Employment Rates Inch Closer to Prerecession Levels

Note: These data have been updated. To see the most recent data and analysis, visit Fiscal 50.

The U.S. employment rate for adults of prime working age has been rising for four years, and the number of states with lower employment rates than before the Great Recession has been shrinking. Despite these signs of improvement, however, the labor market had not completely recovered from the economic downturn by mid-2015.

The employment-to-population ratio for 25- to 54-year-olds, which measures the share of people in their prime working years who have jobs, still shows room for improvement six years after the end of the 2007-09 recession. But there are hints of progress, which can help both household and state finances.

Nationwide, an average of 77 percent of prime-working-age adults were employed in the fiscal year ending June 2015, compared with 79.9 percent in calendar year 2007. The difference between those rates means that, for every 100 adults in their prime working years, 2.9 fewer had jobs in mid-2015 than before the recession. Although it still reflects a drop from the prerecession level, the latest annual rate is greater than those in recent years: 76.2 percent in mid-2014, 75.9 percent in mid-2013, 75.4 percent in mid-2012, and a low of 75.1 percent in 2011.

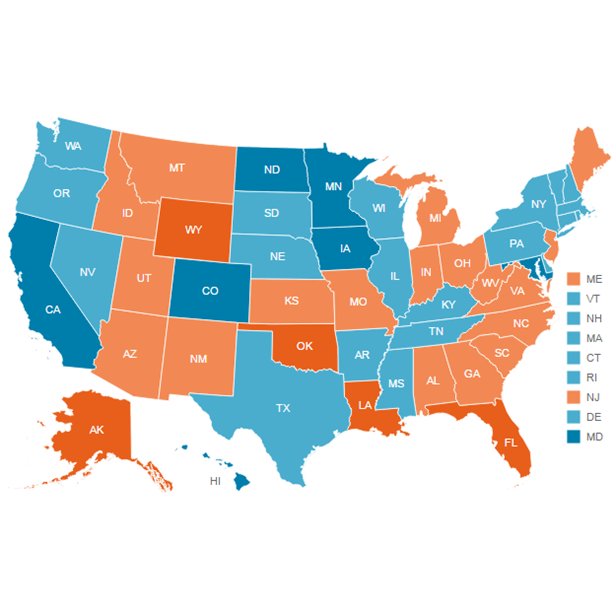

A state-by-state breakdown also shows some headway. Prime-age employment rates in 23 states in fiscal 2015 were below 2007 levels by statistically significant amounts—a lower number of states than in recent years. Although none showed a definitive gain over prerecession levels, the number of states with statistically meaningful decreases in their employment rates was down from 29 in mid-2014, 34 in mid-2013, and 36 in mid-2012.

Changes in employment rates among adults in their prime working years can affect both sides of a state’s budget ledger.

- Revenue: Paychecks help generate individual income tax dollars and fuel consumer spending, which produces tax revenue from sales and business income.

- Expenditures: Unemployed people frequently need more services such as Medicaid and other safety-net programs, which can increase states’ costs.

A rebound in employment rates may provide some relief to states that have experienced budget pressures in recent years. According to Pew’s Fiscal 50 research, about half of states collect less inflation-adjusted tax revenue and most have smaller financial cushions than they did before the recession.

A state-by-state comparison of the employment-to-population ratio for 25- to 54-year-olds in 2007 and fiscal 2015 shows:

- No state reported a statistically significant increase in the share of its employed prime-working-age population.

- Minnesota’s and Massachusetts’ employment rates were 0.2 percentage points higher in mid-2015 than in 2007. But those differences are not statistically significant, meaning that it’s unclear whether the employment rates have fully recovered in those states.

- Among the 23 states with statistically significant employment-rate differences, the biggest was in New Mexico, where there were 7.2 fewer employed people among every 100 New Mexicans of prime working age.

Although unemployment figures receive substantial media attention, many economists also track the employment rate because it provides a broader view of labor market conditions. The unemployment rate, for example, excludes people who are not looking for jobs, but the employment rate captures this group in its measurement of population.

Focusing on 25- to 54-year-olds reduces the distortion of employment trends resulting from demographic effects such as older and younger workers’ choices regarding retirement or full-time education.

Another gauge of employment trends is the labor force participation rate. While the employment-to-population ratio tracks people who have jobs, the labor force participation rate measures people with jobs and those actively looking for work.

A statistically significant decrease or increase indicates a high level of confidence that there was a true change in the employment rate. Changes that are not statistically significant offer less certainty and could be the result of variations in sampling or other methods used to produce employment estimates. Without additional testing for statistical significance, caution should be exercised when comparing changes in employment rates among states.

Download the data to see individual state trends. Visit The Pew Charitable Trusts’ interactive resource Fiscal 50: State Trends and Analysis to sort and analyze data for other indicators of state fiscal health.