The Fiscal Landscape of Large U.S. Cities

Local governments still recovering long after Great Recession's end

Although the U.S. economy made great strides in 2014, showing the strongest growth since the Great Recession, several major cities are recovering unevenly.

Shutterstock

Overview

Although the U.S. economy made great strides in 2014, showing the strongest growth since the Great Recession, cities are recovering unevenly.

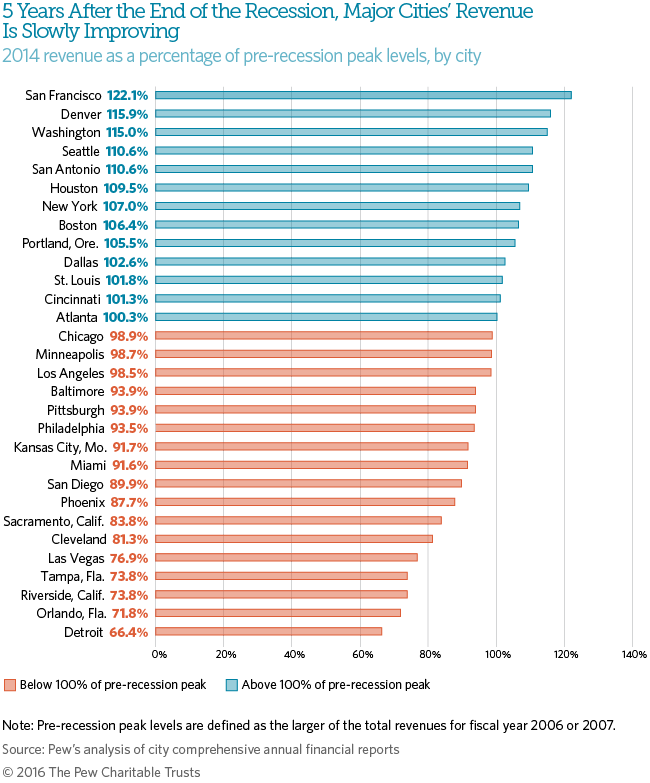

An analysis of the fiscal health of America’s 30 major cities by The Pew Charitable Trusts found that most saw their revenue and spending rise that year. In 2014, some began to surpass peaks set before the Great Recession, which ran from late 2007 through mid-2009. But many cities have not made up lost revenue. Indeed, revenue has continued to drop in some, and they have responded by cutting spending.

This chartbook updates a fiscal analysis of these cities released in April 2016. The exception is Cincinnati, which changed its fiscal year in 2013, making direct comparisons impossible. Pew examined audited city financial records and the issuance of new money bonds.

Total revenue

Thirteen cities—Atlanta; Boston; Cincinnati; Dallas; Denver; Houston; New York; Portland, Oregon; San Antonio; San Francisco; St. Louis; Seattle; and Washington—collected revenue above pre-recession peaks.

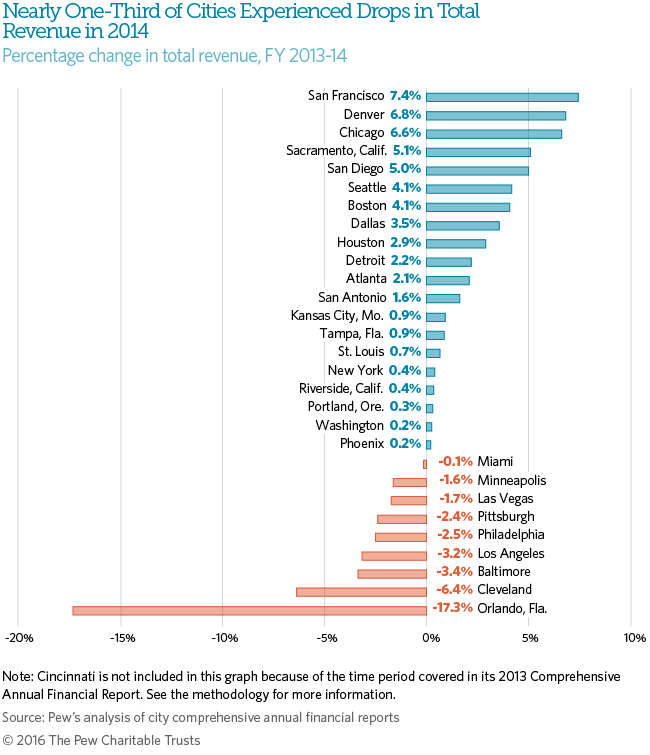

Total revenue in two-thirds of the cities (20 of 29) improved in fiscal 2014, compared with 2013. (In Cincinnati, it grew by 2.9 percent from fiscal 2012 to 2014.)

All of the cities that saw their collected revenue outpace pre-recession peaks recorded positive growth from 2013 to 2014. Only Atlanta saw its property taxes dip in 2013 (-0.4 percent).

Cities with declines

Nine cities (Baltimore, Cleveland, Las Vegas, Los Angeles, Miami, Minneapolis, Orlando, Philadelphia, and Pittsburgh) saw year-over-year drops in revenue.

Seven of these—not Baltimore and Miami—had the biggest drop in revenue since Pew began tracking these cities’ fiscal conditions in fiscal 2007. Orlando (-17.3 percent) and Cleveland (-6.4 percent) were harder hit than the other cities.

Among the seven cities hitting their revenue trough in fiscal 2014, five cities—Cleveland, Los Angeles, Minneapolis, Philadelphia, and Pittsburgh—experienced simultaneous drops in property taxes and intergovernmental funds. These are the two primary sources of revenue for most local governments. Las Vegas saw property tax collections decline to their lowest levels since fiscal 2007, while Orlando was particularly hard hit by a sharp drop in intergovernmental revenue and weak property tax growth.

Property tax

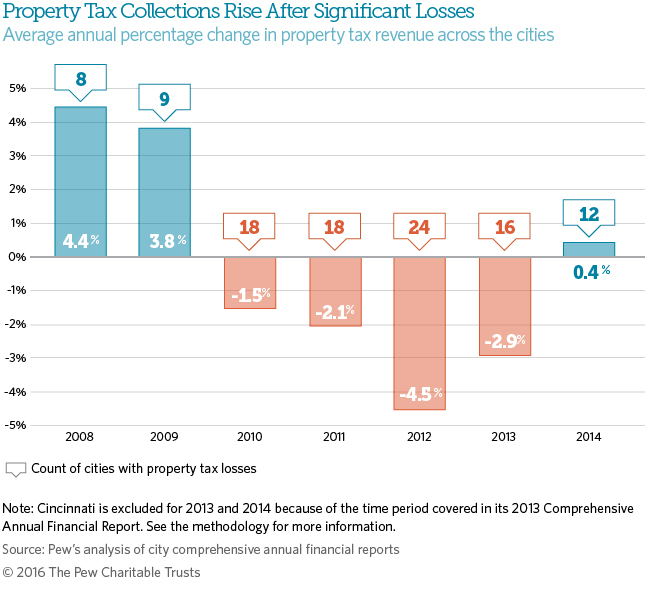

For the first time since 2009, the cities’ property tax collections grew, on average, compared with the previous year (0.4 percent).

In 2014, seven cities (Boston, Denver, Houston, New York, San Francisco, St. Louis, and Washington) saw this revenue stream surpass 2007 levels. Only Boston has seen continuous growth in its annual property tax collection since the recession. Philadelphia had its largest property tax collection in 2013, but it fell in 2014. Seattle had its largest in 2012.

Twelve cities (Atlanta, Baltimore, Cleveland, Detroit, Kansas City, Las Vegas, Los Angeles, Minneapolis, Philadelphia, Phoenix, Pittsburgh, and Riverside) saw property tax losses in fiscal 2014 compared with the previous year. However, fewer cities reported year-over-year losses in 2014, and the losses were smaller than at any other time since 2007.

Intergovernmental revenue

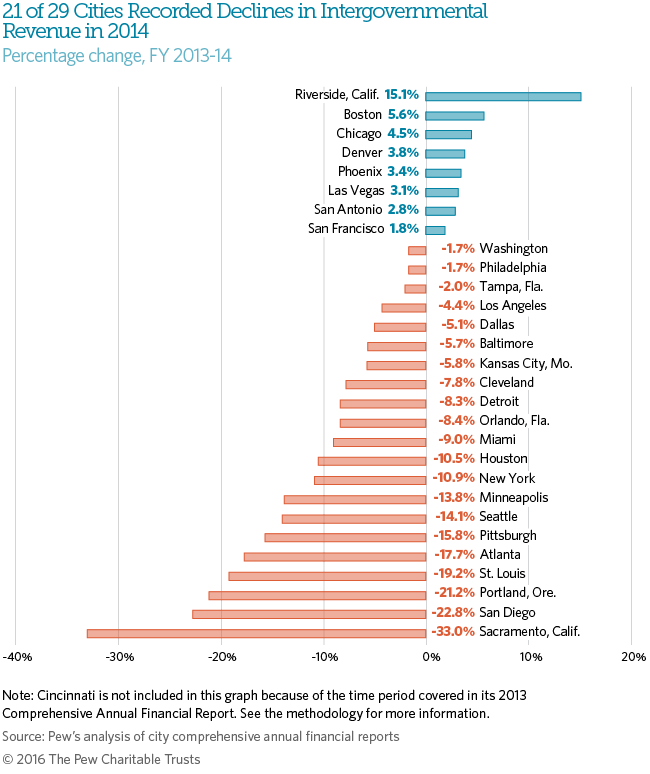

Aid to cities from the federal and state governments is a significant part of the financial picture for local governments. For most cities, it is the second-largest source of revenue. During the recession, intergovernmental aid, a source that city policymakers do not control, was a main determinant of revenue declines and rebounds in nearly half the cities studied.

In fiscal 2014, this key source of revenue continued to pose a challenge for cities. Twenty-one of the 29 cities studied recorded drops in intergovernmental revenue. The average year-over-year decline in aid from other governments was the steepest since fiscal 2008, dropping -6.9 percent from the previous year.

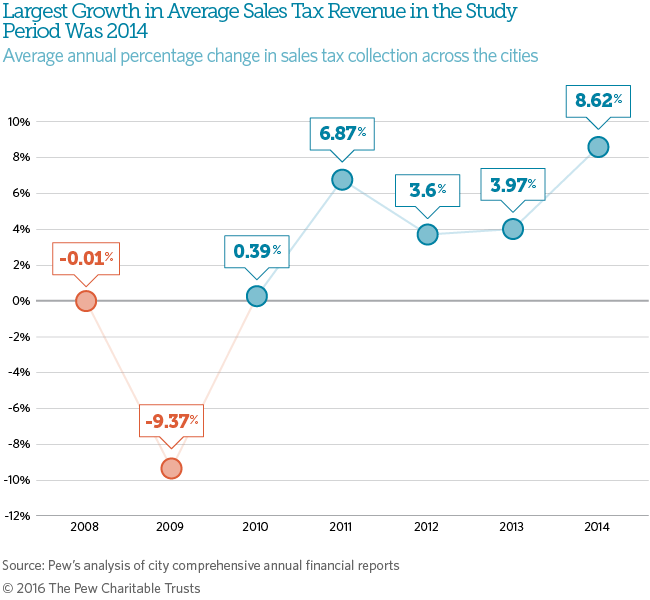

Sales tax revenue

Improving economic conditions helped to boost sales tax collections in nearly every city studied that has this revenue source.

Twenty out of 30 cities in our study collect some kind of sales tax.*

Across all of the cities, sales tax collections grew an average of 8.6 percent compared with 2013 levels—extending this trend to five straight years. Only Atlanta bucked this trend (-1.8 percent).

The 8.6 percent average year-over-year growth among the 20 cities is the largest positive change between fiscal 2007 and 2014.

* - Atlanta, Chicago, Dallas, Denver, Houston, Kansas City, Los Angeles, Minneapolis, New York, Philadelphia, Phoenix, Pittsburgh, Riverside, Sacramento, San Antonio, San Diego, San Francisco, Seattle, St. Louis, and Washington.

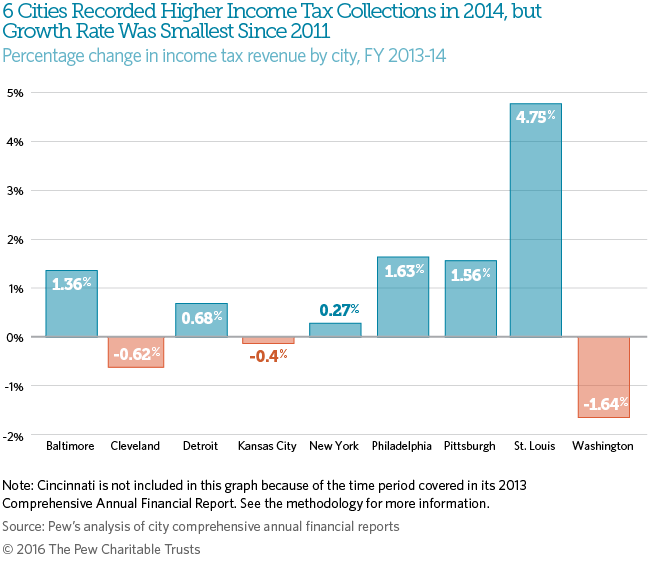

Income tax revenue

Income taxes are a key revenue source for some cities, but growth has slowed the most since 2011. Income taxes across U.S. cities are less common than other forms of local revenue—such as property taxes and intergovernmental revenue. Among the 30 cities we studied, income taxes are levied in only 10 (Baltimore, Cincinnati, Cleveland, Detroit, Kansas City, New York, Philadelphia, Pittsburgh, St. Louis, and Washington).

In these 10 cities, income taxes typically make up a large portion of municipal revenue—27 percent on average. Like sales taxes, income tax collections fell off quickly during the Great Recession but have bounced back with improving economic conditions.

Six of the cities that collect an income tax recorded higher collections between fiscal 2013 and 2014, growing at the slowest average rate (0.9 percent) since 2010, when it was -4.8 percent.

Three cities took in slightly less income tax revenue than the previous year: Cleveland (-0.62 percent), Kansas City (-0.04 percent), and Washington (-1.64 percent).

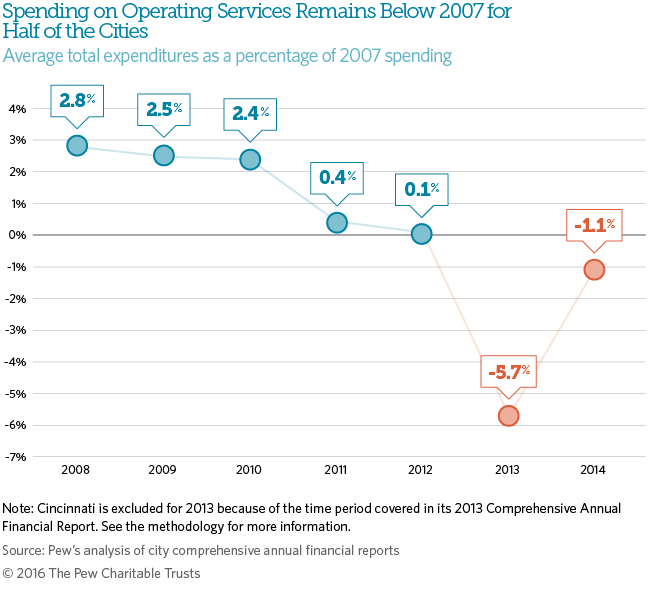

Spending trends

In fiscal 2014, spending in half of the 30 cities had not reached pre-recession levels—remaining on average -1.1 percent below 2007 levels. Strained local government budgets have continued to drive spending cuts to critical public services, such as investments in housing and community development, social services, public safety, and education.

Four cities were at an eight-year spending low in fiscal 2014 compared with 2007: Baltimore (-3.8 percent), Cleveland (-15.8 percent), Las Vegas (-13.7 percent), and Riverside (-16.3 percent).

Chicago and Detroit both registered higher spending in 2014 after two consecutive years of major cuts. Chicago increased its spending on debt compared with the previous year by 51 percent, driven by a $1.5 billion bond issuance. Detroit hiked its general government spending by 53 percent from the previous year, coinciding with its exit from bankruptcy in December.

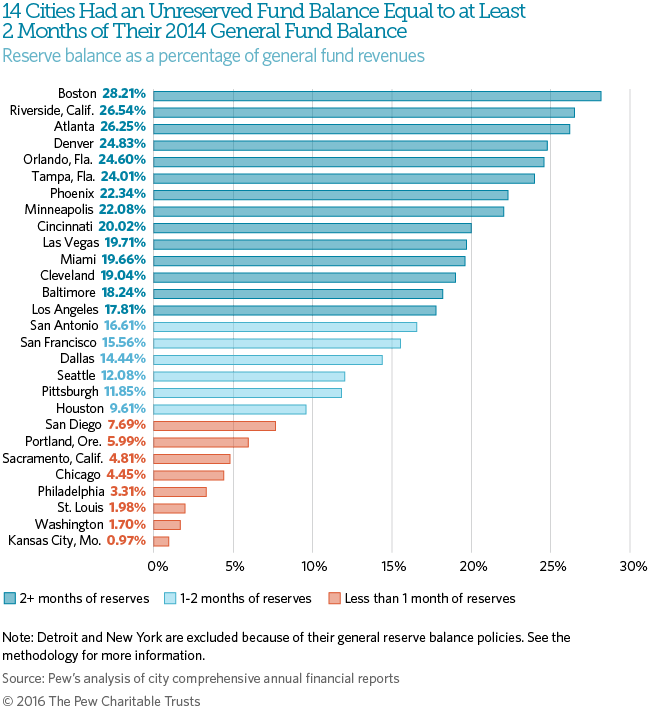

Reserve balances

Reserves are an important fiscal tool, allowing policymakers to maintain key services when revenue drops. After drawing down their reserves during the Great Recession to address historic budget shortfalls, cities have been steadily building them back up as the economy—and collections—improve. Many, however, are struggling to return to pre-recession levels.

Fourteen cities had an unreserved general fund balance equivalent to at least two months of their 2014 general fund revenue—the minimum recommended by the Government Finance Officers Association as a benchmark.

Of these 14 cities, the average balance was 22.4 percent of general fund revenue—8.7 percentage points better than the 30-city average (13.7 percent).

Balance-to-revenue ratios in 16 of the 29 cities studied remain below their pre-recession peak. Fifteen cities were at this mark in fiscal 2013.

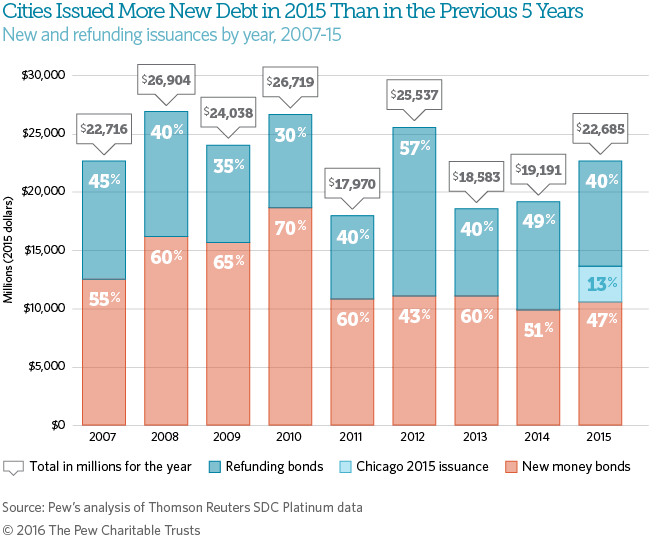

Municipal bond issuances

The 30 cities issued a combined $13.6 billion in new debt in 2015—a 38 percent increase from the previous year. This represents the largest volume of new issuances since 2010, when the federal government accelerated borrowing among state and local governments through the Build America Bonds program.

Refunding bonds, which had driven the majority of issuances in the years after the Great Recession, represented a smaller share of total activity in 2015 than in the previous year.

However, Chicago alone had an outsize impact on the 30-city picture: It issued more than a fifth of all new money bonds ($3.0 billion) as part of its attempt to address fiscal challenges. These included a required hike in pension contributions, budget shortfalls, and deferred investment in infrastructure and schools.

Methodology and definitions

The following describes the methodological approach and terms used in The Pew Charitable Trusts’ chartbook “The Fiscal Landscape of Large U.S. Cities: Local Governments Still Recovering Long After Great Recession’s End.”

The analysis, based on audited city financial statements, continues work undertaken by Pew following the Great Recession, which ran from late 2007 through mid-2009. For this multiyear series, Pew has examined data in the financial statements of the central city in each of the nation’s 30 largest metro areas as defined by the 2010 census. Though included in analyses before 2013, Cincinnati was excluded from the 2013 estimates of revenue, spending, and reserves because city officials changed its fiscal year in 2013. That resulted in financial documents that covered only six months and made it impossible to compare financial information to previous years or to other cities included in the analysis. Cincinnati was added back to the 2014 sample, but 2013-14 comparisons are impossible.1

For the final chart on municipal bonds, Pew examined 1991-2015 calendar year data from the Thomson Reuters SDC Platinum database on municipal bonds issued by the central city in the nation’s 30 largest metro areas according to the 2010 decennial census.

Data and methods

The primary data sources for this analysis are Comprehensive Annual Financial Reports (CAFRs) for fiscal 2007-14. Pew researchers collected data from the statement of revenue and expenditures and the statistical section of each city’s CAFR for every year in the study period.2 This analysis considers all governmental revenue and expenditures and is not limited to those from each city’s general fund.3 Although each city is unique, Pew organized governmental revenue and expenditure line items into major groupings that are comparable across cities. A detailed description of these groupings is given in the revenue and expenditures sections of the methodology.

Controlling for the effects of inflation enables comparisons of how fiscal conditions have changed for cities over the period studied and in relation to each other. Dollars are adjusted for inflation using the U.S. Bureau of Economic Analysis’ National Income and Product Account estimate. The same gross domestic product deflator values were used for all 30 cities in the 2014 analysis, regardless of geographic location, though each was adjusted to accommodate the appropriate fiscal year calendar in a given city. This approach avoids overstating differences between cities based solely on imperfect inflation estimates. The same adjustments were done with the 2015 data from the Thomson Reuters SDC Platinum database.4

Data limitations

There are several differences inherent to the governments of the 30 cities that data adjustments cannot standardize, such as the services they provide, the ways they generate revenue, their governmental structures, and their relationships with surrounding local and state governments. Although we have standardized the data across cities to the greatest extent possible and have consulted with the cities and adjusted data where appropriate, readers should keep these differences in mind.

In a few cases, variations from the standard methodology were required because of data constraints. Philadelphia, St. Louis, and Seattle, for example, did not break out revenue categories consistent with the detail provided by the other cities. After consulting with these cities, researchers relied on data from the supplemental statistical section of the CAFR (for Seattle and St. Louis) and detailed, supplemental financial reports (for Philadelphia). The modifications result in minor differences between the values of the line items used in this research and the values reported in the CAFR’s statement of revenue and expenditures.5

In Florida, the remittance of the city share of state-imposed taxes, specifically sales tax, utility tax, and communication service tax, is reported differently in city CAFRs, especially as it affects Miami and Tampa, Florida. In some instances, these taxes are reported as own-source revenue, though they are locally generated state revenue that the city receives from the state. Pew re-categorized and included this revenue as intergovernmental to ensure accurate cross-city comparisons.

Analytical approach

Pew researchers identified a “peak” and “trough” revenue year for each city, using inflation-adjusted dollars. Peak years could occur at any point in the study period, while trough years were defined as the lowest revenue point between 2008 and 2014; this time frame specifically targets drops in revenue during by the Great Recession.6 Next, Pew grouped cities based on 2014 revenue performance relative to each city’s prior peak to identify those experiencing a rebound—exceeding their previous revenue high points—and those still struggling to return to pre-downturn levels.

For each city, Pew examined the primary drivers of revenue loss between peak and trough years, calculated the total revenue decline, and analyzed the share of that total loss represented by each individual revenue source. Similarly, for rebounding cities, Pew identified the revenue streams that were most responsible for financial gains between a city’s trough year and the end of the study period, as well as between 2012 and 2013. This strategy allowed researchers to assess trends across cities in the types of losses that drove revenue declines and the gains that spurred rebounds.

Revenue

Pew researchers normalized revenue data reported in city CAFRs to create comparable categories that allow for meaningful comparisons across cities. While some types of revenue are reported relatively consistently across cities, in other cases Pew combined CAFR line items to create similar revenue groupings. The categories include:

- Property tax. All revenue that is raised through taxes on the value of property, including residential, commercial, industrial, and other types of property.

- Sales tax. All revenue that is raised through the direct imposition of local-option sales taxes by a city.7

- Income tax. All revenue that is raised through a city’s direct imposition of personal income and wage taxes.8

- Other tax revenue. All tax revenue raised through a city’s direct imposition besides property taxes, sales taxes, and income taxes. For many cities, this category includes special local taxes on hotels, utilities, gasoline, occupancy, alcohol, and/or gross business receipts.

- Intergovernmental revenue. All grants, transfers, and other funding streams that the city receives from other governments at all levels, including federal, state, and local. Because only a handful of cities list intergovernmental aid by source in their CAFR, it is not possible to separate federal, state, and local aid.

- Charges and fees. All funding that cities collect through the imposition of licensing and user fees, such as vehicle registration fees, traffic tickets, construction permits, fines and forfeitures, and payments in lieu of taxes.

- Other nontax revenue. All remaining types of revenue that are not captured in the other categories and that are not collected as taxes, such as donations to government by individuals, income (or loss) from investment decisions, income from the sale and leasing of city capital assets, and income from the rental of city-owned buildings.

Expenditures

Pew researchers also examined how cities responded to revenue decline and growth by looking at changes in operating spending, reserves, and the management of long-term obligations.9 Applying the same approach as with city revenue, researchers grouped CAFR line items where appropriate to create comparable spending categories across the cities. The categories include:

- Public safety. Expenditures on police, fire, emergency, and judicial services.

- Social and health services. Expenditures on hospitals, mental health, Medicaid, welfare, and public health.

- Housing and development. Expenditures on housing and economic development activities.

- Public works and transportation. Expenditures on existing infrastructure, utilities (including water and sewer/sanitation), roads, and public transportation provision and maintenance.10

- Parks, recreation, and cultural facilities. Expenditures on public parks and recreational and cultural facilities, including city-run museums, libraries, and convention centers.

- Education. Expenditures on K-12 education. While schools in 25 of the cities studied are run by separate school boards and authorities, four cities directly provide education.

- General government. Expenditures on operational functions, such as the mayor’s office, and other functions within City Hall that fall outside other major service-delivery categories.

- Debt service. Expenditures on debt, including interest, principal payments, and bond issuance costs.

- Other. All spending that does not fit into another category. It can include such things as retirement benefits (if they are not part of a separate pension fund), other employee benefits (if they are not included in the departments where the employees work), and claims and judgments.

Reserves

Pew measured each city’s available general fund balance as a percentage of total general fund revenue to account for its capacity to fund operations in the face of large and/or sustained budget shortfalls. Pew’s assessment of reserves was limited to the available general fund balance (as opposed to assessing balances across total governmental funds) in an effort to create a standardized measure across the cities.11

Endnotes

- The cities studied in the brief “Fiscal Health of Large U.S. Cities Varied Long After Great Recession’s End” are Atlanta; Baltimore; Boston; Chicago; Cincinnati; Cleveland; Dallas; Denver; Detroit; Houston; Kansas City, Missouri; Las Vegas; Los Angeles; Miami; Minneapolis; New York; Orlando, Florida; Philadelphia; Phoenix; Pittsburgh; Portland, Oregon; Riverside, California; Sacramento, California; San Antonio; San Diego; San Francisco; Seattle; St. Louis; Tampa, Florida; and Washington.

- Mandated by state law, Comprehensive Annual Financial Reports (CAFRs) are final, audited statements of city revenue, expenditures, reserves, and debt. CAFR data were chosen for two reasons. First, CAFRs present city fiscal data that have been reviewed by an outside auditor and are considered final. Other financial documents, such as budgets, are more fluid and tend to be subject to revisions throughout the year as city priorities change. Second, data in CAFRs are standardized by the Governmental Accounting Standards Board (GASB) Statement No. 11 and must comply with Generally Accepted Accounting Principles. Although there are some differences in the way CAFR data are presented from city to city, these documents are much more standardized than other city financial documents.

- The fiscal organization of large cities varies widely. For example, in Phoenix the general fund accounts for about 14 percent of total governmental revenue, while in New York the general fund represents almost 94 percent. Among the 29 cities in this analysis, the general fund typically accounts for about two-thirds of total governmental revenue, which means about one-third of fiscal activity is missed if the general fund is the singular focus of the analysis. This analysis excludes proprietary or enterprise funds generated by the city for specific purposes such as the operation of programs or agencies that are self-sustaining or revenue-positive.

- Inflation adjustments using National Income and Product Account estimates better reflect the inflation pressures facing local governments (as compared with, for example, the consumer price index) but are not a perfect measure of the “basket of goods” for which government entities are responsible. Although this analysis strives to correct for year-over-year changes in the value of the dollar, it is important to not overstate differences between city fiscal conditions based only on the value of a deflator.

- Because Philadelphia has a unique relationship with the state of Pennsylvania resulting from the ongoing existence of the Pennsylvania Intergovernmental Cooperation Authority (PICA)— formed to stabilize the city’s finances—Philadelphia’s CAFR document does not present line items for revenue either in the statement of revenues and expenditures or in the statistical section. Note that Pittsburgh also has an ongoing relationship with PICA, but it does not affect the way the city presents information in its CAFR.

- Including 2007 as a “low” will, for some cities with strong revenue performance, simply capture the earliest point in time, not the impact of the Great Recession on revenue.

- This category does not include sales tax revenue that states or counties impose and collect, and then remit a portion of to the cities. That is captured in intergovernmental aid.

- Income taxes imposed and collected by the state and/or county from which a portion is remitted to cities are captured in intergovernmental aid.

- Operating spending is defined as total governmental expenditures less capital outlays. Three cities—Atlanta, New York, and Pittsburgh—do not separate out capital outlays spending as a line item in their CAFR document, instead reporting capital spending by department in a capital projects fund. Atlanta and New York have done this for each year of the six years of analysis, while Pittsburgh began using this method in 2012. In these three cases, Pew consulted with city officials to arrive at estimates of total capital spending and to reduce expenditure line items appropriately.

- In San Antonio, spending categorized as “sanitation” in the city’s CAFR is dedicated to food inspections. As such, we have included these expenditures under the social services/health category in order to facilitate accurate cross-city comparisons. Note that for all cities, expenditures to expand infrastructure, utilities, roads, and public transportation are accounted for in capital outlays.

- Financial reporting requirements that govern the CAFR result in standardized reporting across the cities’ general fund reserves; this is not the case for balances across other funds. However, note that over the period the report examines, some cities became early adopters of GASB rule No. 54, which changes the way cities report year-end fund balances from two categories (reserved and unreserved) to four (restricted, committed, assigned, and unassigned). See Governmental Accounting Standards Board, “Summary of Statement No. 54” (February 2009), http://www.gasb.org/st/summary/gstsm54.html. For these cities, only the money reported as assigned and unassigned was included as unreserved general fund balances. This treatment is the most consistent with the previous definition and with how cities made the transition in reporting.

State Strategies to Detect Local Fiscal Distress

How states assess and monitor the financial health of local governments

Fiscal Health of Large U.S. Cities Varied Long After Great Recession’s End

Impact of economic downturn persisted for many local governments