How States Can Assess the Affordability of Their Debt

Regular and consistent studies can provide clear evidence

© Shutterstock

© ShutterstockBorrowing money for long-lasting infrastructure enables states to finance multiple pressing needs simultaneously, including roads, bridges, ports, housing, and more. Policymakers, however, often lack the data needed to make informed decisions about their debt.

Overview

When a state government faces a large expense, such as restoring an aging bridge or repairing a deteriorating highway, officials often choose to borrow the money to pay for the project. Distributing the cost of a large investment over many years helps governments in the same way a homeowner might take out a loan to replace a roof or finance a renovation—it frees up cash on hand to meet current, day-to-day expenses. And borrowing for long-lasting infrastructure spreads the cost over the generations of taxpayers who benefit from its use. It also enables states to finance multiple pressing needs simultaneously, including roads, bridges, ports, housing, sewers, parks, prisons, and buildings at public colleges and universities.

Policymakers, however, often lack the data needed to make informed decisions about their debt—from appropriate borrowing levels to the structure of debt issued. Compounding this challenge, many states do not have systematic ways to collect, evaluate, and monitor information about their debt.

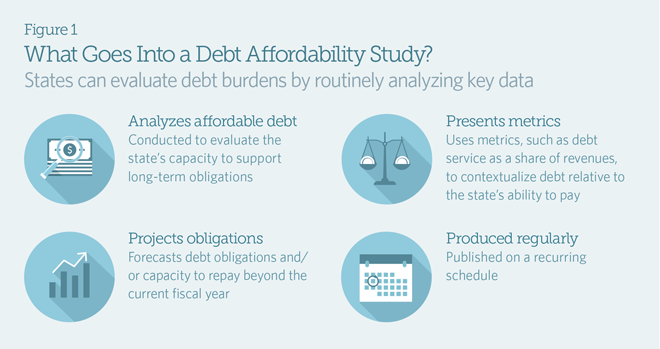

Policymakers can use debt affordability studies to better understand states' long-term obligations, evaluate their capacity to repay existing debts, and inform decisions on the issuance of new debt as well as the structure of any new obligations. The key features of these studies are outlined in Figure 1.

Studies can play critical role

A debt affordability study is a critical tool for defining the totality of a state’s debt, which can be a complex undertaking, in part because debt structures vary from state to state. Long-term debt, for example, may be issued directly by the primary state government, by component units such as legally separate state agencies or authorities, or by local governments such as cities or special districts. These obligations may be the primary responsibility of the state or the state may be called upon to pay when another entity—such as a city or special district—is unable to.

Finally, states borrow in many ways. Among the options are general obligation bonds, debts repaid with a specific revenue source such as a toll, others paid with general fund appropriations, leases, conduit debt (debt issued on behalf of a private entity such as a nonprofit hospital), anticipation notes, and moral obligations that the state has no legal requirement to pay but may do so for political or economic reasons. Because of this wide range of approaches, policymakers and experts often have differing ideas about how much debt states can or should issue.

All debt affordability studies should include the features identified in Figure 1, but states vary in the specific metrics they present, the methods they use to project obligations against revenue, whether they forecast future debt issuances, and how often they produce a study. States also take differing approaches to defining which debts should be included—the scope of the study—and how they benchmark their debt relative to other states.

Identifying what works

When states produce thorough, easy-to-understand debt affordability studies, policymakers can access the information they need to decide how to spend limited resources. Forthcoming research from The Pew Charitable Trusts will provide a 50-state examination of state practices used to produce debt affordability studies, including what debt is included, how the studies are tied to policymaking, and how they can inform capital planning. This work will identify promising approaches that states can consider when seeking to implement new strategies or improve existing ones to evaluate the affordability of state debt.

"When states produce thorough, easy-to-understand debt affordability studies, policymakers can access the information they need to decide how to spend limited resources."

America’s Overdose Crisis

Sign up for our five-email course explaining the overdose crisis in America, the state of treatment access, and ways to improve care

Sign up