Residential Taxes: A Narrowing Gap Between Philadelphia and its Suburbs

From 2000 to 2012, the residential tax burden fell in Philadelphia and rose in many suburbs, leaving the city more competitive on local taxes with its neighboring municipalities.

This is one of the key findings of "Residential Taxes: A Narrowing Gap Between Philadelphia and its Suburbs," a study of state and local tax burdens that set out to determine how much a hypothetical home-owning family paid in Philadelphia compared to the suburbs, and how the city-suburban tax gap has changed in recent years for both commuters and noncommuters.

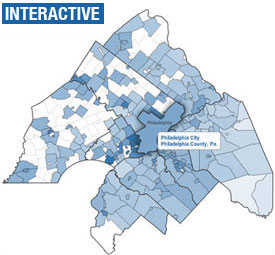

Click on the image to access an interactive graphic featuring 237 municipalities and their tax burdens for 2000 and 2011/2012. |

Our study of 237 municipalities in Pennsylvania and New Jersey found that the tax disadvantage of living in Philadelphia vis-á-vis the suburbs declined markedly between 2000 and 2012 and disappeared in some cases. In 2000, compared to the taxes imposed on noncommuters in the various suburbs, Philadelphia imposed the region's third-highest tax burden on residents. In 2012, it had the 48th-heaviest burden. Driving the improvement in the city's relative position was the fact that the city lagged behind most of the suburbs in raising property assessments in line with market values over the 12 years. In addition, Philadelphia lowered its wage tax slightly, while many Pennsylvania suburbs raised their earned income taxes.

This year, the highest average tax burdens in the region were paid by individuals commuting from the Pennsylvania suburbs to jobs in Philadelphia. Purely from a tax-cost standpoint, those families would have saved money by living, as well as working, in the city instead of commuting from the suburbs. They would have saved even more money had they found comparable-paying jobs in most suburbs.

Our results are expressed in terms of the percentage of household income that a four-person, middle-income family would pay in taxes in each municipality. Three taxes were included: local taxes on property; local and state taxes on earned income or wages; and local and state sales taxes on consumer purchases. We set the family's total earnings at $60,000 in 2012 and $47,500 in 2000, which were roughly the regional medians for each year. In line with the regional averages, we assumed the market value of the family's home was 3.1 times its income in 2012, or $186,000, and 2.3 times its income in 2000, or $109,250. Then we created three scenarios for the family's home and work location: the family's home is in the suburbs and its adults work in Philadelphia where they pay the city's nonresident wage tax (suburban commuters); the family's home and jobs are both in the suburbs (suburban noncommuters); and the family's home is in Philadelphia and its adults work either in the city or suburbs (city residents).