Payday Loan Facts and the CFPB’s Impact

Getty Images

Getty ImagesPayday loans are unaffordable for most borrowers. CFPB’s proposal will help, but it needs to be strengthened.

This fact sheet was updated May 26, 2016, to reflect new data released by the Center for Financial Services Innovation.

Pew has conducted extensive research on the high-cost small-dollar loan market over the past five years. The findings show that although these products offer quick cash, the unaffordable payments lead consumers to quickly take another loan to cover expenses. Twelve million Americans take out payday loans each year, spending $9 billion on loan fees.

The Consumer Financial Protection Bureau (CFPB) is expected to release new rules this year that will transform the market for payday, auto title, and other small-dollar loan products. The data below provide facts on the market and borrower usage, plus a brief review of the CFPB’s proposed framework to regulate payday and auto title loans.

Most borrowers pay more in fees than they originally received in credit

- The average payday loan borrower is in debt for five months of the year, spending an average of $520 in fees to repeatedly borrow $375. The average fee at a storefront loan business is $55 per two weeks.

- Payday loans are usually due in two weeks and are tied to the borrower’s pay cycle. Payday lenders have direct access to a borrower’s checking account on payday, electronically or with a postdated check. This ensures that the payday lender can collect from the borrower’s income before other lenders or bills are paid.

- A borrower must have a checking account and income to get a payday loan. Average borrowers earn about $30,000 per year, and 58 percent have trouble meeting their monthly expenses.

- Although payday loans are advertised as being helpful for unexpected or emergency expenses, 7 in 10 borrowers use them for regular, recurring expenses such as rent and utilities.

- Auto title loans are similar to payday loans, except that the average loan is $1,000 and is secured by a borrower’s car title. Roughly 2.5 million Americans spend $3 billion on auto title loan fees each year.

- Payday loans are available in 36 states, with annual percentage rates averaging 391 percent. The other states effectively prohibit these loans by capping rates at a low level or enforcing other laws.

Payday loans are unaffordable for most borrowers

- The average payday loan requires a lump-sum repayment of $430 on the next payday, consuming 36 percent of an average borrower’s gross paycheck. However, research shows that most borrowers can afford no more than 5 percent while still covering basic expenses.

- As a result, most borrowers renew or reborrow the loans. This explains why the CFPB found that 80 percent of payday loans are taken out within two weeks of repayment of a previous payday loan.

- The payday lending business relies on extended indebtedness: three-quarters of payday loans go to those who take out 11 or more of the loans annually.

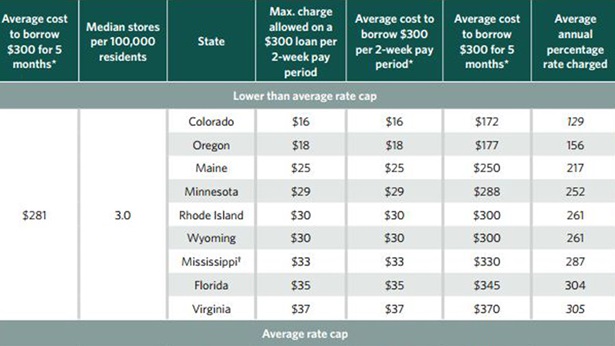

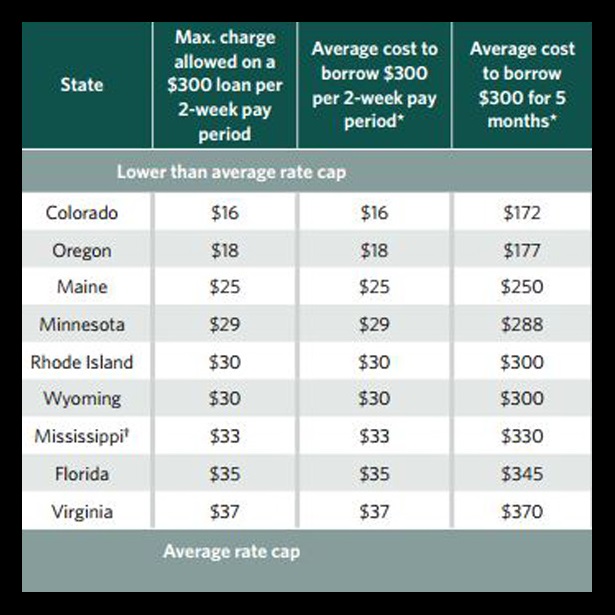

- The payday loan market is not price competitive. Most lenders charge the maximum rate allowed under state law. States without rate limits have the highest prices.

Colorado’s payday loan reform improved affordability, lowered prices, and kept credit available

- In 2010, Colorado law replaced conventional two-week payday loans with six-month installment payday loans at interest rates almost two-thirds lower.

- Access to credit remains widely available in Colorado. Although half of the payday loan stores closed, the other half now serve twice as many customers at each location, and 91 percent of residents still live within 20 miles of a store.

- Average borrowers now pay 4 percent of their next paycheck toward the loan instead of 38 percent.

- Borrowers save money by repaying the loans early, and 75 percent do so.

- Borrowers save more than $40 million annually on the loans.

CFPB’s proposal will help, but it needs to be strengthened

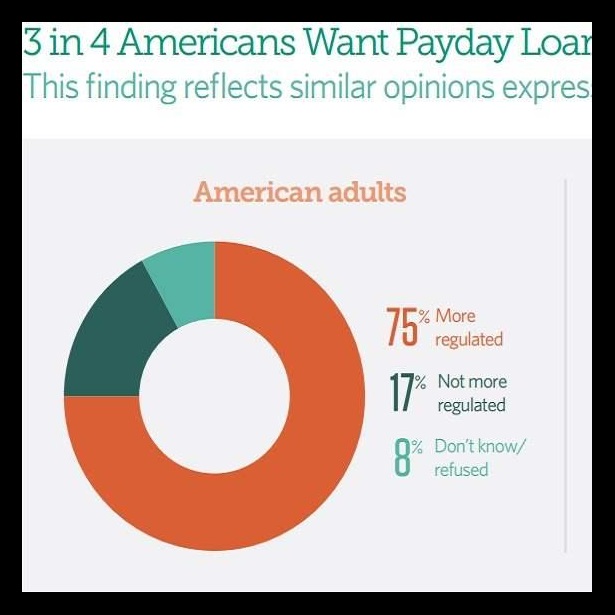

- 75 percent of all Americans favor more regulation of payday loans, and there is strong public support for the CFPB’s proposal to allow loans to be repaid in affordable installments.

- Borrowers overwhelmingly want reform, with 8 in 10 favoring requirements that payments take up only a small amount of each paycheck and that borrowers be given more time to repay their loans.

- The CFPB’s proposal will set a new national minimum safety standard. But high-interest payday and auto title loans will continue to exist where permitted by state law.

- The most dangerous loans under the CFPB framework would be those with no limits on cost, duration, size, payment size, or access to a customer’s account if the lender verifies the applicant’s income and a few expenses. These loans could go on for more than a year at 400 percent interest.

- The safest loans would be those that follow national credit union guidelines or that limit payments to 5 percent of income, and loan duration to six months. These rules would provide a pathway for banks and credit unions to offer customers lower-cost installment loans.

- Pew’s analysis of the initial proposal recommends a stronger ability-to-repay standard in the CFPB rule and clearer guidelines to prevent unreasonable loan durations, unaffordable payments, and lender abuse of checking account access.

- Pew supports the CFPB’s clear standards that enable lower-cost loans with affordable payments at 5 percent of a borrower’s monthly income and a reasonable term of up to six months.

Understanding the CFPB Proposal for Payday and Other Small Loans

Learn More

Federal Rules for Small Loans

This video is hosted by YouTube. In order to view it, you must consent to the use of “Marketing Cookies” by updating your preferences in the Cookie Settings link below. View on YouTube

This video is hosted by YouTube. In order to view it, you must consent to the use of “Marketing Cookies” by updating your preferences in the Cookie Settings link below. View on YouTube