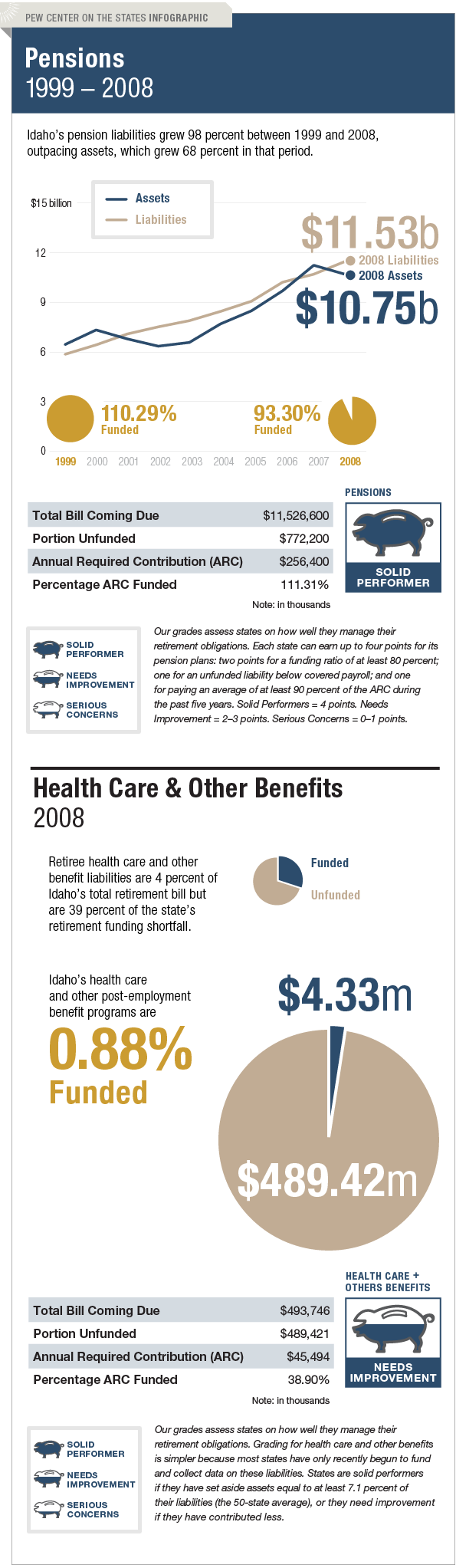

The Trillion Dollar Gap: Idaho

Underfunded State Retirement Systems and the Roads to Reform

Idaho is a top performer when it comes to managing its long-term pension liability, but needs to improve how it handles the bill coming due for retiree health care and other benefits. The state has consistently met or surpassed its actuarially required contribution levels each year since 1997, and it has funded 93 percent of its total pension obligation—well above the 80 percent benchmark that the U.S. Government Accountability Office says is preferred by experts.

Idaho is one of only three states (along with Oregon and West Virginia) in which pension assets reflect the market value—meaning that these states do not average gains and losses over a set period of time. This means that the state's pension system is likely to show a greater drop in funding next year than that of other states, but it also is likely to report a quicker recovery.

Idaho has relatively limited long-term liabilities for retiree health care and other benefits, and it is one of 29 states to set aside any funds to cover these costs.