The Trillion Dollar Gap: Oregon

Underfunded State Retirement Systems and the Roads to Reform

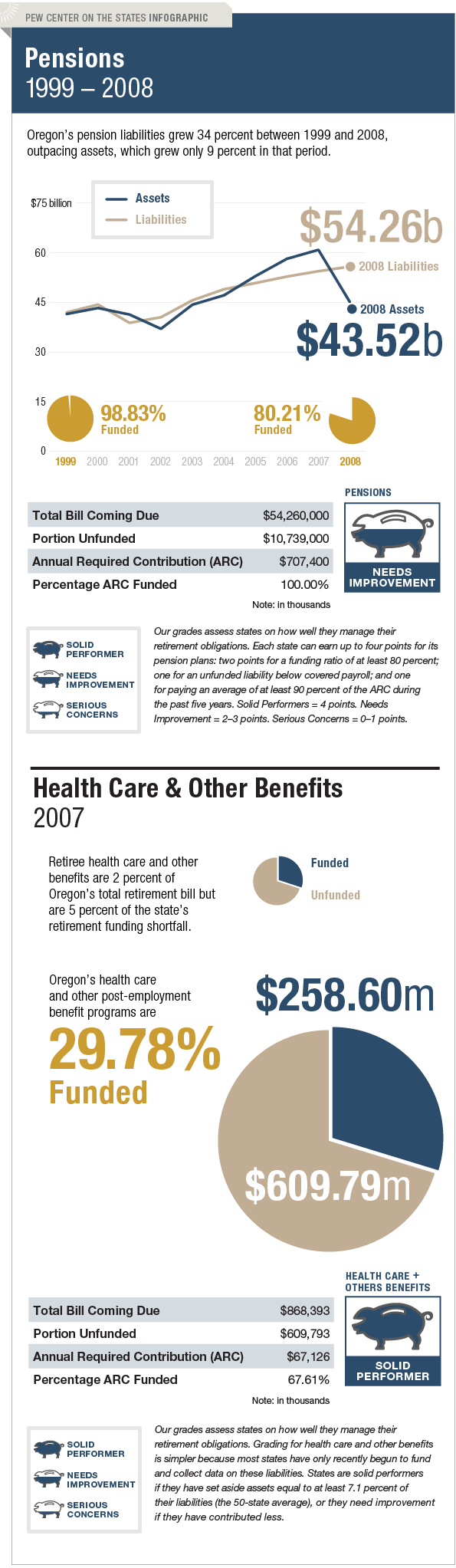

Oregon needs to improve the way it manages its long-term pension liability, but is doing a relatively good job of handling the bill coming due for its retiree health care and other benefits. The Beaver State's pension funding level declined from a high of 112 percent in 2007 to 80 percent just one year later—right at the minimum benchmark that the U.S. Government Accountability Office says is preferred by experts. Much of this loss can be explained by declines in investment returns from 2008. Oregon does not smooth its assets over time, meaning that its data immediately reflect investment losses. Oregon also conducts its actuarial valuation on December 31, more fully accounting for declines in investment returns than plans with valuation dates of June 30. But Oregon has also failed to meet its actuarially required contribution in recent years. Meanwhile, the state has a relatively limited long-term obligation for retiree health care and other benefits—$868.4 million—and already has set aside $258.6 million to cover this bill coming due.