The Federal Debt Ceiling and the States

The debate over raising the federal debt ceiling generally focuses on federal finances, but states are also feeling the repercussions after the U.S. Treasury earlier this year took “extraordinary measures” to avoid hitting the ceiling. The reason: One of those measures is the temporary suspension of the State and Local Government Series program.

The State and Local Government Series, or SLGS, are low-yield securities designed specifically as an investment option for issuers of state and local tax-exempt debt. When the program is suspended, state and local governments must find alternative ways to invest billions of dollars in proceeds from bonds they issue every month in order to comply with federal restrictions regarding investment of tax-exempt bond proceeds. These restrictions prohibit state and local governments from engaging in arbitrage—borrowing money by issuing tax-exempt bonds and then investing the proceeds to earn a higher rate of return than they are paying on the bonds.

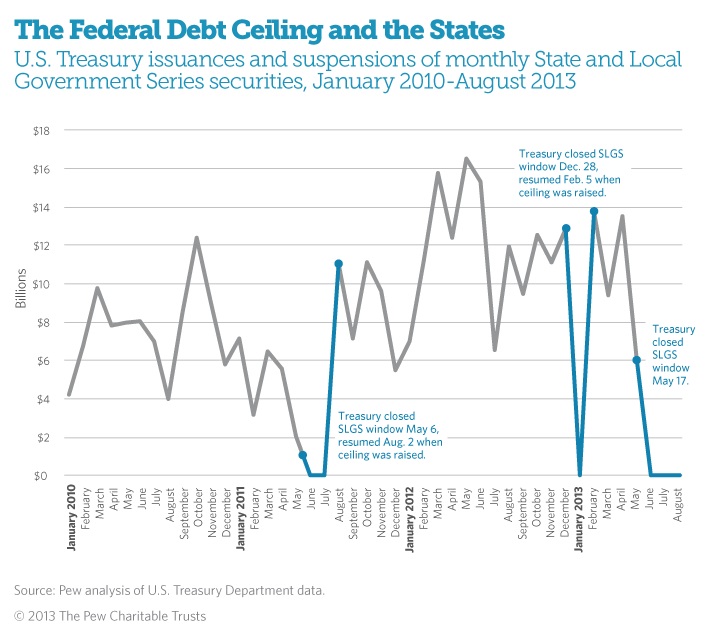

When the federal government approaches its statutory debt limit—the amount of gross debt it can issue—the Treasury Department can take various “extraordinary measures” to stay under the debt ceiling and prolong its ability to borrow.1 Such measures include suspending new investments and redeeming investments in certain existing accounts. It also can suspend the State and Local Government Series, because issuance of these securities increases the nation’s current obligations and debt.2 Treasury took this step in May as the nation was nearing the debt ceiling.3 This is the third such suspension since 2011. (See chart.)

The implications for state and local governments

State and local governments hold outstanding long-term debt, issued for purposes such as infrastructure investments in schools, hospitals, and roads. When they periodically refinance this debt to lower their cost of borrowing—in the same way that a homeowner refinances a mortgage—the State and Local Government Series program helps them remain in compliance with federal law by allowing them to easily invest their borrowed money without violating the prohibition against arbitrage.

According to Treasury Department data, temporary suspension of the State and Local Government Series has happened eight previous times over the past 20 years.6 The current suspension, which began May 17, is the longest in 17 years.7

Although the suspension will not stop state and local governments from issuing new tax-exempt municipal bonds and refinancing their debt, it means that they will have to find alternative ways to invest the proceeds. Many states will probably turn to other government securities, such as regular Treasury bills, which, unlike the State and Local Government Series, are not specifically designed to help states avoid the problem of arbitrage. The Treasury Department notes this “will impose some added cost and inconvenience” on these governments.8

Quantifying the actual effect on states is difficult, but the debt ceiling debate’s intersection with state financing mechanisms shows how actions designed to address a purely federal issue can have consequences for states.

Endnotes

1 More on the mechanics of the debt ceiling can be found in The U.S. Debt Limit: Frequently Asked Questions, The Pew Charitable Trusts, June 2011. http://www.pewtrusts.org/uploadedFiles/wwwpewtrustsorg/Reports/Miscellaneous/US_Debt_Limit_fact_sheet.pdf.

2 In a letter to Congress, Treasury Secretary Jacob Lew detailed the extraordinary measures his department will take over the coming months, including suspending the State and Local Government Series. U.S. Treasury Department, “Secretary Lew Sends Debt Limit Letter to Congress,” May 17, 2013. http://www.treasury.gov/initiatives/Documents/Debt%20Limit%205-17-13%20Boehner.pdf.

3 U.S. Treasury Department, “Treasury Suspends Sales of State and Local Government Series Securities,” May 15, 2013. http://slgs.gov/news/pressroom/pressroom_1305slgsoff.htm.

4 Pew analysis of U.S. Treasury Department data from April 2012 through April 2013. U.S. Treasury Department, “Statistics on Non- Marketable Treasuries,” accessed Aug. 23, 2013. http://slgs.gov/instit/annceresult/annceresult_slgssb.htm.

5 U.S. Treasury Department, “Monthly SLGS Statistics,” accessed June 18, 2013. http://slgs.gov/govt/reports/slgs/slgs_mnthlyslgsstat.htm.

6 U.S. Treasury Department, “SLGS FAQ,” accessed May 24, 2013. http://slgs.gov/govt/resources/faq/faq_slgs.htm#DebtCeil.

7 Ibid.

8 Ibid.