The Need for Improved Disclosures for General Purpose Reloadable Prepaid Cards

General purpose reloadable prepaid cards are a relatively new but increasingly popular financial product. According to data, consumers loaded $64.5 billion onto these cards in 2012, up sharply from $28.6 billion in 2009.

Consumers can purchase the cards online or in retail stores and use them as substitutes for checking accounts by direct depositing their earnings, withdrawing funds at ATMs, and purchasing goods and services. The cards also can supplement checking accounts by helping consumers control their spending, because most cards do not allow consumers to spend more than the balance on the card.

However, the rising popularity of prepaid cards has not been matched by increased protection for consumers that would, for example, require uniform disclosures that clearly lay out fees, terms, and conditions.

What the Research Shows

A 2014 Pew survey, “Why Americans Use Prepaid Cards,” found that only 32 percent of consumers compared terms before choosing a card. Rather, most simply selected a card while in a store without doing any comparison shopping, or they used a card recommended by family or friends.

Pew's research also documents the lack of uniformity in the disclosure information that accompanies prepaid cards, making it difficult for consumers to comparison shop.

Prepaid card issuers disclose information in a wide variety of ways. Some cards do not disclose the fees for particular services, leaving consumers unsure about the service and its cost, if any. Nearly every prepaid card failed to disclose at least one type of fee, service, or consumer protection.

In “Consumers Continue to Load Up on Prepaid Cards,” Pew examined 66 of the most popular prepaid cards and found the following median fees to be most common:

- Monthly fee: $5.95

- Acquisition fee: $9.95

- Out-of-network or in-network ATM withdrawal: $2

- ATM transaction declined: $1

- Point-of-sale signature or PIN transaction: $1

- Point-of-sale transaction declined: $.50

- Live customer service call: $1.95

- Automated customer service call: $.50.

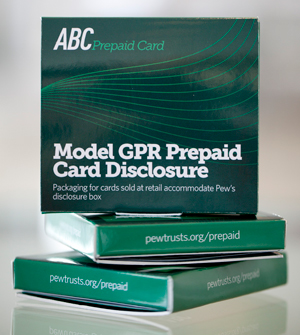

Pew's Model Disclosure Box

In an effort to improve prepaid card disclosures, Pew developed a model summary disclosure box that provides information on the key fees, terms, and conditions of the cards in a concise, easy-to-read manner. This box is based on our checking account disclosure box, which has been adopted by 26 banks and credit unions and currently covers almost 50 percent of domestic deposit volume.

Pew developed the prepaid card disclosure box to help consumers compare the terms and conditions among prepaid products, and between those products and checking accounts. This is important, because the features offered on prepaid cards are similar to those on checking accounts.

To develop the box, Pew sponsored focus groups in Baltimore, Denver, and Austin, TX, in September 2013. We brought together two groups in each city, one consisting of prepaid card users who had checking accounts and another with consumers who did not. Participants reviewed and commented on three disclosure box prototypes. The final box, pictured below, incorporates the feedback from the focus group participants.