How the CFPB Proposal Would Regulate Payday and Other Small Loans

A summary of the draft rule

In June, the Consumer Financial Protection Bureau (CFPB) released a proposed rule to regulate payday, auto title, and some high-cost installment loans. The proposal applies to “covered loans” from any lender, including payday, auto title, online, and nonbank installment lenders as well as banks and credit unions, but not to overdraft services, pawn loans, business loans, and other types of credit. Covered loans are defined as:

- Loans lasting 45 days or less.

- Loans lasting longer than 45 days if they have an all-inclusive annual percentage rate (APR)—which includes annual, application, and other fees, as well as the cost of ancillary products such as credit insurance—above 36 percent and the lender obtains access to a borrower’s checking account or vehicle title (collectively described as a “leveraged payment mechanism”) within 72 hours of disbursing the loan funds. The all-inclusive APR is not a rate limit, which the CFPB does not have authority to set; rather, it defines the loans that are covered by the regulation.

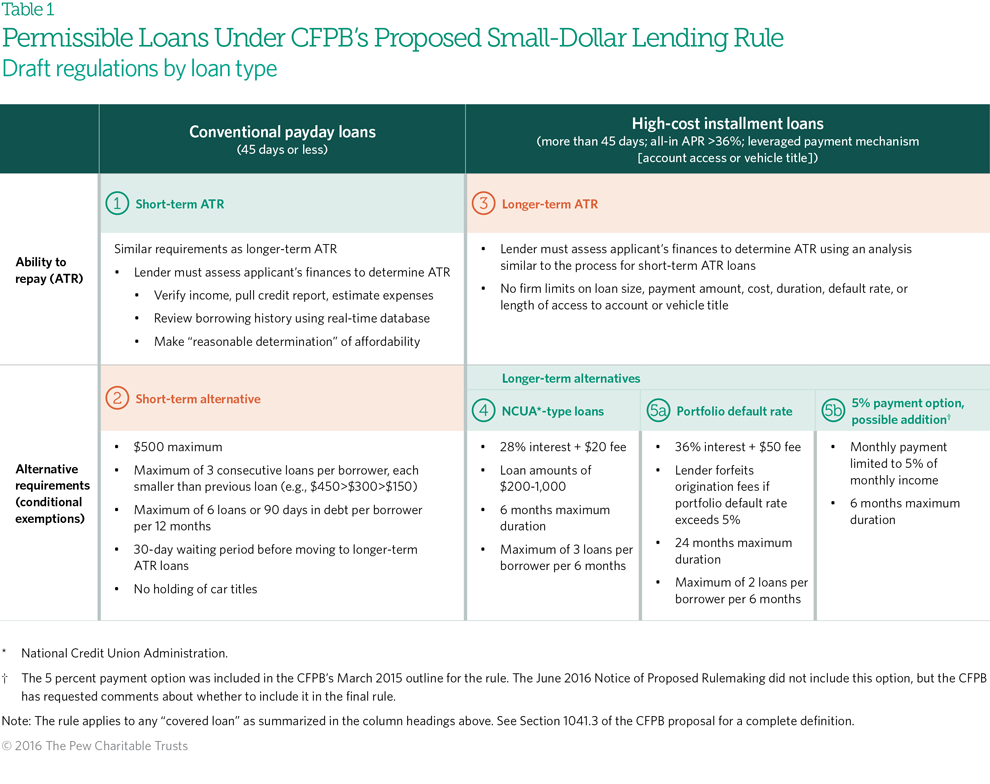

Before issuing covered loans, lenders would be required to use a CFPB-defined process to assess each borrower’s ability to repay (ATR) or they could choose to comply with additional standards, known as conditional exemptions, and then use their own method of determining ATR. As summarized in Table 1, requirements would vary depending on whether the loan was short-term (no more than 45 days) or longer-term.

Click on the image above to expand.

For more information on the CFPB’s allowable loans as outlined in Table 1, see the bureau’s small loan rule. For details on the 5% payment option, see 81 Fed. Reg. 48040.

Short- and longer-term ATR loans

The CFPB’s defined ability-to-repay assessment—also called a “full-payment test”—would require the lender to verify applicants’:

- Debt obligations through credit reports.

- Income and estimated monthly expenses, including accounting for expected volatility.

- Borrowing history as recorded in a specialty payday loan database to be set up by one or more third-party firms. (Lenders would also have to report their lending activity to the database system in real time.)

Using this information, lenders would have to make a “reasonable determination” that their customers would have the ability to repay their loans according to the terms.

This section of the rule places no limits on loan size, payment amount, cost, term, origination fees, default rate, or how long lenders could retain access to borrowers’ checking accounts or vehicle titles.

Refinancing loans would be permissible only if several conditions were met. For more information, see sections 1041.5 and 1041.9 of the CFPB proposal.

Alternative requirements for short-term loans

The proposal provides one alternative in which lenders issuing conventional payday loans of up to $500 would be exempt from conducting the full-payment test. (See Table 1, Section 1.) To limit potential consumer harm associated with unaffordable loan payments, the draft rule specifies that if the borrower took a second loan within 30 days, it must be at least one-third smaller than the initial loan, and a third consecutive loan must be two-thirds smaller than the initial loan. For example, if the first loan is for $450, the second would be for no more than $300, and the third would be for no more than $150.

Lenders would not be able to issue:

- Another short-term alternative loan to a borrower who had three consecutive loans within the past 30 days.

- Another short-term alternative loan to a borrower who had used these loans six times or for 90 days in the previous 12 months.

- A longer-term ATR loan to any borrower who had used a short-term loan within 30 days.

For more information see Section 1041.7 of the CFPB proposal.

Alternative requirements for longer-term loans

The draft rule includes two exemptions to the ATR assessment for loans of more than 45 days’ duration, and the CFPB is soliciting comments on whether to include an additional conditional exemption in the final rule.

Lenders could, without conducting a full-payment test, issue:

- A given borrower up to three loans in a six-month period that had interest rates of no more than 28 percent, application fees of no more than $20, principal balances between $200 and $1,000, and terms between 46 days and six months each. (See Table 1, Section 4.)

This provision would accommodate loans made under the National Credit Union Administration’s Payday Alternative Loan program (NCUA PAL), which was created in 2010 and generated about 170,000 loans in 2014, the most recent year for which this figure is available. For more information, see Section 1041.11 of the CFPB proposal.

- Loans under the portfolio default rate option, which have interest rates of no more than 36 percent, origination fees of $50 with higher fees allowed if they were commensurate with the cost of making the loan, and durations between 46 days and 24 months. (See Table 1, Section 5a.) If more than 5 percent of these loans defaulted in a year, a lender would have to return all origination fees paid by all borrowers that year for this type of loan.

In addition, the CFPB is requesting comments on a third potential longer-term conditional exemption: the 5 percent payment option, or “5 percent payment-to-income ratio.” This alternative would require monthly loan payments to be no more than 5 percent of a borrower’s gross monthly income, with a repayment term longer than 45 days but no more than six months. (See Table 1, Section 5b.)

The CFPB proposed the 5 percent payment option in its 2015 initial framework as a potential “burden-reduction measure” for lenders and a means to ensure consumer access to small-dollar credit. In its most recent proposal, the CFPB states that it “broadly solicits comments on the advisability of such an approach” and asks whether any lenders would choose to offer loans under the 5 percent payment option but not under the core ATR requirements. For more information, see 81 FR 48039.

Additional components

If a lender attempted to withdraw payment from a customer’s checking account and two consecutive attempts were returned unpaid, the lender would have to obtain a new authorization from the customer before debiting the account again. A lender would also have to notify the borrower three days before attempting to debit the account; this requirement would apply only to short-term and ATR loans.

The proposed rule strongly encourages installment loans with terms longer than 45 days. The small-dollar loan market already is shifting away from single-payment loans and toward installment loans and lines of credit, so the proposal would probably accelerate that change.

Comments on the proposal are due Oct. 7, 2016.

Pew conducted an analysis of the proposed rule and its impact, which is posted at http://www.pewtrusts.org/en/research-and-analysis/analysis/2016/09/07/the-cfpbs-proposed-payday-loan-regulations-would-leave-consumers-vulnerable.