States Close Out 2020 With Widespread Tax Revenue Gains

Note: This data has been updated. To see the most recent data and analysis, visit Fiscal 50.

Despite historic declines in the first half of 2020 because of the coronavirus pandemic, tax revenue was on the mend in most states by the end of the year. Boosted by widespread gains in the fourth quarter, total state tax collections had recovered to just 1.9% below their pre-pandemic levels by the close of 2020, after adjusting for inflation, and receipts in 20 states had rebounded fully. Overall, state tax revenue has been on track to bounce back far faster than it did after the Great Recession.

A hallmark of the 2020 recession was its divergent effect on state tax revenue. At the end of December—the midpoint of most states’ fiscal years—20 states had posted greater receipts in the four quarters of calendar year 2020 than in the four quarters of 2019, just before the pandemic. In Idaho, collections were as much as 11.2% higher than a year earlier. However, most still collected less, with double-digit declines in tax revenue in five states, including a 34.4% drop in Alaska.

Three-quarters of states posted year-over-year gains in the final quarter of 2020, but it wasn’t enough to collectively overcome the steepest plunge in at least 25 years during the second quarter.

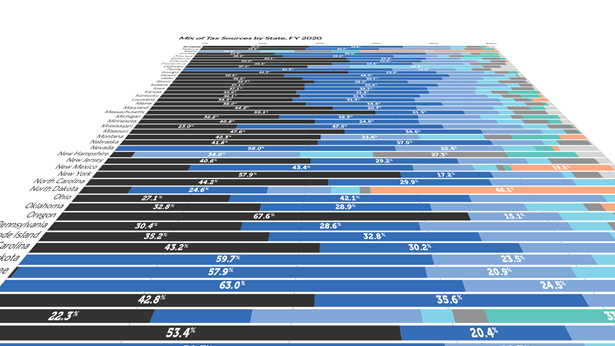

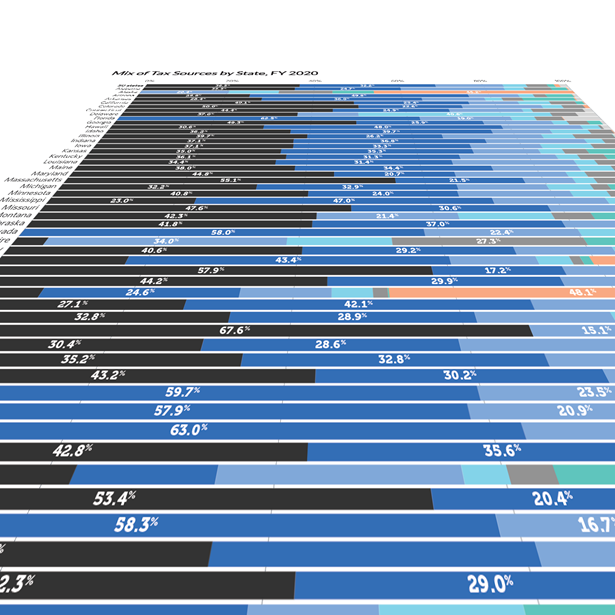

Variation in the size and speed of states’ revenue rebounds was due to a mix of factors, including each state’s economic makeup, the share of jobs that could be performed remotely, the mix of taxes imposed, and differences in COVID-19 caseloads and public health restrictions, such as temporary business closures and limits on gathering sizes.

The pandemic’s sudden onset and widespread disruptions to daily life in March 2020 triggered a sharper decline in total state tax revenue than was recorded during at least the past two recessions—though total losses have not been as deep and the recovery got off to a quicker start.

Preliminary monthly data from the Urban Institute shows total tax revenue continued to grow at least through May 2021, suggesting that quarterly collections were poised to return to pre-pandemic levels in the first half of this year—much faster than the five years it took receipts to rebound after the Great Recession.

States’ fiscal outlooks have brightened considerably in recent months with the increasing pace of vaccinations, the easing of public health restrictions, strong national economic growth, and a historic infusion of nearly $2 trillion in federal aid for taxpayers, businesses, and state and local governments through the American Rescue Plan Act of 2021.

Revenue losses have not been as dire as many states and economic experts had forecast at the outset of the pandemic, thanks to factors such as federal aid that helped support businesses and unemployed workers, a quicker fall in unemployment rates than originally anticipated, and job stability in higher-wage professions that were able to pivot to remote work.

In addition, near-record levels of rainy day funds and the significant federal aid have given states extra breathing room in their budgets that they never had after the Great Recession.

State highlights

A comparison of tax receipts in the fourth quarter of 2020 with the same period a year earlier, averaged across four quarters and adjusted for inflation, shows:

- Idaho (11.2%) and Utah (5.8%) were the only two states to post tax revenue gains of 5% or more since the start of 2020—shortly before the pandemic’s outset. The increases were due in part to much faster growth in both states’ populations and economies—as measured by state personal income—than the national trend during the same period.

- Five states were less than 1 percentage point above their pre-pandemic levels: South Carolina (0.6), Virginia (0.5), North Carolina (0.1), Ohio (0.1), and California (0.1). This is important to note because although revenue surpassed pre-pandemic levels, even a flat revenue trend can still create challenges because states depend on annual increases to keep up with growth in public services and inflation.

- Alaska (-34.4%) was furthest below its pre-pandemic level. This means the state collected only about 65.6% as much in inflation-adjusted tax dollars as it did in 2019, before the pandemic. Because it does not levy personal income or general sales taxes, Alaska is highly dependent on oil-related severance tax revenue, which began falling as production and prices declined in the mid-2010s and fell further as prices plunged in early 2020.

- Ten other states’ collections were down more than 5%: North Dakota (-25.7%), Hawaii (-15.2%), Oregon (-11.6%), Nevada (-10.9%), Texas (-8.5%), Wyoming (-8.3%), Delaware (-7.2%), West Virginia (-6.8%), Florida (-6.3%), and Oklahoma (-5.4%). Since the start of the recession, oil-producing states, such as Alaska and North Dakota, and those reliant on tourism, such as Florida, Hawaii, and Nevada, have had some of the deepest declines in tax revenue.

Recent trends

Although total tax revenue for 2020 was down compared with 2019 levels, the fourth quarter was a bright spot. Overall, collections grew 4.7% from a year earlier, solidifying states’ tax revenue recovery after historic volatility in the second and third quarters of 2020 because of the pandemic’s initial impact and a delay in the income tax filing deadline, which shifted large sums of payments from April to July.

Three-quarters of states (38) reported higher revenue in the final quarter of 2020 than at the end of 2019, just before the pandemic. Gains ranged from more than 10% in California, Colorado, Idaho, New Jersey, and Washington to less than 1% in Iowa, Louisiana, Missouri, New Hampshire, New York, and Oklahoma.

Twelve states bucked the national trend and took in less tax revenue in the fourth quarter. Declines ranged from more than 10% in Alaska (-56.9%), North Dakota (-28.3%), Delaware (-23.1%), Hawaii (-16.8%), and Wyoming (-10.5%) to about 1% in Arkansas and Oregon, mostly driven by drops in severance taxes on oil and minerals or sales taxes on goods and services.

Personal income taxes, which are the largest source of total state tax revenue, grew by 7.7% in the fourth quarter of 2020—the third-strongest gain in any quarter since early 2018, according to data from the Urban Institute. Sales taxes, which are the second-largest source, also posted a gain of 1.7%, lower than pre-pandemic growth rates but on par with the previous quarter.

Both personal income and sales taxes were expected to strengthen further as states lifted public health restrictions designed to stem the spread of the virus, unemployment rates fell, and additional federal aid flowed to individuals and businesses. Although personal income tax growth has driven states’ overall tax revenue recovery since mid-2020, sales taxes were poised to drive further gains in part because of an unleashing of pent-up consumer demand.

State budgets do not adjust revenue for inflation, so percentage changes presented here may differ from tax revenue figures in states’ documents. Without adjusting for inflation, the sum of 50-state tax revenue during the four quarters ending Q4 2020 was 0.7% below the same period in 2019, and tax collections had fully recovered in 26 states. Unadjusted figures do not take into account changes in the price of goods and services.

Adjusting for inflation is just one way to evaluate state tax revenue changes. Different insights would be gained by tracking revenue relative to population growth or state economic output.

Download the data to see individual state trends from the first quarter of 2006 to the fourth quarter of 2020. Visit The Pew Charitable Trusts’ interactive resource Fiscal 50: State Trends and Analysis to sort and analyze data for other indicators of state fiscal health.

Analysis by Barb Rosewicz, Justin Theal, and Alexandre Fall.

Fiscal 50: State Trends and Analysis

Economic Downturns: Protecting State and Local Budgets