How States Can Assess the Affordability of Their Debt

When a state government faces a large expense, officials often choose to borrow the money to pay for the project, freeing up cash on hand to meet day-to-day expenses. Borrowing for long-lasting infrastructure also spreads the cost over the generations of taxpayers who benefit from its use.

But gauging whether a state can afford to take on more debt can be difficult. Policymakers often lack the information they need to make evidence-based decisions about whether to issue bonds or how to manage existing debt in a way that aligns with their resources and spending priorities.

The Pew Charitable Trusts recently completed a 50-state study examining how states assess the affordability of their debt. It found that debt affordability studies can offer policymakers the data they need to make such decisions effectively. Debt studies help them better understand states’ long-term obligations, evaluate their capacity to repay existing debt, and inform decisions on issuing new debt—including how it can be structured.

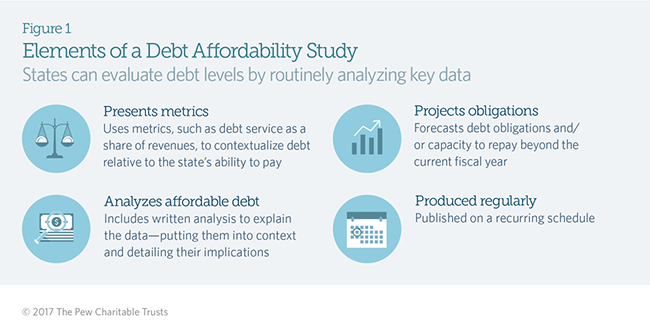

Debt affordability studies include, at a minimum, the elements outlined in Figure 1.

Pew’s research found that 27 states conduct debt affordability studies. Of those, nine lead the way by producing studies that give policymakers a clear understanding of their states’ debt levels through careful projections, smart benchmarking comparisons, multiple descriptive metrics, and analysis, among other things. The 18 other states could improve their debt affordability studies by adding elements such as an expanded scope of analysis.

When states produce thorough, easy-to-understand debt affordability studies, policymakers can access the information they need to decide how to spend limited resources. Debt studies serve as critical tools to help policymakers determine their state’s capacity for borrowing, understand debt levels relative to peer states, and connect debt to capital planning and budgeting. Policymakers can use debt affordability studies to help determine which capital projects to fund first, and how to strike the balance between issuing bonds and paying for projects with cash.

America’s Overdose Crisis

Sign up for our five-email course explaining the overdose crisis in America, the state of treatment access, and ways to improve care

Sign up

Strategies for Managing State Debt

Affordability studies can help states decide how much to borrow