Tax Revenue Recovery Varies Widely; 26 States Still Behind

These data have been updated. To see the most

recent data and analysis, visit Fiscal 50.

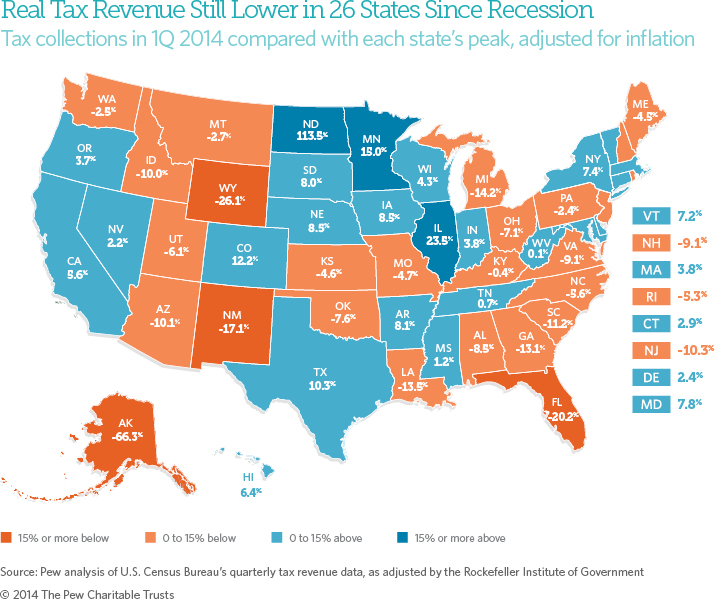

Nationally, total state tax revenue has recovered from its plunge during the Great Recession, despite a slump in receipts in early 2014. But the recovery is uneven. Adjusted for inflation, tax collections in 26 states had not fully rebounded by the first quarter of 2014.

For the fourth straight quarter, total tax revenue for the 50 states was above a key benchmark on the road to recovery. In real dollars, overall tax collections in the first quarter of 2014 were 2.2 percent higher than their peak in the third quarter of 2008, just before the recession took a toll on state tax revenue.

This means that in early 2014, states took in $1.02 for every $1 they collected at their 2008 tax revenue peak, after adjusting for inflation and seasonal fluctuations.

The latest results marked the first decrease after 16 straight quarters of tax revenue increases (based on four-quarter moving averages), but it was not seen as a sign of new economic troubles. The decline was largely anticipated because of a one-time surge in receipts in the prior year as taxpayers accelerated payments to avoid new, higher federal rates on capital gains.

More importantly, state-by-state results continued to vary dramatically.

A comparison of each state’s peak revenue before the end of the recession and its tax receipts in the first quarter of 2014, averaged across four quarters and adjusted for inflation, reveals that:

- Alaska was furthest from its peak, down 66.3 percent. But, its 2008 peak was due to a short-lived windfall from a new state oil tax that took effect just as crude prices spiked to record levels.

- Three other states’ receipts also were still down more than 15 percent from previous peaks: Wyoming (-26.1 percent), Florida (-20.2 percent), and New Mexico (-17.1 percent).

- North Dakota led all states, as its oil boom boosted tax revenue to 113.5 percent above its highest point during the recession.

- The next-largest rebounds were in Illinois (23.5 percent) and Minnesota (15.0 percent). Tax increases imposed after the recession contributed to both states’ revenue growth.

As states regain fiscal ground lost in the recession, policymakers face pressure to catch up on investments and spending postponed due to the downturn. That may be more difficult in states where tax revenue remains below its previous peak.

But even a return to peak levels can leave states with little extra to make up for cuts in federal aid or to pay for costs associated with population increases, growth in Medicaid enrollment, deferred needs, and accumulated debts. A return to peak tax revenue levels does not necessarily signal an economic comeback, because revenue growth can result from tax increases or other policy changes. More than half of the 24 states that are collecting more money than at their inflation-adjusted peak have raised taxes since the start of the recession.

Without adjusting for inflation, 50-state quarterly tax revenue was 10.7 percent above peak, and tax collections had recovered in 36 states as of the first quarter of 2014. Unadjusted figures do not take into account changes in the price of goods and services.

Adjusting for inflation is just one way to evaluate state tax revenue growth. Different insights would be gained by tracking revenue relative to population growth or state economic output.

Download the data to see individual state trends from the first quarter of 2006 to the first quarter of 2014. Visit The Pew Charitable Trusts’ Fiscal 50: State Trends and Analysis to sort and analyze data for other indicators of state fiscal health.

Analysis by Barb Rosewicz and Alex Boucher

Read the updated Fiscal 50 tax revenue analysis: Despite Decline, Tax

Revenue Still Tops Recession Milestone