Louisiana Voters to Decide on Severance Tax-Based Sovereign Wealth Fund

istock

istockThe sovereign wealth fund bill received bipartisan support before being adopted unanimously by the Louisiana Senate and House.

Editor’s note: This analysis was updated to reflect information about a ballot measure created by the legislation.

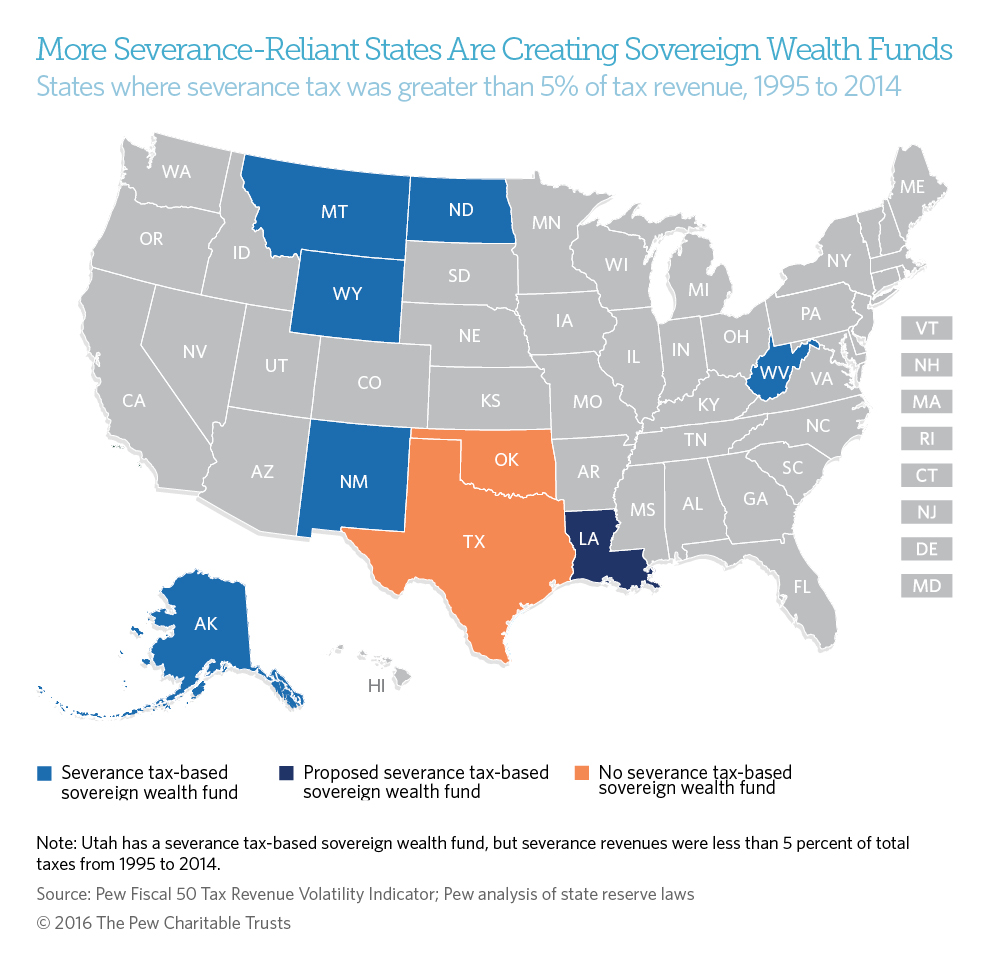

This fall, Louisiana voters will consider a ballot measure that would create a severance tax-based sovereign wealth fund to receive a portion of the state’s tax collections on the extraction of natural resources such as oil and natural gas. This nonoperating, investment fund is intended to generate interest earnings to support the state’s general fund expenditures.

If approved, the ballot measure would create a Revenue Stabilization Trust Fund that would receive above-normal severance and corporate franchise and income tax collections (70 percent of severance tax collections between $660 million and $950 million, and 100 percent of corporate franchise and income tax above $600 million). Furthermore, the proposal would allow Louisiana legislators to appropriate a portion of the principal for capital projects or transportation infrastructure if the fund balance exceeds $5 billion.

This type of investment fund has been put in place by six other U.S. states where revenue from natural resource extraction makes up a significant part of overall tax collections. The public purpose for these types of funds varies from state to state, but most were created to provide an intergenerational source of revenue that would outlast current revenue sources derived from finite natural resource extraction. Of the nine states where severance tax represented more than 5 percent of total tax revenue from 1995 to 2014, it was the most volatile major tax in six of them. In the three remaining states, it was the second most volatile major tax source behind corporate income tax.

As with any type of state savings reserve or investment account fed by a portion of state tax collections, making deposits to a severance tax-based sovereign wealth fund requires a trade-off between short- and long-term fiscal priorities. Each dollar directed to a long-term savings or investment fund is one that can’t be spent immediately on public programs or tax reductions, or used to pay down long-term debt.

Forthcoming Pew research will offer a closer examination of severance tax-based sovereign wealth funds in U.S. states as well as recommendations to improve their governance, transparency, and alignment with public purpose.

Brenna Erford is a manager, and Steve Bailey and Jon Moody are senior associates, for The Pew Charitable Trusts’ states’ fiscal health team.