity mutual funds | 0.90 | 1.24 | 0.34 |

| Hybrid mutual funds | 0.46 | 0.65 | 0.19 |

| Bond mutual funds | 0.55 | 0.86 | 0.31 |

Notes: Expense ratios represent the amount paid in fees divided by the total investment and can be used to compare fund costs. The investment type is obtained using the Lipper class name. The smallest 10% of the total number of funds within each asset category (equity, hybrid, bond) have been excluded from the analysis.

Source: Survivor-Bias-Free U.S. Mutual Fund Databasea

© 2022 The Pew Charitable Trusts

Small fees, big differences: Illustrating the cost to savings

What do these differences in annual fees mean for an investor over time? At first glance, the differences appear small, but they can substantially affect savings over time. Based on the median fees from Table 2 above and assumed mutual fund savings and rates of return reflective of savers’ experiences, the differences in fees paid and account balances can be calculated using Pew’s fee calculator. Below are several examples.

Example 1: A recent retiree

Sarah is retiring at age 65 after a long career. She has $250,000 in her employer’s 401(k) plan and now must decide whether to keep the money there or roll it over into an IRA. She likes the hybrid mutual fund in which her savings are currently invested, so if she does roll the money over, she wants to put it in the same mutual fund. However, the fund’s fees in the 401(k) plan are much lower than in the IRA—even though it is the same fund. For Sarah, the question is whether the difference in fees matters for her retirement security. Here are details that she should consider:

- Total savings: $250,000

- Mutual fund assumed real rate of return: 5% per year

- Time invested: 25 years (to age 90)

- Withdrawals: Sarah would like to withdraw $1,000 each month to supplement her Social Security benefits

- The mutual fund charges an annual fee of 0.46% if the money is held in the 401(k) plan, but the fee is 0.65% if the money is in an IRA. There are no front or deferred sales charges (i.e., loads).

With these inputs, the difference in fees and projected account balance between the 401(k) plan and the IRA can be calculated. Here are the results:

| Mutual fund in 401(k) plan | Mutual fund in IRA |

|---|---|

| Annual fee: 0.46% | Annual fee: 0.65% |

| Total fees over 25 years: $27,233 | Total fees over 25 years: $37,091 |

| Account balance at age 90: $217,553 | Account balance at age 90: $197,040 |

In summary, rolling over her savings to the mutual fund with the higher fee would result in $20,513 less in savings after 25 years—a significant loss for a person living on a fixed income.

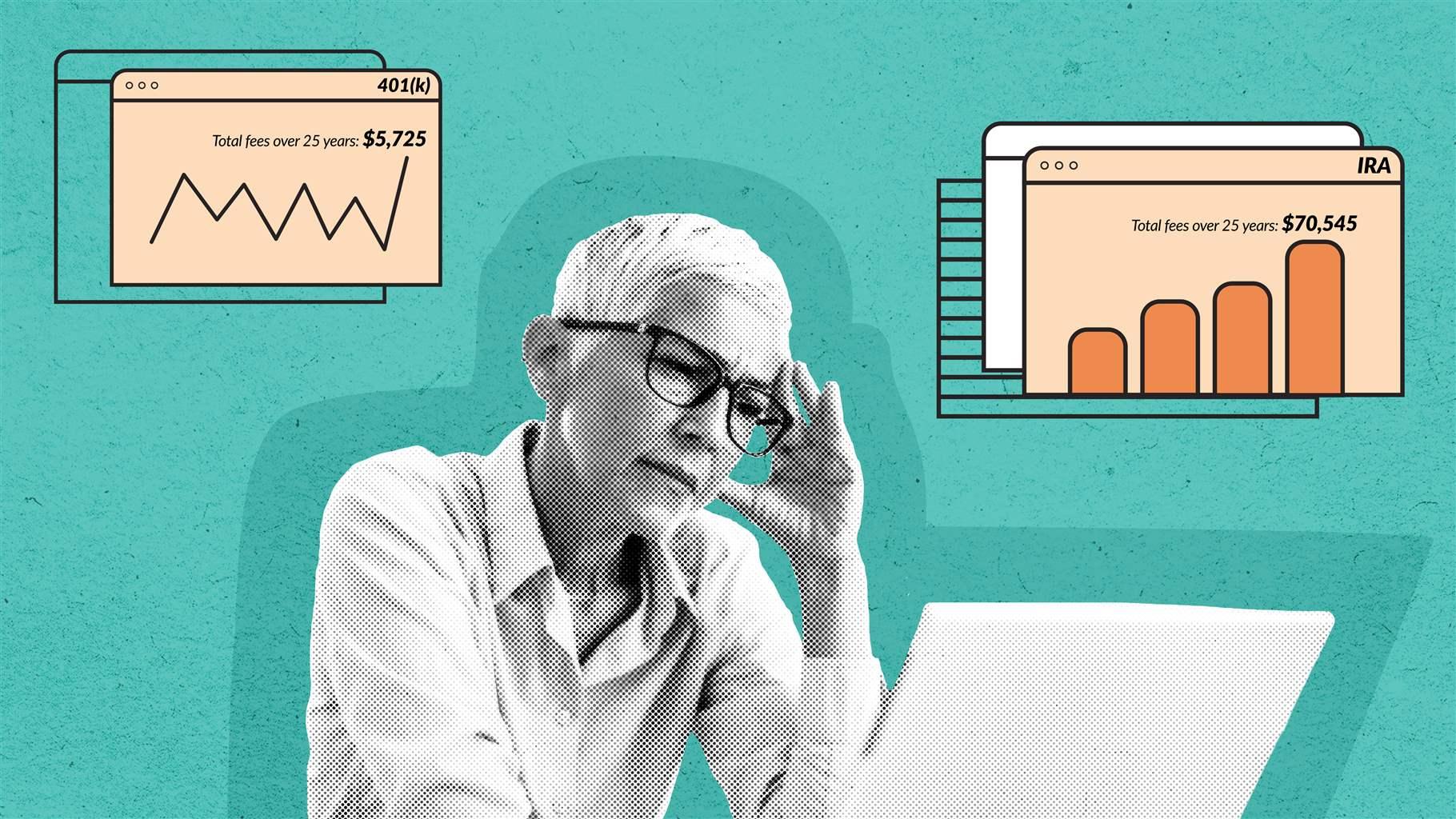

Example 2: Low-cost work plan fund to high-cost IRA fund

Let’s stay with Sarah, who has amassed $250,000 in her employer’s 401(k). Rather than sticking with the same mutual fund when rolling over her savings, Sarah decides to change funds after receiving several marketing pitches and invests in one that was suggested to her. The mutual fund in her 401(k) happens to have particularly low costs at only the 10th percentile of hybrid institutional funds. However, the fund she chooses in the IRA based on the advertisement is higher-cost, at the 90th percentile of hybrid retail funds. Sarah’s new fund’s fees are more than double what they were for the fund in her employer’s plan. Here are some details about her situation:

- Total savings: $250,000

- Mutual fund assumed real rate of return: 5% per year

- With these inputs, the difference in fees and projected account balance between the 401(k) plan and the IRA can be calculated. Here are the results:

- Time invested: 25 years (to age 90)

- Withdrawals: Sarah would like to withdraw $1,000 each month to supplement her Social Security benefits

- The mutual fund charges an annual fee of 0.09% if the money is held in the 401(k) plan, but the fee is 1.44% if the money is in an IRA. There are no front or deferred sales charges (i.e., loads).

With these inputs, the difference in fees and projected account balance between the 401(k) plan and the IRA can be calculated. Here are the results:

| Mutual fund in 401(k) plan | Mutual fund in IRA |

|---|---|

| Annual fee: 0.09% |

Annual fee: 1.44% |

| Total fees over 25 years: $5,725 | Total fees over 25 years: $70,545 |

| Account balance at age 90: $261,015 | Account balance at age 90: $123,385 |

In summary, rolling over her savings to the mutual fund with the higher fee would mean $137,630 less in her account balance when she is 90. Because the higher fees erode subsequent gains, the magnitude of the reduction in savings is even more substantial than the magnitude of the fee increase.

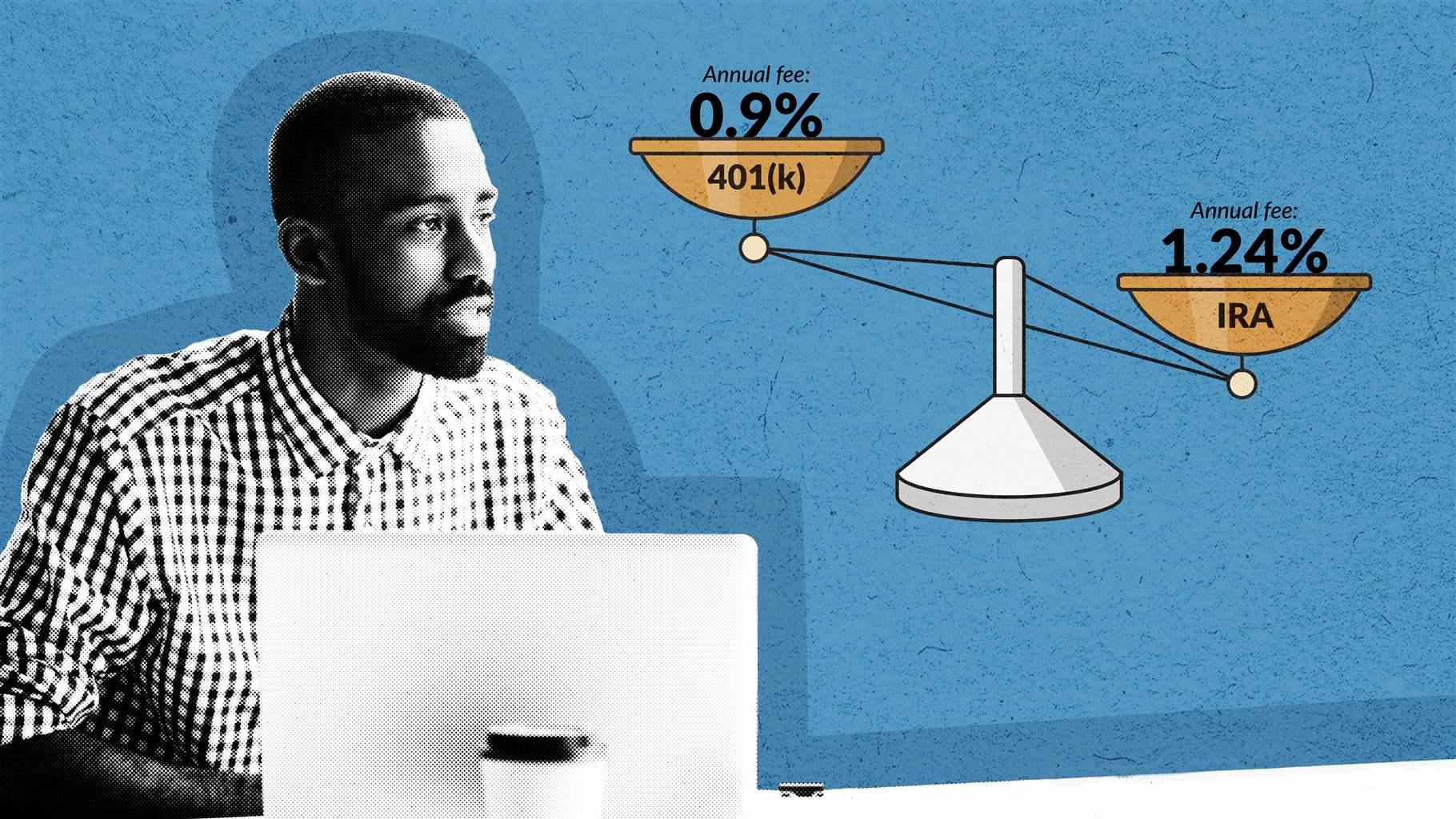

Example 3: An early-career job switcher

Jim is 26 years old and has spent four years in his first job after college. His company offered a 401(k) that included an employer match, allowing Jim to save $30,000 by the time he left for a new position. Because he can no longer contribute to the plan and is unsure how long he will stay at his new job, he decides to roll his 401(k) into an IRA rather than into his new company’s plan. Jim does not have time to research funds, and the mutual fund in which his savings are currently invested has performed well, so he decides to put the assets in the same equity mutual fund. However, the mutual fund fees in the 401(k) plan—at both his old and new jobs—are much lower than in the IRA even though it is the same mutual fund. Jim feels that since he’s only saved a small amount, the difference in fees will not make a big difference to his retirement savings. Here are some details about his situation:

- Total savings: $30,000

- Mutual fund assumed real rate of return: 8% per year

- Time invested: 40 years (to age 66)

- Jim makes no additional contributions to this IRA account. He decides he will leave it until he retires and starts to invest money in his new company’s 401(k) plan once it begins matching contributions.

- The mutual fund charges an annual fee of 0.9% if the money is held in the 401(k) plan, but the fee is 1.24% if the money is in an IRA. There are no front or deferred sales charges (i.e., loads).

With these inputs, the difference in fees and projected account balance between the 401(k) plan and the IRA can be calculated. Here are the results:

| Mutual fund in 401(k) plan | Mutual fund in IRA |

|---|---|

| Annual fee: 0.9% | Annual fee: 1.24% |

| Total fees over 40 years: $61,045 | Total fees over 40 years: $76,417 |

| Account balance at age 66: $507,980 | Account balance at age 66: $443,333 |

Although the difference in total fees paid is somewhat modest ($15,372 over 40 years), these expenses translate into relatively large opportunity costs because they significantly reduce the growth of the account. Rolling over his savings to the mutual fund with the higher fee would reduce Jim’s account balance at retirement in 40 years by $64,647.

These illustrations calculate how costs affect savings for individual investors, but the potential aggregate losses for all investors are massive. Households rolled over more than $516.7 billion dollars in assets in 2018.16 Using the difference in median hybrid funds (0.19 percentage points), over one year the higher fee on the mutual fund in the IRA would generate over $980 million in additional fees alone. Over time, the impact of these additional fees becomes even more substantial because of the cumulative impact of forgone earnings.

Over 25 years at a 5% real rate of return—and assuming $20.5 billion in annual aggregate withdrawals—the higher retail fee fund would create almost $23.5 billion in excess fees, while forgoing nearly $22 billion in earnings. The annual withdrawals represent about 4% of the initial rolled-over amount, a typical rule of thumb for retirees.17 In aggregate, savers would have almost $45.5 billion in reduced savings because they rolled over their savings instead of leaving the assets in a comparatively lower-fee institutional share. And these calculated potential losses in savings over 25 years are from the rolled-over assets for a single year.

Conclusion

By staying in the same investment funds that were in a 401(k) plan when completing an IRA rollover or relying on marketing received during the rollover process to make decisions, savers often face higher annual expenses in the retail investment environment than with the institutional offerings available in their employer-sponsored retirement plan. The hypothetical examples show that even small disparities in fees can lead to big differences in retirement savings account assets.

In 2013, the Government Accountability Office highlighted the often confusing nature of IRA rollovers, finding that the information that plan participants receive upon separation is often insufficient or technical in nature. That reality can be overwhelming and confusing to savers.18

GAO’s study further found that people leaving workplace plans often receive advice or marketing from financial firms favoring IRAs and possibly interpret this information as suggestions to choose providers’ retail investments. More plan sponsors, however, are seeking ways to retain retirees in their plans so that all participants benefit from the lower investment costs that come with economies of scale.19

Employer-sponsored retirement plans and IRAs both make high- and low-cost funds available to investors. On average, the institutional share classes of mutual funds available in an employer plan are less expensive to own than the same fund’s retail share classes.

Savers who are happy with their investments may be better off leaving their assets in the plan when they separate from their employer. Those who want to complete a rollover should seek investments with equivalent or lower expenses than the mutual funds they owned in their 401(k).

To accomplish this, investors need clear, accessible information about fees. In addition, employers may want to augment financial wellness programs with online or other services that help retirees and others leaving their jobs make good decisions with their retirement savings.

Methodology

The analysis of mutual fund annual expenses in this brief uses the 2019 data from the Survivor-Bias-Free U.S. Mutual Fund Database, available from the Center for Research in Security Prices at the University of Chicago. There are 27,750 individual mutual fund share classes with corresponding fee information for that year. Fund share classes that are missing the expense ratio, have the ratio reported as zero, or are missing year-end total net assets are excluded from the analysis (only about 2.8% of observations).

Pew excluded fund shares designated for 529 education savings plans because those shares are not available in an employer-sponsored retirement savings plan. We further restrict the analysis to mutual funds that have at least one institutional share observation and at least one retail share observation because the focus is on expense differences within a mutual fund as an investor might move from institutional to retail shares.

The database contains variables that flag whether each observation represents an institutional or retail share. For common share classes, as indicated in the fund's name, we ensured that observations had the appropriate flag. The following classes are institutional shares: F, I, R, W, Y, and Z. The following are retail shares: retail, Admiral (a class specific to Vanguard Group Inc.), investor, A, B, C, and D. For less common or unique share class names, as well as for funds without a share class indicated in its name, we relied on the given flag in the database. Finally, we retain only equity, hybrid, and income funds as identified by the fund’s Lipper classification because they are the most common types of investments in retirement savings plans.

These restrictions result in 19,375 mutual fund share classes representing 4,390 mutual funds offered by 368 fund management companies. Particularly small or specialized funds might have unique markets or higher expenses. Therefore, we also exclude the smallest 10% of funds (as indicated by total assets under management in the fund across all share classes) in each investment objective category as well as any fund that is the sole offering by a particular management company. In total, the analysis then looked at 3,847 mutual funds offered by 237 fund management companies.

Weighted expense ratios were calculated for the institutional shares and retail shares of each of the funds. An asset-weighted approach allows for the effective expense ratio to reflect where dollars are flowing within each individual fund. For the institutional share weighted expense, we multiplied each share’s annual expense ratio by its percentage of the total year-end net assets held within all institutional shares of the fund. We then summed each component to get the weighted expense ratio. This procedure was repeated for the retail shares. As an example, the weighted retail share expense ratio calculation for The Hartford MidCap Fund follows:

Asset-weighted retail share expense ratio = 1.10 (2954/ (2954+506)) + 1.86 (506/(2954+506)) = 1.21

With respect to the two retail share classes (A shares and C shares), most of the assets are concentrated in the A shares. The asset-weighted retail expense ratio, 1.21, is closer to the expense ratio for A shares. For comparison, the asset-weighted institutional expense ratio is 0.81, indicating that most assets are invested in relatively lower- cost share classes within institutional shares. Table 3 below shows the fees and year-end net assets for The Hartford MidCap Fund.

Table 3

Calculating weighted expenses in The Hartford MidCap Fund

| Share class | A | C | F | I | R3 | R4 | R5 | R6 | Y |

|---|---|---|---|---|---|---|---|---|---|

| Expense ratio (%) | 1.10 | 1.86 | 0.74 | 0.85 | 1.45 | 1.14 | 0.84 | 0.74 | 0.78 |

| Year-end net assets (millions of dollars) | 2,954 | 506 | 2,404 | 4,399 | 102 | 272 | 496 | 1,864 | 1,629 |

|

Weighted expense ratio (%) |

1.21 | 0.81 | |||||||

Key: Institutional share classes are F, I, R3, R4, R5, R6, and Y.

Source: Survivor-Bias-Free U.S. Mutual Fund Database

© 2022 The Pew Charitable Trusts

Table 4 presents full descriptive statistics for the fund-level asset-weighted institutional shares and asset- weighted retail shares.

Table 4

Full descriptive statistics for mutual fund expense ratios (%) across investment types

| Institutional shares | Retail shares | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Investment objective | Average | Min. | 10th percentile | Median | 90th percentile | Max. | Average | Min. | 10th percentile | Median | 90th percentile | Max. |

| Equity mutual funds | 0.89 | 0.01 | 0.54 | 0.90 | 1.24 | 2.7 | 1.23 | 0.04 | 0.79 | 1.24 | 1.65 | 3.04 |

| Growth | 0.85 | 0.01 | 0.60 | 0.85 | 1.10 | 1.90 | 1.16 | 0.05 | 0.83 | 1.18 | 1.46 | 2.16 |

| Value | 0.80 | 0.04 | 0.52 | 0.80 | 1.07 | 1.72 | 1.12 | 0.05 | 0.78 | 1.15 | 1.41 | 2.13 |

| Blend | 0.83 | 0.03 | 0.46 | 0.88 | 1.15 | 1.97 | 1.14 | 0.05 | 0.69 | 1.19 | 1.51 | 2.26 |

| Sector | 0.89 | 0.10 | 0.53 | 0.89 | 1.30 | 2.02 | 1.23 | 0.10 | 0.76 | 1.27 | 1.67 | 2.65 |

| International | 0.99 | 0.01 | 0.66 | 0.99 | 1.33 | 2.77 | 1.32 | 0.07 | 0.95 | 1.35 | 1.74 | 2.99 |

| Global | 0.93 | 0.01 | 0.67 | 0.95 | 1.19 | 1.97 | 1.28 | 0.10 | 0.87 | 1.31 | 1.64 | 2.29 |

| Hybrid mutual funds | 0.52 | 0.03 | 0.09 | 0.46 | 0.99 | 2.00 | 0.81 | 0.07 | 0.35 | 0.65 | 1.44 | 2.63 |

| Bond mutual funds | 0.56 | 0.01 | 0.34 | 0.55 | 0.79 | 2.10 | 0.87 | 0.05 | 0.55 | 0.86 | 1.18 | 2.35 |

| Municipal | 0.54 | 0.06 | 0.40 | 0.55 | 0.67 | 1.00 | 0.81 | 0.09 | 0.58 | 0.82 | 0.98 | 1.25 |

| Government | 0.42 | 0.04 | 0.18 | 0.43 | 0.66 | 1.04 | 0.72 | 0.07 | 0.30 | 0.79 | 1.00 | 1.31 |

| Global | 0.73 | 0.05 | 0.52 | 0.74 | 0.94 | 1.46 | 1.10 | 0.12 | 0.81 | 1.07 | 1.42 | 1.84 |

| Investment grade | 0.44 | 0.05 | 0.29 | 0.44 | 0.60 | 0.89 | 0.74 | 0.07 | 0.50 | 0.73 | 0.98 | 1.81 |

| High yield | 0.71 | 0.01 | 0.57 | 0.71 | 0.89 | 1.24 | 1.05 | 0.63 | 0.83 | 1.04 | 1.32 | 1.66 |

Note: The investment type is obtained using the Lipper class name. The smallest 10% of the total number of funds within each asset category (equity, hybrid, bond) have been excluded from the analysis.

Source: Survivor-Bias-Free U.S. Mutual Fund Database

© 2022 The Pew Charitable Trusts

We used Pew’s fee calculator to analyze the potential aggregate cost to investors of rolling over $517.6 billion in assets from employer-sponsored retirement plans into IRAs. Here are some details about the scenario:

- Total savings: $517.6 billion

- Mutual fund assumed real rate of return: 5% per year

- Time invested: 25 years

- $20.5 billion annual withdrawals

- The mutual fund charges an annual fee of 0.46% if the money is held in the 401(k) plan, but the fee is 0.65% if the money is in an IRA. There are no front or deferred sales charges (i.e., loads).

Here are the results:

| Mutual fund in 401(k) plan | Mutual fund in IRA |

|---|---|

| Annual fee: 0.46% | Annual fee: 0.65% |

| Total fees over 25 years: $64.13 billion | Total fees over 25 years: $87.63 billion |

| Account balance at age 90: $604.88 billion | Account balance at age 90: $559.43 billion |

Difference after 25 years in account balances: $45.45 billion

Endnotes

- Investment Company Institute, “The U.S. Retirement Market, Fourth Quarter 2021” (2021), https://www.ici.org/statistical-report/ret_21_q4_data.xls.

- U.S. Government Accountability Office, “401(k) Plans: Labor and IRS Could Improve the Rollover Process for Participants” (2013), https://www.gao.gov/products/gao-13-30.

- Calculated based on data from Survivor-Bias-Free U.S. Mutual Fund Database, Center for Research in Security Prices, University of Chicago Booth School of Business, 2020.

- BrightScope and Investment Company Institute, “The Brightscope/ICI Defined Contribution Plan Profile: A Close Look at 401(k) Plans, 2018” (2021), http://www.ici.org/files/2021/21_ppr_dcplan_profile_401k.pdf.

- Investment Company Institute, “The Role of IRAs in U.S. Households’ Saving for Retirement, 2021” (2022), https://www.ici.org/system/files/2022-01/per28-01.pdf.

- Investment Company Institute, “The U.S. Retirement Market, Fourth Quarter 2021.”

- Ibid.

- Investment Company Institute, “The Role of IRAs in U.S. Households’ Saving for Retirement, 2021.”

- Investment Company Institute, “The U.S. Retirement Market, Fourth Quarter 2021.”

- Although separating employees also have the option to cash out of their plan, few choose to do so. Job changers are often under the age of 59½ and would be subject to a 10% early withdrawal penalty. Also, unless the saver was using a Roth option, the taxable nature of the cash-out incentivizes taking smaller distributions over time rather than a lump sum.

- In general, if the account balance exceeds $5,000, the plan administrator must maintain the account. See Internal Revenue Code § 401(a) (31)(B)(ii). If the balance is lower, the worker may be required to take a distribution. This may take the form of a direct distribution (which would not be subject to any early withdrawal penalty as long as the worker is age 59½ or older) or a rollover into another retirement plan (such as another employer-sponsored plan or an IRA).

- BrightScope and Investment Company Institute, “The Brightscope/ICI Defined Contribution Plan Profile.”

- U.S. Government Accountability Office, “401(k) Plans.”

- R3 and R4 shares are also institutional retirement shares that might be found in a 401(k) plan. However, they are comparatively more expensive because they have additional expenses related to marketing and payment of intermediaries. These share classes have fewer assets invested in them compared with the R5 and R6 shares that have lower expenses. (See Table 3 in the methodology section.)

- In this analysis, we focus on expense ratios. Some retail share classes have additional one-time expenses such as sales charges (or deferred sales charges), known as front or rear loads. These charges do not apply to all retail shares. To the extent that they apply, it would make the retail share comparably more expensive and our calculations more conservative. In short, we would understate the overall fee difference if a sales charge applied.

- Investment Company Institute, “The U.S. Retirement Market, Fourth Quarter 2021.”

- For illustration purposes, we use 4% of assets as the withdrawal amount, an often-used rule of thumb so as not to outlive assets. For individual investors, the recommended withdrawal amount may be different, depending on the types of investments and market performance.

- U.S. Government Accountability Office, “401(k) Plans.”

- L. Barney, “As More Retirees Remain in Plans, Retirement Income Solutions Follow,” PLANSPONSOR, April 22, 2021, https://www.plansponsor.com/retirees-remain-plans-retirement-income-solutions-follow/.