States Make More Progress Rebuilding Rainy Day Funds

Note: These data have been updated. To see the most recent data and analysis, visit Fiscal 50.

A decade after the Great Recession began, at least half of the states could cover a bigger share of spending with rainy day funds than before the downturn. But most still had a thinner cushion against budget shortfalls in their total balances, which count rainy day reserves plus general fund dollars left over at the end of a budget year.

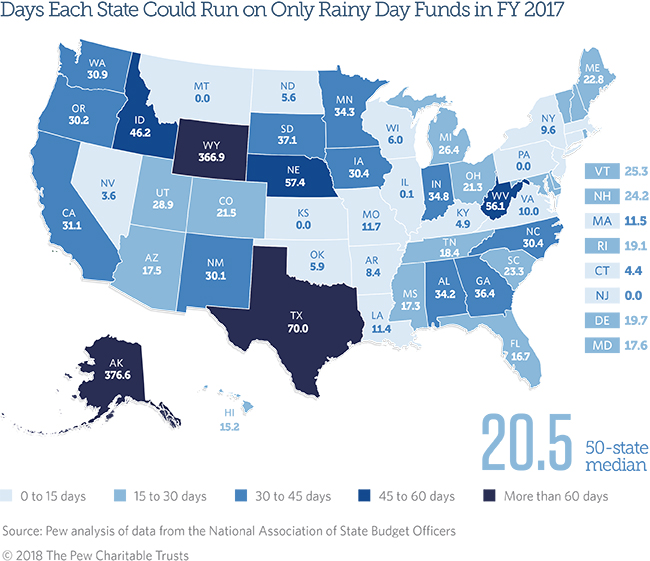

In fiscal year 2017, the 50-state total for rainy day funds increased for a seventh straight year to a record $54.7 billion, enough to run government operations for a median of 20.5 days, also a new high. Early estimates showed savings at near-peak levels in fiscal 2018, which ended in June for most states. The results will probably rise once missing and final data are counted in a year in which higher-than-expected tax revenue led a number of states to increase savings beyond their earlier estimates.

Even with rainy day funds at today’s peak levels, though, most states’ total balances could cover a smaller share of government spending than they could have heading into the 2007-09 recession.

After tax revenue plunged in the downturn, states softened the blow to their budgets by tapping both components of total balances—rainy day reserves and ending balances in their budget’s general fund, which functions as a state’s main checking account. As they did after the 2001 recession, most states have used the current economic recovery to steadily replenish and expand their rainy day funds. However, slow tax revenue recovery and tight budgets have meant fewer dollars left over in year-end balances.

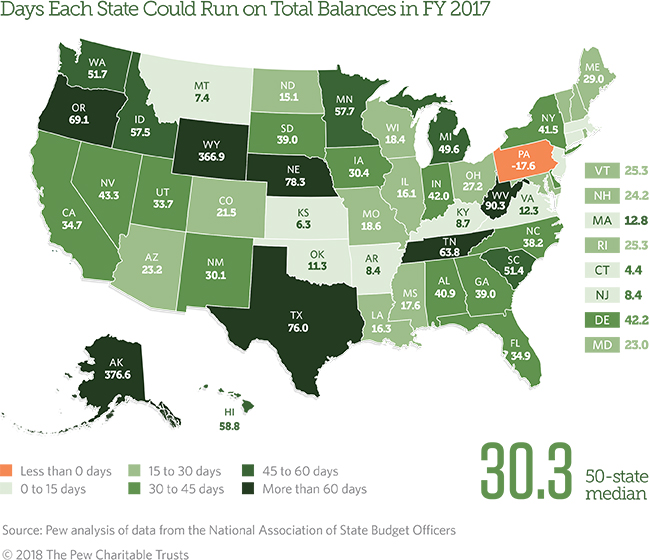

As a result, total balances have improved since their low point but still have fallen short of pre-recession levels, mainly because of smaller ending balances. States had enough in their total balances to fund government operations for a median of 30.3 days in fiscal 2017 and an estimated median of 31.4 days in fiscal 2018, compared with 41.3 days just before the downturn. For many states, though, even pre-recession levels were inadequate to plug huge budget gaps caused by the last recession.

States use reserves and balances to help manage unexpected revenue shortfalls or spending demands, lessening the need for spending cuts or tax increases to balance their budgets. They are an important measure of how well-prepared states are for the inevitable next economic downturn.

Because fiscal 2018 data are still subject to change, Fiscal 50’s rankings of states’ rainy day funds and total balances relative to spending are based on fiscal 2017 results.

Rainy day funds

Nationally, rainy day funds in fiscal 2017 held the greatest amount in both nominal dollars and as a share of government spending since at least 2000, according to data collected by the National Association of State Budget Officers (NASBO). The 50-state total of $54.7 billion could cover a median of 20.5 days, or 5.6 percent of general fund spending. Estimates for fiscal 2018 were $53.9 billion—a median of 20.2 days, or 5.5 percent of spending—but are likely to be revised higher with the inclusion of missing data for Georgia and Oklahoma as well as extra deposits made late in the budget year by states with unexpected surpluses. By comparison, states held $29.9 billion in rainy day funds in fiscal 2007, the last full budget year before the downturn, with enough to cover a median of 16.6 days, or 4.6 percent of spending.

Despite budget pressure from slow tax revenue growth and pent-up spending demands following the recession, policymakers in many states have made efforts to set aside money in rainy day funds. At least 30 states expected to add to their savings in fiscal 2018, while only seven foresaw a drop, according to NASBO data. The trend extends into the current fiscal year, as 28 governors recommended making deposits into their state’s rainy day fund in fiscal 2019, according to NASBO.

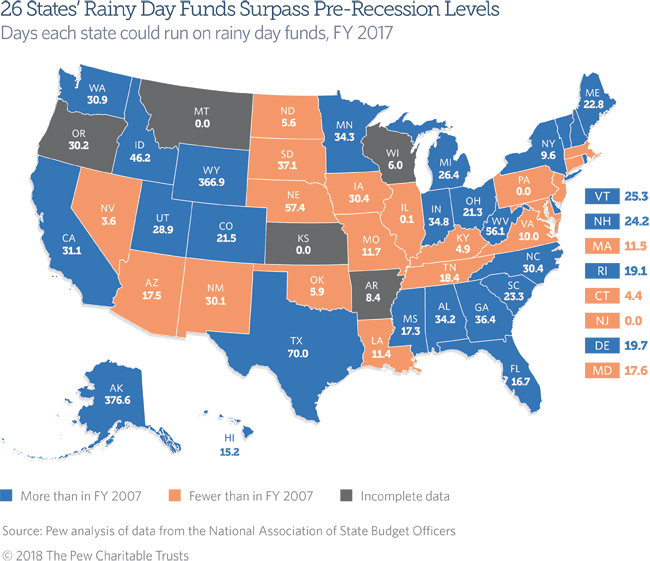

Although many factors determine how much each state should set aside in its rainy day fund, one gauge of states’ progress in building their savings is a comparison with pre-recession levels. In fiscal 2017, at least 26 states had saved enough to cover a greater share of government spending than in fiscal 2007.

Rainy day funds—also called budget stabilization funds—are the largest component of states’ financial cushions, accounting for more than 70 cents of every $1 in total balances, compared with 44 cents of every $1 just before the recession.

Rainy day fund highlights

States’ results for fiscal 2017 and estimates for fiscal 2018 show:

- Alaska ended fiscal 2017 with the nation’s largest rainy day reserves as a share of operating costs (376.6 days), but five years of annual withdrawals to make up for recurring shortfalls in oil-related revenue was expected to bump it from first place. The state expected to end fiscal 2018 with an estimated 191.5 days’ worth of spending, enough for second place.

- Wyoming, the only other state with more than a year’s worth of operating costs (366.9 days), was expected to replace Alaska as the top state once figures are finalized for fiscal 2018.

- Nine states’ rainy day funds could cover more days’ worth of operating costs in fiscal 2017 than at any point since at least 2000: Alabama (34.2 days), Georgia (36.4), Hawaii (15.2), Idaho (46.2), Maine (22.8), North Carolina (30.4), Ohio (21.3), Vermont (25.3), and Washington (30.9). Among those, Alabama, Ohio, and Vermont anticipated adding to their savings in fiscal 2018.

- Eight states had less than a week’s worth of operating costs in reserve in fiscal 2017: Wisconsin (6.0 days), Oklahoma (5.9), North Dakota (5.6), Kentucky (4.9), Connecticut (4.4), Nevada (3.6), Illinois (0.1), and Pennsylvania, with less than a tenth of a day. At least three—Connecticut, Oklahoma, and Pennsylvania—made deposits for the first time in several years at the close of fiscal 2018.

- Three states had nothing in their rainy day accounts at the end of fiscal 2017: Kansas, Montana, and New Jersey. But Montana agreed to make its first deposit at the close of fiscal 2018. Kansas and Montana created their funds just a year ago.

- Seven states expected a decrease in rainy day fund dollars in fiscal 2018, compared with 13 states that had decreases in fiscal 2017.

Total balances

States’ total balances stood at $77.3 billion in fiscal 2017 and could have covered a median of 30.3 days, or 8.3 percent of spending. Amid more favorable budgetary conditions in fiscal 2018, estimates based on incomplete data showed an uptick to $78.1 billion, with a median of 31.4 days, or 8.6 percent of spending. But states had a smaller financial cushion for both years than they had in fiscal 2007. Because states were spending less a decade ago, pre-recession total balances of $67.9 billion could stretch further and cover a median of 41.3 days, or 11.3 percent of spending.

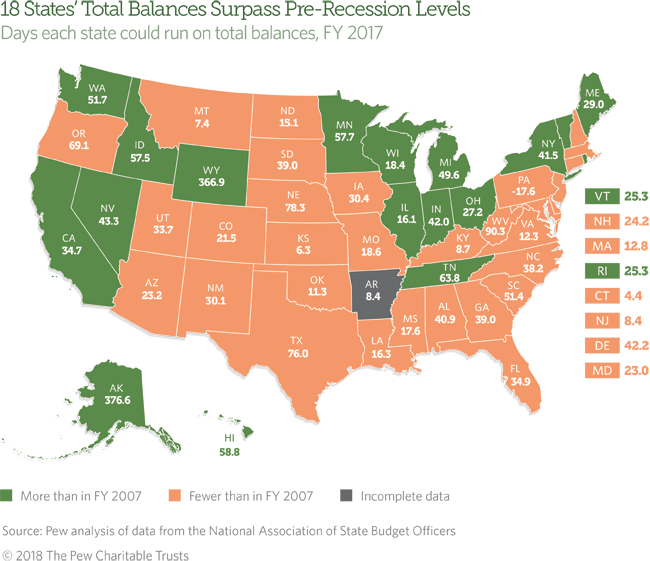

Only 18 states in fiscal 2017 could cover more days’ worth of operating costs with their total balances than they could before the recession. A surge in tax revenue, though, gave many states an opportunity to boost their reserves and balances in the budget year that ended in June for most states.

Most states have found it difficult to match their pre-recession benchmarks for total balances, largely because tight budgets have left fewer unspent dollars in ending balances. Because ending balances vary from year to year and do not accumulate, policymakers cannot count on them as cushions against future emergencies to the degree they can with rainy day funds, which are saved until policymakers decide to draw them down. Still, ending balances can be useful in a budget crunch and provide an additional source of fiscal flexibility.

Total balance highlights

States’ results for fiscal 2017 and estimates for fiscal 2018 show:

- Two states had total balances that could cover more than a year’s worth of operating costs in fiscal 2017: Alaska (376.6 days) and Wyoming (366.9). But Alaska was expected to fall below that benchmark based on estimated results for fiscal 2018.

- Less than a week’s worth of operating costs were held by Connecticut (4.4 days) and Kansas (6.3) in fiscal 2017, but both anticipated their holdings would rise in fiscal 2018.

- Pennsylvania (-17.6 days) ended the 2017 budget year with a negative total balance because of tax revenue shortfalls. Its fiscal 2018 budget resolved the deficit through borrowing and one-time revenue injections.

- Montana’s financial cushion has fallen to its lowest level since at least 2000: 7.4 days in fiscal 2017 and an estimated 9.2 days in fiscal 2018, although final figures could raise that.

- Three states’ total balances in fiscal 2017 could cover more days’ worth of operating costs than at any point since at least 2000: Tennessee (63.8 days), Vermont (25.3 days) and Washington (51.7). Vermont and Washington expected their financial cushions to expand even further in fiscal 2018.

Why reserves matter

States use reserves and balances to manage budgetary uncertainty, deal with revenue forecasting errors, prevent severe spending cuts or tax increases when there are unexpected revenue shortfalls, and cope with unforeseen emergencies. Because reserves and balances are vital to managing unexpected changes and maintaining fiscal health, their levels are tracked closely by bond rating agencies. For example, S&P Global Ratings downgraded Massachusetts’ debt rating in June 2017, citing its “failure to follow through on rebuilding its reserves.” The state addressed the shortcoming in June by making a sizable deposit into its reserve fund.

Building up reserves is a sign of fiscal recovery, but there is no one-size-fits-all rule on when, how, and how much to save. States with a history of significant revenue or economic volatility may desire larger cushions. According to a report by The Pew Charitable Trusts, the optimal savings target of state rainy day funds depends on three factors: the defined purpose of funds, the volatility of a state’s tax revenue, and the level of coverage—similar to an insurance policy—that the state seeks to provide for its budget.

Reserves and balances represent funds available to states to fill budget gaps, although there may be varied levels of restriction on their use. Rainy day funds are typically dedicated to provide budget stabilization during economic or revenue downturns but may also have restrictions on the fiscal or economic conditions in which they can be used. In addition, limits are often set on how much states can deposit into rainy day accounts in a given year when seeking to replenish their reserves.

General fund reserves and balances may not reflect a state’s complete fiscal cushion. States may have additional resources to soften downturns, such as dedicated reserves outside of their general funds or rainy day accounts. In addition, some states undertake considerable spending outside of the general fund, so comparisons across states should be made with caution. One way to standardize the size of reserves and balances is to calculate how many days a state could run solely on those funds, even though it is highly unlikely that would ever happen.

Download the data to see individual state trends. Visit Pew’s interactive resource Fiscal 50: State Trends and Analysis to sort and analyze data for other indicators of state fiscal health.

Fiscal 50: State Trends and Analysis

America’s Overdose Crisis

Sign up for our five-email course explaining the overdose crisis in America, the state of treatment access, and ways to improve care

Sign up