Local Tax Limitations Can Hamper Fiscal Stability of Cities and Counties

3 ways states can help localities improve budget flexibility and resiliency

Overview

As the COVID-19 pandemic continues, local governments across the country face the formidable task of committing resources to rising health care needs while maintaining services their communities expect, including schools, parks, and libraries. At the same time, the pandemic has created significant economic uncertainty for local leaders, with many experiencing large revenue shortfalls that make balancing budgets all the more difficult.

When local governments struggle, states pay a price, too—because of lost jobs, reduced tax collections, diminished services, and, in extreme cases, costly state bailouts. To minimize harm during economic downturns and support localities’ financial stability over the long term, states could review any policies that restrict local budget flexibility— including the policy that is the focus of this issue brief: limitations that states impose on local taxation.

Every state limits the revenue-raising capacity of its local governments, which include municipalities and counties,1 to some degree. For example, a state may prohibit localities from levying a tax entirely; restrict the tax rate, tax base, or total taxes collected; or require dollars to be used for specific purposes. Many local governments are subject to multiple constraints.

Limits on local taxation reflect both the role of state governments in our federalist system as well as concerns of policymakers and taxpayers over rising tax burdens. However, through a literature review and interviews with state and local officials and experts, researchers from The Pew Charitable Trusts found that tax limitations have in some cases created significant budget challenges for local governments and amplified existing ones.

Using examples from several states, this brief examines how these limitations can create long-lasting fiscal challenges for localities. The brief then outlines three strategies that states can consider to help localities manage the current downturn and beyond:

- Temporarily lift limitations to give local officials more options for responding to extraordinary fiscal challenges, including recessions and natural disasters. For example, states could allow localities to pass temporary tax changes or use revenue that is normally restricted to specific functions for other purposes.

- Adjust limitations that may prevent local government revenue from fully recovering after a downturn. In other words, states can allow tax revenue to grow as the economy recovers.

- Increase local budget flexibility in the long term. For example, states can provide financial aid to local governments to mitigate the impact of tax limitations or offer relief from state mandates that increase costs for localities.

The landscape of local tax limitations

Property taxes have long been the main pillar of local government finances in the United States. State limits on those taxes can be traced to the 1800s and gained momentum into the first half of the 20th century, spurred on by Americans’ economic struggles during the Great Depression.2 The popularity of these limits among state policymakers persists: In 2019, Texas lawmakers passed a bill that tightened limitations on the growth of local property tax revenue.3

States have adopted these limits in part because residential property taxes are often unpopular with taxpayers. Because property taxes depend on home values that may not reflect a homeowner’s income level, they can be a burden for lower-income households, whose homes also account for the majority of their wealth.4

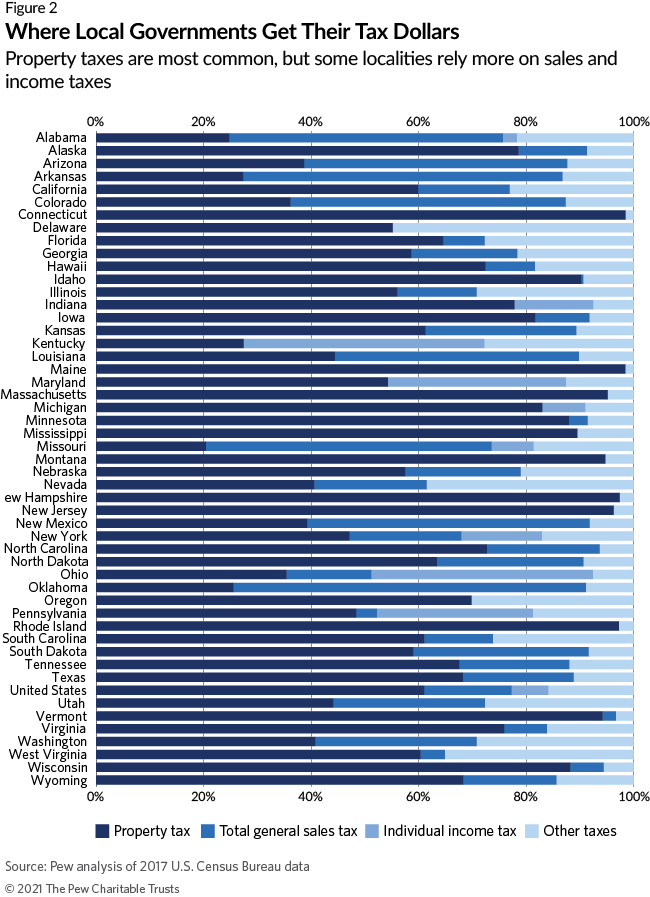

While states have sought to curb the growth of property taxes, they have also limited the ability of local governments to adopt alternative revenue sources. Most local governments are still allowed to collect only one or two of the three major taxes (property, sales, and income taxes).5 These fiscal restrictions also extend in many cases to smaller tax streams, such as excise taxes. The range of these limitations on local taxation reflects efforts by state leaders to increase government accountability, restrain the growth of government, prevent mismanagement of local finances, and boost a state’s ability to attract individuals and businesses.

Some limitations apply to all local governments within a state, while others differ among municipalities and counties. Some states also make exceptions for certain jurisdictions. The rise of home rule provisions in the early 1900s, used to extend the governing authority of local governments, has given some localities more fiscal tools than others. Ohio municipalities, for example, levy an income tax, which has become a growing revenue source as the state has sought to limit local property and sales tax bases.6

In some cases, states allow local governing bodies such as city councils to override a limitation with a simple majority or supermajority vote. But often, state law dictates that increased local taxing authority or local tax changes must either be voter-approved or enacted by the state legislature. Ballot initiatives have also codified local tax limits in state law, in some cases creating constitutional amendments that can be changed only through voter approval.

Local tax limitations: a primer

Property taxes

For cities and counties, property tax revenue makes up 61% of own-source tax revenue—revenue from taxes the local government levies—by far their largest tax source.7 At the same time, most states place restrictions on local property taxation, with limits that fall into three main types: rate limits, assessment limits, and levy limits. In many states, local governments are subject to more than one property tax limit. Michigan, for example, imposes all three types of limitations on its localities.

Property tax is calculated based on two components: the assessed value of the property, which is determined by the local assessor as a percentage of the home’s market value, and the tax rate, usually expressed as what’s known as a millage rate, which is the amount a homeowner pays per $1,000 of the property’s assessed value. For example, an amount of $10 for every $1,000 of assessed value is expressed as 10 mills.

Rate limits are typically caps on how high the millage can go within a jurisdiction. Assessment limits restrain the growth of the property value of individual homes (commonly measured as year-over-year increases). Levy limits restrict the amount or growth of total collections from a locality’s property tax. For local governments that develop their budgets around how much property tax revenue they will bring in each year, levy limits are in effect spending limits. Assessment and levy limits may be a fixed percentage or tied to an economic indicator such as inflation or growth in new construction.

Sales taxes

Although the property tax remains the primary source of tax revenue for local governments in most states, 35 states had some amount of local sales tax collections as of 2017, the most recent year for which complete data is available.8 And as with property taxes, local control of sales taxes is often limited. Many states limit the rates that can be set. Some states also cap the combined sales tax rate of overlapping jurisdictions. In Texas, the total local rate—summed for any city, county, transit district, and special purpose district that overlap at a given location—can’t exceed 2%.9

Often, states require local governments to restrict their sales tax revenue to specific uses: California, Mississippi, and North Carolina, for example, require their counties or municipalities to use sales tax revenue for infrastructure needs.10 And some states don’t allow the revenue from local sales tax to flow entirely to that government’s coffers; North Carolina counties, for example, are required to allocate a portion of their sales tax revenue to the municipalities within their borders.11

What’s more, many local governments have little discretion over the transactions they can tax; a locality may have only the option to adopt the same tax base as its state, with the state assuming responsibility for collecting the local taxes, a practice designed to reduce the burden of administration and compliance on government and businesses. If a state does not tax services, such as personal care and financial services, its local governments likely do not, either, though there are exceptions: Home rule municipalities in Colorado, for example, have the power to set their own sales tax base.12 Finally, states may have highly restrictive criteria around which jurisdictions can levy a sales tax, such as the “resort tax” Montana allows in communities that “meet specific population and economic conditions.”13

Income taxes

At the local level, the personal income tax is the least common of the three major taxes. Local governments in four states—Kentucky, Maryland, Ohio, and Pennsylvania—brought in a quarter or more of their own-source revenue from income taxes in 2017, the most recent year for which complete data is available.14 States may also give income taxing authority only to select jurisdictions; in New York state, for example, only New York City and Yonkers are allowed to impose city income taxes.

Common limitations that states place on local income taxes include parameters around the tax rate that can be set and the base that can be taxed. Although local income tax bases often include wage income, there are exceptions, such as the “intangibles” tax Kansas allows, which applies only to gross earnings from intangible property such as savings accounts, stocks, and bonds.15 While income taxes are typically levied on residents, some localities, such as cities in Ohio, can tax the income of nonresidents who commute in for work.16

Examples of how state revenue limits can hamper local fiscal stability

State limits on local taxation can restrict the ability of localities to fulfill the growing public demand for services. For example, revenue caps are often based on the inflation in prices of consumer goods and services, which tend to grow at lower rates than many of the costs that governments face, particularly health care.

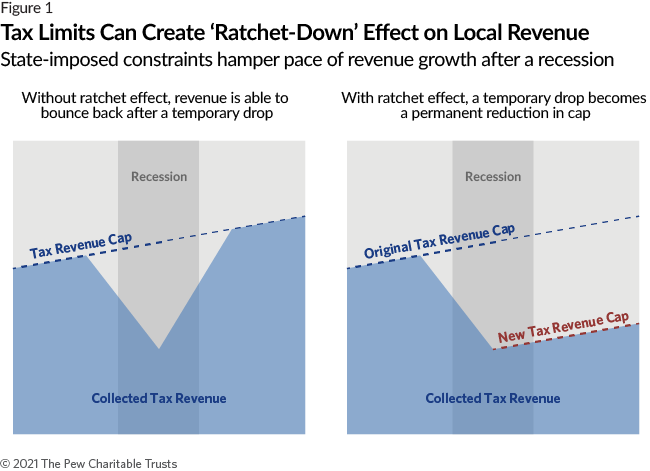

Limitations can also curtail the ability of municipalities and counties to prepare for and recover from recessions. When revenue declines—as it tends to do during an economic downturn—certain limitations on local taxation can keep revenue from fully rebounding, leaving it at an artificially low level even as the economy grows. This socalled “ratchet-down” effect can continue to damage a locality’s revenue base over multiple cycles of economic recession and expansion.

Furthermore, state restrictions on the number and types of taxes that local governments can levy have the effect of shrinking the options that local officials can use to respond to changing economic conditions. “All [of our] taxes are limited in one way or another,” said Geoff Neill, a legislative representative for the California State Association of Counties. “Counties have essentially no budget flexibility at all. They can’t decide how much revenue they want; they just look at how much they will be getting, and budget based on that.”17

In addition to creating year-to-year budget challenges, tax limitations may also affect how well local governments manage long-term liabilities such as public employee pension obligations. Moody’s Investors Service considers tax caps in its evaluation of the credit quality of local government debt, for example.18 Tax limitations lower credit ratings when they restrict financial flexibility and make it difficult for a locality to maintain healthy reserves. Moreover, reduced flexibility may force local governments to use debt rather than cash to address infrastructure needs, which can lead to rising debt burdens that may become unaffordable.19

The following examples demonstrate how some of these challenges have played out around the country.

Michigan

Two property tax limitations in Michigan have led to ratchet-down effects on local revenue. Property values tend to fall temporarily during recessions. But as those values start recovering with the economy, one limitation in Michigan restricts growth in the taxable value of individual parcels while the other requires rate reductions when there is substantial growth in the local housing market overall.20 As a result, in 2019, some communities in the state still had not seen property tax revenue return to 2008 levels, even though real estate values had recovered.21

Michigan’s local governments are constitutionally required to balance their budgets.22 To do so with little revenue flexibility means cutting expenses and chipping away at the local services that residents expect, such as parks and fire protection. Anthony Minghine, deputy executive director of the Michigan Municipal League— an organization that represents the interests of the state’s municipalities—notes that “everyone has a stake in having communities that work and function appropriately.”23 He adds that one long-term consequence of cutting services is that it can make a community less desirable, which further erodes the tax base and creates a negative cycle that’s hard for a locality to break.24 What’s more, this challenge often besets communities that were among the state’s less affluent even before the onset of fiscal problems.

A 2018 analysis by Michigan’s Treasury Department also showed that although the state’s overall local fiscal health has improved since the Great Recession, some communities remain in distress.25 Analysts traced these challenges back to the early 2000s, when the state began to reduce revenue sharing with municipalities, pension and retiree health care costs started to rise, and economic growth slowed. Given these enduring risks to local fiscal health—and inevitable future challenges—the department called on the state to “ensure the local government system is as robust and resilient as possible to economic shocks.”26

Colorado

The state’s Taxpayer’s Bill of Rights—commonly known as TABOR and enacted in 1992—features a strict constitutional limit on revenue growth while also requiring new taxes and tax increases to be approved by voters. Because the TABOR limit for a given year depends on the prior year’s spending level, it also leads to a ratchetdown effect during recessions when budgets shrink.27

Given the severity of the revenue growth limit, cities and counties across Colorado have appealed to voters to change or eliminate the cap. So far, 51 out of 64 counties and 230 out of 274 municipalities have secured voter approval for retaining revenue in excess of the limit, increasing taxes, or enacting new levies—though in many cases these measures are temporary, attached to a specific revenue stream, or both.28 For example, much of Boulder’s sales tax is restricted to specific purposes such as acquisition, maintenance, and programming of open space and mountain parks.

The pandemic provides a dramatic example of how TABOR can amplify recessionary pressures. “For municipalities that have not [voted to exempt themselves from TABOR limits], if they saw a 10% decrease this year in sales tax revenue like we have and then it bounced back next year, [the increase] would be limited to inflation plus a measure of local growth,” said Cheryl Pattelli, chief financial officer for the city of Boulder. “So, basically, they wouldn’t get back what they lost.”29

Tax limitations in Colorado have also caused greater challenges for communities that are among the state’s less prosperous. The Gallagher Amendment, which voters repealed last November, aimed to protect homeowners from rising property taxes by fixing the ratio of residential to commercial taxable property values—so when residential values grew, the residential assessment rate decreased to maintain that ratio.30 But because this restriction was tied to the value of property statewide, as booming housing markets in places such as Denver drove up total property value, the Gallagher Amendment significantly reduced taxable value elsewhere. Colorado’s legislative council staff wrote in July 2020, before the repeal, that the amendment had created stark regional disparities: Slow-growing counties saw their tax bases shrink by as much as half from 2004 to 2019, while other counties grew their tax bases, some by greater than 50%.31 What’s more, many of the struggling communities are small and rural, with little commercial real estate to depend on for additional revenue.32

The scope of local government authority in the United States

The power to grant authority to local governments is reserved for states under the 10th Amendment of the U.S. Constitution, and because of subsequent court decisions, this authority is now defined as one of two types, either home rule or Dillon’s Rule.33 As a result, state-local relations and the degree of local discretion vary widely across states.

Dillon’s Rule stems from two court decisions issued by Judge John F. Dillon of the Iowa Supreme Court in 1868 and affirms that a local government can only exercise powers explicitly authorized by the state. For any additional authority, localities must secure permission from the state legislature.

Beginning in the 1900s, the inflexibility of Dillon’s Rule prompted many states to enact so-called “home rule” provisions, delegating state power to their local jurisdictions without requiring them to seek legislative permission. Although home rule tends to increase local autonomy, especially over governing structure, tax policy authority typically remains limited. Even those localities with more fiscal freedom are subject to a restricted set of policy tools defined in their state’s constitution.34 The practical distinction between home rule and Dillon’s Rule is not always straightforward: Home rule status does not preclude states from adding restrictions, and some local governments under Dillon’s Rule may enjoy relatively broad freedom to make certain decisions.

Although the majority of states adhere to Dillon’s Rule, some of those states have nonetheless designated select localities as home rule.35 For example, Illinois uses a population threshold to grant home rule status to cities and counties with relatively large populations.36

New York

A law that took effect in 2012 restricts property tax revenue growth in New York to the lesser of 2% and the prior year’s inflation rate.37 “[Inflation] has been as low as 0.1% or 0.2%, which essentially means a municipality can’t increase its levy at all,” said Barbara Van Epps, deputy executive director of the New York State Conference of Mayors. “So [city officials] have to be able to explain to residents, ‘Look, we’re overriding [the cap] so we can keep collecting garbage and keep the streetlights on and keep our parks clean.’”38

The Office of the New York State Comptroller has assessed the fiscal health of the state’s local governments each year since 2012.39 “What we often find for local governments in stress is that they have high fixed costs that they fund with limited revenue options,” said Tracey Hitchen Boyd, the assistant comptroller for the Division of Local Government and School Accountability. “The tax cap is a limit on flexibility—flexibility that may be greatly needed.”40

The state also imposes a constitutional limit on total property tax revenue in a single year, currently set at 1.5% to 2.5% of real property value.41 If a locality exceeds the limit, the state withholds its aid payments to the locality by the excess amount. Since the limit depends on property values, it fluctuates with the local housing market, meaning a downturn in values can push a community closer to its limit.

Along with the 2012 growth cap, the single-year limit only makes it harder for local governments to use property tax revenue to shore up their budgets when taxes that are more sensitive to changes in the economy, such as the sales tax, dip. The pandemic, for example, has led to local sales tax revenue across New York being down nearly $1.6 billion from January through October 2020 compared with the same period in the previous year.42

Wisconsin

During a statewide period of rapid economic growth, Wisconsin capped annual property tax revenue increases at the rate of new construction (calculated as the value the construction adds as a percentage of total taxable property).43 But the Great Recession ended the boom and, years later, growth in many communities remains sluggish. In 2018, the Wisconsin Policy Forum—an independent policy research organization—found that for over 60% of cities and villages, the average rate of new construction from 2012 to 2017 was 1% or less. That means that under the state’s cap, property tax revenue growth didn’t even keep pace with inflation for most of that period.44

Even in the capital city and university town of Madison, for example, with its relatively strong and stable economy and robust development, new construction has amounted to only 1% to 2% of total taxable property value annually in recent years.45 According to city finance director David Schmiedicke, the corresponding constraint on property tax revenue growth has made it hard to finance wage increases for city staff and spending initiatives such as expanding the transit system. At the same time, the taxes Wisconsin cities can levy are extremely limited. Schmiedicke added that while the one-time aid to local governments under this year’s American Rescue Plan Act will help Madison recover from the pandemic’s short-term impacts, the city’s budget will continue to face significant structural challenges because of the state’s constraints on local revenue.46

Pennsylvania

The Keystone State limits local governments to a few broad-based revenue sources, for which the tax rates are capped.47 Andrew Sheaf, a local government policy manager with the state’s Department of Community and Economic Development, helps localities in fiscal distress get back on their feet through the department’s Act 47 program,48 which allows for tax increases beyond the state’s cap—a solution that is often needed to help a distressed locality balance the following year’s budget.

From Sheaf’s experience, local governments would benefit from more revenue flexibility: “I think there’s value to having locally elected officials being able to look at their tax structure, their population, and make their own decision in terms of what the right tax structure should be,”49 he said.

Absent this flexibility, Pennsylvania localities can face a set of hard choices when trying to balance their budgets. Although they can raise rates on property taxes up to a limit, the challenge then becomes whether homeowners can afford the increases—especially the significant share of older residents who are out of the workforce and have relatively low incomes.50 But given the lack of alternative revenue options, not increasing property taxes may require service cuts that affect quality of life. Ultimately, said Amy Sturges, director of governmental affairs for the Pennsylvania Municipal League, either option—increasing property taxes or reducing services—could drive away current residents and discourage people looking to move into the community, which could erode the tax base over time.51

In the wake of the pandemic, cities with long-standing financial issues are now facing multimillion-dollar deficits and considering major spending cuts, said John Brenner, the league’s executive director designate. “In Pennsylvania, we seem to lag behind a recession. We have issues years after recession numbers start to change. Local leaders will have to wrestle with [the current crisis] for multiple years.”52

States can consider increasing local budget flexibility

As cities and counties begin to recover from the pandemic and recession, states can strengthen the capacity of their local governments to respond to fiscal challenges in three ways:

1. Temporarily lift tax limitations to give local officials more options for responding to extraordinary fiscal challenges, including recessions and natural disasters.

States can give their localities more room to maneuver by temporarily lifting certain revenue restrictions—on a case-by-case basis or in reaction to a recession or natural disaster.

Some states have already put this idea into practice. Governor Phil Murphy signed legislation in August 2020 to allow New Jersey’s local governments to borrow for pandemic-related expenses and back those bonds with property taxes that do not have restrictions.53 In Texas, the 2019 bill that tightened the property tax cap makes exceptions for emergency declarations (though policymakers are currently debating whether the pandemic applies).54

Pennsylvania’s Act 47, enacted in 1987, assists local governments that the state designates as financially distressed and grants them options to raise revenue beyond what is normally allowed.55 Implementing Pennsylvania’s approach, however, requires the state to monitor local finances closely and regularly. More importantly, policymakers could take action to give a locality more fiscal options well before it falls into financial distress.

2. Adjust limitations that may prevent revenue from fully recovering after a downturn.

As local governments in Michigan and Colorado can attest, certain tax limitations can erode revenue over time and create fiscally unsustainable conditions. Fundamentally, limitations are meant to check the long-term growth of revenue and spending. But revenue growth following a recession helps cities and counties rebuild their budgets— and reverse spending cuts to the government services their residents expect. After a recession, states can allow the pace of economic recovery—rather than an artificial cap—to dictate a return to pre-recession conditions.

Colorado’s Referendum C, passed by the voters in 2005 to eliminate TABOR’s ratchet-down effect on state revenue, shows that a simple modification can ensure that a tax limit does not impede revenue recovery after a recession.56 Before the referendum, the TABOR cap was calculated by adjusting the prior year’s spending level by inflation plus population growth. Referendum C changed the formula for the cap to use a fixed base, which means that even when spending drops during recessionary periods, the cap does not.

In some states, property tax rates can adjust to keep revenue from falling when property values decline— helping to smooth the revenue stream during economic downturns and making it more stable than other more economically sensitive tax sources. Maryland, for example, allows for this adjustment by not imposing a property tax rate limit.57 Although New York state limits property tax bases, New York City’s property tax rate can fluctuate to generate the revenue needed to pay for a determined level of public services: As the last act in adopting its budget, and after all other revenue has been calculated, the city sets the rate to yield the property tax revenue it needs to balance the budget.58

3. Increase local budget flexibility in the long term.

In addition to putting local governments in a better position to handle fiscal crises, states would also benefit from evaluating if and how tax limitations and other state constraints are impeding local fiscal sustainability in the long term. States can then consider ways to increase the flexibility localities have to address ongoing fiscal challenges, ensure a resilient tax base, and maintain the service quality their residents expect.

The pandemic’s effects may add to local budget challenges. Uncertainties around teleworking, commercial real estate values, and consumer behavior, for example, have raised questions about whether some key local revenue streams will become unreliable in the long term. Increased budget flexibility can allow local officials to more effectively adapt to potentially lasting changes to the economy and to their tax base.

There are various ways states can grant more flexibility to their local governments apart from modifying tax limitations. Policymakers can evaluate which approaches are most suitable given their state’s current fiscal conditions and state-local dynamics.

Many local governments must by law adopt their state’s sales tax base and are unable to better align their own base to changes in the economy until the state takes steps to do so. The majority of states—and, as a result, localities—now tax online sales, a revenue stream that has been a boon during the pandemic as online purchases have largely replaced in-person shopping.59 However, most states do not tax many services—for example, personal care and professional consulting—even though consumer spending has shifted significantly to the service sector and away from goods over time. According to a 2017 survey by the Federation of Tax Administrators, only Hawaii and New Mexico have sales tax bases that include nearly all of the 176 services listed in the survey.60 Florida’s 2020 Tax Handbook estimated the fiscal impact of adding personal services to the sales tax base to be $277 million for fiscal year 2021—up from the 2010 estimate of $168 million—a percentage of which would be distributed to local governments according to Florida’s local half-cent sales tax allowance and state revenue-sharing formulas.61

Local governments are often subject to various state and federal mandates, many of which require funds from localities’ own budgets. A 2016 analysis by the National Association of Counties found that over the previous decade, nearly three-quarters of states had increased mandates, decreased funding, or both.62 States could reduce the burden of mandates on localities by shouldering a portion of the costs. When Indiana imposed new tax rate limits in 2010, for example, the state also took over about $3 billion of local spending, including school operating costs and police and fire pensions.63

States could also allow cities and counties to levy a new tax to fund specific additional functions or expenses they require localities to take on, such as those associated with maintaining the court system and providing health services.64 “We’d love to figure out new ways to do what we’re mandated to do,” said Danene Sorace, mayor of Lancaster, Pennsylvania. “The challenge is that we’re required to do these things and yet we’re not given the tools to pay for them.”

In addition, states could permit and support partnerships between cities and counties to jointly deliver services— which, at a minimum, could help localities avoid budget cuts that affect service quality, especially during recessions when demand increases for certain services. A 2020 report by the Government Finance Officers Association sampled 200 cities and counties and found that local officials deemed several key government services as shareable, in particular maintenance services.65 Texas, for example, gives local governments the legal authority to enter into interlocal agreements to increase efficiency in effectively providing services such as police, fire protection, public health, and waste disposal.66

In 2007, New Jersey adopted a new law to more effectively promote the use of shared services with a goal of reducing local expenses that lead to high property tax burdens on residents.67 In Gloucester County, efforts to share services among various municipalities began when smaller communities were struggling to provide some services on their own. Now, because of the demonstrated cost savings and quality of service delivery, all of the county’s municipalities participate in sharing services, including stormwater management, trash disposal, and 911 dispatch. The county has addressed job losses that resulted from service sharing by helping municipalities reallocate workers whose positions were eliminated.68

Lastly, states can reassess why they impose limits on local taxation. If a state’s primary concern is reducing the property tax burden on constituents, policymakers could consider applying and strengthening targeted tax relief measures—such as homestead exemptions, which are widely used and typically exempt some portion of a home’s value from property taxes69—rather than restricting localities’ overall revenue. Other targeted measures aimed at providing tax relief to certain segments of the population include “circuit breaker” programs that give tax credits to low-income homeowners if their property tax bills exceed a certain share of their income.

Additionally, states could balance more restrictive tax limits with direct financial aid to local governments: Minnesota, for example, strictly targets its state aid payments to help localities keep property tax growth low.70

Conclusion

Tax limitations can create daunting challenges for cities and counties as they try to balance their budgets while maintaining the level of services their residents expect in the long term. And evaluating if and how states’ tax limitations impede the ability of local officials to manage their finances and provide services effectively is a key first step. Policymakers can then take the appropriate measures to ensure that local governments have the necessary tools to weather unexpected budget crises and strengthen their fiscal health into the future.

Endnotes

- This brief excludes school and special districts in its analysis.

- B.P. Paquin, “Chronicle of the 161-Year History of State-Imposed Property Tax Limitations” (working paper, Lincoln Institute of Land Policy, 2015), https://www.lincolninst.edu/publications/working-papers/chronicle-161-year-history-state-imposed-property-tax-limitations.

- R. Roldan and S. Najmabadi, “Gov. Greg Abbott Signs Bill Designed to Limit Property Tax Growth,” The Texas Tribune, June 12, 2019, https://www.texastribune.org/2019/06/12/abbott-signs-property-tax-bill-sb2/.

- Institute on Taxation and Economic Policy, “Who Pays? A Distributional Analysis of the Tax Systems in All 50 States” (2018), https://itep.org/whopays/.

- M.A. Pagano and C.W. Hoene, “City Budgets in an Era of Increased Uncertainty” (Brookings Metropolitan Policy Program, 2018), https://www.brookings.edu/research/city-budgets-in-an-era-of-increased-uncertainty/; J. Griffith, J. Harris, and D.E. Istrate, “Doing More With Less: State Revenue Limitations and Mandates on County Finances” (National Association of Counties, 2016), https://www.naco.org/ resources/doing-more-less-state-revenue-limitations-and-mandates-county-finances; J. Walczak, “Local Income Taxes in 2019” (Tax Foundation, 2019), https://taxfoundation.org/local-income-taxes-2019/.

- E.A. Scharff, “Powerful Cities?: Limits on Municipal Taxing Authority and What to Do About Them,” New York University Law Review 91, no. 292 (2016): 292-343.

- Pew’s calculations from United States Census Bureau, Census of Governments: Finance, 2017, last modified Sept. 10, 2020, https://www.census.gov/data/datasets/2017/econ/local/public-use-datasets.html.

- Ibid.

- Texas Comptroller of Public Accounts, “Combined Area Sales and Use Tax,” accessed March 22, 2021, https://comptroller.texas.gov/taxes/sales/combined-area.php.

- W.B. Afonso, “State LST Laws: A Comprehensive Analysis of the Laws Governing Local Sales Taxes,” Public Budgeting & Finance, no. Winter 2017 (2017): 25-46.

- North Carolina G.S. 105-472(a), https://www.ncleg.gov/EnactedLegislation/Statutes/HTML/BySection/Chapter_105/GS_105-472.html.

- Colorado Department of Revenue, “Local Government Sales Tax,” accessed March 22, 2021, https://tax.colorado.gov/local-government-sales-tax.

- Montana Department of Transportation and Land Use, “Financing Districts—Resort and Local Option Taxes,” accessed March 22, 2021, https://www.mdt.mt.gov/research/toolkit/m1/ftools/fd/rlot.shtml.

- Pew’s calculations from United States Census Bureau, Census of Governments.

- Kansas Department of Revenue, “Intangibles,” accessed March 19, 2021, https://www.ksrevenue.org/perstaxtypesint.html.

- Ohio Department of Taxation, “2020 Annual Report” (2020), https://tax.ohio.gov/static/communications/publications/annual_reports/2020annualreport.pdf.

- D. Kernan and G. Neill (California Association of Counties), interview with The Pew Charitable Trusts, Sept. 10, 2020.

- Moody’s Investors Service, “U.S. Local Government General Obligation Debt Rating Methodology” (2020), 14.

- Moody’s Investors Service, “Property Tax Reform Limits Revenue-Raising Ability, a Credit Negative for Bulk of Local Governments” (2019).

- E. Walcott, “A Refresher on Proposal A and Local Property Taxes” (Michigan State University Extension, 2016), https://www.canr.msu.edu/news/a_refresher_on_proposal_a_and_local_property_taxes.

- J. Mack and S. Levin, “As Michigan Real Estate Values Rebound, Property Tax Revenues Continue to Lag,” Michigan Live, Feb. 3, 2020, https://www.mlive.com/news/2020/02/as-michigan-real-estate-values-rebound-property-tax-revenues-continue-to-lag.html.

- A. Minghine (deputy executive director, Michigan Municipal League), interview with The Pew Charitable Trusts, Sept. 21, 2020.

- Ibid.

- Ibid.

- Michigan Department of Treasury, “The Fiscal Health of Michigan’s Local Governments” (2018), https://www.michigan.gov/documents/treasury/Fiscal_Health_of_Michigans_Local_Governments_2018_638566_7.pdf.

- Ibid.

- G. Sobetski, “The TABOR Revenue Limit” (Legislative Council Staff Nonpartisan Services for Colorado’s Legislature, 2018), https://leg.colorado.gov/sites/default/files/the_tabor_revenue_limit.pdf.

- Colorado Municipal League, “TABOR Election Results: Tax Rate Questions, Debt Issues, Revenue Retention” (2018), https://www.cml.org/home/publications-news/resource-detail/Election-Results-Tax-Rates; The Bell Policy Center, “What Is Debrucing?” (The Bell Policy Center, 2019), https://www.bellpolicy.org/2019/07/12/what-is-debrucing/.

- C. Pattelli (chief financial officer, city of Boulder), interview with The Pew Charitable Trusts, Oct. 15, 2020.

- S. Hindi, “Colorado Voters Repeal Gallagher Amendment,” The Denver Post, Nov. 3, 2020, https://www.denverpost.com/2020/11/03/colorado-amendment-b-gallagher-results-election-2020/; M. Carey, “The Gallagher Amendment” (Legislative Council Staff, Nonpartisan Services for Colorado’s Legislature, 2020), https://leg.colorado.gov/sites/default/files/images/lcs/gallagher_amendment_memo_-_final.pdf.

- Carey, “The Gallagher Amendment.”

- B. Eason, “Amendment B Puts Spotlight on Gallagher’s Mixed Legacy of Budget Cuts, Tax Relief, and Inequality in Colorado,” The Colorado Sun, Sept. 15, 2020, https://coloradosun.com/2020/09/15/amendment-b-gallagher-colorado/; Colorado Municipal League, “TABOR Election Results”; Eason, “Amendment B.”

- National League of Cities, “Cities 101—Delegation of Power,” accessed March 19, 2021, https://www.nlc.org/resource/cities-101-delegation-of-power/.

- Scharff, “Powerful Cities?”

- J.J. Richardson Jr., M. Zimmerman Gough, and R. Puentes, “Is Home Rule the Answer? Clarifying the Influence of Dillon’s Rule on Growth Management” (The Brookings Institution, 2003), https://www.brookings.edu/research/is-home-rule-the-answer-clarifying-the-influence-of-dillons-rule-on-growth-management/.

- Ibid.

- Office of the New York State Comptroller, “Under Pressure: Local Government Revenue Challenges During the COVID-19 Pandemic” (2020), 5, https://www.osc.state.ny.us/files/local-government/publications/pdf/local-government-revenue-challenges-during-covid-19-pandemic.pdf#page=1.

- B. Van Epps (deputy executive director, New York State Conference of Mayors), interview with The Pew Charitable Trusts, Oct. 6, 2020.

- Office of the New York State Comptroller, “Archived Data and Publications,” accessed April 26, 2021, https://www.osc.state.ny.us/local-government/fiscal-monitoring/archived-data-and-publications.

- T. Hitchen Boyd (assistant comptroller for the Division of Local Government and School Accountability, Office of the New York State Comptroller), interview with The Pew Charitable Trusts, Jan. 15, 2021.

- Office of the New York State Comptroller, “Hitting the Limit: The Constitutional Tax Limit and Its Implications for Local Governments” (2019), 2, https://www.osc.state.ny.us/files/local-government/documents/pdf/2020-05/ctl-implications-for-local-governments.pdf.

- Office of the New York State Comptroller, “DiNapoli: Statewide Local Sales Tax Collections Decline 5.2 Percent in October,” news release, Nov. 13, 2020, https://www.osc.state.ny.us/press/releases/2020/11/dinapoli-statewide-local-sales-tax-collections-decline-52-percent-october.

- Wisconsin Policy Forum, “Changing Patterns of New Construction: What Do They Mean for Municipal Budgets?” (2018), https://wispolicyforum.org/research/changing-patterns-of-new-construction-what-do-they-mean-for-municipal-budgets/.

- Federal Reserve Bank of Minneapolis, Consumer Price Index, 1913-, accessed March 23, 2021, https://www.minneapolisfed.org/about-us/monetary-policy/inflation-calculator/consumer-price-index-1913-.

- Wisconsin Policy Forum, “Changing Patterns of New Construction.”

- D. Schmiedicke (finance director, city of Madison), interview with The Pew Charitable Trusts, Oct. 21, 2020.

- The Local Tax Enabling Act, 511, Pennsylvania General Assembly (1965), https://www.legis.state.pa.us/cfdocs/Legis/LI/uconsCheck.cfm?txtType=HTM&yr=1965&sessInd=0&smthLwInd=0&act=0511.

- A. Sheaf (local government policy manager, Department of Community and Economic Development), interview with The Pew Charitable Trusts, Jan. 12, 2021.

- Ibid.

- Ibid.

- A. Sturges and J. Brenner (Pennsylvania Municipal League), interview with The Pew Charitable Trusts, Sept. 29, 2020.

- Ibid.

- An Act Authorizing Local Units to Issue Coronavirus Relief Bonds, 2475, Senate (2020), https://www.njleg.state.nj.us/2020/Bills/S2500/2475_I1.HTM.

- B. Johnson, “Texas Senate Bill Would Tie Property Tax Disaster Loophole to ‘Physical’ Damage, Excluding Pandemic,” The Texan, https://thetexan.news/texas-senate-bill-would-tie-property-tax-disaster-loophole-to-physical-damage-excluding-pandemic/.

- Pennsylvania Department of Community and Economic Development, “Act 47 Financial Distress,” accessed May 4, 2020, https://dced.pa.gov/local-government/act-47-financial-distress/.

- Sobetski, “The TABOR Revenue Limit.”

- Maryland Department of Assessments and Taxation, “A Homeowner’s Guide to Property Taxes and Assessments,” accessed April 13, 2021, https://dat.maryland.gov/realproperty/Pages/HomeOwners-Guide.aspx.

- The New York City Advisory Commission on Property Tax Reform, “Preliminary Report” (2020), https://www1.nyc.gov/assets/propertytaxreform/downloads/pdf/NYC-AdvCommission-Prelim.pdf.

- E. Bohatch, “SC’s Online Sales Tax Revenue Doubles Thanks to COVID-19 Pandemic Spending,” The State, https://www.thestate.com/news/politics-government/article247551370.html; J. Walczak and J. Cammenga, “State Sales Taxes in the Post-Wayfair Era” (Tax Foundation, 2019), https://taxfoundation.org/state-remote-sales-tax-collection-wayfair/; T. Whetstone, “Knox County Sales Tax Numbers Are Even Better Than Pre-Pandemic Figures,” Knox News, https://www.knoxnews.com/story/news/politics/2020/12/01/knoxcounty-sales-tax-numbers-better-than-pre-covid-19-figures/3776700001/; P. Williams, “Fla. Bill for Online Sales Tax Back on the Table for 2021,” Law 360 Tax Authority, https://www.law360.com/tax-authority/articles/1333357/fla-bill-for-online-sales-tax-back-on-thetable-for-2021.

- Federation of Tax Administrators, “Sales Taxation of Services,” accessed March 24, 2021, https://www.taxadmin.org/sales-taxation-of-services.

- Florida Revenue Estimating Conference, “Florida Tax Handbook” (2020), http://edr.state.fl.us/Content/revenues/reports/tax-handbook/taxhandbook2020.pdf; Florida Revenue Estimating Conference, “Florida Tax Handbook” (2010), http://edr.state.fl.us/Content/revenues/reports/tax-handbook/taxhandbook2010.pdf.

- Griffith, Harris, and Istrate, “Doing More With Less.”

- D. Faulk, “The Impact of Property Tax Rate Caps on Local Property Tax Revenue in Indiana” (Ball State University Center for Business and Economic Research, 2013), https://joe4hou.files.wordpress.com/2016/01/the-impact-of-property-tax-rate-caps-on-local-property-tax-revenue-in-indiana.pdf.

- Griffith, Harris, and Istrate, “Doing More With Less.”

- S.C. Kavanagh and C. Fabian, “Government as a Platform: Plugging In the Best Service Providers” (Government Finance Officers Association, 2020), https://gfoaorg.cdn.prismic.io/gfoaorg/a16393a5-ff98-42cf-a4a0-be3e54cf2789_Part+3_GovernmentasaPlatform2020.pdf.

- Texas Government Code Sec. 791.001, 791.003 (2021), https://statutes.capitol.texas.gov/Docs/GV/htm/GV.791.htm#791.001.

- New Jersey Uniform Shared Services and Consolidation Act (2007), https://www.njleg.state.nj.us/2006/Bills/PL07/63_.PDF.

- Delaware Valley Regional Planning Commission, “Implementing Shared Services, Municipal Implementation Tool #25” (2013), https://www.dvrpc.org/reports/MIT025.pdf.

- Institute on Taxation and Economic Policy, “Who Pays?”

- P. Dalton, “Levy Limits” (The Research Department of the Minnesota House of Representatives, 2015), https://www.house.leg.state.mn.us/hrd/pubs/ss/sslvylmt.pdf.