States Forecast Wide-Ranging Effects on Revenue Since the Pandemic’s Start

Projections show stark differences in budget outlooks as Congress approves relief package

States received a huge boost when President Joe Biden signed a $1.9 trillion relief package on March 11 that provides an extra $195 billion in federal aid to help plug budget shortfalls and repair economies ravaged by the coronavirus pandemic.

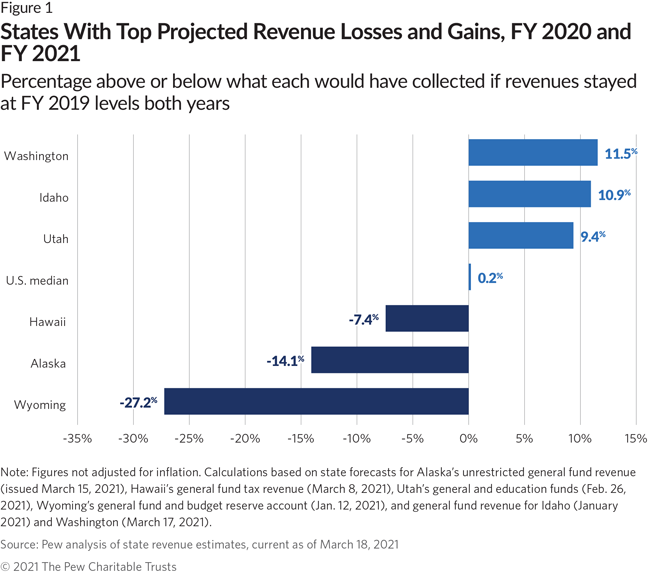

No state was spared in 2020 from the sharpest economic downturn on record, although some found themselves in much weaker fiscal positions—and more in need of federal funding—than others. A Pew analysis of the most recently revised general fund revenue forecast issued in every state finds vast differences in the projected toll of the recession over the two fiscal years since the pandemic’s start:

- 19 states projected revenue to fall in the current budget year, which typically ends June 30, with 13 of those estimating declines on top of losses last year.

- When both this and last fiscal year are considered, 23 states expect total estimated revenue to be lower than it would have been had it remained at pre-pandemic fiscal year 2019 levels, not accounting for inflation.

- A dozen states expected to maintain positive revenue growth in nominal dollars for fiscal 2020 and fiscal 2021, but generally at a slower rate than originally forecasted.

With the newly enacted federal aid package known as the American Rescue Plan, Congress acknowledges that some states were hit worse than others: More dollars are steered to states with steeper unemployment, rather than divvying up aid strictly by population. States can use the money for several purposes, including making up for lost revenue to fund government services.

Two states expecting the top total revenue losses over this and last fiscal year—Alaska and Wyoming—have seen taxes on the extraction of natural resources plummet. Wyoming’s January forecast projected a 23% revenue drop this fiscal year in the two main accounts that fund general operating expenses, following severe losses in fiscal 2020. By comparison, Idaho, Washington, and 10 other states expect to maintain positive revenue growth both years, though often at slower rates than originally forecasted. Generally speaking, states with economies less tied to energy, tourism, and other hard-hit industries have held up better.

How much states will collect remains uncertain, given the unknown course of the virus and the economic recovery, plus the inherent difficulties of accurately estimating revenue collections months in advance. State revenue forecasts, a first step in budget planning, are subject to error and fluctuating conditions. Historically, states underestimate revenue during economic expansions, but are more likely to be overoptimistic during downturns, a 2011 Pew study found.

Generally, revenue losses have not been as dire as feared at the pandemic’s outset. Still, a national projection issued by Moody’s Analytics in February predicted aggregate state government general fund revenue could fall for three consecutive years—from fiscal 2020 through fiscal 2022—with a combined revenue loss of about $100 billion. The only other time since at least 1980 that inflation-adjusted general fund revenue declined three years in a row was around the Great Recession, according to National Association of State Budget Officers (NASBO) figures.

Importantly, drops in revenue alone understate the severity of the budget challenges that led Congress to approve additional state and local aid. As many states work on next year’s budgets and make adjustments by June 30 to end the current fiscal year in the black, they’re also contending with billions of dollars in pandemic-related expenses for Medicaid, safety-net services for the jobless, and costs linked to the public health crisis, such as vaccine distribution.

States with largest projected revenue losses

At least seven states’ forecasts, most issued before approval of the latest federal coronavirus relief package, estimated general fund revenue for fiscal 2020 and 2021 that together would be more than 5% lower than it would have been had collections in both years stayed at pre-pandemic fiscal 2019 levels, not accounting for inflation.

Energy states were among the worst hit as they contended with fallout from the coronavirus and lower oil and natural gas prices that predated the pandemic and depressed revenue. Wyoming’s latest forecast projected that its two main operating accounts—the general fund and budget reserve account—would take in 27% less over this and last fiscal year than if revenue had stayed flat at fiscal 2019 levels, the sharpest loss of any state. Only six active oil and gas rigs were operating in Wyoming at the end of December, down from more than 30 throughout much of 2019, according to the state forecast.

Similar drop-offs in drilling and accompanying job losses are adding to budget pressures in Alaska and New Mexico, also among the states with the steepest revenue declines. Energy states generally have relatively large reserve funds to help weather sudden revenue swings, although Alaska has less to cushion shortfalls after significantly drawing down its savings in recent years.

States with economies reliant on leisure and hospitality also faced significant losses. In its most recent projections in early March, Hawaii expected a nearly 3% annual drop in general fund tax revenue on top of a 6% decline last fiscal year after the collapse of its tourism industry, for the third-greatest loss of any state in the first two years of the pandemic. Nevada projected general fund collections to dip further this year after falling about 5% in fiscal 2020 when casinos remained shuttered for months.

Other states forecasting among the sharpest losses since fiscal 2019 included Michigan and Oklahoma.

When forecasts were issued matters: Those published more recently tend to be more optimistic because of the improved national economic outlook. State choices of economic recovery scenarios and other assumptions used in forecasts also can lead to differences in projections. For example, Alaska’s recent forecast did not assume the latest round of federal coronavirus aid for fiscal 2021, while Oregon’s, issued last month, did anticipate another relief package.

Comparing states’ revenue to pre-pandemic levels actually understates the full severity of budget strain directly resulting from the pandemic, as most budgets were based on earlier forecasts predicting economic and revenue gains. That means even flat growth could open budget gaps. In the decade before the arrival of COVID-19, total state general fund revenue reported by NASBO climbed by about 3.8% annually on average, not accounting for inflation.

States expecting top revenue growth

Several states with strong economies leading up to the pandemic avoided a drop in total revenue.

Washington projects solid revenue growth to continue this fiscal year and, when combined with increases last year, expects to collect nearly 12% more than if collections had stayed at pre-pandemic fiscal 2019 levels, the largest two-year gain nationally. The state’s recent forecast cited strong retail sales and a booming real estate market. Idaho also projected its revenue this and last year will surpass its pre-pandemic forecast, with recent monthly tax collections still topping updated estimates.

Despite the recession, Utah similarly took in enough revenue to pass a series of tax cuts for Social Security recipients, veterans, and families with children. The state’s forecast showed general and education fund revenue over this and last fiscal year coming in more than 9% above totals if both years remained unchanged from fiscal 2019. That was up slightly from an earlier forecast issued right before the COVID-19 outbreak.

Other states that had forecast among the strongest revenue growth over the two-year period include Arizona, Nebraska, and South Dakota.

Given the additional federal aid and ramped-up vaccine rollout, many states could end up exceeding their recent projections, most of which were issued between December 2020 and early March 2021, before enactment of the most recent legislation.

Even before the latest coronavirus relief bill, states’ recent forecasts and national projections had scaled back the size of budget shortfalls predicted early in the pandemic. The fiscal picture improved in part because earlier rounds of federal aid and expanded unemployment benefits helped prop up state economies and tax revenue. Internet purchases and continued spending by higher-income Americans able to work remotely also supported sales tax revenue. Employment and the U.S. stock market further recovered quicker than many economists expected.

About the data

Pew reviewed each state’s most recent revised revenue estimate as of March 18, 2021, with most published since December 2020. Revenue figures represent net general fund revenue, except in those states where officials recommended including additional funds. Revenue losses or gains for both fiscal 2020 and 2021 were combined to account for income tax filing delays that deflated some states’ fiscal 2020 totals. The change in total revenue for fiscal 2020 through fiscal 2021 compared with fiscal 2019 levels, not adjusted for inflation, was calculated as follows: [(fiscal 2020 revenue – fiscal 2019) + (fiscal 2021 revenue – fiscal 2019)] / (fiscal 2019 revenue x 2).

Barb Rosewicz is a project director, Mike Maciag is an officer, and Alexandre Fall is an associate with The Pew Charitable Trusts’ state fiscal health initiative.