Fiscal 50: State Trends and Analysis

Pandemic Aid Lifts Federal Share of State Budgets to New Highs

Pew’s Fiscal 50: State Trends and Analysis presents 50-state data on key fiscal, economic, and demographic indicators and analyzes their impact on states’ long-term fiscal health.

States’ Fiscal Conditions Remain Strong as Uncertainty Mounts

After an initial jolt to state finances, stronger-than-expected tax revenue growth and unprecedented federal aid have lifted states’ outlooks. Many economists had predicted a dark chapter for state budgets when the coronavirus pandemic triggered a historic contraction in the U.S. economy in early 2020, abruptly ending the longest U.S. economic expansion on record. But the recession proved to be the shortest on record and most states now enjoy surprisingly strong fiscal conditions, though slowing revenue gains associated with moderating economic growth and tax cuts enacted in 2021 and 2022, spending pressure from still-elevated inflation rates, and a tapering of federal pandemic aid pose mounting threats.

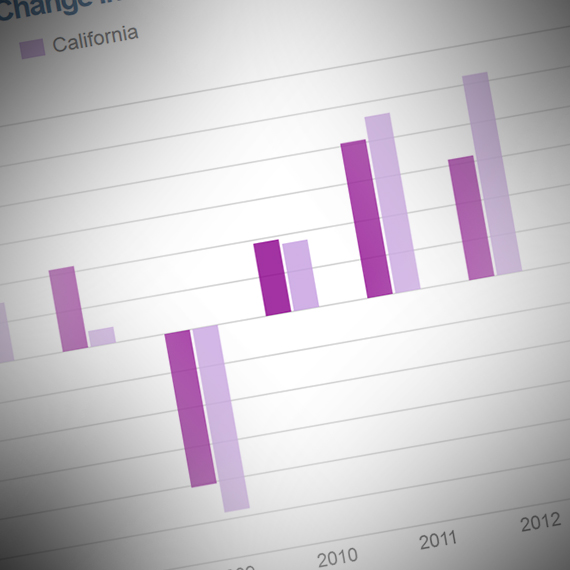

A hallmark of the COVID-19 economy has been its divergent effect on state tax revenue. From the start of the pandemic through the second quarter of 2022, cumulative tax revenue nationally and in most states was higher than it would have been if pre-pandemic growth trends had continued. Still, annual revenue growth rates slowed substantially during fiscal 2022 and are on track for negative growth by the end of the current budget year.

Robust federal aid has played a central role in supporting the economy and state finances. Federal assistance for taxpayers, businesses, and state and local governments—along with higher-than-expected tax collections—helped alleviate stress on budgets and allowed the majority of states to avoid tapping their rainy day funds. In fact, after dipping briefly in fiscal 2020, the total amount set aside in rainy day funds nationwide grew to a new high by the end of fiscal 2022.

States’ economies have generally experienced steady growth in recent years despite the pandemic’s disruption. The national rate of prime-age adults with a job almost fully rebounded to pre-pandemic levels during the 12-month period ending in June that corresponds with most states’ fiscal 2022. Every state recorded an annual increase last year in total personal income from all sources, another key economic indicator. Earnings from work, which experienced the sharpest growth in over two decades, drove much of the gains. Pandemic-related government assistance to individuals and businesses also contributed, although much of the aid has since subsided.

Long-running challenges complicate recovery

The coronavirus pandemic intensified two challenges already facing states: It put pressure on Medicaid, the health care program that is most states’ second-biggest budget expense, and introduced a novel source of volatility that triggered unexpected swings in tax revenue, further complicating revenue forecasting and budgeting.

Meanwhile, states continued to face long-term fiscal pressures from inherited shortfalls in funding for public employees’ pension and retiree health care benefits; recurring deficits between annual state revenue and expenses; and weak population growth, which can diminish economic prospects and revenue collections.

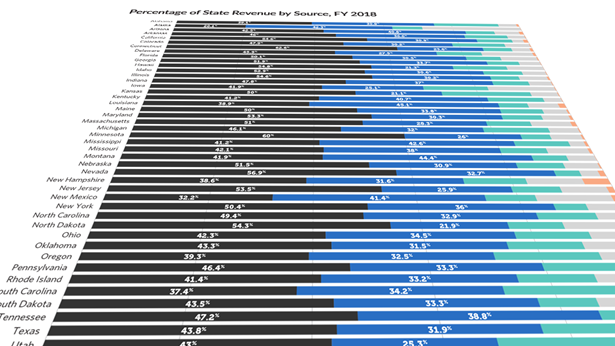

One lifeline for states continued to be federal dollars, which made up roughly one-third of all state revenue before the latest economic shock led to a boost in federal aid to states.

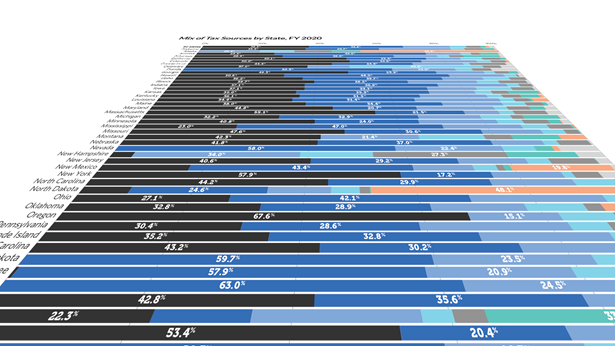

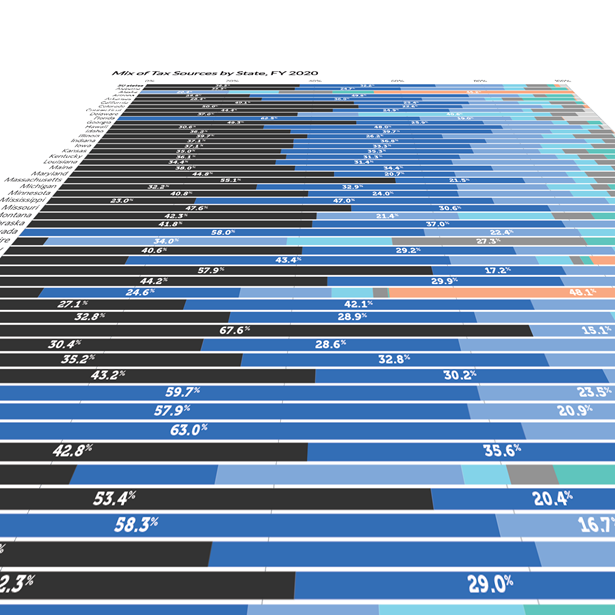

Tax revenue

State Tax Revenue Declines From Record Highs . In nearly three-quarters of states—the most since the start of the COVID-19 pandemic—tax revenue outperformed its pre-COVID growth trend as of the end of the first quarter of 2023 when all receipts since January 2020 are combined. Nationally however, inflation-adjusted collections, appear to have peaked in 2022 and are now on a downward trend after posting three quarters of consecutive declines for the first time since the Great Recession of 2007-09. View the indicator or print the analysis. (Last updated September 25, 2023)

Reserves and balances

Record State Budget Reserves Buffer Against Mounting Fiscal Threats Most states increased their rainy day fund balances at the end of fiscal year 2023, allowing them to cover a larger share of spending if needed compared with one year earlier. Despite this, savings growth was notably slower than the dramatic gains posted in fiscal 2021 and 2022 and leftover budget dollars shrank dramatically. As fiscal conditions tighten amid mounting uncertainties, most states expect their total financial cushions to decline by the end of the current budget year. View the indicator or print the analysis. (Last updated Dec 4, 2023)

State Personal Income

States See Gains in 2021 Personal Income, But Growth Varies. Every state experienced personal income growth in 2021 as the economy continued to rebound from severe losses earlier in the pandemic. Earnings from work drove much of the gains, recording the steepest annual rate increase in over two decades. Federal aid and other public assistance further contributed to the growth, climbing from 2020’s elevated levels. Total growth ranged from more than 5% in Idaho and South Dakota to nearly zero in Vermont, after accounting for inflation. View the indicator or print the analysis. (Last updated May 12, 2022)

Employment-to-Population Ratio

Employment-to-Population Ratio

States’ Prime-Age Employment Rates Tick Up. Americans of prime working age increasingly held jobs in fiscal year 2022, as businesses seeking to bounce back from losses earlier in the pandemic hired more workers. In the majority of states, however, the share of 25-to-54-year-olds who were employed on average over the 12-month period ending in June was still lower when compared to pre-pandemic levels. Growth may have stalled more recently as the national prime-age employment rate has remained relatively flat since March. View the indicator. (Last updated September 15, 2022)

Long-running challenges complicate recovery

The coronavirus pandemic intensified two challenges already facing states: It put pressure on Medicaid, the health care program that is most states’ second-biggest budget expense, and introduced a novel source of volatility that triggered unexpected swings in tax revenue, complicating revenue forecasting and budgeting..

Meanwhile, states continued to face fiscal pressures from inherited shortfalls in funding for public employees’ pension and retiree health care benefits; recurring deficits between annual state revenue and expenses; and weak population growth, which can diminish economic prospects and revenue collections.

One lifeline for states continued to be federal dollars, which made up roughly one-third of all state revenue before the latest economic shock led to a boost in federal aid to states.

State Medicaid Spending

States Collectively Spend 17 Percent of Their Revenue on Medicaid. Medicaid consumed a greater portion of states’ own money in nearly every state between fiscal 2000 and 2017. States’ increases varied widely, however, from less than 1 cent to nearly 12 cents more per dollar of state-generated revenue, exerting different degrees of budget pressure. Medicaid’s claim on state revenue surged in the wake of the Great Recession, after temporary federal economic stimulus dollars expired but before the federally funded expansion of Medicaid eligibility began, and has remained stable since. Medicaid is most state governments’ second-biggest expense, after K-12 education. View the indicator or print the analysis. (Last updated January 9, 2020)

Tax revenue volatility

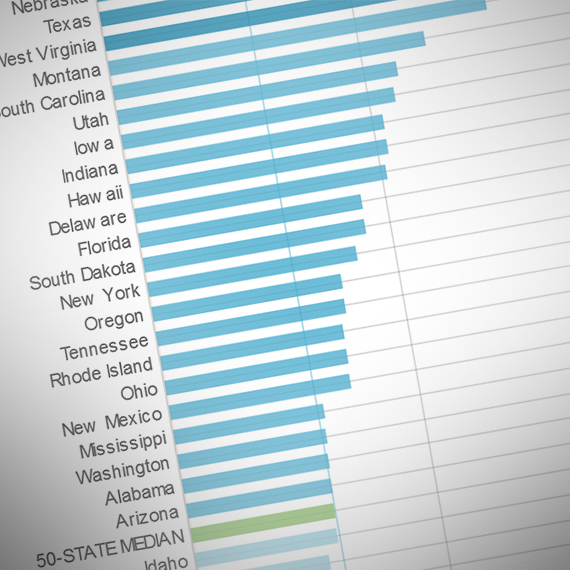

State Tax Revenue Uncertainties Climb Amid the Pandemic. After years of relative stability, the long-term volatility of state tax revenue trends increased to a record high by the end of fiscal 2021 as multiple temporary factors fueled an unexpected surge in collections. Unforeseen swings in tax dollars present challenges to policymakers even under less extreme economic conditions, with some states more prone to volatility than others. During the 20 years ending in fiscal 2021, Alaska recorded the most volatility and South Dakota the least, after removing the effects of state tax policy changes. View the indicator or print the analysis. (Last updated October 14, 2021)

Debt and Unfunded Retirement Costs

The Debt and Unfunded Retirement Indicator is temporarily unavailable as Pew updates its methodology and data sources.

Fiscal Balance

Nine States Began the Pandemic With Deficits. As the coronavirus pandemic triggered substantial volatility in states’ balance sheets in fiscal 2020, 20 states recorded annual shortfalls—the most since the Great Recession and four times more than in the prior year. States can withstand periodic deficits, but long-running imbalances—such as those carried by New Jersey, Illinois, Connecticut, Hawaii, Massachusetts, Maryland, Kentucky, New York, and Delaware—can create an unsustainable fiscal situation, pushing off some past costs for operating government and providing services onto future taxpayers. View the indicator or print the analysis. (Last updated December 16, 2022)

Population Change

Southern States Gain Residents the Fastest. Population growth over the 2010 to 2020 decade slowed nationally to a rate not seen since the Great Depression, although only three states—Illinois, Mississippi, and West Virginia—lost residents. COVID-19 depressed growth in 2021, and although the pace of population growth picked up between July 2021 and July 2022, it remained slower than it was over the preceding decade. The Midwest and Northeast grew at the slowest pace over the 2010s and actually recorded population declines in 2022, as people continued moving South and West. Population trends are tied to states’ economies and government finances and are therefore useful for understanding both. View the indicator or print the analysis. (Last updated May 17, 2022)

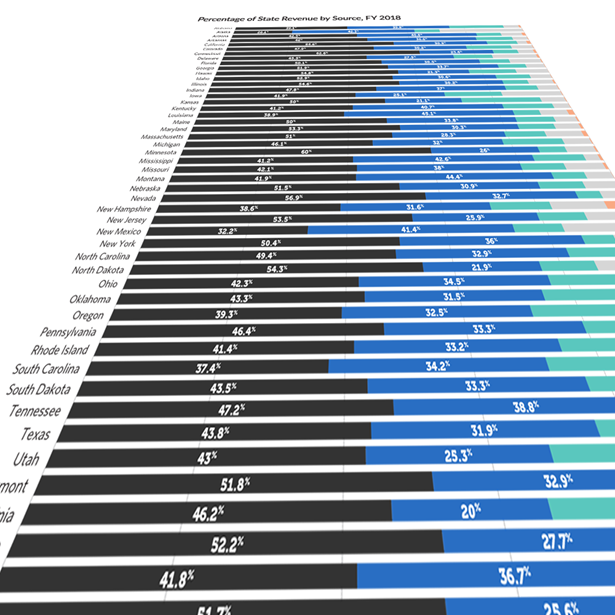

Federal Share of State Revenue

Pandemic Aid Lifts Federal Share of State Budgets to New Highs The share of states’ total revenue that comes from federal funds climbed to a record high nationally and in most states in fiscal year 2021, the first full budget year bolstered by temporary COVID-19 pandemic aid from the federal government. The federal share of state budgets grew at a slower rate than in the prior year, however, because of a simultaneous spike in tax revenue. Despite mounting fiscal and economic uncertainties, the portion of revenue from federal funds is expected to remain elevated through at least fiscal 2024—the last year in which states can allocate pandemic aid. View the indicator or print the analysis. (Last updated August 28, 2023)